Updated on Jan 5, 2026

Share on:

Future Enterprises, a veteran in India's retail and consumer services sector, boasts a storied history across grocery, fashion, and logistics through its group brands.

Today, the company stands at a critical crossroads, grappling with immense financial pressures, industry disruptions, and a full-scale business transformation.

The key question remains: Can this legacy player navigate these challenges to reignite growth?

The initial deep dive and research for this analysis were completed by Sonal Sharma, a student in IIDE's Online Digital Marketing Course, July Batch 2025. If you found her work valuable, a quick 'well done' message to Sonal Sharma on LinkedIn would be greatly appreciated!

This SWOT analysis breaks down the most critical internal and external factors that are poised to shape Future Enterprises' next chapter. It's designed to be a straightforward, highly practical tool for students and entrepreneurs looking to understand real-world corporate strategy.

About Future Enterprises

If you grew up in India anytime in the last two decades the name "Future Group" probably triggers a very specific memory. Maybe it was the chaotic rush of a Sabse Sasta Din sale at Big Bazaar or grabbing a quick outfit at Brand Factory. For a long time Kishore Biyani’s retail empire wasn’t just a company, it was a habit for millions of Indian middle-class families.

But behind those storefronts and flash sales was the engine room that kept it all running: Future Enterprises Limited (FEL). I’ve been following the retail space for years, and watching the trajectory of FEL is like watching a slow-motion crash of a luxury car. It’s a fascinating, albeit slightly tragic, case study in how quickly fortunes can change in the business world.

Here's the sobering snapshot on Future Enterprises (FEL) - it's rough, but let's break it down simply.

Quick Facts Today:

- Around since 1987 (retail ancient history).

- Once employed ~50,000 people.

- FY24 revenue: just ₹393 Cr (huge drop).

- Market cap: ~₹33 Cr (startups beat that now).

What Went Wrong?

A perfect storm: too-fast expansion, piled-up debt, and rivals like Reliance Retail, DMart sprinting ahead with better tech and cash. Now in CIRP (court-managed insolvency) to salvage pieces and pay creditors - like emergency business surgery.

Bottom Line:

FEL shaped Indian shopping with Big Bazaar, but retail's brutal - no legacy saves you without adapting fast. Tough road ahead, but lessons for all.

Why Does SWOT Analysis Matter Now?

The Indian retail sector is highly competitive and rapidly transforming. Consumer preferences are shifting toward digital commerce and value formats. Traditional retail faces pressure from organized chains and deep-pocketed new entrants. Economic cost pressures like rising rents and debt servicing are also strategic concerns. Conducting a SWOT analysis helps unpack how Future Enterprises can survive and thrive in this dynamic context.

Learn Digital Marketing for FREE

SWOT Analysis of Future Enterprises

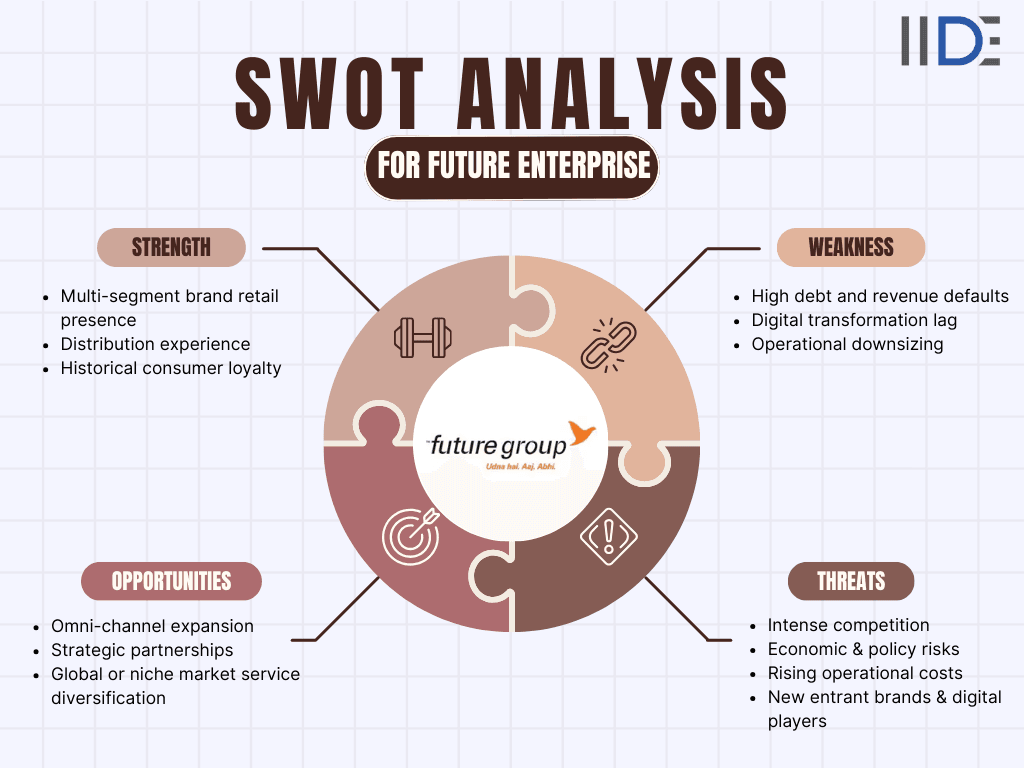

1. Strengths

Established Legacy & Brand Recognition:

Future Enterprises is considered a true veteran in the Indian retail and consumer services sector, possessing a long and storied history. This enduring presence has cultivated a high degree of trust and market familiarity among consumers. The analysis notes that the Future Group name and the associated loyalty are considered the company’s "one true asset" during its current challenges.

Multi-Segment Retail Footprint:

The company was the backbone of the Future Group ecosystem, which historically operated across several major retail segments, including grocery, fashion, and logistics, through its various group brands. This multi-segment approach allowed the company to broaden its customer reach across numerous categories.

Distribution Experience:

Future Enterprises Limited (FEL) was the engine room that handled the heavy lifting for the entire group. Its role was critical, encompassing manufacturing, supply chain management, insurance, and the core infrastructure that allowed the front-end stores to operate. This extensive, hands-on experience in distribution and supply chain provides a foundational strength in its in-store operations.

Historic Consumer Loyalty:

For two decades, the retail empire built by Kishore Biyani became a habit for millions of Indian middle-class families, particularly through marquee brands. Brands such as Big Bazaar and Food Bazaar, which were part of the expanded group, once commanded strong consumer affinity and loyalty, a significant advantage that is rooted in the company's legacy.

2. Weaknesses

Financial Stress & Default History:

The core strategic weakness is the company's severe financial distress, which includes significant debt burdens and a history of loan defaults. This situation has led to the company currently undergoing the Corporate Insolvency Resolution Process (CIRP), which is the corporate equivalent of emergency surgery to salvage what remains and pay back creditors.

Declining Revenue & Market Valuation:

The latest figures show a massive contraction in the company's scale.

- Revenue (FY24): Shrunk to approximately ₹393 Cr, a massive contraction for a company of this historical size.

- Market Value: As of December 2025, the market capitalization is hovering around ~₹33 Cr, indicating an extreme loss of value and investor confidence. The document notes that startups founded recently are worth ten times this amount.

Underleveraged Digital Transformation:

The company has lagged significantly in digital adoption compared to its agile competitors. While competitors were "sprinting ahead" with better technology and deeper pockets, Future Enterprises failed to scale its e-commerce and digital customer engagement effectively. This digital transformation lag is a major vulnerability against nimble online players.

Operational Downsizing:

The ongoing restructuring due to the financial crisis has forced the company to reduce its operational scale. This downsizing has the negative effect of reducing the company's bargaining power with key partners like suppliers and landlords, making future operations more difficult and expensive. The document suggests the fall was caused by a "perfect storm" of aggressive expansion, mounting debt, and a market shift that caught them off guard.

Explore the insightful marketing strategy of Future Enterprises, from Big Bazaar's consumer rituals to navigating retail disruptions - perfect blueprint for Indian brands, read the full blog now.

3. Opportunities

Expansion into New Formats (Omni-channel Retail & Micro-stores):

Future Enterprises can align with current consumption trends by shifting its physical footprint. The analysis specifically recommends that the company should "Ditch the Dinosaurs" by switching out huge, old-school stores for smaller, smarter, and more efficient formats. This move would not only reduce costs but also provide customers with a modern and better shopping experience, complementing a necessary shift toward an omni-channel retail strategy.

Strategic Alliances & Partnerships (Digital & Logistics):

To overcome its weakness in digital transformation, a critical path forward is through collaboration. The document's recommendations emphasize that the company must "Team Up" with external experts. This means partnering with smart, agile delivery services and logistics startups to outsource the complicated parts of modern delivery. Such alliances would help modernize the entire retail experience without requiring massive internal investment.

Leveraging Brand Legacy for Global Entry & Proprietary Brands:

The company's Established Legacy & Brand Recognition is noted as its "one true asset." This goodwill can be leveraged beyond the domestic market. By focusing on proprietary value brands, Future Enterprises could find potential to enter markets abroad, capitalising on the established reputation and experience it has in the retail sector.

Diversification into Services (Financial, Insurance, Loyalty):

While the core retail business is under distress, the company's "engine room" historically handled key support functions, including insurance. The document notes that "The valuable pieces, like the insurance business, will likely find a new home." Expanding into financial services, insurance partnerships, and loyalty ecosystems represents a critical way to unlock new, higher-margin growth streams that are less capital-intensive than traditional physical retail. This diversification can stabilize the business as the traditional retail model is being restructured.

4. Threats

Intense Competition:

The threat of intense competition is the most immediate and critical. Future Enterprises is up against two formidable forces:-

- Deep-Pocketed Giants: Global and powerful Indian retail conglomerates like Reliance Retail and Avenue Supermarts (DMart) are "sprinting ahead." These competitors possess "deeper pockets, better tech, and zero baggage," making it nearly impossible for a financially crippled company like FEL to compete on price, scale, or technology.

- Online Platforms: The document notes that the Indian retail sector is "rapidly transforming" with consumer preferences shifting toward digital commerce. This relentless shift means traditional physical retail, which was the core of Future Group, is under constant pressure from efficient online players.

Economic & Policy Shifts:

The company's core retail business is highly sensitive to macroeconomic instability.

- Shifting Consumer Behavior: Changes in consumer spending patterns, which are now favoring digital commerce and value formats, erode the profitability of FEL's traditional large-format stores.

- Regulatory Risks: Unfavorable changes in retail regulations or policy (mentioned as retail regulation in the analysis) can create additional hurdles, especially for a company already undergoing the Corporate Insolvency Resolution Process (CIRP).

Rising Operational Costs:

For a legacy retailer with a massive physical footprint, operational costs become a significant threat, especially during a financial crisis.

- Rent Escalation: The rising cost of maintaining numerous physical stores (known as rent escalation) severely erodes profit margins. This problem is exacerbated by the company's financial distress, as the ongoing restructuring is forcing it to reduce its operational scale, which in turn reduces its bargaining power with key partners like suppliers and landlords.

- Debt Servicing: The document explicitly mentions debt servicing as an economic cost pressure, which is a massive concern given the company is currently "drowning in debt (insolvency)."

Discover the innovative business model of Big Bazaar that revolutionized Indian hypermarkets through value retailing, private labels, and everyday low prices. Explore the full breakdown in our dedicated blog.

IIDE Student Takeaway, Conclusion & Recommendations

Key Takeaways

Future Enterprises' story is a harsh lesson: rapid growth on debt without a solid base leads to collapse.

The old Future Group - Big Bazaar, Food Bazaar - built deep consumer trust and rituals over two decades, now its sole edge amid chaos. Yet, crippling debt and CIRP insolvency overshadow everything, forcing focus on creditors over revival.

Actionable Recommendations

- Embrace Digital Platforms: Invest in strong e-commerce sites right away. Traditional retail is fading, so meet customers online where they shop daily.

- Form Strategic Partnerships: Team up with efficient logistics and delivery experts. Let specialists handle the complexities of modern supply chains.

- Modernize Store Formats: Replace large, outdated stores with compact, efficient ones. This cuts costs and offers a fresh, enjoyable shopping experience.

- Restructure Finances: Tackle the heavy debt head-on through restructuring and selling non-essential assets. Stability is key to any future progress.

Future Outlook Question

The big question now is: Can Future Enterprises actually manage to reinvent itself and become a fast, digitally-savvy player in India's cutthroat retail market?

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Feb 20, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

Future Enterprises Limited, founded in 1987 and based in Mumbai, serves as the backbone of the Future Group, managing retail infrastructure, investments in subsidiaries, and operations in manufacturing, supply chain, logistics, and insurance.

FEL focuses on developing and leasing retail infrastructure, holding stakes in group companies like Future Supply Chain for logistics and Future Generali for insurance, plus trading in apparel like denim and global sourcing for food and fashion.

It supports front-end retail like Big Bazaar and Food Bazaar for groceries, plus lifestyle stores, while handling the backend for value and lifestyle segments in India's consumer market.

As of late 2025, FEL faces high debt (over ₹4,500 Cr in ratings), low revenue (₹105 Cr), heavy losses (₹678 Cr), and is under the Corporate Insolvency Resolution Process (CIRP), with low credit ratings like ACUITE D.

Despite issues, FEL holds value in its retail assets, consumer goodwill from brands like Big Bazaar, and potential in logistics, insurance JVs, and supply chain for recovery.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.