Students Centric

Placements Report

Trackable results, real numbers

Reviews

Proven success, real voices

Trainers

Expert-led, Industry-Driven Training

Life at IIDE

Vibrant Spirit student life

Alumni

Successful Journeys, Inspiring Stories

Learning Centre

Webinars

Blogs

Case studies

Live, Interactive Masterclasses

Fresh Insights, quick reads

Real-life, Industry relevant

More

Hire from us

Hire Top Digital Marketing Talent

Work with us

Join Our Team, Make an Impact

Customised Training

Personalised digital marketing training for your company

Refer & earn

Simple, easy rewards

Contact us

Get the answers you need

About us

Know more about IIDE

Explore all course options

Trending

Professional Certification in AI Strategy

- Ideal for AI Enthusiast

Orginally Written by Aditya Shastri

Updated on Aug 9, 2025

Previously, we did the thorough business model of PayPal. Today we are going to see the thorough SWOT analysis of Razorpay.

Razorpay, one of the most major payment gateways in the Indian market, saw great prospects during the covid outbreak as everything moved online, as did many other internet businesses. Through its website or app, the company provides a framework for businesses to receive, handle, and disburse online payments.

Its goal is to make money transactions and management as painless as possible for startups so they may focus on other areas of growth. Approximately 5 million merchants use the platform, including BookMyShow, Airtel, Zomato, Ola, and others, compared to 1 million in 2019.

Razorpay has been making perfect use of digital marketing since it was founded in the year 2014. As the world was online and still shifting online, the marketing techniques are changing which is digital marketing. If you are interested in learning about the latest – check out our Free MasterClass on Digital Marketing 101 by the CEO and Founder of IIDE, Karan Shah.

Before we begin with the SWOT analysis of Razorpay, here’s a deep dive into the company’s history, founding, products, financial status, competitors.

About Razorpay

(Razorpay Founders Harshil Mathur (left) and Shashank Kumar, Source: Economic Times)

Razorpay is India’s only payments system, allowing businesses to accept, process, and distribute payments using its product suite. It allows you to use a debit card, credit cards, net banking, UPI, and popular wallets such as Mobikwik, JioMoney, Airtel Money, Ola Money, FreeCharge, and PayZapp to make payments.

Razorpay’s two founders, Harshil and Shashank, met at IIT Roorkee and began working together in 2014. As the two saw how difficult it was for new businesses to receive money online in the past, they began looking into businesses that could help with payment processing.

There were few payment processing companies in India at the time, so businesses had to compile a long list of documents. Razorpay Smart Collect, Razorpay Subscriptions, Razorpay Route, and Razorpay Invoices were all introduced in 2017 by the platform. These solutions are designed to manage duties including cash flow, money disbursement, bank wires, and the collection of regular payments.

| Founder | Harshil Mathur & Shashank Kumar |

|---|---|

| Year Founded | 2014 |

| Origin | Banglore, India |

| No. of Employees | 1890 |

| Company Type | Private, Independent Company |

| Market Cap | $ 3 Billion (2021) |

| Annual Revenue | $ 145.2 Million (2021) |

| Net Income/ Profit | $ 40 Billion (2021) |

(Razorpay Services, Source: Razorpay)

Services by Razorpay

Razorpay is an online money transfer service. It offers a variety of services, including:

- Debit & Credit Card

- Net Banking

- UPI

- Wallet Services

- Banking

Competitors of Razorpay

- Paytm Business

- PayU

- Paypal

- Stripe Connect

- Payoneer

After understanding the core of the company, let us now proceed to the SWOT analysis of Razorpay.

SWOT Analysis of Razorpay

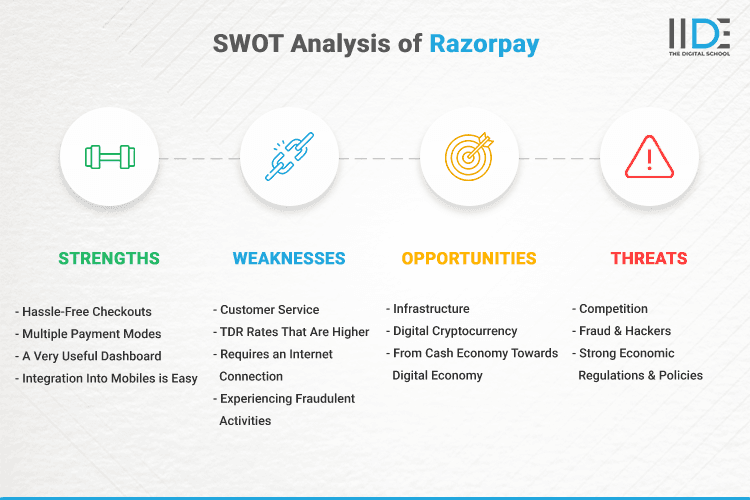

A SWOT analysis determines the strengths, weaknesses, opportunities, and threats that a firm faces. It’s a tried-and-true management model that lets Razorpay compare its company and performance to that of competitors and the industry at large.

It’s an excellent tool for determining where the firm thrives, where it falters, generating remedies, and determining how the organisation may expand.

To better understand the SWOT analysis of Razorpay, refer to the infographic below:

So let us first begin by enhancing the strengths of Razorpay from the SWOT analysis of Razorpay.

Strengths of Razorpay

Strengths are an organization’s unique qualities that give it an advantage in acquiring greater market share, attracting more customers, and boosting profitability. Razorpay’s advantages are as follows:

- A Very Useful Dashboard: One of the platform’s greatest benefits, according to many, is the Razorpay control panel. It allows you to control individual payments, access critical data, and evaluate key metrics and statistics.

- Checkouts that are Rapid, Visual, & Easy to Complete: One of the key characteristics of Razorpay is that its checkouts have a visual design that is easy to understand and intuitive. They stand out because of how simple they are to integrate: all they require is a single line of javascript to run in any e-commerce system.

- Multiple Payment Modes: Another of Razorpay’s best features is its broad range of payment options, which gives your customers the freedom to complete their payment using the method of choice.

- Integration Into Mobiles is Easy: Mobile traffic already outnumbers computer traffic, according to various reports and figures. Razorpay allows for simple mobile consolidation.

Weaknesses of Razorpay

Weaknesses are aspects of a company or a brand that should be improved. The following are Razorpay’s primary flaws:

- Customer Service: Several customer service concerns, including a lack of a helpline number and FIRC filing delays, are widespread.

- Experiencing Fraudulent Activities: Electronic transactions are unquestionably straightforward, convenient, and appropriate. Even yet, it demands a certain amount of risk. As a result, you’ll need technical assistance as well as a secure mechanism to complete the transaction and transfer payments.

- Requires an Internet Connection: The entire transaction mechanism for sending and receiving money, as well as opening an account, is reliant on the internet and a fast connection. It can function in both advanced and developed environments. Razorpay services, on the other hand, would be ineffective in growing economies and developing countries where internet availability is a major concern.

- TDR Rates That Are Higher: Their TDR rates for payment gateways are slightly higher than other companies.

Opportunities for Razorpay

Opportunities are areas in which a firm might focus to improve performance, improve services, and, ultimately, profit.

- Digital Cryptocurrency: Freelancers and online users are increasingly using digital crypto-currencies such as bitcoins. Many platforms are even willing to accept cryptocurrency. Many variables, such as digital literacy, internet connectivity, and the internet, have contributed to its growth. It also opens the door for Razorpay to either launch or begins accepting this currency.

- From Cash Economy Towards Digital Economy: Developing economies, such as India, are aiming to go cashless or reduce their reliance on the currency. It presents a fantastic chance for Razorpay to expand its services to capitalize on the potential.

(Razorpay Marketing in Digital World, Source: Razorpay)

Bonus Tip: As the world is moving towards digitalization it is opening enormous opportunities to establish a career in digital marketing. If you are also well-versed in several digital marketing areas then we can assure you that you will land your dream job soon. Each skill of digital marketing is taught by subject area experts and digital enthusiasts who were successful in moulding our students into skilled professionals of the future.

- Infrastructure: Razorpay requires an infrastructure that can handle the goals as well as expected quick growth in demand following the launch. Infrastructure is also required to handle demand changes. These variations could occur as a result of increased payment transaction volumes during certain times of the day, changes in market circumstances, or policy changes by the government. Furthermore, the infrastructure had to deliver the consistency that Razorpay and its merchants needed to manage e-commerce services constantly.

Threats to Razorpay

Environmental variables that can harm a company’s growth are known as threats. Razorpay’s threats include the following:

- Competition: Razorpay is up against stiff competition from platforms like PayU, Paytm business, PayPal, and others, all of which are vying for the same market share as Razorpay. Razorpay has always been vulnerable to competition and will continue to be so in the future.

- Fraud & Hackers: When we consider the scope of the company’s operations, we find that it operates in over 100 nations. It also poses a significant security risk from hackers throughout the world.

- Strong Economic Regulations & Policies: Some nations, such as Taiwan, China, and Japan, have rigid rules and regulations that make it difficult for corporations like PayPal to set up shop there.

This ends our thorough SWOT analysis of Razorpay. Let us conclude our learning below.

Learn Digital Marketing for FREE

- 45 Mins Masterclass

- Watch Anytime, Anywhere

- 1,00,000+ Students Enrolled

To Conclude

After an in-depth study of the SWOT analysis of Razorpay, we have realized that the company has a strong position in the online fund transferring market. The company’s operations have allowed it to grow in terms of the number of consumers and money it generates.

The business should take advantage of opportunities such as increasing its market in developing countries. We are confident that Razorpay will overcome these challenges and continue to be the best company on the planet.

Digital technology is also emerging, thus, the need for digital marketing is elevated throughout the years. If you are interested in grasping a skill or investing in upgrading your skills in marketing, feel free to check out IIDE’s 3 Month Advanced Online Digital Marketing Course to know more.

We hope this blog on the SWOT analysis of Razorpay has given you a good insight into the company’s strengths, weaknesses, opportunities and threats.

If you enjoy in-depth company research just like the SWOT analysis of Razorpay, check out our IIDE Knowledge portal for more fascinating case studies.

Thank you for taking the time to read this, and do share your thoughts on this case study of the SWOT analysis of Razorpay in the comments section below.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

Courses Recommended for you

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

- Bosch 2025: Strategic Insights into Market Position, Challenges, and Growth Opportunities

- Nasher Miles Marketing Strategy 2025: A Journey from Trolleys to Trendsetters

- Beco Marketing Strategy 2025: Leading India’s Eco-Friendly Revolution

- P-TAL Marketing Case Study: Reviving India’s Timeless Craftsmanship

- Marketing Case Study: Rocca - Rising Above the Chocolate Crowd in India

- Unveiling What's Up Wellness Marketing Strategy: Key Tactics and Insights

- Lenskart Marketing Strategy 2025: AI, Content & Omni-Channel Success

- Ruban's Jewelry Marketing Strategy for Crafting Timeless Success in the Luxury Market

- Decoding iMumz’s Marketing Playbook: A Wellness Brand Built on Empathy

- Nish Hair Marketing Strategy: The Complete AIDA Playbook for D2C Success

Author's Note:

I’m Aditya Shastri, and this case study has been created with the support of my students from IIDE's digital marketing courses.

The practical assignments, case studies, and simulations completed by the students in these courses have been crucial in shaping the insights presented here.

If you found this case study helpful, feel free to leave a comment below.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.