Orginally Written by Aditya Shastri

Updated on Jan 6, 2026

Share on:

Vedanta Resources is a global natural resources and metals powerhouse with roots in India and headquarters in London. In 2024-25, it remains one of the most diversified mining-to-metals groups worldwide, spanning assets from zinc and aluminium to oil & gas and power.

But with diversification comes complexity and questions about debt, regulation, and future growth. So what exactly are Vedanta’s competitive strengths? Where does it struggle? What opportunities await, and what threats could derail its strategy? This SWOT analysis provides an overview for entrepreneurs, investors and business students.

Before diving into the article, I would like to inform you that the research and initial analysis for this piece were conducted by Sarashree Joshi. She is a current student in IIDE’s Online Digital Marketing Course, July Batch 2025.

If you found this helpful, feel free to reach out to Sarashree Joshi to send a quick note of appreciation for her fantastic research; she will appreciate the kudos!

About Vedanta Resources

Founded in 1976 by Anil Agarwal, Vedanta Resources Ltd. has grown into a global leader in metals, mining, oil, gas, and power. With operations across India, Africa, GCC, and Australia, Vedanta continues to play a crucial role in supplying essential resources worldwide in 2024-25, supporting industries and infrastructure across continents.

The company’s unofficial slogan, Empowering the World with Sustainable Resources, reflects its commitment to producing vital metals while focusing on net-zero emissions by 2050 and environmentally responsible operations.

One interesting fact about Vedanta is that it owns one of the largest zinc mines in the world, highlighting its scale and influence in global commodity markets.

Overview Table

| Attribute | Details |

|---|---|

| Official Name | Vedanta Resources Ltd. |

| Founded | 1976 |

| Headquarters | London, UK |

| Industries | Metals & Mining, Oil & Gas, Energy |

| Geography | India, Africa, GCC, Australia |

| Revenue | USD 17.1 Bn (latest) |

| Employees | 90,000+ |

| Key Competitors |

Hindalco, NALCO, Tata Steel, Adani Power |

Why SWOT Analysis Matters in 2026?

In 2026, Vedanta stands at a pivotal moment. It is pursuing a major demerger strategy to unlock shareholder value and enable focused sector growth.

At the same time:

- Consumer demand for metals is linked to global economic cycles, EV adoption, and infrastructure spending.

- Environmental regulation and ESG compliance remain critical market forces.

- Commodity price volatility continues to impact profitability.

- Investors are keenly watching capital structure and refinancing risks.

This SWOT analysis helps you see where Vedanta stands strategically today and what lies ahead.

Learn Digital Marketing for FREE

SWOT Analysis of Vedanta Resources

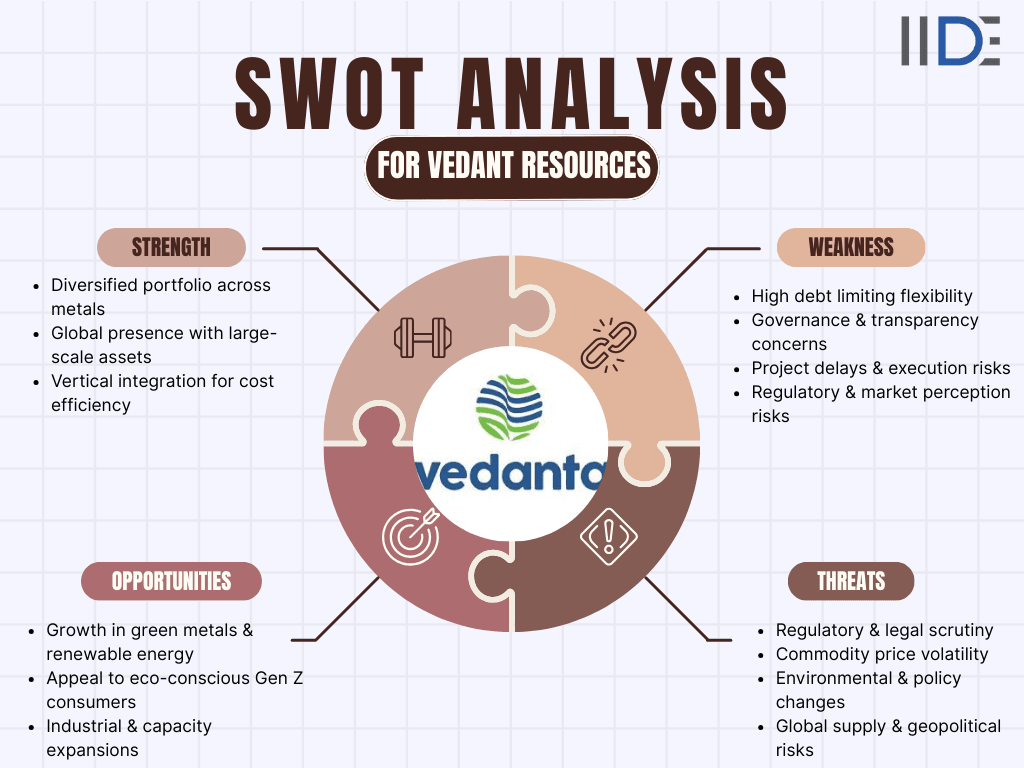

This SWOT analysis highlights where the company excels, where it can improve, and what the future may hold.

Strengths: What Makes Vedanta a Global Giant?

Vedanta Resources has several strong competitive advantages:

1. Diversified Portfolio Across Commodities:

- Vedanta operates across a wide spectrum of natural resources, including metals such as zinc, copper, iron ore, and aluminium.

- Beyond metals, the company is also active in oil and gas, as well as power generation.

- This broad diversification reduces dependence on any single sector, allowing Vedanta to balance revenue streams even when certain markets experience volatility.

- By operating across multiple commodities, Vedanta can strategically leverage cross-segment synergies, optimise resource allocation, and maintain resilience against market fluctuations, a key advantage that enhances both investor confidence and long-term stability.

2. Global Presence & Asset Scale:

- With operations spanning India, Africa, and other international markets, Vedanta holds some of the largest and most productive assets in the industry.

- Notably, it owns one of the largest zinc mines globally and has substantial production bases for aluminium, copper, and other critical metals.

- This global footprint not only ensures access to diversified resources but also positions Vedanta to respond to international demand efficiently.

- Such a scale strengthens the company’s negotiating power in procurement, distribution, and global partnerships, allowing it to compete effectively with peers like Tata Steel and NALCO.

3. Vertical Integration & Cost Leadership:

- Vedanta’s operations are fully integrated, from mining and extraction to refining and distribution.

- This vertical integration allows the company to control costs at each stage of production and ensures supply chain efficiency.

- By reducing reliance on third-party suppliers and optimising operational processes, Vedanta achieves cost leadership, a crucial factor in commodity-driven markets where price competitiveness directly impacts profitability.

- This model also enables rapid responsiveness to market changes, giving Vedanta a strategic edge over less-integrated competitors.

4. Commitment to Sustainability & ESG:

- Vedanta has made sustainability a central part of its strategy, with ambitious goals such as achieving net-zero carbon emissions by 2050 and water positivity by 2030.

- The company ranks favourably in several sustainability indexes, demonstrating its proactive approach to environmental, social, and governance (ESG) principles.

- This commitment not only aligns with global decarbonization trends but also strengthens Vedanta’s appeal to ESG-focused investors and stakeholders.

- By embedding sustainability into its operations, Vedanta enhances brand reputation, ensures regulatory compliance, and positions itself as a responsible global resource leader.

5. Credit Profile Improvement:

- In 2026, S&P upgraded Vedanta’s credit rating, reflecting the company’s improved financial discipline and reduced refinancing risks.

- A stronger credit profile enables Vedanta to access capital more efficiently, pursue strategic expansions, and negotiate favourable financing terms.

- This improvement reassures investors and partners of the company’s long-term stability and underpins its ability to fund growth initiatives, including investments in renewable energy, technology upgrades, and international expansions.

- A healthy credit rating also strengthens market confidence in Vedanta’s operational and strategic decisions.

Weaknesses: Where Could Vedanta Improve?

Even giants face challenges, and Vedanta is no exception. Understanding these weaknesses shows how the company might stumble compared to competitors and what it needs to fix for future growth.

1. High Debt Load:

- Vedanta carries a substantial debt burden, which limits its flexibility for expansion, strategic investments, and large-scale projects.

- Heavy borrowing can increase financial pressure, especially during periods of commodity price volatility or economic slowdown.

- In contrast, some competitors like Hindalco manage debt more predictably, giving them greater operational freedom and stability.

- Vedanta’s high leverage could also affect its ability to raise capital quickly or invest in new growth areas, making debt management a critical strategic focus.

2. Governance & Transparency Concerns:

- Vedanta has faced scrutiny over complex corporate structures and cash flows that appear to favour the parent company.

- This opacity can create uncertainty among investors and stakeholders regarding decision-making and accountability.

- Companies like Tata Steel, on the other hand, are known for smoother governance practices, providing clearer reporting and enhancing stakeholder confidence.

- Improving transparency and strengthening corporate governance could help Vedanta build trust and attract long-term investment.

3. Project Delays & Execution Risks:

- Several of Vedanta’s expansion initiatives, including coal blocks and new mining assets, have experienced delays or operational hurdles.

- Such execution risks can slow anticipated cost savings, reduce revenue potential, and allow faster-moving competitors to capture market share.

- Efficient project management and stronger operational oversight are essential to ensure that Vedanta can fully realise its growth plans and maintain competitiveness.

4. Regulatory & Market Perception Risks:

- Vedanta operates in a highly regulated environment, and policy changes, regulatory scrutiny, or reports from short-sellers can create uncertainty for investors and affect share prices.

- Companies that face fewer regulatory challenges tend to enjoy more stable operations and investor sentiment.

- Strengthening compliance mechanisms and proactive communication can help Vedanta mitigate these risks and maintain market confidence.

5. Dividend & Capital Allocation Debates:

- Criticism around Vedanta’s dividend policies and brand fee structures perceived to favour the parent company over subsidiaries has raised questions among shareholders about fairness and capital allocation.

- Competitors with clearer and more transparent dividend strategies tend to inspire greater investor trust.

- Aligning dividend and capital allocation policies with shareholder expectations could reinforce confidence and support long-term investment.

Vedanta’s approach to sustainability and innovation mirrors how Tata Steel's strategic marketing has build credibility and deepen stakeholder loyalty.

Opportunities: Where Can Vedanta Grow Next?

Vedanta is well-positioned to grow with global trends like renewable energy, EVs, and sustainability-focused industries. Here’s where it can expand:

1. Green Metals & Renewable Energy:

- Vedanta has a strong opportunity to tap into the growing global demand for metals such as copper, aluminium, and zinc, which are essential for renewable energy infrastructure like solar panels, wind turbines, and electric vehicles.

- Beyond metals, the company is actively investing in solar and wind energy for its operations, reducing its carbon footprint and aligning with global energy transition goals.

- This focus on green energy not only supports sustainability but also positions Vedanta as a responsible and forward-looking brand, appealing to ESG-conscious investors and partners.

2. Gen Z & Sustainable Consumption:

- The rising influence of eco-conscious Gen Z consumers creates an opportunity for Vedanta to develop products and solutions that resonate with environmentally responsible preferences.

- Pilot projects such as green aluminium production, biomass usage, and low-carbon metal solutions allow the company to test sustainable innovations in the market.

- By catering to this demographic, Vedanta can enhance brand perception, build loyalty among a new generation of stakeholders, and align with global trends favouring sustainability.

3. Industrial & Capacity Expansion:

- Vedanta is strategically expanding its industrial capacity by adding new aluminium smelters and increasing zinc and copper production.

- These expansions support growing demand from infrastructure, construction, and industrial sectors, both in India and internationally.

- Such projects not only strengthen Vedanta’s market presence but also contribute to job creation and regional economic development, enhancing the company’s reputation as a growth-focused, socially responsible player in the industry.

4. Global Partnerships:

- The company is actively pursuing international collaborations and subsidiaries, including ventures such as a US-based copper operation.

- These partnerships provide access to new markets, additional capital, and advanced supply chain networks.

- By leveraging global alliances, Vedanta can accelerate growth, diversify business risks, and expand its footprint beyond domestic markets, positioning itself competitively against peers like Tata Steel and NALCO.

5. Tech & Innovation:

- Technological innovation is central to Vedanta’s growth strategy.

- The company is investing in high-purity graphite, value-added alloys, and digital mining technologies, which enhance operational efficiency, reduce costs, and improve safety standards.

- These innovations also open doors to high-value and emerging markets, allowing Vedanta to differentiate its offerings and create long-term competitive advantage.

- By combining technology with sustainability, the company strengthens its market positioning while meeting the demands of modern industrial and ESG-focused stakeholders.

Threats: What Could Hold Vedanta Back?

Vedanta faces several external risks that could impact growth, profits, and reputation.

1. Regulatory & Legal Risks:

- Vedanta operates in highly regulated industries, making it vulnerable to regulatory scrutiny and legal challenges.

- Government probes, audits, and reports from short-sellers create uncertainty around operational continuity and strategic initiatives.

- Such issues could delay projects, increase compliance costs, and impact investor confidence.

- Compared to competitors with fewer regulatory hurdles, Vedanta must maintain robust legal and compliance mechanisms to safeguard its operations and market reputation.

2. Commodity Price Volatility:

- Vedanta’s revenue and profit margins are heavily influenced by the global prices of metals such as zinc, copper, and aluminium.

- Fluctuations in commodity prices can reduce predictability in financial planning and profitability.

- Sharp market swings may also affect Vedanta’s competitiveness compared to peers with more diversified product portfolios or hedging strategies.

- Managing this volatility is crucial for sustaining growth and maintaining investor confidence.

3. Environmental & Policy Changes:

- Stricter environmental, mining, and pollution regulations globally have increased compliance requirements and operational costs for Vedanta.

- Failure to meet these standards can result in project halts, fines, or reputational damage.

- As ESG expectations grow, proactive regulatory management becomes essential, both to ensure uninterrupted operations and to maintain trust among investors, partners, and the public.

4. Global Supply & Geopolitical Risks:

- Vedanta is exposed to global supply chain vulnerabilities, including export restrictions, trade barriers, and geopolitical tensions.

- These risks can disrupt production, delay deliveries, and increase operational costs.

- Limited access to key markets or raw materials can hinder growth and reduce responsiveness to market demand, making strategic global partnerships and risk mitigation critical for the company’s sustainability and competitive positioning.

5. Market Perception & Reputation:

- Negative media coverage, investor scepticism, or governance concerns can impact Vedanta’s brand reputation.

- Such perception risks can increase financing costs, slow down expansion projects, and reduce stakeholder trust.

- In contrast, competitors with stronger brand management or transparent governance enjoy smoother access to capital and more favourable market perception.

- For Vedanta, managing public perception and proactively communicating corporate initiatives is essential to protecting its market position and investor confidence.

Explore our in-depth marketing strategy of Cairn - decoding targeted campaigns and oil & gas dominance tactics.

IIDE Student Takeaway & Conclusion

Vedanta exemplifies how ambitious conglomerates must balance growth with accountability, offering vital lessons for future business leaders.

Key Lessons

Large corporations like Vedanta thrive through adaptability, turning diversification into a strategic superpower when executed effectively. High debt remains a persistent drag on expansion, regardless of market success, while sustainability has evolved into a core driver of investor confidence. Strong governance and transparency foster enduring credibility in volatile industries.

Recommendations

- Reduce debt levels: Prioritize financial restructuring to boost stability and unlock capital for high-return investments.

- Invest in green initiatives: Accelerate renewable energy and sustainable metals projects to align with global ESG demands.

- Enhance governance: Implement transparent reporting and ethical standards to rebuild stakeholder trust.

- Adopt digital transformation: Leverage automation and AI for operational efficiency and competitive edge.

- Forge global partnerships: Expand strategic alliances for technology access and market diversification.

Final Thought

Vedanta's trajectory hinges on mastering change through tech adoption and fiscal discipline - proving that sustainable success for marketers and entrepreneurs stems from harmonizing bold opportunities with rigorous accountability.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

Vedanta Resources is a diversified natural resources company producing zinc, lead, silver, copper, aluminum, iron ore, oil, gas, and power, with key assets in India via subsidiaries like Hindustan Zinc and Vedanta Limited.

Headquartered in London, UK, it operates primarily in India, with mining in Australia, Zambia, and oil/gas in multiple countries, employing over 65,000 people worldwide.

Key deals include Balco (aluminum, 2001), Sesa Goa (iron ore, 2007), Cairn India (oil/gas, 2011), and Electrosteel Steels (2018), consolidating its diversified portfolio.

Controlled by the Agarwal family via promoter entities, its mission emphasizes building a leading global natural resources company through sustainable growth and stakeholder value.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.