Orginally Written by Aditya Shastri

Updated on Jan 6, 2026

Share on:

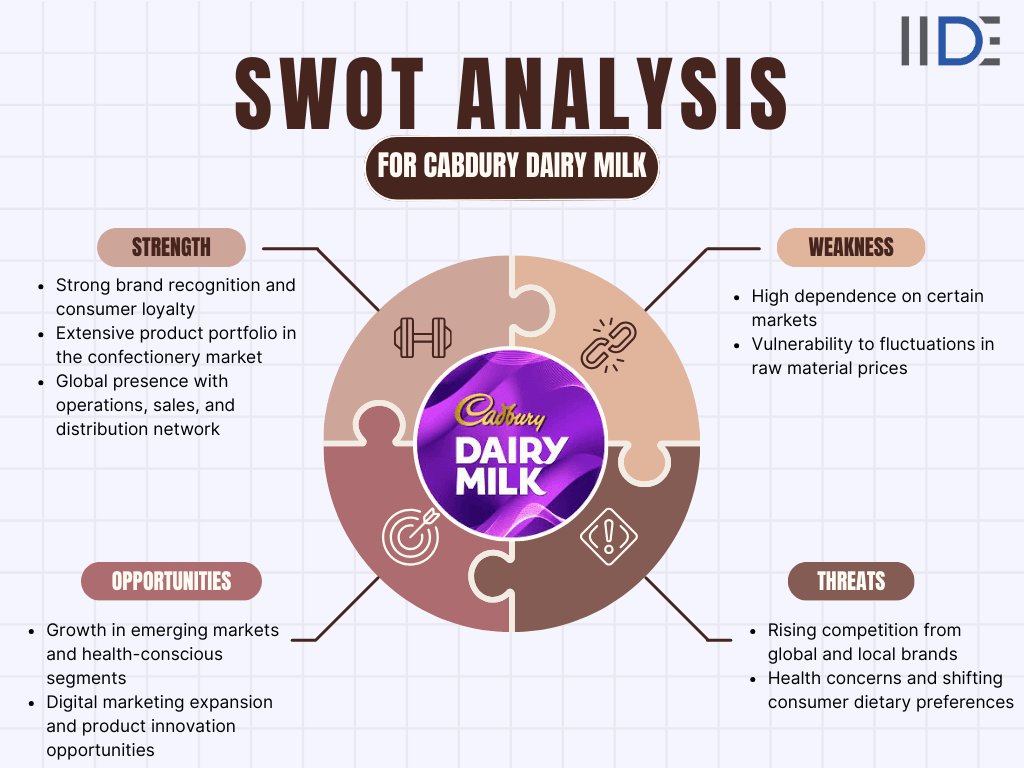

Cadbury Dairy Milk, a confectionery under the Mondelēz International umbrella, continues its sweet dominance in 2025 across global markets. But why does the Cadbury Dairy Milk brand stand out amidst fierce competition and growing health trends in 2026? And are there growing challenges from local competitors and volatile cocoa prices that threaten its market share?

This in-depth case study offers key insights into the brand's enduring strategies. By understanding the intricate strengths, weaknesses, opportunities, and threats highlighted in this comprehensive SWOT analysis of Cadbury Dairy Milk, digital marketers and business students alike can apply these valuable insights to their own business strategies and campaigns.

This article's research was done by Milan Dhingra. He is a student in IIDE’s Online Digital Marketing Course, May Batch 2025. If you find this analysis helpful, you can reach out to him on LinkedIn to share your appreciation.

About Cadbury Dairy Milk

Cadbury started in 1824 in England selling tea and chocolate drinks. In 1905, they launched the first Dairy Milk bar, which became famous because it used more milk than other chocolates. Today, it’s owned by a big company called Mondelēz International.

Fun Fact: The brand bounced back from a big quality scandal in 2003 by adding better safety checks and running major advertising campaigns to win back customer trust. In 2024-2025, Cadbury is celebrating 200 years and still focuses on emotional advertising.

Their main slogan is "A glass and a half full of joy". This slogan reminds people that the chocolate is creamy (from all the milk) and makes you feel happy. In India, they use "Kuch Accha Ho Jaaye, Kuch Meetha Ho Jaaye" (Let something good happen, let something sweet happen).

Overview Table

| Attribute | Details |

|---|---|

| Official Name | Cadbury Dairy Milk |

| Parent Company | Mondelēz International |

| Founded | 1905 |

| Headquarters |

London, UK (Cadbury)/Global via Mondelēz |

| Industry | Confectionery/Chocolate |

| Revenue Contribution |

Significant share within Mondelēz’s chocolate portfolio |

| Key Markets | India, UK, Europe, Others |

| Competitors | Nestlé, Mars, Hershey’s, Amul, Lindt |

Why SWOT Analysis Matters Now?

- Changing Consumer Preferences: Health-focused consumers in 2025 are choosing low-sugar, vegan, and “better-for-you” chocolate options. This shift pushes Cadbury Dairy Milk to innovate with reduced-sugar variants, portion-controlled packs, and new ingredient formulations that still protect its signature creamy taste.

- Cost Pressures: Cocoa, dairy, sugar, and global transport costs remain highly volatile. These rising input expenses tighten margins and influence Cadbury’s decisions on packaging, pricing strategy, and regional supply chain optimization - especially in price-sensitive markets like India and Southeast Asia.

- Technological Transformation: The chocolate industry is rapidly digitizing. Automation, AI-powered demand forecasting, and smart factory systems now help brands reduce waste and improve operational efficiency. Cadbury also benefits from digital marketing, social listening tools, and QR-based traceability to build transparency and trust.

- Sustainability & Ethical Sourcing: Consumers and regulators are demanding proof of ethical cocoa sourcing. Sustainability programs, farmer support initiatives, and eco-friendly packaging have become essential - not just for brand reputation but also for long-term supply stability.

- Evolving Competitive Landscape: Cadbury faces intense pressure from traditional rivals (Nestlé, Mars, Hershey’s), premium brands (Lindt, Godiva), health-driven disruptors (vegan & zero-sugar chocolate startups), and growing private-label brands from supermarkets. To stand out, Dairy Milk must continue balancing affordability, taste, and innovation.

- Regulatory Challenges: Sugar taxes, stricter labeling laws, and advertising regulations - especially around children are reshaping how chocolate brands market and design their products. International compliance adds another layer of complexity for a global brand like Cadbury.

Understanding these forces through a 2026 SWOT analysis helps marketers, entrepreneurs, and strategists evaluate where Dairy Milk excels, where it needs adaptation, and how it can future-proof its leadership in a fast-changing market.

Learn Digital Marketing for FREE

SWOT Analysis of Cadbury Dairy Milk 2026

Strengths of Cadbury Dairy Milk

Cadbury Dairy Milk remains one of the strongest brands in the global confectionery industry. Its long heritage, emotional branding, and massive scale give it a firm competitive advantage in 2026. Supported by Mondelēz International’s financial muscle, the brand continues to dominate key markets and earn deep consumer trust.

1. Exceptional Brand Reputation & Consumer Trust

- Cadbury has built unmatched goodwill over its 200-year history, translating into high brand loyalty across continents.

- Two centuries of legacy (since 1824) have established strong emotional and historical roots.

- High consumer loyalty in the UK and strong awareness globally reinforce the brand’s reliability.

- Example: After the 2003 quality scare, Cadbury used Amitabh Bachchan in a powerful trust-building campaign that restored sales within eight weeks.

- Crisis resilience demonstrates the strength of its brand equity.

- Consumer trust directly translates to market stability and premium positioning.

2. Cadbury Dairy Milk enjoys market leadership in multiple regions

- Commands 64-70% chocolate market share in India (2024–25) - one of the largest chocolate markets globally.

- Leadership enables strong retailer influence and visibility.

- High penetration across income groups strengthens volume consistency.

- Strong brand recall fuels impulse purchases.

- Example: India remains Cadbury’s most strategic chocolate market.

3. Extensive & Efficient Global Distribution Network

- Cadbury’s supply chain is one of the strongest in the industry.

- Products reach urban supermarkets and rural kiosks alike.

- Distribution drives sales in impulse-driven categories where availability is equal to purchase.

- Mondelēz’s global logistics infrastructure ensures consistent product flow.

- Strong cold-chain and stock management capabilities maintain quality.

- Allows Cadbury to quickly scale new launches across markets.

4. Parent Company Backing & Financial Strength

- Mondelēz International gives Cadbury massive strategic advantages.

- Mondelēz generated $37B in LTM revenue (mid-2025).

- Access to R&D, global tech, analytics, and distribution systems.

- Strong capital backing enables aggressive marketing and innovation.

- Example: A $4.5 million investment in cell-based cocoa R&D (2024) shows long-term commitment to sustainability and cost control.

- Financial strength protects Cadbury during market volatility.

5. Award-Winning Emotional Advertising

- Cadbury’s emotional marketing sets it apart from competitors.

- Campaigns create emotional resonance, elevating the product beyond a treat.

- “Kuch Meetha Ho Jaaye” positioned Dairy Milk as essential to Indian celebrations.

- Emotional storytelling builds multi-generational loyalty.

- Consistent brand messaging strengthens premium perception.

- Advertising has contributed significantly to long-term volume growth.

Weaknesses of Cadbury Dairy Milk

Despite its leadership, Cadbury faces internal vulnerabilities that could affect future growth. Understanding these weaknesses highlights where the brand may fall behind competitors and how evolving market dynamics could impact profitability.

1. High Sugar Content in Core Products

- The traditional Dairy Milk bar contains over 50% sugar, misaligned with global health trends.

- Increasing consumer preference for low-sugar and dark chocolates.

- Makes the brand vulnerable to criticism and health regulations.

- Competitors like Amul and artisanal brands offer “healthier” alternatives.

- High sugar levels reduce appeal for fitness-focused and diabetic consumers.

- Could slow growth if not addressed through reformulation.

2. Heavy Dependence on Chocolate Confectionery

- Cadbury’s success relies heavily on chocolate sales.

- Approx 72% of Mondelēz India’s revenue comes from Cadbury chocolate.

- Lack of diversification increases risk during category downturns.

- Competitors like Nestlé have beverages, cereals, dairy, and snacks for stability.

- Heavy reliance limits flexibility in price-sensitive periods.

- Makes Cadbury more exposed to seasonal fluctuations.

3. Vulnerability to Quality Control Crises

- Quality lapses can lead to severe trust issues.

- The 2003 worm controversy caused a 30% drop in sales.

- A repeat could permanently impact market share.

- High visibility increases reputational damage risks.

- Product safety concerns may heavily impact premium markets.

- Long recovery periods threaten profitability.

4. Pricing Sensitivity in Emerging Markets

- Premium pricing exposes Cadbury to substitution risk.

- Consumers may switch to cheaper local alternatives when budgets tighten.

- Price increases (due to raw material inflation) worsen switching behavior.

- Strong local competitors like Amul threaten share via value pricing.

- Weak demand elasticity in rural markets affects volume.

- High input costs tighten margins further.

5. Lack of Control Over the US Market

- Cadbury does not control its U.S. recipe or distribution.

- Hershey owns Cadbury rights in the U.S.

- Recipe differences lead to inconsistent global brand experiences.

- Limits Mondelēz from executing a unified global strategy.

- Weakens competitive edge in the world's largest chocolate market.

- Restricts ability to launch new products in the U.S.

Discover the secrets behind Cadbury's iconic campaigns and consumer loyalty in our detailed analysis of the marketing strategy of Cadbury.

Opportunities for Cadbury Dairy Milk

Global trends are opening new avenues for Cadbury to innovate and expand. With strong brand equity and global reach, Dairy Milk is well-positioned to capitalize on emerging opportunities - especially those influenced by Gen Z preferences.

1. Expansion Into Health & Wellness Segments

- Consumer demand for healthier indulgences is at an all-time high.

- Gen Z prefers low-sugar, high-cocoa, and vegan options.

- Opportunity to launch zero-sugar or plant-based Dairy Milk variants.

- Bournville can be leveraged to capture dark chocolate growth.

- Early vegan trials in the UK show strong potential.

- Reformulation can help future-proof the brand.

2. Penetrating Rural & Emerging Markets

- Rising disposable incomes open new customer bases.

- India and China’s rural markets show rapid chocolate adoption.

- The Indian chocolate market may reach $5.5B by 2033.

- Cadbury’s distribution network gives it a natural advantage.

- Large rural youth population equals to demand expansion.

- Small affordable packs boost penetration.

3. Growth in E-commerce & Personalization

- Digital platforms redefine how consumers buy chocolate.

- Direct-to-consumer gifting portals enhance experience.

- Personalization appeals to Gen Z and millennials.

- Online festivals and gifting occasions drive spikes in sales.

- Social media and influencer activations boost digital reach.

- E-commerce reduces dependence on retail margins.

4. Strategic Product Innovation & Diversification

- Innovation can extend Cadbury’s leadership.

- New formats (filled bars, premium lines, limited editions).

- Example: Dairy Milk Milkinis launch with 360° marketing.

- Innovations help counter health and premiumization trends.

- Seasonal and limited-edition products increase excitement.

- Diversification reduces revenue dependency on classic bars.

Threats to Cadbury Dairy Milk

The chocolate industry faces increasingly unpredictable external challenges. These threats can significantly impact Cadbury’s sales, trust, and strategic growth if not managed effectively.

1. Intense Competition from Global & Local Players

- Market rivalry is stronger than ever.

- Global giants: Mars, Nestlé, Ferrero.

- Local strong players: Amul with high-cocoa claims.

- Price wars reduce margins in emerging markets.

- Competitors innovate quickly with healthier variants.

- Premium gifting brands challenge Cadbury’s festive dominance.

2. Rising Health Awareness & Sugar Regulations

- Governments are tightening rules around sugar.

- Sugar taxes (e.g., UK) increase prices and reduce demand.

- Warning labels impact purchase intent.

- High sugar products face decreasing acceptance.

- Schools and workplaces restrict sugary snacks.

- Long-term risk: core products may face declining relevance.

3. Volatile Raw Material Prices & Supply Chain Risks

- Cocoa and dairy costs are increasingly unpredictable.

- Frequent “record-high cocoa price” news impacts profitability.

- Supply disruptions affect product availability.

- Rising input costs force price hikes.

- Consumers trade down during inflation cycles.

- Long reliance on cocoa farms exposes Cadbury to climate risks.

4. Shifting Gifting & Consumption Patterns

- Consumer behavior is evolving rapidly.

- Premium non-food gifts reducing chocolate gifting share.

- Younger consumers prefer experiences over products.

- Seasonal demand could weaken over time.

- Requires consistent reinvention to stay relevant.

- Premiumization trends challenge mass-market products.

See how Cadbury balances product, price, place, and promotion to dominate the confectionery market in our marketing mix of Cadbury analysis.

IIDE Student Takeaway, Conclusion & Recommendations

The case study shows that Cadbury Dairy Milk is a very powerful brand. It has huge strengths like a famous name, loyal customers, and a massive network for selling chocolate all over the world. These things make it the market leader in many places.

However, the brand faces one major challenge: The core product is high in sugar. This is a weakness because people everywhere are trying to eat healthier. This health trend is a real threat to future sales.

The overall future for Cadbury is strong, but only if they change how they sell and what they sell. They need to use their strong name to quickly adapt to what today's customers want.

Actionable Recommendations

Here are detailed, practical marketing recommendations, based on the SWOT analysis and what we study at IIDE, for Cadbury to grow and stay ahead of competitors:

1. Aggressively Market "Better-For-You" Products Online: Don't just rely on the classic Dairy Milk bar. Use your strong brand name to push healthier options like Bournville dark chocolate and any new vegan or low-sugar bars.

How To Do It:

- SEO & Google Ads: Make sure Cadbury shows up at the top of Google when people search for "healthy chocolate options" or "vegan chocolate India."

- Targeted Social Media: Use Facebook and Instagram ads to reach people who follow health and fitness pages.

- Why this works: This uses an Opportunity (health trends) to fix a Weakness (high sugar content).

2. Dominate the E-commerce Gifting Space: Cadbury is already known for gifting ("Kuch Meetha Ho Jaaye"). They can own this space online even more.

How To Do It:

- Improve the Website: Make the Cadbury Gifting website very easy to use.

- Use Personalization: Let customers easily add custom photos, messages, or create unique gift boxes.

- Use Data (CRM): Collect customer emails and send them reminders for birthdays, anniversaries, and festivals.

- Why this works: This uses a Strength (gifting image) to maximize an Opportunity (online shopping growth) and build long-term customer loyalty.

3. Turn Sustainability into a Key Marketing Message: Consumers, especially younger ones (Gen Z), care about the planet and ethical sourcing. Cadbury's "Cocoa Life" program is good, but they don't talk about it enough.

How To Do It:

- Be Transparent: Put information about ethical sourcing and recycled packaging right on the product pages and in social media posts.

- Show the Impact: Use marketing campaigns that clearly explain where the cocoa comes from and how it helps farmers.

- Why this works: This helps manage a major Threat (regulations and consumer pressure) and builds a better brand image.

A Forward Look

Cadbury has everything it needs to stay the top chocolate brand. By using smart digital marketing strategies to sell healthier products and connecting with customers online, the brand can successfully adapt to the modern world and ensure continued growth for many years to come.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

Cadbury Dairy Milk's popularity in India stems from its successful localization strategy, emotional marketing campaigns, affordability across different pack sizes, wide distribution reaching even rural areas, consistent quality, and cultural integration into Indian celebrations and gifting traditions. The brand has positioned itself as a symbol of expressing love and joy, resonating deeply with Indian consumers.

Cadbury Dairy Milk offers numerous variants, including Dairy Milk Silk (premium smoother chocolate), Fruit & Nut, Crackle, Roast Almond, Oreo, Caramel, Bubbly, Marvellous Creations, and seasonal or limited editions. In India, flavors like Dairy Milk Silk Red Velvet, Silk Mousse, and region-specific varieties are also available to cater to diverse taste preferences.

A standard 13g Cadbury Dairy Milk bar contains approximately 70 calories. A regular 55g bar has around 280-300 calories, depending on the variant. The calorie content varies across different sizes and flavors, with variants like Fruit & Nut or Silk having slightly different nutritional profiles due to additional ingredients.

Cadbury Dairy Milk is available in various price points to cater to different consumers. Small bars start from ₹5-10, medium-sized bars (13-23g) range from ₹20-40, regular bars (50-55g) cost ₹50-90, and larger sharing packs and premium variants like Silk can range from ₹100-300 or more. Prices may vary based on location and retailer.

Yes, Cadbury Dairy Milk contains vegetable fats which may include palm oil, depending on the region and specific product formulation. Mondelez International has committed to sourcing sustainable palm oil and is working towards 100% certified sustainable palm oil across its products. The exact ingredients can be verified on individual product packaging.

Cadbury Dairy Milk distinguishes itself through its unique recipe with a high milk content ("a glass and a half" of milk), its characteristic creamy and smooth texture, consistent quality maintained globally, strong emotional brand connection through memorable advertising, and wide accessibility across price points. The brand's heritage, dating back over a century, also adds to its premium perception and consumer trust.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.