Orginally Written by Aditya Shastri

Updated on Feb 15, 2026

Share on:

HSBC India marketing strategy operates as a premium globally connected bank that caters to affluent individuals, HNWIs and corporates with international ambitions. Its marketing strategy in India is anchored in wealth management, cross-border banking, and relationship-led services, positioning HSBC as the preferred partner for globally minded customers.

Among all channels digital marketing and relationship driven engagement play the most critical role supported by high-impact brand campaigns, OTT partnerships, experiential events and selective traditional media.

By combining global expertise with local market understanding HSBC reinforces its promise of “opening up a world of opportunity” while maintaining a strong presence in India’s competitive banking landscape.

Student Credit

Before diving into the article, I’d like to inform you that the research and initial analysis for this piece were conducted by varada chandwadkar.She is a student of IIDE’s PG in Digital Marketing program (May 2025 batch).

If you found this helpful feel free to reach out to varada chandwadkar to send a quick note of appreciation for her fantastic research – she’ll appreciate the kudos.

About HSBC

HSBC India belongs to the HSBC Group one of the world’s largest international banking and financial services organizations.

With a strong presence in India HSBC offers a wide range of services including wealth and private banking personal banking commercial banking and global markets solutions.

The bank combines deep local market expertise with an extensive international network. This enables customers to seamlessly manage domestic and cross-border financial needs.

HSBC India focuses on serving affluent individuals globally active professionals corporates and high-growth businesses. It positions itself as a premium trusted partner that helps clients connect to global opportunities through high-quality service innovation and long-term relationships.

Learn Digital Marketing for FREE

Marketing Objective and business challenges

The marketing objective of HSBC India is to use a glocal approach by combining global banking expertise with local insights to attract affluent individuals, corporates, and high-growth businesses.

The bank focuses on expanding its HNWI and UHNWI base through tailored wealth, private banking, and cross-border solutions. At the same time, it aims to strengthen reach and engagement by expanding its physical branch network and delivering a seamless, mobile-first digital experience.

HSBC faces intense competition from strong domestic private banks while trying to differentiate beyond its global brand image. It is also navigating internal restructuring, high regulatory compliance requirements, and the need to match the speed and usability of leading fintech and private bank apps.

Additionally geopolitical risks, market volatility, and talent retention add pressure to its growth ambitions in India.

As a British multinational banking giant, HSBC frequently competes for market share with rivals like Standard Chartered, whose approach is detailed in the Marketing Strategy of Standard Chartered.

Buyers Persona:

Rohit

Mumbai

Occupation: Working Professionals

Age: 18 - 50 years Old

Motivation

- Preference for a globally trusted and secure bank

- Need for cross-border banking and international transactions

- Interest in wealth management and foreign currency services

- Demand for digital banking with human support and relationship managers

Interest & Hobbies

- International travel and global business exposure

- Investment planning and long-term wealth growth

- Tracking financial markets and economic trends

- Adoption of digital finance and premium banking services

Pain Points

- Lengthy banking processes and slow approvals

- Concerns around online security, fraud, and data privacy

- Limited personalised support in digital-only banking

- Difficulty managing multi-currency and international finances

Social Media Presence

- YouTube

- Twitter (X)

Marketing Strategy of HSBC

Let’s take a look at the marketing strategy of HSBC and how HSBC carries out the marketing campaign, for example.

Segmentation, Targeting, and Positioning

HSBC, a global banking giant, uses a smart strategy to cater to its massive customer base. They combine two key approaches:

- Understanding Where You Are: Since cultures, preferences, and even financial systems vary greatly around the world, HSBC focuses on geographic segmentation. This allows them to tailor their services to the specific needs of each region.

- Knowing Your Needs: HSBC also recognises that people at different life stages have different financial goals. They use demographic segmentation, considering factors like income level and life cycle stage, to group customers with similar needs.

- Targeting the Next Generation: One exciting area for HSBC is the millennial market (aged 25-34). Through surveys, they’ve created a profile of their ideal millennial customer, that is, ’The Carefree Experientialist.’ This group is tech-savvy and seeks experiences, and HSBC wants to be their financial partner as they plan for the future.

- Bridging the Gap: Local Bank, Global Reach HSBC goes beyond just offering products. They position themselves as a bridge between cultures, leveraging their global reach while maintaining strong local connections. Their ‘world’s local bank’ tagline perfectly captures this strategy – a global bank that feels familiar wherever you are.

For those aspiring to understand and replicate such achievements, pursuing a post-graduation in digital marketing can offer invaluable insights and skills.

HSBC’s Marketing Campaigns

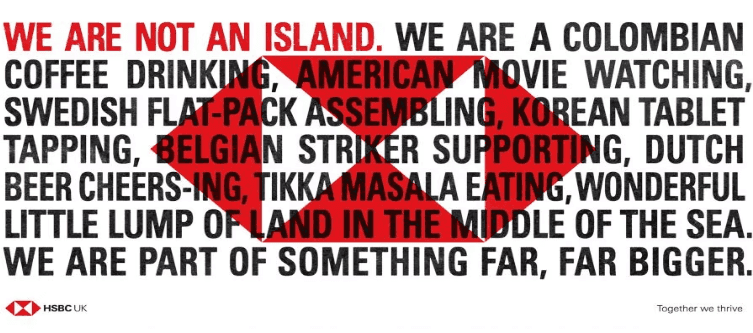

1. Together We Thrive

Source: Google

HSBC hit a rough patch in 2018. Branch closures, competition from new players, and the retirement of their iconic ‘The World’s Local Bank’ slogan all combined caused a 25% drop in their brand value. Needless to say, the brand desperately needed a refresh.

The answer came in two parts: A renewed sense of purpose and a unified visual identity. Together We Thrive' (2018) refreshed global purpose. Current: 2025 NRI 'Deep Connection to Roots' campaign targets Global Indians via OOH airports, YouTube, PVR films’ campaign, created by Saatchi & Saatchi and Wunderman Thompson, addressed both. While branch closures meant they could no longer claim to be the world’s local bank literally, the campaign captured the spirit of HSBC’s commitment to an open and interconnected world.

Source: Google

In 2018, HSBC launched the ‘Together We Thrive’ campaign to revamp its brand image. This campaign resonated with audiences worldwide because it allowed local markets to create unique stories that addressed their specific needs. A key goal was to shift the perception of HSBC from a bank for the elite to a more approachable and inclusive financial institution. Print ads highlighted the international connections of Britons, showcasing ties to countries like India, Korea, Sweden, and America.

HSBC’s marketing campaign also leveraged video to connect with audiences. One video featured a couple whose wedding was postponed. The husband creates a simple yet intimate ceremony at home to show his love and commitment. Another video depicts a disappointed child whose vacation was cancelled. The resourceful father builds a locomotive at home, creating a special memory despite the setback.

Through these heartwarming stories, HSBC targeted frustrated millennials (aged 25-40) whose plans were disrupted by unforeseen circumstances. The campaign aimed to convey the message that even in difficult times, there’s still room to create lasting memories.

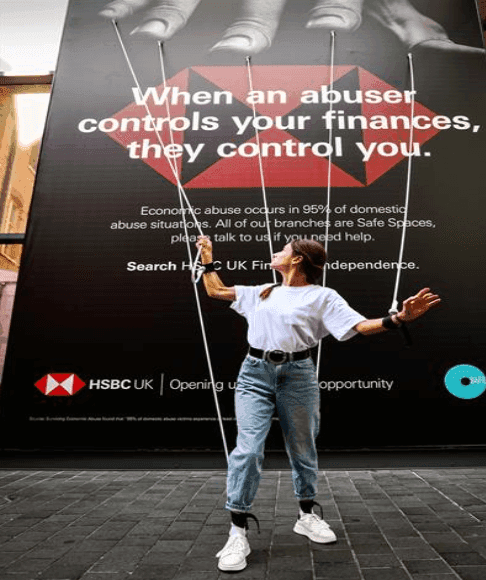

2. When an Abuser Controls Your Finances, They Control You

Source: Google

A live billboard in Spitalfields Market promotes HSBC UK’s in-branch ‘safe spaces’ for those experiencing domestic abuse.

It incorporates the original out-of-home campaign, which debuted in May and depicted strings attached to a hand with the copy: “India-focused: 'Safe Spaces' evolved into 2026 wellness lounges at events for affluent stress relief.” These strings connect a live performer to the billboard. At first, their movements are natural, allowing them to move a certain distance before being dragged back.

HSBC’s target audience for this ad was people of all ages who are victims of domestic abuse, have access to specialist help and advice and have the opportunity to build a life beyond the crisis.

Marketing Channels Used by HSBC

Hybrid Marketing Approach: HSBC India uses a mix of digital, traditional, and experiential channels to target premium and affluent customers.

Digital & Social Media: Active presence on LinkedIn (professionals & corporates), Instagram (brand storytelling), and Facebook (reach & engagement).

Influencer & Brand Ambassador Marketing: Celebrity-led campaigns featuring Virat Kohli to build trust, aspiration, and strong brand recall.

Content & OTT Marketing: Targeted campaigns on OTT platforms like Disney+ Hotstar to reach digitally savvy, high-income audiences.

Traditional Media: Continued use of TV, print, and outdoor advertising for nationwide visibility and premium brand recall.

Experiential Marketing & Sponsorships: HSBC Golf League (now with app for tournaments/merch), Star Struck IP (Arijit Singh tour, Shakti Mumbai sold out), upcoming 2026 global entertainer, PVR lounges, and premium lounges at PVR to engage affluent customers.

Mobile & Digital Platforms: HSBC app and website used for personalised communication, product discovery, and wealth insights.

Direct & Relationship Marketing: Relationship managers and storytelling campaigns like “Our Customers, Our Ambassadors” to build trust and retention.

Comparing HSBC’s market position with the SWOT analysis of Barclays provides a comprehensive view of how top-tier UK banks navigate global economic shifts.

HSBC Marketing Strategy Breakdown

1. Premium, Global & Digital Brand Positioning

HSBC India positions itself as a premium, globally trusted bank with strong digital capabilities.

It's campaigns consistently reinforce the idea of global access and sophistication, reflected in messaging like “Opening up a world of opportunity”, which appeals to affluent, internationally minded customers.

2. Clearly Defined Target Audience

HSBC’s marketing primarily targets High-Net-Worth Individuals (HNWIs), UHNWIs, and the “Global Indian” segment such as professionals working abroad, entrepreneurs expanding overseas, and families planning international education.

For example, campaigns around overseas education loans and global investments directly address these cross-border needs.

3. Wealth & Private Banking as Growth Drivers

Wealth management and private banking are central to the strategy.

HSBC highlights personalised portfolio management, global investment access, and exclusive advisory services through premium campaigns, especially after re-entering private banking in India.

4. Digital Transformation & Personalisation

The bank has invested heavily in AI, data analytics, and mobile-first platforms to improve customer experience.

For instance, its mobile banking app enables personalised wealth insights and global account visibility, helping affluent customers manage finances across countries seamlessly.

5. High-Impact Brand Building

HSBC leverages large-scale sponsorships, OTT advertising, experiential events, and celebrity-led campaigns to build aspiration. A notable example is its long-term association with Virat Kohli, which enhances brand trust and recall among premium audiences.

Partnerships with OTT platforms like Disney+ Hotstar and events like HSBC Golf League further strengthen reach among urban, digitally savvy consumers.

6. Global Connectivity Storytelling

A recurring theme in HSBC’s marketing is its international network across markets.

Campaigns often showcase how the bank supports cross-border education, global business expansion, and international wealth management clearly differentiating it from domestic-only banks.

7. Relationship-Driven Marketing

HSBC combines digital outreach with high-touch relationship management. Dedicated relationship managers, personalised communication, and customer-led storytelling campaigns such as “Our Customers, Our Ambassadors” help build trust and long-term loyalty.

8. Strategic Focus on India & Asia

All marketing efforts align with HSBC’s broader strategy of prioritising high-growth Asian markets.

India is positioned as a key growth hub, with increased branch expansion, digital investments, and targeted campaigns supporting both affluent retail clients and globally active corporates.

This integrated approach allows HSBC India to balance brand-building with performance-driven marketing, while staying aligned with its core objective of serving premium, globally connected customers.

Results & Impact

Reported over $2.4 billion in profit before tax in 2025, showing double-digit year-on-year growth.

- Wealth and personal banking profits grew by ~80%, driven by rising demand from affluent and globally active clients.

- Commercial and corporate banking profits crossed $500 million, highlighting strong traction among businesses and MNCs.

- Received regulatory approval to open 25 new branches, marking the largest expansion by a foreign bank in India in over a decade.

- India emerged as one of HSBC’s top profit-contributing markets globally.

- Digital and wealth-led initiatives contributed significantly to revenue growth in 2025.

- Continued profit momentum with ~22%% driven by NRI inflows and AI-wealth tools in 2026.

- Strong positioning in cross-border banking and global markets, supporting international trade and investments.

India became HSBC’s largest employee base globally, underlining long-term commitment to the market. Well placed to benefit from India’s rapidly expanding HNWI and wealth management market.

What Worked & Why

HSBC India succeeded in India by clearly positioning itself as a premium, globally connected bank something domestic competitors cannot easily replicate.

Its strong focus on cross-border banking, wealth management, and international connectivity resonated well with HNWIs and the “Global Indian” segment.

Celebrity-led branding, especially campaigns featuring Virat Kohli, significantly boosted brand recall and trust by aligning HSBC with excellence, aspiration, and global success.

At the same time, a digital-first approach using LinkedIn, Instagram, OTT platforms like Disney+ Hotstar, and experiential events like HSBC Golf League helped the bank reach affluent, digitally savvy audiences effectively.

Finally, HSBC’s relationship-driven model combining personalised advisory services, dedicated relationship managers, and improved digital platforms strengthened customer trust and long-term loyalty.

The parallel expansion of branches and mobile banking further reinforced HSBC’s long-term commitment to the Indian market.

While HSBC focuses on premium global wealth management, it faces aggressive competition in the Indian market from local leaders, as seen in the Marketing Strategy of HDFC Bank.

What Didn’t Work & Why

Despite its strong brand, HSBC India struggled to compete on speed and mass-scale digital experience against domestic private banks and fintechs, whose apps and onboarding processes are often faster and more intuitive.

This limited HSBC’s appeal beyond premium, niche segments. Its premium-first positioning also restricted wider market penetration, making it harder to capture mid-income or mass-affluent customers compared to banks like HDFC or ICICI.

Additionally, frequent regulatory constraints and internal restructuring slowed execution and reduced marketing agility in a fast-moving Indian banking environment.

Lastly, HSBC’s relationship-led model, while effective for HNWIs, is resource-intensive and less scalable, limiting rapid expansion compared to digitally native competitors.

Want to Know Why 50,00,00+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 23, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.