Orginally Written by Aditya Shastri

Updated on Feb 2, 2026

Share on:

Lux is one of Unilever’s most iconic beauty soap and body wash brands, present in 100+ countries and especially strong across Asia, the Middle East, Africa, and Latin America. In 2023, Lux delivered double‑digit growth within Unilever’s skin cleansing portfolio, propelled by its ProGlow technology bars and premium body wash push.

This SWOT analysis helps entrepreneurs and business students decode how a century‑old “beauty soap of the stars” remains relevant in 2026.

Before diving into the article, I would like to inform you that Atul Jain conducted the research and initial analysis for this piece. He is a current student in the IIDE in Online Digital Marketing course , June Batch 2025.

If you find this article helpful, then feel free to reach out to Atul Jain to send a quick note of appreciation for her fantastic research. He will appreciate the kudos!

About Lux

Lux is a global personal care brand from Unilever, originally launched as a toilet soap in 1925 by Lever Brothers and now present in more than 100 countries. Positioned as a glamorous, fine-fragrance beauty soap of the stars, it has historically featured Hollywood and Bollywood celebrities in its communication.

In 2024, all Lux soap bars worldwide were endorsed by the UK-based Skin Health Alliance, reinforcing its skin-care credentials. By 2025-26, Lux evolved into a premium liquid and sensorial cleansing brand, with its China Sparkling range becoming the No. 1 fragranced body wash globally.

The brand's 101-year heritage, combined with continuous innovation like ProGlow technology and premium serum shower collections, positions Lux as both a mass-market icon and an aspirational premium cleansing authority.

SWOT stands for strengths, weaknesses, opportunities, and threats a strategic framework used to evaluate a brand's competitive position and guide strategic planning.

Overview Table

| Parameter | Details |

|---|---|

| Official Company Name | Unilever PLC (brand: Lux) |

| Brand Owner / Parent | Unilever |

| Brand Founded | 1925 as Lux toilet soap by Lever Brothers |

| Corporate Headquarters | London, United Kingdom (Unilever PLC) |

| Brand Category | Personal Care / Skin Cleansing & Beauty Soap |

| Key Product Lines | Beauty soaps, bar soaps with ProGlow tech, premium body wash, shower gels, premium serum shower collection, bath additives, shampoos & conditioners |

| Geographic Areas Served | 100+ countries across Asia, Middle East, Africa, Latin America, parts of Europe and Asia Pacific |

| Parent Company Revenue 2025 | ~€59.7 billion Unilever group revenue (9 months 2025) |

| Projected Full Year 2025 Revenue | ~€63–€64 billion (on track for full-year guidance) |

| Personal Care Segment Revenue 2025 | ~€10.35 billion (9 months 2025, Personal Care 22% of group) |

| Lux Brand Performance 2025 | Double-digit growth in premium soaps; Skin Cleansing delivered competitive performance underpinned by double-digit growth in premium soaps and strengthened body wash positioning |

| Skin Cleansing Category Growth 2025 | Low single-digit growth driven by innovation (ProGlow, premium serum shower collection, Lux International range); continued premiumisation focus |

| Employees (Parent Company) | ~128,000–129,000 global employees (Unilever, 2025–26) |

| Hindustan Unilever (HUL) Q2 FY26 Performance | Beauty & Wellbeing delivered 5% USG; Personal Care turnover flat (impacted by GST changes); Skin Cleansing showed double-digit growth in premium soaps and competitive body wash positioning |

| HUL Revenue Q2 FY26 | ₹16,034 crore consolidated revenue (Q2 FY26, +1.9% YoY) |

| Main Global Competitors | Lifebuoy (Unilever), Dove (Unilever), Santoor, Dettol (Reckitt Benckiser), Palmolive, L'Oréal skin cleansing, Nivea (Beiersdorf), local beauty soap brands |

| Brand Website | lux.com / Unilever brand pages / HUL India portal |

| Key Strategic Focus 2025–26 | Premiumisation through liquid body washes and serum shower formulations; Lux International soap range expansion; Science-led innovation and digital-first consumer engagement |

| Lux Market Position | No. 1 fragranced body wash in China (chosen by 200+ million consumers; 1 in 6 homes in China) |

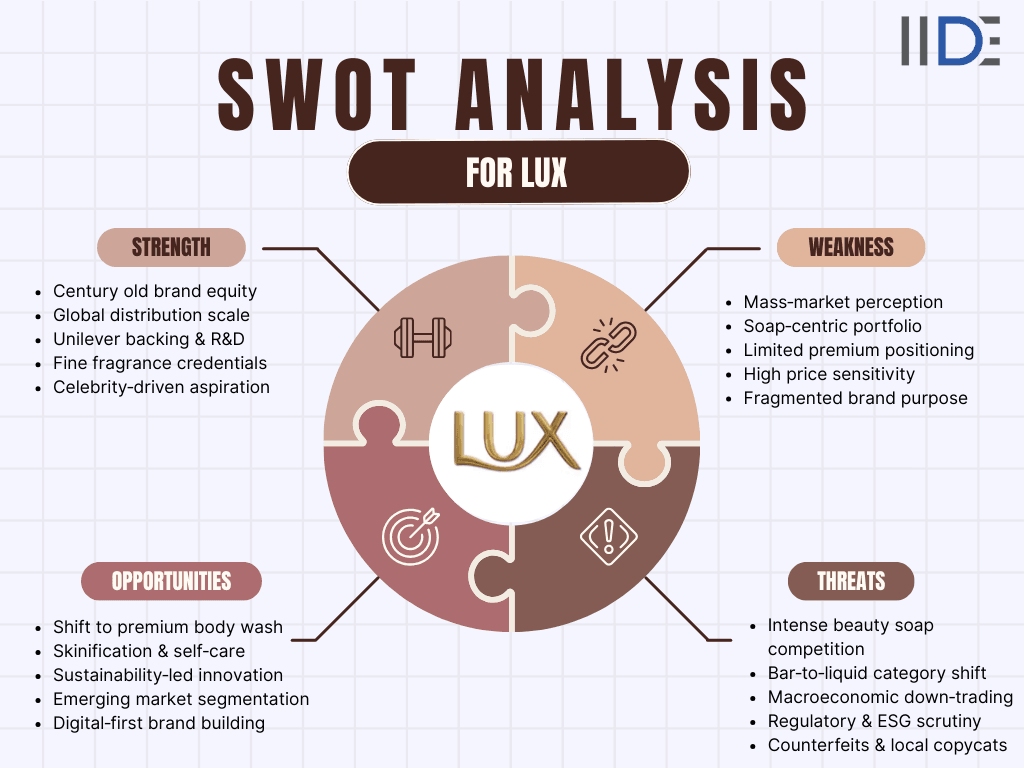

SWOT Analysis of Lux

Before diving into each quadrant here is a quick strategic summary

- Strategic Position: Mass‑to‑mass‑premium fine‑fragrance beauty cleansing brand with strong emotional equity and scale.

- Core Edge: Celebrity‑backed aspirational positioning plus Unilever’s R&D, distribution, and investment muscle.

- Key Vulnerability: Intense competition, commoditisation of bar soap, and risk of being stuck as a mass soap in a world shifting to premium, liquid, and sustainable formats.

Learn Digital Marketing for FREE

Strengths of Lux

Strengths of Lux: The Beauty Bar's Superpowers in 2026

Brand Recognition & Heritage

- 101-year-old brand established in 1925, with deep consumer trust spanning generations across 100+ countries.

- Global recognition with iconic packaging and distinctive fine fragrance positioning.

- Brand loyalty driven by Lux's heritage as "beauty soap of the stars" and consistent aspirational messaging.

- Recognized as the No. 1 fragrance skincare cleansing brand globally according to Kantar's 2022 Brand Footprint report.

- Valued at approximately €1.2 billion as of 2023, demonstrating substantial brand equity.

Celebrity & Cultural Endorsements

- Strong historical association with Hollywood icons (Elizabeth Taylor, Marilyn Monroe) and Bollywood celebrities (Katrina Kaif, Kareena Kapoor, Shah Rukh Khan).

- Celebrity ambassadors significantly influence consumer purchases and elevate aspirational brand appeal.

- Successful campaigns resonate across diverse cultural audiences worldwide, adapting to regional preferences while maintaining global coherence.

- Ongoing influencer and celebrity partnerships strengthen brand visibility in emerging digital channels.

Global Market Dominance

- Dominant market position in fragrance-led personal care across 100+ countries.

- Strong presence across Europe, Asia, Middle East, Africa, Latin America, and Asia Pacific.

- No. 2 most-chosen beauty brand globally, demonstrating widespread consumer preference.

- Market leadership in India, Pakistan, Brazil, Thailand, and South Africa.

- Particularly dominant in China: No. 1 fragranced body wash brand chosen by 200+ million consumers; found in one in six Chinese homes.

Extensive Distribution Network

- Products available in 100+ countries with unmatched global reach.

- Access to 11,000+ stores across markets (as of March 2023), expanded further in 2025–26.

- Distribution extends to both urban and rural markets in developed and emerging regions.

- Unilever's sophisticated, real-time supply chain provides competitive advantage in delivery speed, pricing efficiency, and market responsiveness.

Product Variety & Innovation

- Diverse product portfolio including beauty soaps, bar soaps with ProGlow technology, premium body wash, shower gels, premium serum shower collection, bath additives, shampoos, and conditioners.

- Multiple variants across different fragrances, sizes, and formulations tailored to regional preferences and demographic segments.

- Successfully expanded from bar soaps into premium liquid formats—body washes, shower creams, and serum shower collections.

- ProGlow technology bars deliver clinically proven skin benefits, driving double-digit growth in 2026.

- Lux International range expansion demonstrates commitment to premiumisation and innovation.

Unilever's Corporate Backing & R&D Excellence

- Access to Unilever's ~€63–€64 billion full-year 2025 revenue base and substantial marketing budget.

- Robust R&D capabilities enabling continuous product innovation, formulation advancement, and quality assurance.

- Financial stability to weather market fluctuations, invest in premium innovation, and absorb supply chain shocks.

- Strategic priority status ensures Lux receives consistent investment in marketing, digital transformation, and premium product development.

- Personal Care segment (containing Lux and Dove) grew 4.6% underlying sales in Q3 2026, outpacing broader group growth.

Sustainability & Quality Standards

- Biodegradable packaging and plastic reduction efforts demonstrate eco-conscious commitment aligned with 2026 consumer expectations.

- All Lux soap bars received Skin Health Alliance (UK) endorsement in 2024, reinforcing clinical credibility and dermatological substance.

- Consistent quality assurance and safety standards meet global regulatory requirements across all markets.

- Affordable quality positioning balances premium aspiration with mass accessibility, creating competitive moat.

Market Performance & Momentum

- Skin Cleansing segment delivered double-digit growth in premium soaps and competitive body wash positioning in Q2 FY26.

- Lux's premium liquid innovation driving market growth in China and expanding across Asia, Middle East, and Africa.

- Hindustan Unilever (HUL) Beauty & Wellbeing segment achieved 5% underlying sales growth in Q2 FY26, with Skin Cleansing as a growth driver.

- Double-digit growth momentum sustained across emerging markets through premiumisation strategy.

Weaknesses of Lux: Where the Glow Dims in 2026

- Mass-Market Perception Limiting Premium Growth

- Perceived as mass-market or value brand rather than premium, restricting pricing power relative to competitors.

- Limited ability to command premium margins comparable to Dove or luxury skincare brands.

- Brand image constrained by traditional "beauty soap" positioning despite innovation efforts, creating ceiling on premium positioning.

- Mass perception makes premium line extension challenging, risking brand dilution if not carefully segmented.

Limited Unisex & Male Market Appeal

- Brand heavily marketed toward women, with minimal engagement of the rapidly growing men's grooming market.

- Female-centric campaigns and celebrity endorsements overlook significant untapped male consumer segment.

- Underrepresentation of male participation limits market expansion opportunities and revenue diversification.

- Men's grooming currently handled by other Unilever brands, creating internal cannibalization risk if Lux ventures into space.

Weak Rural Market Penetration

- Successfully serves urban and middle-to-upper-class consumers but fails to penetrate rural and low-income segments.

- Limited outreach prevents access to enormous untapped consumer bases in developing regions, particularly India and Africa.

- Rural market remains largely unaware of Lux positioning or unable to afford premium pricing, constraining volume growth.

- Distribution gaps in rural informal retail limit market capture.

Over-Dependence on Celebrity Endorsements

- Heavy reliance on celebrity endorsements creates reputational vulnerability if ambassadors face controversies or scandals.

- Advertising controversies (e.g., Shah Rukh Khan bathtub ad criticism) have caused social media backlash and brand damage.

- Celebrity-focused messaging overshadows product-focused communication and functional skincare benefits.

- Shift toward digital creators and influencers reduces traditional celebrity ROI, yet Lux still heavily invested in Bollywood partnerships.

Concentrated Product Portfolio

- Revenue heavily concentrated in soaps and shower gels with limited diversification into broader skincare, face care, or wellness categories.

- Vulnerability to market shifts as consumers migrate from bar soaps and basic body wash to dermatology-driven skincare and multi-step routines.

- Narrow product range compared to competitors diversifying into targeted serums, moisturisers, face masks, and specialty treatments.

- Limited adjacency plays in haircare, face care, or cosmetics restrict cross-selling and trading-up opportunities.

Lag in Organic & Natural Trends

- Limited adoption of organic and natural product formulations despite explosive growth in green beauty segment.

- Use of synthetic fragrances and chemicals concerns eco-conscious consumers seeking natural beauty alternatives.

- Risk of losing fast-growing green consumer markets as rivals (e.g., Himalaya, The Body Shop, local artisanal brands) accelerate natural product development.

- "Greenwashing" perception if sustainability claims not backed by transparent sourcing and ingredient disclosure.

Intense Competition & Market Saturation

- Faces aggressive competition from multinational brands (Dove, Lifebuoy, Palmolive, Nivea, L'Oréal) and regional power brands (Santoor, Dettol).

- New market entrants and emerging D2C brands (e.g., Wow Skin Science, The Derma Co.) further fragment market share.

- Private-label and discount brands offer lower-cost alternatives, driving sustained pricing pressure.

- Market saturation in developed regions (EU, North America) limits expansion potential and forces focus on emerging markets.

Price Sensitivity in Key Markets

- High susceptibility to pricing pressure in value-conscious emerging markets, particularly India and Pakistan.

- Vulnerability to down-trading when economically challenged consumers shift to lower-cost alternatives during inflationary periods.

- Engagement in price wars erodes profitability without creating sustainable competitive advantage or brand differentiation.

- Unilever's 2026 price hikes may accelerate down-trading if not paired with clear value communication.

Environmental & Regulatory Challenges

- Regulatory hurdles across different countries regarding product composition, marketing claims, and sustainability standards.

- Stricter packaging and ingredient regulations (EU, India's Digital Personal Data Protection Act) may increase compliance costs and complexity.

- Risk of reputational damage if sustainability efforts perceived as insufficient or greenwashed in eyes of conscious consumers.

- Reformulation costs to meet evolving standards could compress margins if not offset by pricing or volume.

Risk of Brand Fatigue

- After 101 years in market, consumers may seek newer, trendier brands better aligned with evolving tastes and values.

- "Old" brand perception may alienate younger demographics (Gen Z, Gen Alpha) preferring contemporary, digital-native brands.

- Celebrity-dependent image makes brand feel dated compared to purpose-driven competitors with authentic Gen Z connections.

Vulnerability to Supply Chain Disruptions

- Global operations exposed to geopolitical conflicts (Russia-Ukraine, Middle East tensions), natural disasters (monsoons, earthquakes), and pandemic-like events.

- Product shortages and production cost increases squeeze margins and create stockout risks.

- Fragranced ingredients and specialty sourcing particularly vulnerable to disruptions; fragrance suppliers concentrated in a few regions.

- 2026 showed supply chain resilience but ongoing geopolitical fragmentation remains a structural risk.

Counterfeit Products

- Prominent brand status makes Lux a high-value target for counterfeiting in developing markets (India, Pakistan, Africa).

- Counterfeit products damage brand reputation, safety perception, and consumer trust, particularly in unregulated informal retail.

- Weakened brand equity from copycats affects sales, price realization, and long-term brand health.

- Limited enforcement of IP protection in some markets enables continued counterfeiting.

Opportunities for Lux: Future Moves for the Fragrance

Icon

Accelerating Premium Liquid & Body Wash Growth

- Growing global demand for liquid body cleansers presents high-margin expansion opportunity; global body wash market projected to grow 5–7% CAGR through 2031.

- Lux's successful China Sparkling range (No. 1 fragranced body wash, 200+ million consumers) demonstrates strong potential for premium liquid expansion across Asia, Middle East, Africa.

- Innovation with new fragrances (e.g., luxury collaborations), textures (foams, oils, serums), and functional formats (exfoliating, hydrating, aromatherapy) can establish Lux as leader in sensorial cleansing.

- Premium body wash carries 40–60% higher margins than bar soaps, directly supporting profitability goals.

Skinification & Self-Care Trend Integration

- Consumers increasingly view cleansing as part of skincare routine, not just hygiene; "skinification" of body care growing 15–20% YoY in developed markets.

- Opportunity to position Lux with clinically backed skin benefits (hydration, brightening, anti-aging) grounded in Skin Health Alliance endorsement and ProGlow/specialty technologies.

- Integration of nourishing, barrier-support, and adaptogenic ingredients aligns with self-care and wellness megatrends.

- Serum shower collection and premium liquid innovations directly address skinification demand.

Emerging Market Expansion in Asia, Africa & Latin America

- Rising disposable incomes and growing middle class in emerging markets drive demand for beauty and personal care; India, Southeast Asia, Africa represent $50B+ TAM opportunity.

- Rural India, Pakistan, Africa, and Southeast Asia represent largely untapped markets with 60–70% penetration headroom in urban/semi-urban segments.

- Culturally and economically tailored communication strategies (regional fragrances, affordably priced entry variants, local influencers) can penetrate underserved regions.

- Hindustan Unilever's distribution already reaches 600,000+ villages, providing foundation for rural expansion with tailored Lux offerings.

Male Grooming Market Entry

- Growing male grooming category expanding 12–15% CAGR; currently dominated by niche and emerging brands.

- Dedicated men's grooming bars, shower gels, and body washes can unlock new demographic and significant revenue streams without cannibalizing female-focused lines.

- Lux's fragrance heritage positions it well for premium men's grooming, distinct from mass deodorant soap category.

- Celebrity male ambassadors (cricket, Bollywood) can anchor positioning.

Sustainability & Ethical Sourcing Leadership

- Eco-friendly packaging innovations (concentrates, refill pouches, biodegradable alternatives) appeal to Gen Z and environmentally conscious consumers (25–30% of developed market consumers).

- Transparent sustainability communication and responsible fragrance sourcing (sustainable florals, lab-based alternatives) differentiate Lux from competitors.

- ESG-focused campaigns and third-party certifications (cruelty-free, vegan, carbon-neutral) can build stronger ties with conscious consumers and reduce "old-fashioned" perception.

- Refill and lightweight packaging can improve margins while reducing environmental footprint.

Organic & Natural Product Diversification

- Rapidly growing segment of organic and natural beauty products expanding 18–22% CAGR in developed and emerging markets.

- Expanding portfolio to include plant-based, chemical-free, and naturally derived variants can attract health-conscious consumers and command 20–40% price premium.

- Premiumisation through natural positioning enables higher price points and margins vs. mass bar soaps.

- Sub-brand approach (e.g., "Lux Pure" or "Lux Botanicals") allows separate positioning without diluting core brand.

Digital-First & E-Commerce Transformation

- E-commerce penetration continues to grow post-pandemic; personal care online penetration in India reached 15–20% by 2025, with projected 25–30% by 2027.

- Strengthening digital touchpoints, shoppable content, live shopping events, and social commerce increases accessibility and direct consumer connection.

- Direct-to-consumer (DTC) channels reduce reliance on traditional retail, improve margins by 10–15%, and provide first-party consumer data.

- Amazon, Flipkart, and regional marketplaces offer high-growth channels; owned D2C platform (lux.com) can build loyalty.

Personalization & Customization Experiences

- Growing consumer desire for "built-for-me" products enables fragrance customization (e.g., scent profiling quizzes) and ingredient customization (skin type, concerns).

- Technology-enabled personalization (AR for fragrance selection, AI-powered skin assessment, personalized recommendations) enhances customer experience and repeat purchase rates.

- Personalized packaging and limited-edition collaborations create emotional connection and social media buzz.

Strategic Digital & Influencer Collaborations

- Partnerships with digital creators, music festivals, sporting events, and Gen Z-focused platforms strengthen brand relevance and drive engagement.

- Social-first content around confidence, self-expression, and anti-judgment (moving beyond beauty-only messaging) builds cultural authenticity.

- Influencer collaborations (especially micro and mid-tier influencers with high engagement) reach younger audiences more effectively than traditional celebrity endorsements.

- Podcast sponsorships, TikTok challenges, YouTube creators provide cost-effective reach.

Loyalty Programs & Repeat Purchase Incentives

- Structured loyalty programs encourage repeat purchases, increase customer lifetime value by 30–50%, and build first-party data for insights.

- Rewards for repeat buyers (points, exclusive products, early access) strengthen customer relationships and reduce churn.

- Gamification (challenges, tier progression) drives engagement and social sharing.

Related Category Diversification

- Cross-category expansion into haircare, targeted skincare (serums, masks, moisturisers), or wellness products leverages brand equity and increases occasions.

- Cross-promotion and brand extension opportunities within personal care ecosystem allow trading up from soap to premium skincare.

- Lux shampoos and conditioners already present; expansion into face care, body serums, and bath products provides natural adjacencies.

Tech Integration & AR/VR Innovation

- Augmented reality for virtual product sampling and fragrance "try-on" enhances shopping experience and reduces return rates.

- Virtual showrooms and 3D product visualization increase engagement and reduce friction in online shopping.

- AI-powered skincare routines and personalized recommendations (based on skin type, concerns, preferences) differentiate brand experience.

Cruelty-Free & Vegan Product Lines

- Rising ethical consumption awareness creates niche but rapidly growing market for cruelty-free and vegan options; estimated 20–25% CAGR through 2030.

- Meeting these standards attracts values-driven consumers and future-proofs brand against shifting regulatory and consumer expectations.

- Third-party certifications (PETA, Leaping Bunny) enhance credibility.

Value-Added Services & Wellness Content

- Beauty tips, skincare masterclasses, wellness podcasts, and expert-led content provide holistic brand experience beyond product.

- Positioning Lux as beauty and wellness authority, not just a product brand, increases brand affinity and loyalty.

- Educational content drives organic traffic, improves SEO, and establishes thought leadership.

Threats to Lux: Challenges in a Competitive Arena

In-House Competition from Unilever Brands

- Direct competition from Dove and Pears within Unilever portfolio.

- Dove's "Real Beauty" narrative and premium moisturising positioning attracts Lux consumers, especially among conscious buyers.

- Pears' heritage positioning and delicate care claims compete for same market segments, risking internal cannibalization.

- Unilever's portfolio optimization could deprioritize Lux if Dove captures more value, as evidenced by Dove's stronger growth trajectory in recent years.

Intensified Global & Local Competition

- Aggressive competition from multinational brands (Lifebuoy, Palmolive, Nivea, L'Oréal) and regional power brands (Santoor, Dettol).

- New market entrants and emerging D2C brands (Wow Skin Science, The Derma Co., Nykaa Beauty) further fragment market share, especially with Gen Z consumers.

- Private-label and discount brands (Decathlon, e-commerce store brands) offer lower-cost alternatives, driving sustained pricing pressure.

- Private-label market growing 15–20% faster than branded players; poses structural threat to mid-tier brands.

Secular Shift from Bar Soaps to Liquids & Dermatology-Driven Skincare

- Global consumer migration toward liquid formats and dermatology-driven skincare products; bar soap consumption declining 2–3% CAGR in developed markets.

- If Lux fails to accelerate liquid transformation, core bar soap business faces long-term volume stagnation and margin compression.

- Younger consumers (Gen Z, Gen Alpha) increasingly bypass bar soaps entirely, viewing them as outdated; category skew aging.

- Clinical skincare brands (CeraVe, La Roche-Posay, Cetaphil) gaining share from traditional cleansing brands.

Health Consciousness & Declining Demand for Traditional Formulations

- Rising health awareness and preference for natural/chemical-free alternatives threatens traditional synthetic formulations.

- Consumers increasingly seek products with functional benefits (prebiotics, probiotics, adaptogens, antioxidants); basic cleansing insufficient.

- Misalignment with wellness and clean beauty trends risks alienation of conscious consumer segment, especially millennials and Gen Z.

- "Toxic ingredients" narratives (e.g., parabens, sulfates, synthetic fragrances) damage perception of traditional mass beauty soaps.

Macroeconomic Headwinds & Down-Trading Risk

- Economic downturns and inflation push consumers toward lower-priced alternatives; India's inflation at 5.7% (2025) pressures discretionary spending.

- Reduced discretionary spending on non-essentials directly impacts personal care category, especially premium and mid-tier segments.

- Currency volatility (INR depreciation) and trade disruptions affect sourcing costs and profitability in emerging markets.

- Unilever's 2025 price increases may accelerate down-trading if value communication weak, as seen in some categories.

Regulatory Tightening & Compliance Costs

- Stricter regulations on ingredients (heavy metals, banned substances), packaging claims, and sustainability across EU, US, India, and major markets.

- Non-compliance risks include regulatory penalties, product recalls, and brand damage; recent regulations on microplastics and PFOA compounds particularly relevant.

- Reformulation and packaging changes increase operational complexity and R&D costs; passed-through costs may trigger consumer backlash.

- India's Digital Personal Data Protection Act (DPDP) and upcoming sustainability regulations increase compliance burden.

Supply Chain Volatility

- Geopolitical conflicts (Russia-Ukraine, Middle East), natural disasters (monsoons, earthquakes), and pandemic-like events disrupt global supply chains.

- Product shortages and production cost increases squeeze margins; fragrance and specialty ingredient sourcing particularly at risk.

- Fragranced ingredients and specialty sourcing concentrated in a few regions (Grasse for fragrances, India for botanical extracts), creating vulnerability.

- 2026 showed resilience but structural geopolitical fragmentation (e.g., regionalization of supply chains) remains ongoing risk.

Counterfeit & Informal Market Activity

- Widespread counterfeiting in developing markets (India, Pakistan, Africa, Southeast Asia), particularly in informal retail channels.

- Counterfeit products damage brand reputation, safety perception, consumer trust; unsafe counterfeits pose health risks.

- Weak enforcement of IP protection in some markets enables continued counterfeiting; organized counterfeit networks growing in sophistication.

- Counterfeits estimated to represent 5–10% of market in some regions, directly cannibalizing brand revenue.

Rise of Local & Artisanal Brands

- Consumers increasingly prefer locally-made products, supporting artisanal and regional players; "Make in India" sentiment strong.

- Local brands often command cultural authenticity premium over global brands; Santoor, local beauty soap makers gaining ground.

- Artisanal positioning appeals to conscious consumers seeking transparency and local employment impact.

Data Security & Digital Privacy Risks

- E-commerce expansion increases exposure to data breaches and cybersecurity threats; potential for consumer data loss and reputational damage.

- Data privacy regulations (GDPR, India's DPDP) increase compliance burden and restrict first-party data collection capabilities.

- Mishandling of consumer data could result in fines and loss of trust.

Raw Material Price Volatility

- Fluctuations in fragrance, palm oil, coconut oil, and chemical input costs directly impact gross margins (30–40% typical).

- Limited ability to pass through costs in price-sensitive markets without losing volume; fragrance costs rising 10–15% YoY due to geopolitical tensions.

- Dependence on imported fragrances (France-based suppliers) creates FX exposure and supply risk.

Cultural Sensitivity & Misalignment Risks

- Global brands risk cultural missteps in diverse markets with different values and sensitivities.

- Past advertising controversies (e.g., Shah Rukh Khan bathtub ad causing social media backlash, beauty-focused messaging alienating inclusive values) demonstrate reputational vulnerability.

- Misaligned messaging around gender, inclusivity, or environmental claims can trigger social media campaigns and brand damage.

Trade Restrictions & Geopolitical Fragmentation

- Tariffs, trade wars, and regional blocs (e.g., Brexit, India-China tensions) disrupt cross-border distribution and supply chains.

- Increasing regionalisation of global commerce (e.g., RCEP, USMCA) complicates expansion strategy and may fragment Lux's unified global approach.

Consumer Preference Volatility

- Rapid shifts in beauty and wellness trends risk making Lux positioning outdated if not rapidly adapted; trend cycles accelerating due to social media.

- Younger demographics gravitating toward sustainability, ethics, authenticity, and purpose may not align with Lux's traditional glamour-driven positioning.

- TikTok and social media-driven trends (e.g., glass skin, slugging, minimalist routines) can quickly shift preference away from traditional soaps.

SWOT Analysis of Lux 2026

Lux's strengths lie in heritage, global reach, Unilever's backing, fine-fragrance expertise and celebrity-led aspiration. However, a mass-market image, soap dependence and fierce competition constrain premium growth in 2026's evolving landscape.

Opportunities exist in liquid formats (60% category growth), skinification trends, sustainability positioning, emerging male grooming and rural segments, and digital commerce expansion (India's D2C market projected $35.92B by 2032), while threats stem from structural category shifts toward premiumization, down-trading to value competitors, regulatory demands for transparency, counterfeits, and D2C insurgents embedding authenticity into brand DNA from inception.

IIDE Student Takeaway, Recommendations & Conclusion

As an IIDE Digital Marketing student, the SWOT analysis of Lux illuminates the critical strategic imperative facing legacy beauty brands in 2026: balancing heritage equity against market velocity. Lux's €1.2 billion global valuation and 34% household penetration reflect unmatched brand legacy, yet this foundation masks a fundamental positioning misalignment.

The brand's century-long celebrity-endorsement model and soap-centric portfolio face structural erosion as consumers-particularly Gen Z-now demand scientific credibility, ingredient transparency, and sensorial innovation over aspirational glamour.

Actionable Priorities:

1.Brand Repositioning: Shift to "Science + Sensation + Sustainability" narrative with dermatologist-led campaigns. Unifies positioning for Gen Z who want efficacy + experience.

2. Liquid Category Focus: Scale body wash as hero category (60% growth) with texture innovations beyond fragrance. Captures global shift to liquids; builds on Sparkling success.

3. D2C Platform: Launch web + Nykaa/Tira direct sales targeting 10-15% revenue in 24 months. India's D2C market hits $35.92B by 2032, capturing margin + data.

4. Clinical Credibility: Publish dermatologist research and commit to 100% recyclable packaging by 2027. 56% Gen Z buy sustainable; counters Medik8/Ethique science advantage.

5. Market Expansion: Launch unisex male grooming line + ₹10-20 rural sachets. Delivers 15-20% volume growth from underserved segments.

6. Digital Marketing: Redirect 40% budget from TV/celebrity to influencers + UGC campaigns. Leverages 17.2% e-commerce CAGR in India with lower customer acquisition cost.

Future Outlook

Lux has 18-24 months to reposition from celebrity glamour to science-driven wellness. India's cosmetics market grows $21.5B→$43.85B (2025-2033, 9.3% CAGR). By 2027, category splits into value soaps, premium skinification (8.28% CAGR), and artisanal niches. Lux spans all three but lacks clear positioning.

Success requires full organizational commitment-not siloed premium launches. Execute these 6 recommendations to claim premium skinification leadership, defend against D2C disruption, and leverage €1.2B valuation + Unilever R&D for 2030 dominance.

Want to Know Why 50,00,00+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

More SWOT Analysis

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.