Orginally Written by Aditya Shastri

Updated on Jan 6, 2026

Share on:

In 2026, Redington India continued to play a critical role in powering the technology ecosystem across emerging markets. From distributing smartphones and enterprise hardware to enabling cloud and software solutions, Redington acts as a silent backbone for global tech brands. But in a volatile global economy, is this distribution giant still positioned for sustainable growth in 2026?

This blog dives deep into the SWOT Analysis of Redington India, helping students, marketers, and business leaders understand its market position, challenges, and future potential.

Before diving into the article, I’d like to share that the research and foundational insights for this SWOT analysis were contributed by Shreeya jain, a current student of PGDM in Digital Marketing at IIDE, Batch June 25

If you found this article insightful, feel free to connect with Shreeya Jain on LinkedIn to share your feedback or appreciation - it will surely be valued.

- About Redington India 2026

This analysis reflects a combination of academic research, industry understanding, and stratFounded in 1993, Redington (India) Ltd is a leading IT, telecom, and technology product distribution company.

Headquartered in Chennai, the company operates across 37 emerging markets, connecting over 250 global technology brands with millions of end customers. Its portfolio spans hardware, software, cloud services, and integrated supply-chain solutions. In 2025, Redington remains a key enabler of digital transformation across Asia, the Middle East, and Africa.

Brand Slogan: Trusted Supply Chain Partner – reflecting Redington’s role as a reliable bridge between global technology brands and emerging markets.egic thinking developed as part of the IIDE curriculum.

While technology is evolving at a supersonic pace, its adoption lags significantly behind due to many ever-evolving tangible and intangible barriers. This friction of technology or gap between the rate of innovation in technology and the speed at which it gets adopted, Redington is trying to reduce actively.

Redington values over US$10 billion and is a rapidly growing technology solution provider with a network of 450+ international brands across 40 markets in the IT space. We power the quick technology adoption moving at unmatched velocity and scope.

| Attribute | Details |

|---|---|

| Official Company Name | Redington Limited |

| Founded Year | 1963 |

| Website URL | www.redingtongroup.com |

| Industries Served | IT Hardware, Cloud, Cybersecurity, IoT, Mobility |

| Geographic Areas Served | India, MEA, Turkey, LATAM, Southeast Asia |

| Revenue (FY25) | ₹99,562 crore |

| Net Income/PAT (FY25) | ₹1,340 crore |

| Employees | ~2,000 (approx., distributor model) |

| Main Competitors | Ingram Micro, Tech Data, Synnex, eClerx, Zensar |

Learn Digital Marketing for FREE

Why SWOT Analysis of Redington India Matters in 2026

In 2026, Redington India operates in a rapidly changing technology distribution market, making a SWOT analysis crucial. The company faces competition from global distributors like Ingram Micro, regional players like Compuage and Savex, and new digital supply-chain and e-commerce entrants.

Customer expectations are shifting, with enterprises and Gen Z buyers demanding faster fulfillment, cloud solutions, software integration, and omnichannel experiences. Redington’s focus on software and cloud distribution addresses these trends.

Technology adoption :AI-driven forecasting, automation, and digital supply chains,is critical for efficiency and margins. Macroeconomic factors like inflation, currency volatility, and enterprise spending, along with evolving regulations and sustainability requirements, further impact operations.

These forces make SWOT analysis essential to understand how Redington can leverage strengths, address vulnerabilities, and stay competitive in 2026.

SWOT Analysis of Redington India

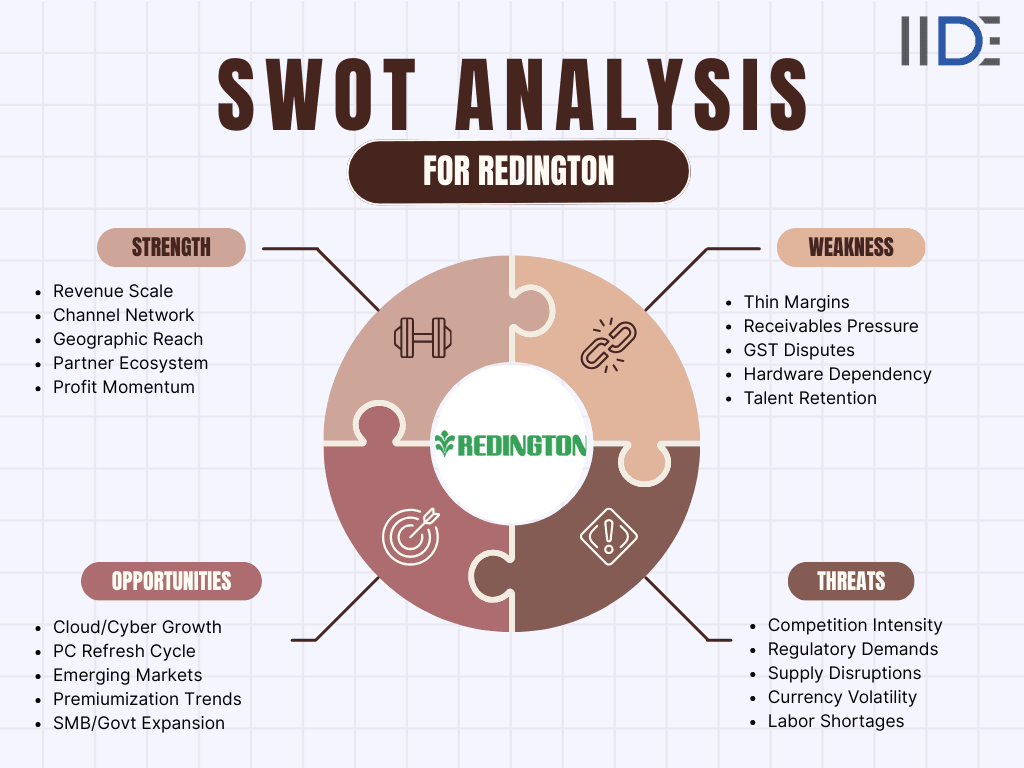

Strengths of Redington India

1. Large Distribution Network

Redington operates in 38 emerging markets (including India, the Middle East, Turkey, and Africa) with an incredibly robust physical and digital footprint.

- Optimal Logistics: Through its subsidiary ProConnect, the company manages over 168 warehouses and approximately 7.7 million square feet of storage space.

- Deep Reach: They serve more than 39,000 customer locations and work with over 40,000 channel partners, allowing them to penetrate Tier 2, 3, and 4 cities where global brands might otherwise struggle to reach.

2. Strong Global Brand Relationships

Redington acts as a "preferred partner" for over 290 international brands.

- The "Apple" Factor: Redington is the largest distributor for Apple in India. High-profile launches (like the iPhone) significantly boost their revenue and stock sentiment.

- Tech Titans: They have long-standing ties with Samsung, Microsoft, HP, Dell, and Cisco. Because these brands are market leaders, Redington enjoys a constant, high-volume demand for essential hardware and software.

3. Diversified Business (The Pivot to Services)

A major strength is Redington’s transition from a pure hardware distributor to a solutions provider.

- Cloud & Software: Their Software Solutions Group (SSG) is a major growth engine. They offer cloud migration, cybersecurity (via partnerships with firms like CrowdStrike), and AI-driven analytics.

- CloudQuarks: This is their proprietary digital platform that simplifies cloud subscriptions and billing for resellers, making Redington a central hub for the "as-a-service" economy.

- Risk Mitigation: By increasing revenue from software (which has higher margins of around 5.5–6% compared to 4–5% for hardware), they reduce their vulnerability to the low-margin, high-volume nature of the PC and mobile markets.

4. Financial Stability

Despite the thin margins typical of the distribution industry, Redington maintains a strong financial profile.

- Revenue Growth: The company has seen a 5-year CAGR of approximately 14%, reaching revenues close to ₹100,000 crore (FY25).

- Healthy Balance Sheet: They maintain a low debt-to-equity ratio (around 0.3x to 0.4x) and carry a high Crisil AA+ credit rating.

- Working Capital Efficiency: They are experts at managing "inventory turnover" - how quickly they sell and replace products - which ensures they have enough cash flow to fund massive operations.

5. Industry Recognition

Certifications and awards serve as "trust signals" for both investors and vendors.

- Governance: Redington is often cited for its high standards of corporate governance and transparency, being one of the first distributors in India to be publicly listed (2007).

- Vendor Awards: They frequently win "Distributor of the Year" awards from partners like IBM, Microsoft, and HP. These accolades make it easier for them to win exclusive distribution rights for new products and expand into new territories.

Redington India – Weaknesses

1. Thin Hardware Margins

The core of Redington's business - distributing PCs, smartphones, and servers - is notoriously low-margin.

- The Profitability Trap: While hardware drives massive revenue (nearly ₹100,000 crore in FY25), the operating margins are razor-thin, typically hovering between 2% and 2.5%.

- Volume Obsession: To make a meaningful profit, the company must move enormous volumes. Any slight dip in consumer demand or a delay in a product launch (like a late iPhone release) can disproportionately hurt the bottom line.

- Inventory Risk: Because technology depreciates rapidly, holding "dead stock" (products that don't sell quickly) leads to heavy write-offs, further eating into those small margins.

2. Dependence on Volatile Emerging Markets

Redington’s heavy footprint in markets like Turkey, Nigeria, and Kenya is a double-edged sword.

- Currency Fluctuations: Redington often buys products in USD but sells them in local currencies (like the Turkish Lira). In 2024–2025, extreme inflation and currency devaluation in Turkey created significant "forex losses" that suppressed overall group profits.

- Geopolitical Instability: Political unrest or changes in import regulations in African markets can abruptly halt supply chains, making long-term financial planning difficult.

3. High Operating Costs & Capital Intensity

Maintaining the "backbone" of the tech industry is expensive.

- Fixed Costs: To compete, Redington must constantly invest in "Grade A" automated warehouses and specialized logistics (via its subsidiary ProConnect). This requires massive fixed capital investment.

- Working Capital Pressure: Redington has to pay vendors (like Apple or HP) almost immediately, but they often give credit terms (30–60 days) to their 40,000+ resellers. This "gap" requires them to keep large amounts of cash or short-term debt on hand, leading to high interest expenses.

4. Fierce Competitive Landscape

Redington faces a "pincer movement" from both global giants and nimble local players.

- Global Competitors: Ingram Micro, Tech Data

- Local / Regional Competitors: Compuage, Savex, HCL Tech Such deficiencies can affect profitability in the future if reforms are not made.

Opportunities in Redington India

Redington is currently undergoing a massive evolution, shifting from a "box mover" (hardware distributor) to an "ecosystem orchestrator." This transition is designed to capture higher-margin, more predictable revenue streams.

Here is an elaboration of the strategic opportunities you identified:

1. Software & Cloud Expansion (The "Digital Trinity")

Redington is moving toward a Software-as-a-Service (SaaS) and cloud-heavy model to escape the low margins of hardware.

- Recurring Revenue: Unlike a one-time laptop sale, cloud subscriptions provide monthly or annual recurring revenue (ARR). In Q2 FY26, Redington reported a staggering 48% YoY growth in its software solutions segment.

- CloudQuarks Platform: Their proprietary digital marketplace, CloudQuarks, automates the entire lifecycle of cloud services - from sales and billing to renewals - making it easier for their 40,000+ partners to sell cloud products from AWS, Microsoft, and Google Cloud.

2. Enterprise Digital Transformation

As businesses move their entire operations online, they no longer just buy "parts"; they buy "solutions."

- Advanced Tech: Redington is capitalizing on the demand for Cybersecurity, Managed Services, and Hybrid Cloud infrastructure.

- Outcome-Based Selling: Instead of just selling a server, Redington now helps enterprises design their digital architecture.

This "Consulting-as-a-Service" model allows them to charge for expertise rather than just logistics.

3. AI & Automation in the Supply Chain

Redington is using AI both as a product to sell and as a tool to improve their own efficiency.

- Smart Logistics: Through its subsidiary ProConnect, the company uses AI-driven demand forecasting to predict which products will sell where. This reduces "dead stock" and lowers warehousing costs.

- AI Capability Centre: They have developed over 75 AI use cases, ranging from internal process automation to "AI-enabled Managed Service Providers" (AIMSPs) who help small businesses adopt AI.

4. Gen Z-Driven Consumption & Omnichannel

The shopping habits of Gen Z (digital natives) are forcing a change in how technology is distributed.

- Omnichannel Strategy: Redington is blurring the lines between online and offline. Their Direct-to-Retail (D2R) model supports 5,000+ premium stores, ensuring that a Gen Z consumer can research an iPhone online and find it instantly available at a local shop.

- Premiumization: Gen Z’s preference for high-end, "authentic" technology is driving a surge in the Mobility Solutions Group, which grew 18% recently, fueled by high demand for premium smartphones.

5. Strategic Partnerships & Hyperscalers

By aligning with the world's most powerful tech companies, Redington gains access to exclusive markets.

- Hyperscaler Alliances: Deeper ties with Google Cloud, Microsoft, and AWS allow Redington to be the bridge for Small and Medium Businesses (SMBs) entering the cloud.

- Sustainability & ESG: They are increasingly partnering with providers of "Green Tech" and circular economy solutions (like device buy-back programs). This appeals to modern investors and helps them enter "Green IT" vertical markets.

Threats to Redington India

Redington Limited operates as a vital link in the global technology supply chain, but its role as an intermediary makes it highly sensitive to macroeconomic and geopolitical shifts. As of late 2025, these threats have become more pronounced due to volatile global trade policies and shifting consumer behaviors.

Here is an elaboration on the external threats facing the company:

1. Global Economic Uncertainty

Redington’s expansive footprint in 38 markets exposes it to a "cocktail" of economic risks.

- Currency Volatility: This is arguably the biggest threat. In regions like Turkey and parts of Africa, sharp devaluations of local currencies against the US Dollar force Redington to raise prices, which crushes consumer demand. Because Redington buys in USD and sells in local currency, any delay in hedging or price adjustment leads to direct "forex losses."

- Inflation & Purchasing Power: High inflation in emerging markets has led Gen Z and middle-class consumers to delay "refresh cycles" for smartphones and laptops. In recent quarters, this has specifically impacted the sales of high-end brands like Apple and Samsung in international markets.

2. Technology Disruption (The "Middleman" Threat)

New-age digital platforms and brand-direct models are challenging Redington’s traditional value proposition.

- Direct-to-Consumer (D2C) Shifts: Brands like Dell, Apple, and HP are increasingly pushing sales through their own web stores and flagship retail outlets. This "disintermediation" removes the need for a distributor, potentially shrinking Redington's market share in urban hubs.

- Digital-First Competitors: New-age B2B platforms (like Udaan in India) use heavy VC funding to offer aggressive credit terms and digital-first logistics to small retailers, competing directly with Redington’s traditional channel partner network.

3. Changes in Regulation

As a cross-border distributor, Redington must navigate a "regulatory maze" that can change overnight.

- Import Duties & Tariffs: Governments often use import duties to protect local manufacturing (e.g., India’s "Make in India" initiative). Sudden increases in tariffs on finished electronics can make imported stock instantly uncompetitive or force Redington to hold expensive inventory that they cannot sell profitably.

- Compliance Complexity: New laws like India's Digital Personal Data Protection Act (DPDPA) 2023 and stricter Anti-Money Laundering (AML) rules in the Middle East increase the "cost of doing business." Non-compliance can lead to massive fines or even the suspension of distribution licenses.

4. Increasing Competitiveness

The distribution industry is seeing intense "price wars" as players fight for the same vendor contracts.

- Industry Consolidation: Global giants like TD SYNNEX and Ingram Micro have massive economies of scale, allowing them to operate on even thinner margins than Redington. If these giants decide to capture market share by undercutting prices, Redington’s profitability could face a "race to the bottom."

- Local Challengers: Regional players like Savex Technologies and Rashi Peripherals are becoming more sophisticated, offering specialized "value-added" services that were previously Redington’s unique selling point.

SWOT Analysis of Redington India 2026

Key Takeaways & IIDE Student Recommendations

Core Insight

Redington India’s core strength lies in its unmatched distribution network and trusted brand relationships. However, margin pressure and macroeconomic volatility pose ongoing challenges.

Strategic Recommendations

From an IIDE student’s perspective, Redington should aggressively scale its software and services portfolio to improve margins and revenue stability. Investing in AI-powered logistics and demand forecasting can help reduce operational costs and manage market volatility.

Expanding digital and direct-to-business channels will align the brand with Gen Z and enterprise buyers seeking speed and convenience. Additionally, selective market focus and deeper partnerships with cloud hyperscalers can help Redington transition from a distributor to a value-added technology solutions leader.

Future Outlook

If Redington successfully leverages its strengths while adapting to digital and service-led models, it is well-positioned to remain a dominant player in emerging markets beyond 2026.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

More Case Study

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.