Updated on Feb 19, 2026

Share on:

HDFC Bank’s marketing strategy is built on trust-led branding, SEO-driven educational content, mobile-first engagement, and CRM-based personalisation to strengthen customer acquisition and retention.

With over 100 million customers and nearly 97% digital transaction adoption in early 2026, the bank uses omnichannel marketing and mass media to simplify financial products, promote safe digital banking, and position itself as a dependable long-term banking partner across urban and semi-urban India.

The research and initial analysis for this case study were conducted by Femy Shah, a student of IIDE’s Post Graduate Digital Marketing (Batch May 2025).

About HDFC Bank

HDFC Bank entered India’s banking sector in 1994 during the post-liberalisation phase, positioning itself as a customer-focused private bank known for strong service quality and early digital adoption.

Headquartered in Mumbai, it stood out from traditional public sector banks through technology-led operations and consistent customer experience. A major milestone came in 2023 with its merger with HDFC Ltd., which strengthened its capabilities in home loans, retail banking, and end-to-end financial services.

As of currently, the bank operates around 9,600 branches and 21,000+ ATMs, serving over 97 million customers across India with a wide portfolio spanning savings accounts, credit cards, loans, investments, insurance, and digital payments.

Beyond products, HDFC Bank positions itself as a trusted financial partner focused on security, reliability, and long-term relationships.

Its vision of becoming a world-class Indian bank combines digital innovation with human-centric service an approach that resonates strongly in a trust-driven banking market.

Learn Digital Marketing for FREE

Marketing Objective or Business Challenge

Despite its strong market position, HDFC Bank faces intensifying competition from agile fintech startups that are rapidly reshaping customer expectations around speed, personalisation, and digital-first experiences.

The bank must navigate the delicate balance of maintaining profitability while ensuring asset quality and meeting stringent regulatory requirements. The primary challenge involves transitioning millions of customers from traditional branch-based banking to fully digital channels without compromising service quality or trust.

HDFC Bank's core objective is to accelerate digital adoption, enhance brand equity through trust-based communication, and deepen customer engagement using data-driven personalisation.

Additionally, the bank aims to expand its presence in semi-urban and rural markets while reducing customer acquisition costs through digital channels and shifting from transactional product-selling to building experience-driven, long-term relationships.

You can compare this with the marketing strategy of SBI to understand public vs private bank positioning.

Buyers Persona:

Priya & Arjun

Mumbai

Occupation: SWorking Profession

Age: 18 - 45 year old

Motivations

- Seeking a stable, trustworthy banking partner for long-term financial security

- Preference for seamless digital transactions for everyday banking needs

- Interest in wealth creation through investments and savings products

- High value placed on responsive customer service and problem resolution

Interest & Hobbies

- Regular online shopping and UPI-based payments

- Active expense tracking and investment portfolio monitoring

- Travel enthusiast interested in credit card rewards and lifestyle benefits

Pain Points

- Confusion around complex banking terminology and financial jargon

- Persistent concerns about online fraud and digital security threats

- Lack of personalised financial advice tailored to individual goals

- Frustration with slow resolution times for complex banking issues

Social Media Presence

- YouTube

- Twitter (X)

Marketing Channels Used by HDFC Bank

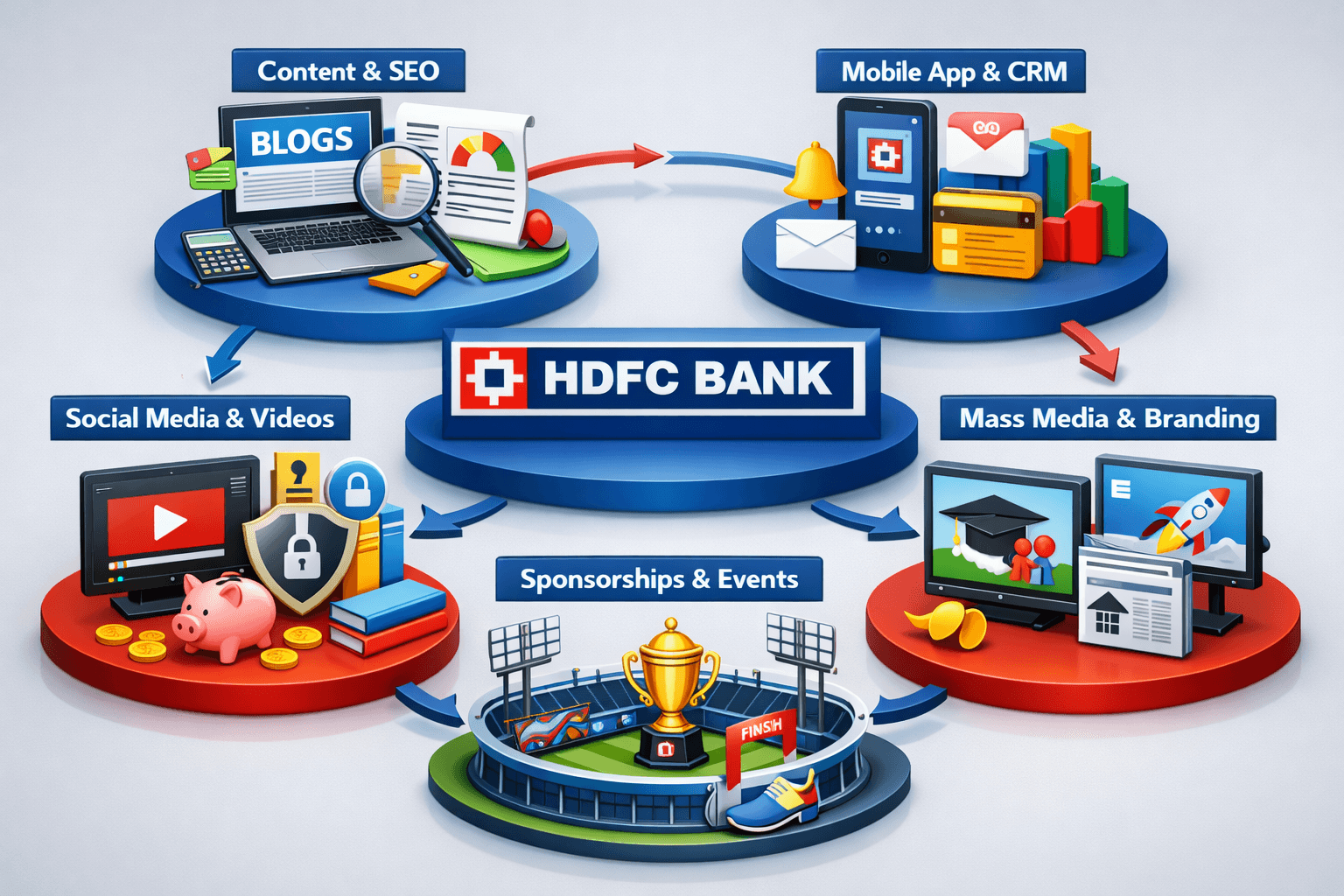

HDFC Bank follows a well-integrated marketing strategy combining digital performance, content marketing, social media, and traditional media to reach customers across India.

On the digital side, the bank focuses on:

- SEO-optimised blogs and financial education content

- Performance marketing for loans, credit cards, and investments

- Mobile app promotions and CRM-based email/SMS marketing

HDFC Bank uses a multi-channel marketing strategy combining digital campaigns, social media, and traditional advertising to attract high-intent customers and strengthen engagement.

Educational content, fraud-awareness initiatives, and personalised communication help build trust, while IPL sponsorships and mass media boost brand visibility. By integrating mobile banking, NetBanking, and branch support, the bank delivers a seamless omnichannel experience that drives awareness, retention, and long-term customer relationships.

HDFC Bank Marketing Strategy Breakdown

1. Content Marketing & SEO

HDFC Bank invested heavily in SEO-driven content to capture customers at the research stage of their financial journey.

They created blogs, guides, and FAQs on topics like:

- Credit scores

- Loan eligibility

- Tax planning

- Digital banking safety

This helped the bank rank for high-intent financial keywords while positioning itself as a trusted advisor rather than just a product seller.

Educational content reduced hesitation among first-time users and built confidence before purchase decisions.

Axis Bank marketing strategy focuses on digital acquisition and youth-centric campaigns similar to HDFC.

2. Mobile App & CRM Marketing

The HDFC Bank mobile app and NetBanking platform are not just service tools they act as powerful engagement channels.

Through personalised emails, SMS alerts, and in-app notifications, customers receive reminders, spending insights, bill alerts, and pre-approved offers.

This approach encourages:

- Habit-driven engagement

- Repeat usage

- Higher customer lifetime value

CRM-led personalisation ensures communication stays relevant rather than intrusive.

3. Social Media & Educational Content

HDFC Bank uses social media and video platforms to simplify complex financial topics.

Short videos, explainers, and tips help users understand:

- Investments

- Loans

- Fraud prevention

- Digital banking

Campaigns like fraud awareness initiatives made financial safety relatable, especially for younger audiences.

This strategy strengthened the bank’s positioning as a responsible and customer-centric brand.

4. Mass Media & Brand Communication

HDFC Bank continues to invest in television, print, and outdoor advertising to maintain mass-market visibility.

Campaigns focus less on products and more on life moments like:

- Education

- Family milestones

- Entrepreneurship

This emotional storytelling builds trust and long-term brand recall across diverse demographics.

IPL sponsorships and festive campaigns further boost national visibility.

5. Sponsorships & On-Ground Presence

The bank actively invests in large-scale sponsorships and events such as sports leagues, marathons, and corporate initiatives.

These high-visibility touchpoints:

- Strengthen leadership perception

- Create emotional brand connections

- Expand nationwide presence

They also complement digital marketing by building offline credibility.

What Worked & Why

HDFC Bank’s trust-first positioning worked strongly in a credibility-driven industry like banking. Campaigns focused on safety, reliability, and digital security helped retain customers even as fintech platforms gained traction.

Early investment in digital infrastructure and CRM marketing delivered scale and efficiency. With most transactions moving to mobile banking, NetBanking, and UPI, the bank improved convenience while lowering operational pressure.

SEO-led financial education built authority, app-led campaigns drove daily usage, and personalised communication increased engagement and retention.

Strong presence across TV advertising and IPL sponsorships ensured nationwide brand recall. This balance of emotional branding and performance-driven digital marketing helped HDFC Bank stay competitive against both traditional banks and fintech startups.

The Marketing strategy of Kotak Mahindra Bank reveals premium positioning and CRM-driven engagement.

What Didn’t Work & Why

After the 2023 HDFC Ltd merger, the bank faced short-term digital issues like app slowdowns and transaction failures, which led to negative feedback on social media.

The communication felt reactive, especially for digital-first users who expect seamless, fintech-level experiences. This created a temporary gap between HDFC Bank’s digital promise and actual user experience.

The situation highlighted a key lesson for digital banking: operational stability must come before marketing communication.

Even strong, trust-led brands face high expectations, and service disruptions can quickly impact customer sentiment and brand perception.

Want to Know Why 50,00,00+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Feb 20, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.