Updated on Jan 6, 2026

Share on:

With a strong presence in the automotive, architectural, and consumer glass segments, Asahi India Glass Limited (AIS) is India’s leading integrated glass solutions provider. By 2025, it operates at the crossroads of infrastructure expansion, sustainability regulations, and electric vehicle (EV) adoption.

AIS stands out due to its end-to-end manufacturing, technological leadership, and focus on green and EV-driven solutions.

However, challenges such as rising energy costs, environmental compliance, raw material volatility, and global competition may impact growth.

This SWOT analysis of AIS helps investors, marketers, and business students understand its competitive position, risks, and long-term outlook.

Before diving into the article, I would like to inform you that the research and initial analysis for this piece were conducted by Tripti Jain. She is a current student in IIDE’s PGDMS, June Batch 2025.

If you found this article helpful, feel free to reach out to Tripti Jain and share a quick note of appreciation for her insightful research. She would truly appreciate the encouragement.

About Asahi India Glass Ltd.

Asahi India Glass Limited (AIS) was jointly established in 1984 by Asahi Glass Company (AGC), Japan, and Indian promoters, marking the beginning of a strong Indo-Japanese collaboration in the glass industry. Headquartered in Gurugram, Haryana, AIS has grown into a dominant player in automotive glass as well as architectural glass solutions across India.

The company’s motto, “Glass with a Vision,” reflects its commitment to sustainability, safety, and continuous innovation. With India’s automobile industry rebounding in 2024-2025 and the real estate and infrastructure sectors expanding, AIS is positioned as a critical supplier supporting growth across automotive, construction, and industrial applications.

Overview Table

| Attribute | Details |

|---|---|

| Official Company Name | Asahi India Glass Limited (AIS) |

| Founded Year | 1984 |

| Website URL | www.aisglass.com |

| Industries Served | Automotive Glass, Architectural Glass, Consumer Glass |

| Geographic Areas Served | India (primarily), exports |

| Revenue (FY25) | ₹4,594 crore |

| Net Income/PAT (FY25) | ₹365 crore |

| Employees | ~4,000 (approx.) |

| Main Competitors | Saint-Gobois, AGC, Schott, Gujarat Guardian, Pilkington |

Learn Digital Marketing for FREE

Why SWOT Analysis of Asahi India Glass Limited Matters in 2025

The Indian glass industry is undergoing rapid transformation. Rising energy costs, stricter sustainability regulations, and intense global competition are reshaping the competitive landscape. At the same time, infrastructure development, premium housing, and electric vehicles (EVs) are opening up new demand avenues.

Readers can also explore how a global rival adapts its strategy through the Marketing Strategy of Saint-Gobain, a leader in architectural glass solutions.

Asahi India Glass Limited's SWOT analysis assesses how well AIS can control risks while seizing new opportunities.

SWOT Analysis of Asahi India Glass Limited

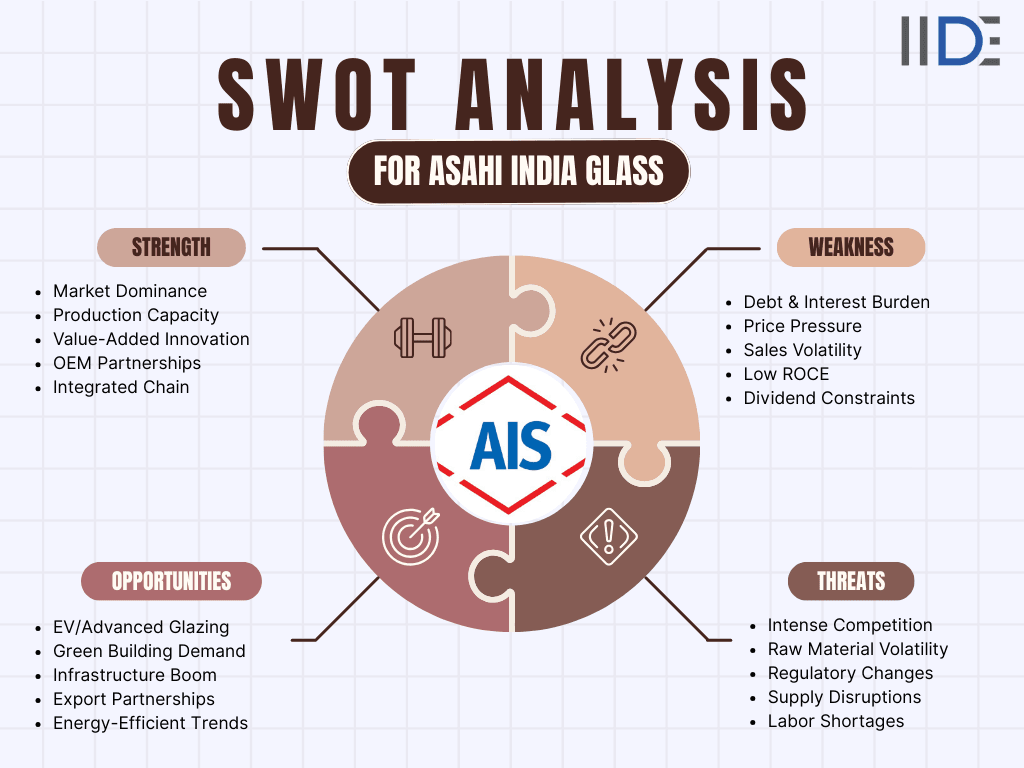

Asahi India Glass’s Strengths: Glass Market Leader

Asahi India Glass Limited has strength in brand leadership for India's automotive glass. Material supply is made to large-sized OEMs such as Maruti Suzuki, Tata Motors, and Hyundai. The integrated model of manufacturing developed by the company allows the quality and cost control of its products.

AIS also invests in R&D by offering value-added products such as laminated safety glass, solar control glass, and acoustic glass. Long-term Japanese technology partnership lends it global credibility.

Key Strength Highlights:

Market leader of automotive glass in India

AIS is the leading supplier of automotive glass in India to most major vehicle manufacturers. This leadership ensures high volumes, strong pricing power, and stable demand across market cycles.

Strong OEM relationships

AIS has long-term relationships with large OEMs such as Maruti Suzuki, Tata Motors, and Hyundai, thereby assuring repeat orders, high trust, and strong entry barriers for any competitor.

Advanced Manufacturing & R&D Capabilities

AIS operates modern manufacturing plants supported by in-house R&D. It develops value-added products such as laminated, solar control, and acoustic glass that raise safety and margins.

Support from AGC (Japan)

AIS draws on the technical support and global expertise from among the world's largest glass manufacturers-AGC, thereby enhancing product quality and innovation with a greater world credibility.

Asahi India Glass’s Weaknesses: Financial Strains

Despite its leadership, AIS derives a high degree of dependence from the automotive segment. Any sluggishness in vehicle sales would, therefore, impact its revenues directly.

Energy and raw material costs for the company are high, compressing margins. Its international presence is restricted compared to global glass giants, and vulnerability remains very high due to domestic market fluctuations.

Key Weakness Highlights:

High dependence on auto industry cycles

A lion's share of AIS's revenue is generated from the automotive sector. The entire replacement of glass products depends on vehicle sales, and their sales decline necessarily affects demand for its glass products.

Energy-intensive processes

Glass manufacturing requires high energy use, which in turn increases operating expenses. Increasing fuel and power prices may make it hard for AIS to remain in business without comprising its profit margins.

Limited global diversification

AIS' predominant interest lies with the Indian market. Very limited international presence increases exposure to domestic economic risks.

Asahi India Glass’s Opportunities

India's push for electric vehicles opens up a big opportunity for AIS to supply lightweight and smart glass solutions. The growing norm for green buildings advances the demand for energy-efficient architectural glasses. Supporting the trends in long-term growth are government-driven projects for infrastructure and premium housing.

This could also enable AIS to expand beyond India through strategic partnerships and exports.

Key Highlights of Opportunity:

EV and smart mobility growth

This growth of electric vehicles translates to higher demand for lightweight and advanced glasses. AIS can leverage its R&D power to supply the demands of EV manufacturers.

Growing demand for green construction

Green building norms are increasing demand for energy-efficient glass. The architectural glass portfolio of AIS gels well with the evolving shift towards this.

The infrastructure and real estate expansion

Metro projects, airport projects, and smart city projects boost the demand for architectural glasses. Growth is further added by premium housing and commercial spaces.

Export and international partnership potential

By diversifying revenues through expanding exports and global partnerships, AIS reduces its dependence on the Indian market.

Asahi India Glass’s Threats

AIS is facing intense competition from multinational players like Saint-Gobain and Guardian Glass. Volatile fuel and energy prices are a serious threat. Environmental regulations are expected to raise compliance costs for companies further.

Any slowdown in the economy or sluggish demand from the auto industry could bring down the volumes significantly.

Key Threat Highlights:

Strong international competitors

The company is facing competition from other global players like Saint-Gobain and Guardian Glass. This increases the pricing pressure and innovation requirements.

Energy price volatility

Frequent changes in fuel and energy prices directly impact production costs and thus can reduce profitability within an energy-intensive industry.

Regulatory and sustainability pressures

Stricter environmental norms raise the cost of compliance. Sustainability norms require continuous investment.

Economic uncertainty

Economic slowdowns reduce demand from automotive and construction sectors. The outcome is negative for sales volume and growth.

SWOT Analysis of Asahi India Glass Limited 2026

IIDE Student Takeaway, Conclusion and Recommendations

From an IIDE student’s perspective, the SWOT Analysis of Asahi India Glass Limited clearly shows how a strong market position is built through long-term strategy rather than short-term wins. AIS’s leadership in automotive glass, strong OEM relationships, and technology backing from AGC highlight the importance of consistency, quality, and strategic partnerships in building a sustainable business.

At the same time, this analysis helps students understand that even market leaders face vulnerabilities. AIS’s heavy dependence on the automotive sector and energy-intensive operations demonstrate how external factors like economic cycles and fuel costs can significantly impact performance. This underlines the need for diversification and risk management in any business model.

The opportunities section offers valuable learning on growth strategy. AIS can leverage trends such as electric vehicles, green buildings, and infrastructure development to future-proof its business. For management students, this shows how aligning product innovation with macro trends is critical for long-term relevance.

In conclusion, AIS’s biggest strength is its technological leadership and OEM trust, while its biggest risk lies in industry cyclicality. Strategic focus on exports, sustainability, and innovation can help balance this risk. For students and aspiring entrepreneurs, AIS serves as a strong example of how Indian companies can scale responsibly while preparing for global competition.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

Feb 20, 2026

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

More Case Study

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.