Updated on Jan 5, 2026

Share on:

Upstox remains a strong player in India’s investing space in 2026. But what makes it stand out? And what challenges does it face next? This analysis breaks down Upstox’s position in the market and how it competes with other major brokers.

If you're an entrepreneur or a business student, you’ll get clear insights into brand strategy, user behaviour, and market trends. See how Upstox stays ahead and what the future could look like for the platform. These learnings can help you sharpen your own business thinking, build better strategies, and stay competitive in your career.

Before diving into the article, I would like to inform you that the research and initial analysis for this piece were conducted by Pearl Remedios. She is a current student in IIDE's Online Digital Marketing Course, July Batch (2) of 2025.

If you found this helpful, feel free to reach out to Pearl Remedios to send a quick note of appreciation for his fantastic research, she will appreciate the kudos!

About Upstox

Upstox, launched in 2009, has grown into one of India’s most popular investment platforms. It’s known for simple trading tools, low costs, and a user-friendly experience. Over the years, Upstox has built a strong presence across the country, especially among new and young investors.

The brand has also been shaping its identity through campaigns that focus on financial empowerment and accessibility. These campaigns encourage users to take control of their money and start investing with confidence.

In 2026, Upstox continues to enjoy strong recognition in India’s fast-growing fintech space. But the market is evolving quickly. Investors today expect better education, seamless technology, and more personalized tools.

Even with these challenges, Upstox stays competitive by expanding its product ecosystem, improving its tech stack, and staying sharply focused on user needs. Its ability to evolve keeps the brand relevant in a rapidly changing financial landscape.

What Does SWOT Stand For in Upstox’s Case?

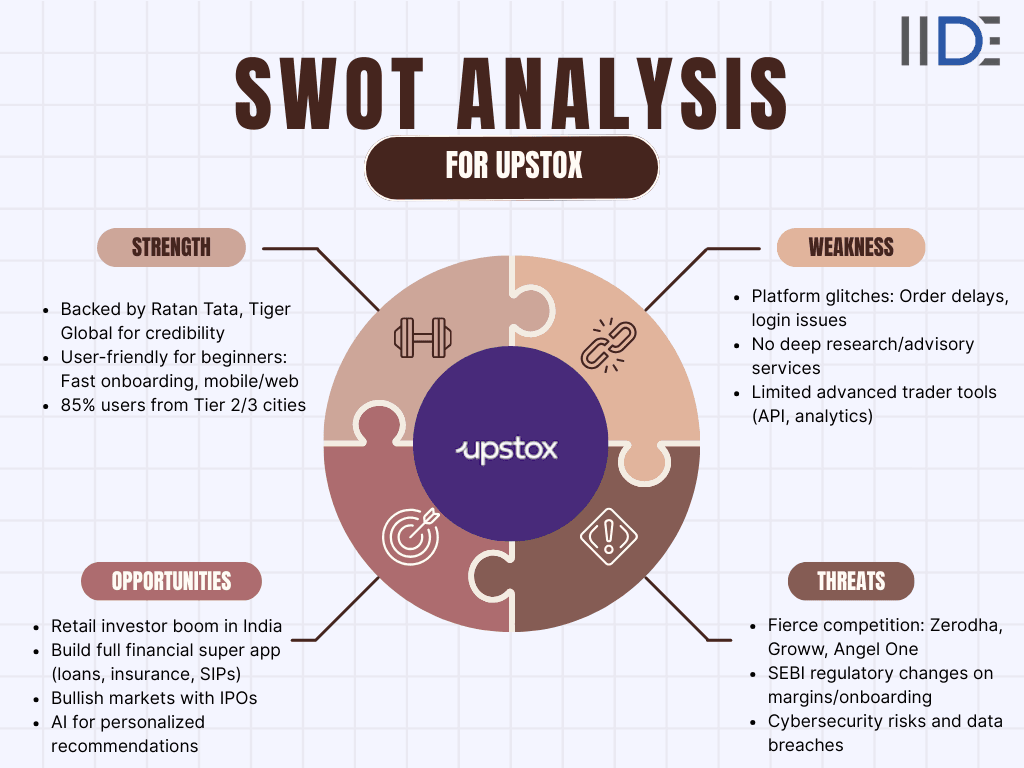

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. In this article, we break down each of these to understand how Upstox operates in India’s competitive fintech market and how the brand is preparing for growth in 2026. This helps you see where Upstox wins, where it struggles, and what could shape its future.

Why Does SWOT Analysis Matters Now?

Competitive Landscape: Upstox faces tough competition from major players like Zerodha, Groww, and Angel One. New fintech entrants and super-apps are also reshaping the space. Understanding these competitors helps Upstox refine its strategy and stay relevant.

Investor Preferences Are Changing: Users today expect easy onboarding, cleaner UI, better research tools, and stronger customer support. As more Indians invest for the first time, Upstox must keep adapting to meet these expectations.

Technology and Innovation: Tech drives everything for Upstox. From faster order execution to AI-powered insights and improved app performance, innovation is key to the platform’s success. Staying ahead in technology helps Upstox deliver a smoother and smarter investing experience.

Economic Conditions Impact Investors: Market cycles influence how often people trade. Slowdowns or volatile markets can reduce trading volumes. This makes it important for Upstox to build products that encourage long-term investing, not just active trading.

Regulations Shape the Industry: SEBI rules around margins, F&O, onboarding, and compliance directly affect Upstox. These regulations push the brand to stay agile, improve transparency, and protect users while remaining competitive.

Trust, Ethics, and User Safety: Users expect secure platforms and responsible practices. Upstox continues to invest in stronger security, transparent communication, and customer-first policies. This builds trust in an industry where safety and credibility matter the most.

Learn Digital Marketing for FREE

SWOT Analysis of Upstox in 2026

1. Strengths of Upstox

Affordable Pricing Designed to Appeal to Retail Investors: An important feature in every SWOT analysis of Upstox is its cost-effectiveness. The platform provides equity delivery indefinitely and imposes a fixed Rs 20 fee per order for intraday F and O commodity and currency transactions. Its first approach reduces operational expenses and renders the platform very attractive, to budget-aware customers. In market research Upstox frequently appears as one of the affordable brokers nationwide.

Trust Built Through Strong Investor Backing: Upstox receives support from investors such as Ratan Tata and Tiger Global. This endorsement enhances brand credibility. Indicates sustained stability. In competitor analysis such distinguished backing provides Upstox with an edge over newer or less financially supported platforms.

Easy to Use and Ideal for Beginners: The platform provides an user interface, fast onboarding, seamless order execution and reliable functionality on both mobile and web. These attributes make it accessible for newcomers and lower the apprehension commonly linked to stock trading. Market analysis reports emphasize that ease of use is a key factor driving the increase of novice investors in India and Upstox is ideally equipped to cater to this group.

Wide Product Portfolio: Upstox enables users to invest in equities, derivatives, commodities, currencies, mutual funds, digital gold, insurance offerings, fixed deposits, bonds and international markets as well. This extensive range aids in portfolio diversification. Brings Upstox nearer to evolving into a comprehensive financial ecosystem instead of just a brokerage platform.

Strong Penetration in Tier 2 and Tier 3 Cities: Eighty-five percent of Upstox users are from -metropolitan areas. Entering these markets has enabled Upstox to develop lasting loyalty. In competitor analysis reports Upstox is regularly acknowledged for its regional presence, an area where many brokers are still striving to grow.

Technology Driven Experience: Upstox dedicates resources to enhancing engineering and platform improvements. Real-time analytics, TradingView-integrated charts, rapid execution and tools such as UpNews significantly enhance the trading process. This technological capability boosts its attractiveness to digitally-focused users.

Consistent Financial Growth: Upstox has announced growth in both its revenue and net earnings. Its capacity to maintain profitability in a competitive market provides a solid base for ongoing growth.

2. Weaknesses of Upstox

Platform Stability Issues: A frequent issue highlighted in SWOT analysis discussions is the dependability of the platform. At times users have experienced delays in order processing, during periods difficulties logging in and lagging charts. Such interruptions may undermine confidence for active traders requiring consistent performance.

Customer Support Limitations: Customer service has become a vulnerability. Late replies, restricted availability and sluggish ticket processing impact user contentment. Given the number of users enhancing the scalability of customer support is essential.

Limited Research and Advisory Services: Upstox operates on a discount brokerage framework and does not supply comprehensive research reports or advisory services. This could be a disadvantage for novices seeking assistance. Rival firms such as Angel One and ICICI Direct presently provide robust research platforms.

Fewer Features for Advanced or Professional Traders: Professional users frequently anticipate trading instruments, smooth API integration and strong analytical frameworks. Upstox offers choices in this area relative to some rivals. This may drive frequency or algorithmic traders to different platforms.

Lower Brand Visibility Compared to Market Leaders: In competitor comparisons Upstox continues to fall behind Zerodha in trust leadership and Groww in widespread market recognition. This results in costs for acquiring customers and hampers natural growth.

Dive into the marketing strategy of Upstox to discover how digital campaigns and influencer partnerships drive its dominance among young retail investors in Tier 2/3 cities.

3. Opportunities for Upstox

India’s Retail Investor Boom: India is experiencing a surge in demat account registrations alongside increasing financial literacy across all age brackets. A higher number of professionals are participating in the equity market than at any previous time. Market trend analyses indicate sustained long-term expansion in this area presenting an opportunity for Upstox.

Deeper Penetration into Non Metro Markets: Tier 2 and Tier 3 areas continue to be neglected. Upstox has the potential to grow by providing support in languages, investment materials in local dialects, collaborations with regional influencers and offline community-driven events.

Expansion into a Full Financial Ecosystem: Upstox has the opportunity to evolve into a financial super app by incorporating offerings, like loans secured by securities, personal finance management tools, insurance technology services, tax advisory options, retirement planning and systematic investment plans. This strategy boosts customer retention. Enhances the lifetime value of each user.

Leadership Through Financial Education: Financial literacy serves as a catalyst for development in India. Upstox has the potential to expand by offering courses, explanatory videos, concise guides and webinars across various languages. Groww showed how education can fuel growth and Upstox can enhance its stance by adopting a comparable approach.

Favorable Market Conditions: An expanding stock market naturally draws in investors. Robust IPO launches, boosted earnings and elevated savings ratios provide Upstox a distinct edge, in gaining users amidst bullish periods.

Integration of Artificial Intelligence: AI has the capability to provide tailored investment recommendations, forecast alerts, automated research overviews and intelligent portfolio prompts. These features can greatly improve the user experience. Set Upstox apart from smaller rivals.

4. Threats to Upstox

Intense Competition in the Broking Industry: Upstox directly competes with Zerodha, Groww, Angel One and newcomers such as PhonePe Share Market. Every rival holds a stance whether through pricing, features or brand recognition. Since all platforms provide fees, customer loyalty is delicate and the expenses for switching are very minimal.

Regulatory Changes: The brokerage sector relies significantly on SEBI guidelines. Modifications in margin requirements stringent client onboarding procedures or limitations on derivatives might lower trading activity and impact earnings. Such regulatory challenges are factors in market evaluations as well as SWOT analysis assessments.

Cybersecurity and Privacy Risks: Brokerage platforms often face attack threats. A single breach or leak of information can lead to harm to their reputation. Ensuring security systems demands ongoing investment and rigorous surveillance.

Market Volatility: Bear markets typically cause a decline in trading activity, a drop in account openings and diminished investor interest. Upstox relies significantly on trading volumes; extended market slumps may diminish revenue and boost user attrition.

Heavy Dependence on Retail Investors: The majority of Upstox’s users are investors who are very sensitive to price and tend to change platforms rapidly. The firm has a footprint, in the institutional sector, which usually offers more consistent large-volume business.

Uncover SWOT analysis of Groww insights: user surge and mutual fund strength vs. scalability issues in India's investment boom.

IIDE Student Takeaway, Conclusion & Recommendations

This SWOT assessment indicates that Upstox holds competitive strengths, in affordable pricing, advanced technology, ease of use and regional reach. Its extensive range of products and consistent financial expansion further enhance its long-term prospects.

Recommendations

- Fix platform glitches fast: Prioritize stability upgrades for zero-lag trading during peak hours - add more servers and beta testing with students to catch issues early.

- Boost customer support for newbies: Launch 24/7 chatbots in Hindi/ regional languages plus quick video call support; train agents on beginner queries to build trust.

- Add free basic research tools: Offer simple stock scanners, trend alerts, and short explainer videos - no need for fancy advisory, just enough to guide first-time investors like us.

- Expand education for Gen Z: Create bite-sized TikTok-style reels, quizzes, and campus webinars on investing basics; partner with college influencers for Tier 2/3 reach.

- Roll out student-specific perks: Free demat accounts for under-21s, zero-fee trades on first ₹10K, and campus referral contests to hook young users early.

- Amp up advanced features gradually: Introduce easy API for algo trading bots and AI portfolio tips, starting simple so even non-tech students can experiment.

- Diversify beyond retail trading: Add micro-SIPs in mutual funds and crypto exposure to reduce volatility dependence and appeal to long-term savers.

Insights from both market analysis and competitors analysis indicate that India’s investment landscape is expanding rapidly, especially in Tier 2 and Tier 3 markets. If Upstox strengthens its customer support, expands into a full financial ecosystem, and continues improving its technology, it can become one of the strongest leaders in India’s digital investment space.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Feb 20, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

Yes, Upstox Demat accounts are held with CDSL, ensuring safety as Upstox acts only as an intermediary.

Flat Rs 20 per executed order for equity delivery, intraday, F&O, options, currency, and commodities; free equity delivery trading.

MTF lets you buy stocks with 50% own funds, borrowing the rest from Upstox, subject to VAR margins and eligibility.

Trade equities, derivatives, commodities, currencies, mutual funds (lump sum/SIP), digital gold, bonds, FDs, and international markets.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.