Updated on Jan 7, 2026

Share on:

Kraft Heinz is one of the most powerful players in the global food and beverage industry. Kraft Foods was formed in 2015 through the merger of Kraft Foods Group and H.J. Heinz Holding Corporation. The company has solidified its position as a household name. In this article, we will delve into Kraft Heinz's business strategy , perform a SWOT analysis, and examine its key competitors for 2026. Let’s delve in- are you ready to uncover what’s working for Kraft Foods and what’s not?

Before diving into the article, I would like to inform you that the research and initial analysis for this piece were conducted by Mehek Kothari. She is a current student in IIDE's Professional Certification in Digital Marketing & Strategy, June Batch 2025.

If you found this helpful, feel free to reach out to Mehek Kothari to send a quick note of appreciation for her fantastic research, she will appreciate the kudos!

About Kraft

The original Kraft Foods business was founded in 1923 by James L. Kraft in Chicago (then part of National Dairy). Today, the business is part of The Kraft Heinz Company (formed via the 2015 merger of Kraft and Heinz) headquartered in Chicago, Illinois & Pittsburgh, Pennsylvania. The brand slogan “Make Today Delicious” reflects its focus on broadly accessible packaged foods. In 2024 the company recorded net sales of around US$25.8 billion.

Overview Table

| Parameter | Detail |

|---|---|

| Official company name | The Kraft Heinz Company (Kraft as core brand) |

| Founded (legacy origins) | Heinz: 1869; Kraft: 1909; merged into Kraft Heinz in 2015 |

| Headquarters | Chicago, Illinois, USA & Pittsburgh, Pennsylvania, USA |

| Website | https://www.kraftheinzcompany.com/ |

| Industries served | Packaged foods, condiments, cheese, meals, snacks |

| Geographic areas served | North America, Europe, Asia-Pacific, Latin America |

| Revenue 2024 (net sales) | 25,846,000,000 USD |

| Net income 2024 | 2,746,000,000 USD |

| Employees (2024) | 36,000 employees |

| Main competitors | Nestlé, PepsiCo, General Mills, Mondelez, Conagra Brands |

Learn Digital Marketing for FREE

Why should Kraft Foods consider SWOT Analysis?

- Competitive Landscape: Traditional packaged-food giants face intense pressure from private labels, premium brands, and health-driven disruptors.

- Shifts in Consumer Preferences: More consumers are seeking healthier, cleaner-label, plant-based or lower-processed options. A legacy company like Kraft must adapt to the changing environments.

- Technology & Channel Evolution: Growth of e-commerce, direct-to-consumer, supply-chain digitisation and demand for faster innovation put pressure on slow-moving giants.

- Economic & Cost Pressures: Rising commodity prices, inflation, input-costs, labour costs, and supply-chain disruptions all weigh heavily on margins.

- Regulatory & Sustainability Trends: Issues like artificial dyes, additives, packaging waste, sustainability commitments are increasingly important. For example, Kraft has pledged to remove certain artificial food dyes by end-2027.

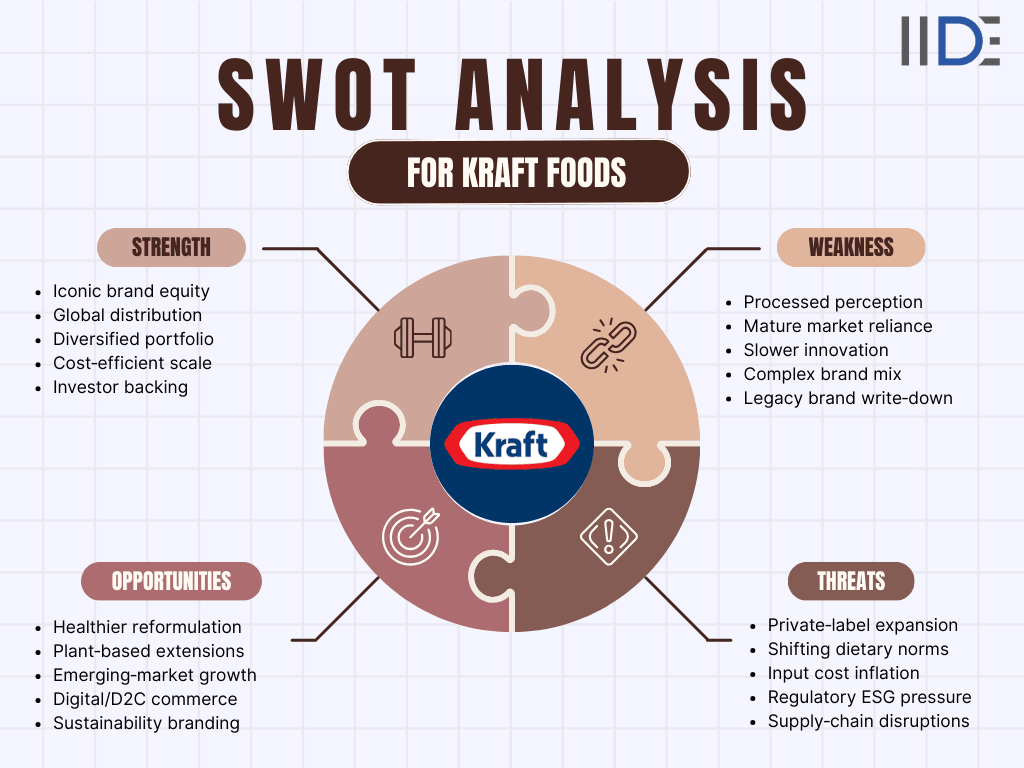

SWOT Analysis of Kraft Foods 2026

Below is a structured SWOT for Kraft as a core brand within Kraft Heinz, reflecting the packaged food landscape up to early 2026.

Kraft’s strengths: the pantry powerhouse in 2025

- Iconic Brand Portfolio: Kraft, Heinz, Philadelphia, Oscar Mayer and others are deeply familiar to consumers, giving strong brand equity.

- Scale & Global Reach: The company is among the largest food & beverage companies globally being the third-largest in North America and fifth globally.

- Diverse Product Range: From condiments and sauces to ready-meals and snacks, Kraft covers many categories and eating occasions.

- Established Distribution & Retail Relationships: Years of operations have built deep relationships with retail chains, foodservice, and supply-chain networks.

- Financial Stability (relatively): Although facing headwinds, the company still generates billions in revenue and profit, enabling investment and innovation. For example, net income around US$2.7 billion in 2024.

Kraft’s weaknesses: legacy baggage in a modern food world

- Slowing Growth & Declining Sales: The revenue figure of US$25.8 billion in 2024 shows a decline compared to prior years, reflecting underlying growth challenges.

- Low R&D / Innovation Spend: The company historically spends less than 1% of net sales on R&D which constrains innovation relative to agile competitors.

- Heavy Dependence on Mature Western Markets: While global, a lot of revenue still comes from North America where growth is slower, and consumer shifts are intense.

- Brand Complexity & Legacy Baggage: With nearly 200 brands and many categories, managing focus, capital allocation and brand relevance becomes difficult. As noted, the company is splitting into two in part because the complexity of current structure makes it challenging to allocate capital effectively

- Pressures from Input Costs & Consumer Backlash: Rising commodity costs and inflation put pressure on margins; consumers are switching to lower-cost store brands.

Kraft’s opportunities: future moves for the pantry icon

- Split into Two Companies to Unlock Value: The planned demerger (two companies by late 2026) could let each business focus, streamline operations and grow faster

- Healthier / Clean Label / Plant-based Growth: With consumers moving toward healthier options, Kraft can innovate in clean-label, plant-based categories or premium meal solutions.

- Emerging Markets / International Expansion: Growth in Asia, Latin America and Africa still offers upside as packaged-food penetration rises.

- E-commerce & Direct-to-Consumer Channels: Leveraging online sales, subscription models, ready-meal kits and hybrid channels can provide higher-margin growth.

- Sustainability & Regulatory Alignments: Initiatives like removing artificial dyes, reducing packaging waste enhance brand perception and meet social expectations.

Kraft’s threats: challenges in an intense competitive arena

- Consumer Shift Away from Traditional Packaged Foods: Consumers increasingly prefer fresher, less-processed, premium or home-cooked options, a challenge for legacy brands.

- Private Label & Discount Brand Pressure: Retailers store brands often lower cost are capturing share, especially in inflationary environments.

- Commodity Price Volatility & Supply-Chain Disruption: Ingredients, packaging materials, labour costs may spike. Any disruption either logistics or geopolitical adds risk.

- Regulatory Risk & Reputation Issues: Food safety, additives, environmental regulations, health scrutiny especially for processed foods can pose threats.

- Execution Risk of the Split: The demerger itself brings risk like cost to separate, potential culture, brand disruption, management distraction. If mishandled, it could harm performance.

SWOT Analysis of Kraft Foods 2026

IIDE student Takeaway, Conclusion & Recommendations

Kraft enters 2025 as a classic case of a powerful legacy brand operating in a structurally attractive yet fast‑evolving packaged food market. Its iconic status, broad distribution, and resilient core categories provide a solid earnings base, but they coexist with reputational baggage around processing, slower innovation, and heavy exposure to low‑growth mature markets. The core strategic tension is clear: how can Kraft modernise its portfolio and perception without undermining the comfort‑food familiarity that made it successful.

For students and practitioners, Kraft illustrates the limits of cost‑cutting as a primary strategy and the need to reinvest savings into differentiated innovation, brand building, and ESG. To move forward, Kraft should:

- Accelerate clean‑label reformulations and transparently communicate nutritional upgrades in flagship products.

- Build a focused plant‑based and high‑protein sub‑portfolio under or adjacent to the Kraft brand, using disciplined test‑and‑learn launches.

- Prioritise 3–4 high‑potential emerging markets with localised flavours, value packs, and route‑to‑market partnerships.

- Use digital channels and D2C pilots to gather first‑party data, refine propositions, and deepen loyalty with younger consumers.

- Integrate sustainability into product and packaging design choices rather than treating ESG as a reporting exercise.

Looking beyond 2025, Kraft’s ability to sustain leadership will depend on shifting from a purely defensive “cash cow” mindset to an innovation‑led, consumer‑centric growth agenda. If it balances its heritage with bolder moves in health, sustainability, and digital, Kraft can remain a relevant pantry staple rather than a nostalgic relic in the global food landscape.

Want to Know Why 5,00,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Feb 20, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

More Case Study

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.