Updated on Jan 21, 2026

Share on:

AT&T stands as America's largest telecommunications provider, delivering wireless, broadband, and media services to 250+ million connections. It maintains market leadership with 2025 revenues projected near $122 billion, powering connectivity across the U.S. How will 5G and streaming shape AT&T's future dominance?

This SWOT analysis of AT&T examines its strengths, weaknesses, opportunities, and threats in 2026 and helps students, marketers, and business enthusiasts understand how the brand competes, adapts, and positions itself in today’s telecom landscape. The insights shared here can also help you apply similar strategic thinking to real-world brands and businesses.

Before diving into the article, I would like to inform you that the research and initial analysis for this piece were conducted by Shejal Agarwal. She is a current student in IIDE's PG in Digital Marketing, June Batch 2025.

If you found this helpful, feel free to reach out to Shejal Agarwal to send a quick note of appreciation for his fantastic research; she will appreciate the kudos!

About AT&T

AT&T Inc. is an American multinational telecommunications company founded in 1983 and headquartered in Dallas, Texas. The brand offers wireless services, fibre broadband, and enterprise communication solutions, primarily across the United States. Over the years, AT&T has built a strong reputation for large-scale network infrastructure and consistent service delivery.

As of 2026, AT&T continues to focus heavily on 5G expansion, fibre broadband rollout, and strengthening its core telecom operations after stepping away from media businesses. Its long-standing market presence and massive customer base make it a key player in the global telecom industry.

“To offer the best entertainment and communications experiences in the world,” says AT&T. For more than 140 years, AT&T has been altering the way people live, work, and play as the first genuinely modern media corporation.

| Attribute | Details |

|---|---|

| Official Company Name | AT&T Inc. |

| Founded Year | 1983 (Bell System 1876) |

| Industries Served | Wireless, Broadband, Fibre, Latin America |

| Geographic Areas Served | U.S., Mexico, Latin America |

| Revenue (2025 est.) | ~$122 billion |

| Net Income (2024) | $16.6 billion |

| Employees | 160,000+ |

| Main Competitors | Verizon, T-Mobile, Comcast, Charter |

Learn Digital Marketing for FREE

Why SWOT Analysis of AT&T Matters in 2026

The telecom industry is evolving faster than ever. Customer demand for faster internet, seamless connectivity, and digital services continues to rise. At the same time, telecom companies face pricing pressure, regulatory scrutiny, and cybersecurity risks.

A SWOT analysis of AT&T helps break down:

- How AT&T uses its strengths to stay competitive

- Where internal weaknesses could impact future growth

- What opportunities the brand can leverage in a digital-first world

- Which external threats pose the biggest risks

Understanding these factors is especially useful for marketers and business students learning how large brands make long-term strategic decisions.

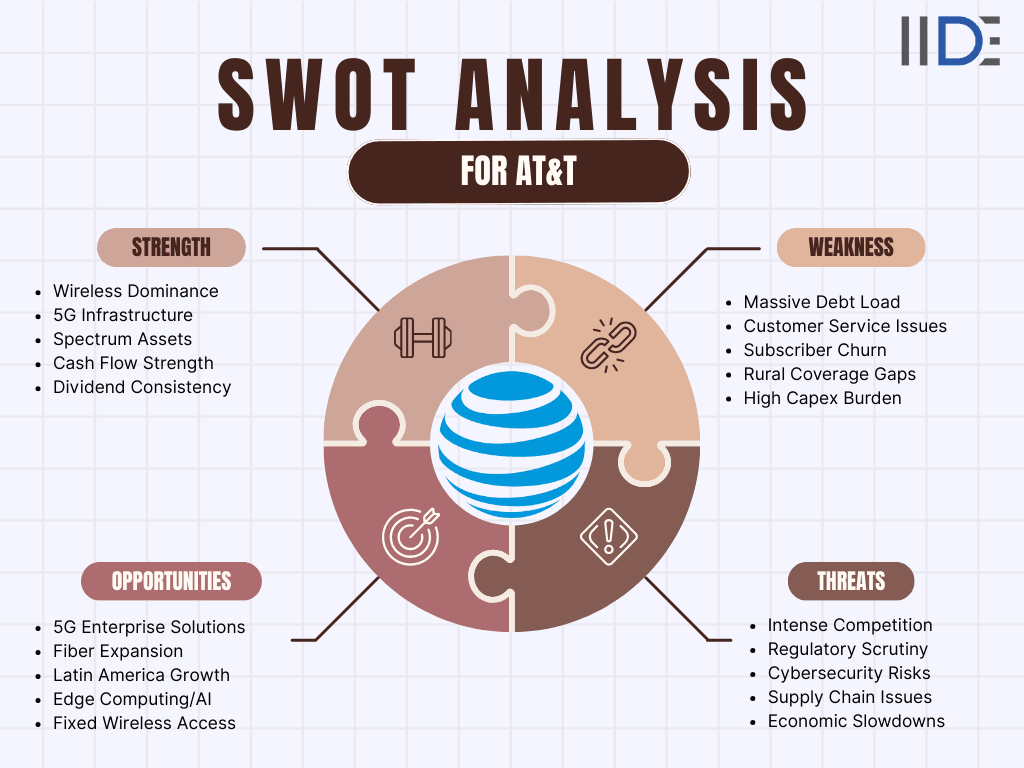

SWOT Analysis of AT&T

Before diving into the individual elements of the SWOT analysis, it is important to understand why AT&T is a relevant brand to analyse in 2025.

As one of the largest telecommunications companies in the world, AT&T operates in a highly competitive and regulation-heavy industry where technological advancement and customer experience play a critical role.

This SWOT Analysis of AT&T evaluates the brand’s internal strengths and weaknesses along with external opportunities and threats.

The objective is to understand how AT&T sustains its market position, where it faces challenges, and how it can strategically grow in the evolving telecom landscape.

Strengths of AT&T

In this SWOT analysis of AT&T, the brand’s strengths are deeply rooted in its scale, infrastructure, and brand legacy.

1. Strong Brand Recognition

AT&T is one of the most recognisable telecom brands in the U.S. Its long-standing presence builds trust among consumers and enterprise clients alike.

2. Extensive Network Infrastructure

Heavy investments in 5G and fibre broadband allow AT&T to serve millions of customers efficiently and prepare for future connectivity demands.

3. Diversified Telecom Services

The company offers wireless plans, broadband, business connectivity, and IoT solutions, reducing dependence on a single revenue stream.

4. Stable Revenue and Cash Flow

Despite competitive pressure, AT&T continues to generate steady service revenue, supporting long-term operations and investor confidence.

Weaknesses of AT&T

While AT&T has scale and reach, it also faces notable internal challenges.

1. High Debt Levels

- AT&T carries significant debt, which limits flexibility for aggressive expansion or large-scale innovation.

2. Legacy Infrastructure Transition

Upgrading from older network systems to modern fiber infrastructure is costly and operationally complex.

3. Network Quality Perception

In some regions, AT&T’s network performance is perceived as weaker compared to competitors, affecting customer retention.

4. Regulatory and Trust Issues

Past data breaches and service disruptions have impacted customer trust and regulatory relationships.

Opportunities for AT&T

Several growth opportunities can strengthen AT&T’s future position.

1. 5G-Based Enterprise Solutions

Beyond mobile services, 5G enables enterprise use cases such as IoT, smart cities, and private networks.

2. Fiber Broadband Expansion

Growing demand for high-speed internet makes fiber rollout a major growth driver, especially in underserved areas.

3. Smart Home and Connected Devices

Bundled smart home services can increase customer lifetime value and differentiation.

4. Digital Transformation Services

Businesses increasingly need secure, scalable connectivity solutions, creating opportunities in cloud and enterprise services.

Threats to AT&T

External risks continue to challenge AT&T’s growth and profitability.

1. Intense Competition

Rivals like Verizon and T-Mobile aggressively compete on pricing, speed, and innovation.

2. Economic Uncertainty

Economic slowdowns may reduce consumer spending on upgrades and enterprise contracts.

3. Cybersecurity Risks

Telecom networks are prime targets for cyberattacks, and any breach could damage brand credibility.

4. Regulatory Pressure

Changing telecom regulations and data privacy laws add ongoing compliance challenges.

SWOT Analysis of AT&T 2026

IIDE Student Takeaway, Conclusion & Recommendations

Key Insight:

AT&T’s biggest advantage lies in its infrastructure scale and trusted brand name. These strengths position it well for long-term relevance in a connectivity-driven economy.

Biggest Risk:

High debt and complex network upgrades could limit agility compared to leaner competitors.

Recommendations:

AT&T should continue accelerating its fiber broadband rollout in high-demand regions while investing heavily in cybersecurity to rebuild and maintain customer trust. Expanding bundled offerings across wireless, broadband, and smart home services can improve customer retention and lifetime value.

At the enterprise level, AT&T should focus on monetizing 5G through industry-specific solutions rather than relying only on consumer mobile plans.

Future Outlook:

If AT&T successfully balances financial discipline with innovation and infrastructure investment, it can remain a dominant telecom player well beyond 2026.

Want to Know Why 5,00,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Feb 20, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

More Case Study

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.