Updated on Jan 6, 2026

Share on:

With a strong global presence and a wide range of products in the chemical, packaging, and technical textile industries, SRF Limited is a prominent Indian multi-business chemicals and industrial corporation. Even in a turbulent global economy, SRF has demonstrated resilience in 2024-2025 with strong quarterly profitability and capacity expansions.

However now the question is, what precisely makes SRF competitive, and what obstacles can affect its success in the future? We will answer these questions in this thorough SWOT analysis to provide investors, business students, and entrepreneurs with useful information.

Before diving into the article, I would like to inform you that the research and initial analysis for this piece were conducted by Hritick Das. He is a current student in IIDE's Online Digital Marketing Course, July Batch 2025.

If you find this helpful, feel free to reach out to Hritick Das to send a quick note of appreciation for his fantastic research, he will appreciate the kudos!

About SRF Limited

Originally established as Shri Ram Fibres Limited in 1970, SRF has developed into a multifaceted chemicals and industrial products with its headquarters located in Gurugram, India.

Fluorochemicals, specialty chemicals, packaging films (now Performance Films & Foils), and technical textiles are all part of its portfolio. SRF currently runs production facilities in South Africa, India, Thailand, and Hungary and exports to more than 90 nations.

| Attribute | Details |

|---|---|

| Official Name | SRF Limited |

| Founded | 1970 |

| Headquarters | Gurugram, Haryana, India |

| Industry | Chemicals, Packaging, Textiles |

| Products |

Fluorochemicals, Specialty Chemicals, Technical Textiles, Packaging Films |

| Geographic Reach | 90+ countries |

| Employees | 10,000+ (approx.) |

| Website | www.srf.com |

Why SWOT Analysis Matters Now?

Rapid fluctuations in demand patterns, changes in global supply chains, pressure from imports on prices, and technological upheaval characterize today's industrial scene.

Understanding SWOT aids stakeholders in assessing possible growth opportunities, risks from regulatory changes and economic headwinds, and strategic positioning in a competitive global marketplace for a diverse manufacturer like SRF. Long-term planning and investment decision-making are also aided by a solid SWOT analysis.

Learn Digital Marketing for FREE

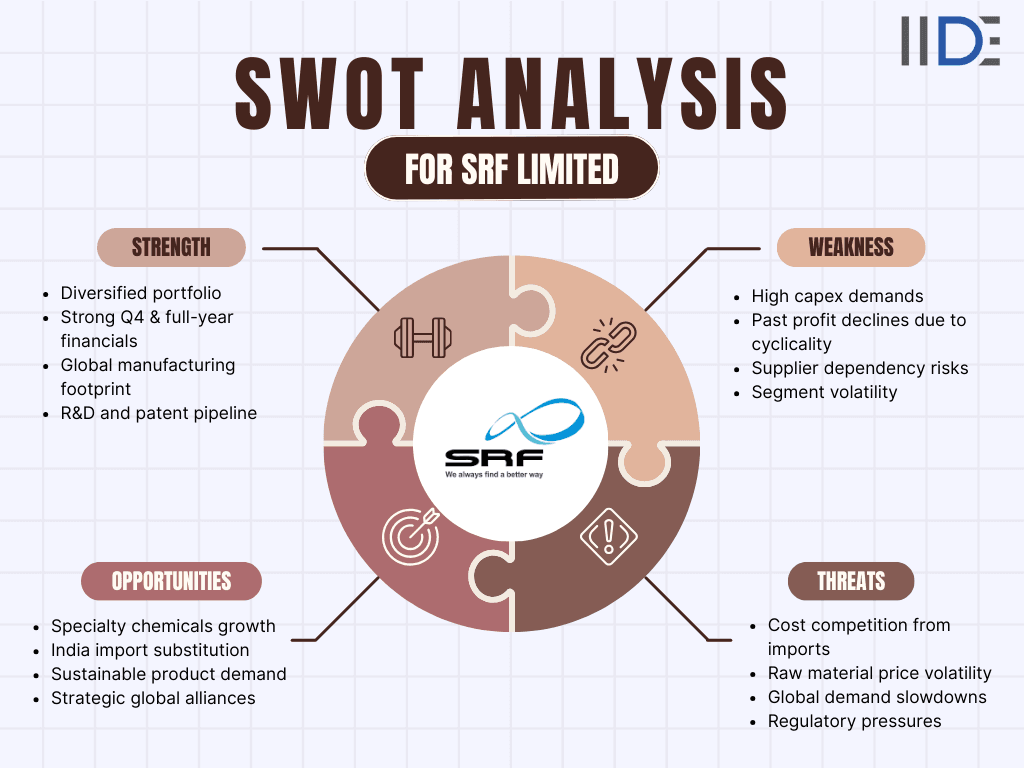

SRF Limited's SWOT Analysis

1. Strengths

A business model that is diversified:

- Operates across chemicals, specialty chemicals, packaging films, and technical textiles.

- Reduces dependence on any single market or product line.

- Helps stabilize revenue during downturns in one segment.

- Enables balanced growth across cyclical and non-cyclical sectors.

Excellent Operational and Financial Results:

- Delivered strong FY25 performance despite market volatility.

- Reported 21% growth in Q4 sales, showing demand resilience.

- Achieved 60% rise in profit before tax, reflecting operational efficiency.

- Demonstrates ability to generate solid margins in challenging conditions.

Manufacturing Presence and Global Reach:

- Operates facilities in India, Thailand, South Africa, and Hungary.

- Geographic spread reduces dependence on any single region.

- Strengthens supply capabilities for global customers.

- Enhances long-term growth opportunity through wider market access.

Market Dominance in Important Areas:

- Holds global leadership in products like nylon tire cord fabric.

- Strong presence in difluoro and trifluoro alkyl intermediates.

- Competitive edge supported by large-scale, specialized production.

- Reinforces customer loyalty due to reliable product quality and expertise.

Innovation and Intellectual Property:

- Continuously invests in R&D to develop advanced products.

- Holds hundreds of patents across its chemical and materials portfolio.

- Innovation pipeline supports long-term differentiation.

- Helps capture value in high-tech, high-margin product categories.

2. Weaknesses

High Needs for Capital Expenditures:

- Requires large investments for new plants and capacity expansion.

- Heavy capex can tighten cash flows in the short term.

- Returns on new projects may take time to materialize.

- Increases financial exposure if market conditions weaken.

Unpredictable and Cyclical Business Segments:

- Technical textiles and packaging films depend on commodity pricing cycles.

- Profitability fluctuates with raw material price movements.

- Sensitive to economic slowdowns affecting demand.

- Creates short-term earnings instability.

Past Profits Were Affected by Industry Headwinds:

- Experienced lower profitability during FY24 due to weak demand.

- Faced inventory destocking across global markets.

- Encountered pricing pressure from oversupply in certain products.

- Shows vulnerability to adverse global industry trends.

Dependency on Supplier Dynamics and Imported Inputs:

- Relies on external sources for critical raw materials.

- Exposed to volatility in international supply chains.

- Cost structure may be impacted by import price fluctuations.

- Increases operational risk during global disruptions.

Explore the innovative marketing strategy of SRF Limited, which leverages targeted B2B campaigns on LinkedIn and sustainability-focused initiatives to lead in specialty chemicals and packaging.

3. Opportunities

Expansion of Fluorochemicals and Specialty Chemicals:

- Rising global demand for refrigerants creates growth potential.

- Specialty intermediates gaining traction in pharmaceuticals and agrochemicals.

- SRF can expand capacity to capture higher-margin opportunities.

- Strengthens presence in fast-growing global chemical markets.

Domestic Market Growth and Import Substitution:

- India’s focus on chemical self-reliance boosts local manufacturing.

- Opportunity to replace imported intermediates with domestic production.

- Strong demand growth expected from Indian industrial sectors.

- Allows SRF to strengthen market share within India.

High-value and Sustainable Product Lines:

- Growing demand for eco-friendly refrigerants supports new product development.

- Advanced polymers attract high-value markets such as electronics and mobility.

- Aligns SRF with global sustainability regulations and trends.

- Creates long-term revenue streams from premium product categories.

International Partnerships and Strategic Collaborations:

- Partnerships like Chemours enhance access to niche technologies.

- Collaborations support quicker entry into specialized markets.

- Strengthens technical capabilities through shared expertise.

- Expands product offerings beyond internal R&D capabilities.

4. Threats

Low-Cost Producers’ Competitive Pressure:

- Chinese producers often supply chemicals at lower prices.

- Can erode global pricing benchmarks for key SRF products.

- May reduce export margins and competitiveness.

- Increases the need for efficiency and product differentiation.

Raw Material and Energy Price Volatility:

- Fluctuating input costs affect profitability, especially in chemicals.

- Packaging film margins are particularly sensitive to oil-derived raw materials.

- Sudden spikes in energy prices raise overall operating costs.

- Hard to maintain stable pricing in volatile commodity markets.

Slowdowns in the World Economy:

- Lower global demand reduces chemical export orders.

- Industrial clients may cut back on procurement during recessions.

- Sluggish growth in developed markets impacts specialty chemical sales.

- Creates uncertainty for near-term revenue visibility.

Environmental and Regulatory Difficulties:

- Tight environmental norms increase compliance costs.

- Restrictions on certain chemicals may affect product portfolios.

- Delays in approvals can hinder capacity expansion.

- Requires continuous investments to meet sustainability standards.

Discover a comprehensive SWOT analysis of GHCL, uncovering its strengths in cost-efficient soda ash production, weaknesses in raw material dependency, opportunities in expanding consumer goods like i-flo detergents, and threats from volatile chemical prices and competition.

IIDE Student Takeaway - Key Strategic Implications

A SWOT analysis on SRF Limited shows that there is an opportune brand with unusual strengths and unusual challenges. The prime strength for SRF Limited would be its portfolio and innovation capabilities, which make it variable and adaptable with regards to chemicals, packaging, and technical textiles.

The prime challenge within this brand arises from market pressures and costs associated with raw materials, as these might affect profitability. As IIDE students researching on this brand, we propose that capital expenditures should focus on speciality chemicals and high-end fluoroproducts. At the same time, there should be active efforts at cost optimization.

Additionally, SRF should identify opportunities based on its presence and innovation capabilities within developing markets and specialisation.

Conclusion & Recommendations

As of today's time, SRF Limited finds itself at a critical juncture. Its portfolio diversity, geospatial presence, and R&D focus make it an enviable position, but at the same time, it faces uncertainties and threats due to market uncertainties and sector-specific challenges.

From a marketing and business strategy perspective, SRF should better leverage its position to counter weaknesses: more visibility for high-value specialty products, entry into emerging geospatial markets, and making more efficient use of digital market outreach for B2B businesses.

By balancing innovation expenditure with efficient operations, it should better tap opportunities while tackling threats. Looking ahead, if SRF maintains focus on innovating and invests in high-growth business opportunities and makes its operations more resilient, it will be poised for continuing on its growth trajectory and extending its leadership position within the global chemicals and industrial intermediates market.

Want to Know Why 5,00,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

SRF is a company involved in diversified chemicals and industrial manufacturing, producing fluorochemicals, specialty chemicals, packaging films, and technical textiles.

SRF has eleven manufacturing plants in India, Thailand, South Africa, and Hungary, with exports to over 90 countries and a workforce exceeding 8,000 employees.

SRF is India's largest technical textiles manufacturer, a leader in fluorochemicals with innovations like low-GWP refrigerants, and holds a significant market share in packaging films with a strong R&D focus.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.