Orginally Written by Aditya Shastri

Updated on Jan 5, 2026

Share on:

Imagine a future wherein farming becomes climate-proof, pesticide-free, and powered by innovation-and one company is aggressively racing to make that future real. That company is UPL, a global agrochemical giant operating in more than 130 countries and re-inventing itself from a traditional pesticide manufacturer to next-gen sustainable agriculture leader.

But this is where the real story lies: Will UPL ultimately be able to evolve quickly enough to survive the Biotech revolution? Can it stay ahead as new age agri-tech disruptors reshape what farmers expect from crop protection brands?

This SWOT Analysis of UPL uncovers some surprising strengths driving its global dominance, weaknesses holding it back, massive opportunities it can still capture, and threats that might redefine its future. If you want to understand where the agriculture industry is headed, and how UPL plans on staying in the game, this breakdown is your shortcut to clarity.

Before diving into the article, I’d like to inform you that the research and initial analysis for this piece were conducted by Rinki Agarwal. She is a current student in IIDE’s Online Digital Marketing Course, July-2025.

If you find this helpful, feel free to reach out to Rinki Agarwal to send a quick note of appreciation for her fantastic research - she’ll appreciate the kudos!

About UPL

UPL Limited, established in 1969 by Rajnikant Shroff, has evolved from being a small Indian-based manufacturer of pesticides to a giant in the agrochemical industry with a worldwide presence from Mumbai. UPL currently provides sustainable agriculture solutions for all stages of a crop, from seeds and crop protection products to bio-solutions and post-harvest solutions.

As of 2024-25, UPL promotes the brand philosophy “OpenAg” - a vision that has been developed around open collaboration, sustainability, and a focus on food security. This brand philosophy repositions UPL from being a chemical company to a futures-driven agriculture innovator.

Now a Top 5 agrochemical player globally, UPL proudly operates in 130+ countries, has a growing bio-solutions range, and aims for a world where farming becomes even more productive, robust, and sustainable.

| Parameter | Details |

|---|---|

| Official Name | UPL Limited |

| Founded | 1969 |

| Founder | Rajnikant Shroff |

| Headquarters | Mumbai, India |

| Brand Philosophy/Slogan |

OpenAg - Open Agriculture. Open Opportunity. |

| Industries |

Agrochemicals, Biosolutions, Seeds, Crop Nutrition, Sustainable Agriculture |

| Global Reach | 130+ countries |

| Revenue (FY24) |

~USD 5.6 Billion (Source: UPL Annual Report 2024) |

| Net Income (FY24) | ~USD 130+ Million |

| Employees | ~13,000+ |

| Key Products |

Crop Protection, BioSolutions, Seeds, Soil Health, Zeba, Decco Post-Harvest |

| Major Competitors |

Bayer CropScience, Syngenta, BASF, Corteva Agriscience, FMC Corporation |

Why SWOT Analysis Matters Now?

The world's agriculture and agrochemical industry is changing, with UPL at the heart of this shift. Recent years have changed how farmers work how products face regulation, and how companies come up with new ideas.

Here's why a SWOT Analysis of UPL holds special significance in 2026:

1. Growing Rivalry Between Old Giants & New Agri-Tech Players: UPL now competes with more than just big names like Bayer or Syngenta-modern biotech firms bio-solution startups, and digital-farming platforms are gaining ground. Looking at UPL's strategic position helps gauge how well it can protect its market share.

2. Big Move Toward Eco-Friendly & Chemical-Free Farming: Buyers, shops, and rule-makers want safer greener crops. This trend pushes companies to focus on bio-solutions, soil-friendly farming, and low-residue methods. UPL's change under "OpenAg" becomes a key area to examine.

3. New Tech Is Changing Farming: AI, drones precise spraying, soil sensors, and digital advice tools are changing how farmers use crop protection products. A SWOT analysis shows if UPL is keeping up fast enough to stay relevant in this tech-driven future.

4. Money Troubles & Unpredictable Profits

Agrochemical businesses worldwide face hurdles such as:

- Changes in raw material prices

- Shifts in currency values

- Pricier manufacturing & shipping

- Political issues messing up supply chains

Looking at UPL's strong and weak points helps us figure out how tough it is in this situation.

5. Tougher Rules Everywhere: Nations in the EU, US, and Asia are banning or limiting many chemical pesticides. This makes products riskier and shakes up income stability. A SWOT breakdown shows how much UPL might suffer from these rule changes.

Learn Digital Marketing for FREE

SWOT Analysis of UPL

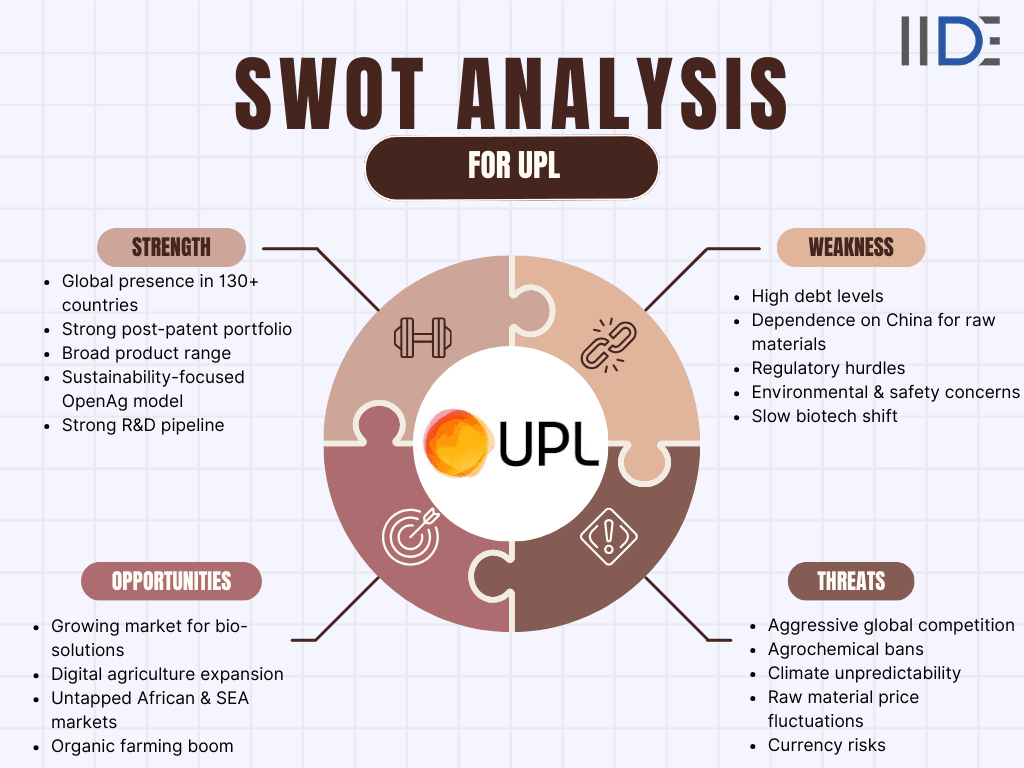

To be more specific, The SWOT Analysis of UPL presents a comprehensive picture with regards to its position within the ever-changing global agriculture market. By taking a look at UPL’s Strengths, Weaknesses, Opportunities, and Threats, it becomes very clear as to UPL's main competitive benefits, weaknesses UPL needs to improve, opportunities UPL should tap into, and threats it faces.

1. Strengths of UPL

UPL is indeed one of the most prominent contributors in the global agriculture chemicals market, thanks to its vast presence across geographies and an extensive product range.

1. Strong Global Presence

- Active in 130+ countries, making it among the most geographically diversified global participants within the agrichemical market.

- Having presence in Asia, Africa, LATAM, North America, and Europe decreases dependence on any single market.

- Geographic diversification shields earnings against challenges such as weather aberrations, government regulation ban, or political turmoil.

- It also ensures faster product penetration and better farmer relationships.

- Its access to high growth markets like Brazil, India, and Africa enhances its growth.

2. Leadership in Post-Patent Molecules

- UPL is known worldwide for expertise and knowledge in off-patent and post-patent herbicides and crop-protection molecules, thus giving it a cost advantage.

- Reduces the cost of agrochemicals for farmers, and it affects emerging markets.

- Provides competitive pricing relative to R&D innovators such as Bayer and Corteva.

- Assists UPL in penetrating price-sensitive markets and growing volumes.

- An optimum pipeline, even beyond patents, can be efficiently commercialized with reduced risk.

3. Strong Product Portfolio

- UPL’s lineup advantage is reflected in size and breadth.

- 14,000+ product registrations, among the highest in the industry.

- It encompasses all stages of crop life, from Crop Protection Products (Insecticides, Herbicides) to Post-Harvest Management (via Decco).

- Diversification helps mitigate reliance on any given category and can improve cross-sales.

- Suitable for various climates, crop species, modes of farming, and price ranges.

- Presence in high-demand crops such as soya beans, cotton, maize, wheat, and fruits.

4. ‘OpenAg’ Sustainability

- OpenAg places UPL at the forefront for sustainable agriculture and “climate-smart” solutions.

- It encourages collaboration with governments, research institutions, agritech start-ups, and climate agencies.

- Improves ESG performance and enhances investor and stakeholder trust.

- The BioSolutions division meets global market requirements for ‘green’, residue-free, and organic materials.

- It's easy to see why sustainability is so highly valued. It clearly helps differentiate UPL, even within highly regulated industries and get.

- Represents short-term recognition as an innovator and agriculture visionary.

5. Strong R&D and Innovation

- UPL operates several R&D centers in India, the US, Europe, and LATAM, covering the following areas: Biostimulants, Bio-pesticides, Residue-free crop solutions & Precision farming devices.

- According to the UPL FY24 report, the pipeline over 25% includes biological products.

6. Strategic Acquisitions

- UPL has attained global leadership position with very aggressive and integrated acquisition moves.

- Arysta LifeScience (2019) - It was one of the biggest ever agrochemicals purchases; it instantly diversified UPL’s product and geographic base.

- Advanta Seeds - Improved seed technology capabilities and better integrated crop solutions.

- Sinagro (Brazil) - Increased presence and networking abilities within the main agriculture regions within LATAM.

- OptiCrop (AI solution) - It has strengthened UPL’s digital agriculture and precision farming capabilities.

These acquisition synergies have brought about better distribution, cost savings, and extension of its global presence. Diversified business segments improve UPL’s ability to withstand market fluctuations.

2. Weaknesses of UPL

While UPL is one of the most dominant companies in the global agrochemical industry, highlighting its weaknesses is helpful in balancing the view of its strategic position.

1. High Debt Levels

- Large acquisition purchases, including Arysta LifeScience, have caused UPL’s debt to escalate.

- A large debt/equity ratio affects financial viability because it raises the perceptions of debtors.

- Interest and repayment demands could weaken the company’s ability to engage in heavy R&D spending and environmental projects.

- A slightest slump in global demand will impact UPL’s comfort level with leverage.

2. Dependency on Raw Material Imports

- UPL imports a significant quantity of Active Ingredients and intermediates, particularly from China, as it accounts for a major share of global production.

- Geopolitical factors, supply chain issues, or export bans will directly drive costs up.

- A high dependence will impact production schedules and certainty within uncertain times.

- Makes UPL’s control over prices and supply limited.

3. Regulatory Challenges

- Agrochemicals are widely facing ban and prohibition, particularly in Europe and North America.

- Product removals may occur due to any form of regulation.

- A rising ESG agenda will accentuate compliance costs associated with traditional chemical formulations.

- Time taken for approval of new molecules impacts the launch pipeline.

4. Quality and Safety Concerns

- Previous incidents associated with leaks at plants, employee safety, and environmental regulations have posed compliance concerns.

- Even sporadic instances may have a negative effect on brand credibility and licensing within strict regulatory environments.

- A growing international focus on chemical producers increases reputation risk.

5. Slower Transition Toward Biotech

- Although global giants such as Corteva, Bayer, and Syngenta are heavily invested in seed genetics and biotechnology, UPL still maintains more focus on chemicals.

- It reduces competitiveness in the rapidly expanding biotech sector.

- A slow rate of adaptation may impact the organization’s relevance within the emerging market dynamics, which are leaning towards precision breeding.

Explore our in-depth marketing strategy of UPL - uncovering bold campaigns and growth tactics that fuel its market leadership.

3. Opportunities for UPL

There are a number of high-growth opportunities that UPL can tap into: increasing demand for bio-solutions, greater precision and digital farming adoption, and a higher emphasis on sustainable, climate-smart agriculture.

1. Global Shift to Bio-Solutions

- Biologicals are emerging as the fastest-growing market within crop protection.

- According to Statista, biopesticides have a CAGR of 14%+ and are well ahead of synthetics.

- UPL’s strong pipeline of bio-stimulants and natural crop enhancers make it poised and ready for this shift.

- Rising demand for organic and residue-free food contributes to its adoption.

2. Expansion in Africa & Southeast Asia

- Africa, Southeast Asia, and LATAM nations are experiencing rapid modernization within agriculture.

- These regions have lower crop protection penetration and hence an enormous volume potential.

- Government-supported farmer programs drive more people toward affordable solutions, and UPL specializes in these.

- Strong presence in Brazil keeps UPL ahead in the LATAM market.

3. Precision and Digital Agriculture

- UPL’s acquisitions, for instance, OptiCrop, provide farmers with crop insights via AI.

- Precision agriculture is becoming increasingly necessary for improving production and lowering costs.

- Digital technologies improve product differentiation and foster greater loyalty with farmers.

- Collaboration with drone sprayer technology firms can help UPL build its eco-system very effectively.

4. Growing Organic Farming Movement

- Rising global temperatures are nudging farmers toward solutions like improving soil qualities, using less water, reducing crop loss & boosting resilience.

- Products such as Zeba, a moisture retention polymer, meet these requirements exactly.

- OpenAg positioning helps UPL have an impressive sustainability story worldwide.

5. Partnerships with Agri-Tech Startups

- Partnerships with agritech start-ups, biotech innovators, and climate platforms could hasten innovation cycles.

- Engagement with governments and NGOs enhances brand trust and market reach.

- Joint ventures for high-demand product categories can help cut R&D expenses and diversify.

4. Threats to UPL

While being a global company with a strong product portfolio, UPL also has to face several external threats that may considerably affect its long-term stability and growth.

1. Fierce Competition

- Top competitors include Bayer, Syngenta, BASF, Corteva, and FMC.

- Such companies, therefore, invest much more in R&D, primarily in biotechnology and new molecular entities.

- Competitors may innovate away demand for older chemical formulations.

- Price wars are rising in emerging markets, thereby affecting margins.

2. Regulatory Bans

- Many countries are putting stricter regulations on the use of pesticides containing chemicals.

- Bans on high-toxicity molecules directly have an impact on the legacy portfolio of UPL

- Regulatory rejection or delays slow down the release of new products.

- Growing ESG enforcement increases compliance costs.

3. Raw Material Price Fluctuations

- Prices of active ingredients and chemical intermediates often increase and decrease on a constant basis.

- Preproduction is affected by global supply chain disruptions, such as shipping delays or export bans.

- Sudden surges in price reduce profitability in price-sensitive markets.

4. Climate Change

- Rainfall is erratic, and droughts and floods disrupt planting cycles.

- With a lowered production of crops, farmers spend less on purchasing the required agrochemicals.

- Outbreaks of pests due to climatic interference may disrupt product demand unpredictably.

5. Currency Volatility

- UPL derives its revenues from over 130 countries, thereby also exposing the company to much FX volatility.

- Especially, LATAM currencies like the Brazilian Real are particularly volatile.

- Currency depreciation reduces consolidated earnings and increases import costs.

Explore the SWOT analysis of Bayer CropScience (UPL's key rival) and uncover strategic insights to sharpen your competitive edge.

IDE Student Takeaway, Recommendations & Conclusion for UPL in 2026 and Beyond

SWOT Analysis on UPL shows it as a ‘post-patent’ giant that is successfully transitioning itself from a conventional Agrochemicals player to a complete Sustainability leader. The UPL brand ‘OpenAg’ (Open Agriculture) mission, extensive distribution network spanning 130+ countries, and strategy of fast debt reduction act as strong forces within itself on the fluctuating Agrochemicals market.

However, there are some challenges that affect the brand, and these include high price competition from Chinese generics and balancing the costs associated with servicing debt and innovating biosolutions.

Core Tension

As it peers, UPL derives the majority of its business from its traditional chemicals. However, it seems that with regards to regulatory and consumption trends, the world is slowly shifting against traditional chemicals. The challenge arises from balancing maximum financial gains from the “old world” of traditional crop protection with investments in the “new world” of NPP and biosolutions.

Future Outlook

To chart its own course in the future, UPL needs to carve out a niche for itself, not only as a low-cost producer but also as an agile innovator within its BioSolutions offering. Since big-budget competition from Bayer and Syngenta leads in developing proprietary chemicals, UPL’s advantage rests with its “OpenAg collaboration” approach among startups, developing innovation at a quicker pace.

‘Sustainability’ is no longer a buzzword for UPL but a business imperative. UPL’s Nurture.farm and projects involving ‘carbon credits’ will enable it to capitalize on ‘regenerative agriculture’ and tap into ‘big food’ giants requiring a sanitized supply chain.

Recommendations

- Double Down on NPP (Natural Plant Protection): The brand needs to focus on rapidly expanding its NPP business unit. As governments began to be more strict about residues of chemicals on plants within the EU and Americas regions, UPL will be well-positioned to gain market share with its ‘hybrid’ offerings.

- Deleveraging & Financial Discipline: Having achieved its 2024-2025 debt reduction campaign, UPL needs to be more disciplined from a capital expenditure perspective. By lowering interest expenses, it will be more nimble and better equipped to adapt to local currency fluctuations within its core regions, including Latin America and India.

- Strengthen “OpenAg” Collaborations: Rather than competing with Bayer and Corteva on research and development expenditure, UPL needs to be the “Android” solution for agriculture – an open platform for agriculture tech start-ups and research centers, as it does with Kimitec, and employ UPL’s distribution capabilities for scaling.

- Digital Integration: Extend the Nurture.farm platform to bind farmers. UPL can shift focus from product sales to sales of “yield outcomes” because it will be offering services like spraying, soil testing, and carbon credits.

UPL’s large distribution network and agility make it an extremely competitive challenger for ‘Big 4’ brands like Bayer, Syngenta, Corteva, and BASF. However, it faces a challenging market with commodity price fluctuations.

Looking ahead, UPL’s success will rely on its successful implementation of a “Hybrid” strategy involving competition on price vis-à-vis Chinese generics in the chemicals business and competition on value and sustainability vis-à-vis Western majors in the biosolutions business.

UPL can thus provide a comprehensive ‘seed-to-harvest’ solution with its Advanta Seed portfolio and NPP division. UPL will thus continue to remain financially fit and become a prominent food systems architect in 2025 and beyond if it can maintain its financial viability as it leads the change towards regenerative agriculture. UPL will then no longer remain a generic chemistry player.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

UPL Limited, formerly United Phosphorus Limited, focuses on manufacturing agrochemicals, seeds, and sustainable farming solutions like herbicides, fungicides, and insecticides.

The company is headquartered in Mumbai, India, with operations spanning over 130 countries.

Jai Shroff serves as the Chairman and Group CEO, driving innovation in agricultural solutions.

UPL ranks as the fifth-largest generic agrochemical company worldwide, following major players like Bayer and Syngenta.

UPL emphasizes sustainability, environmental protection, and supporting farmers with products reaching 90% of the world's food basket.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.