In the previous article, we did an in-depth SWOT analysis on the U.S Bank. Today we are here with another detailed SWOT Analysis of the Commonwealth Bank, one of the most dominant banks in Australia.

Commonwealth Bank or CommBank of Australia is the largest bank by assets and the top-ranking bank by market capitalization in Australia headquartered in Sydney. Commonwealth Bank is dominating the commercial and retail banking market of Australia with its businesses across New Zealand, Asia, the United States and the United Kingdom.

The bank has maintained its position amongst the Australian and New Zealand market with all its efforts in working on its marketing strategies. In this developing digital period, they have been adopting advanced marketing strategies which are essential for reaching out and making a great Digital presence. So if you want to know how to utilize digital marketing for your benefit – take a look at our free masterclass on digital marketing by the CEO and Founder of IIDE, Karan shah.

Thus, this makes us keen to know everything about how Commonwealth Bank works. Here in this blog, we have a comprehensive SWOT analysis of Commonwealth Bank. But first, let’s take a look and know more about how Commonwealth Bank works as a firm.

About Commonwealth Bank

Commonwealth Bank commonly known as CommBank is an Australian Multinational banking group headquartered in Sydney, Australia. The bank was founded in the year 1911 by the Australian government running under Andrew Fisher Labor, later became fully privatized in 1996. The bank used to be the central issuer of Australian banknotes from the Department of the Treasury after the central bank. The bank is among the top 4 big banks in Australia, and the largest banking group in New Zealand and the Pacific region.

Commonwealth Bank provides a variety of financial services including retail, business and institutional banking, funds management, superannuation, insurance, investment and broking services. Since 1991, the bank has been listed on the Australian Stock Exchange. In Australia, the bank serves about 6 million consumers at over 1,100+ branches. It has around 43,500 staff & serves about 9 million consumers worldwide.

| Founder | Andrew Fisher Labor Government |

|---|---|

| Year Founded | 1991 |

| Origin | Australia |

| No. of Employees | 43,585 |

| Company Type | Public |

| Market Cap | A$ 177.00 Billion (2021) |

| Annual Revenue | A$ 30.16 Billion (2020) |

| Net Income/ Profit | A$ 9.63 Billion (2020) |

Products & Services by Commonwealth Bank

Commonwealth Bank provides different services to keep its consumers satisfied. Commonwealth Bank is one of the topmost banking groups in the world. Below mentioned are some of the Commonwealth Bank products and services.

- Personal and commercial banking

- Wealth management

- Investment services

- Financial planning

- Credit cards

- Insurance

- Mortgages

Competitors of Commonwealth Bank

Commonwealth Bank brings a huge competition for itself, as it provides services in the whole world. Below mentioned are some of the competitors for Commonwealth Bank:

- Westpac banking

- BNZ bank

- HSBC bank

- ANZ

- The Royal Bank of Scotland

- OCBC bank

Now that we have some idea of how Commonwealth Bank works, let’s focus on a detailed SWOT analysis of Commonwealth Bank.

SWOT Analysis of Commonwealth Bank

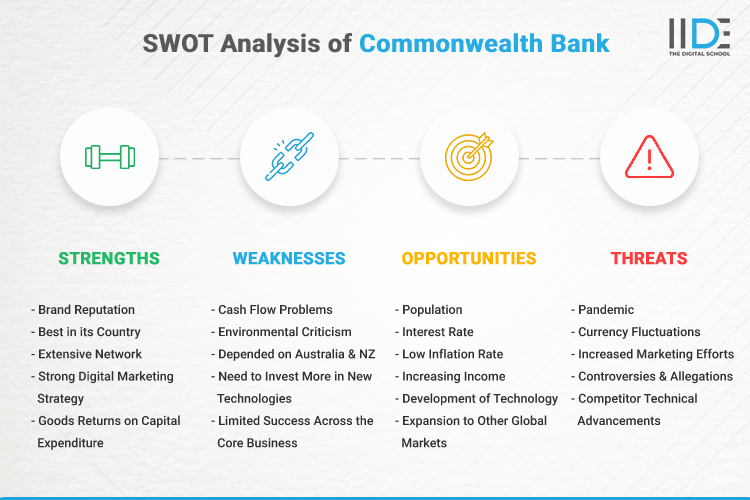

SWOT analysis of Commonwealth Bank is the study of strengths, weaknesses, opportunities, and threats of the company. This will help the company understand strong factors for their growth, weakness, and threats to rectify them for further growth.

To better understand the SWOT analysis of Commonwealth Bank, refer to the infographics below:

Below is a step-by-step detailed guide to help you with the SWOT analysis of Commonwealth Bank.

Strengths of Commonwealth Bank

Certain abilities of an organization that are advantageous in capturing market share, attracting more customers, and maximizing profits can be called the strengths of that organization.

- Extensive Network: The bank has more than 42,000 employees with a global presence of 34+ countries with a very wide range of services including retail banking, premium business and wealth management services.

(The CommBank App, Source: CommBank)

- Brand Reputation: Commonwealth Bank has been in the business of banking for a large number of years. Also, with the variety of secure services, it provides such as the go on CommBank app which is backed with secured digital channels to provide its users to securely transact with Commonwealth Bank. These big steps made Commonwealth Bank established as a leader in the industry. This helps the corporation to gain a reputation and get recognized easily.

Useful Tip: The time is digital and you can build your business reputation online by learning and implementing the ways from an online reputation management course which is taught by digital marketing industry experts in a practical oriented form.

- Strong Digital Marketing Strategy: With a very strong online presence on every social media site has built a strong customer relationship. Want to know how social media works as a strength for Commonwealth Bank? Then you must check out the benefits of social media marketing to get the answer to your query.

- Best in its Country: The Bank is at the top of the big four banks in Australia and which itself tells that the bank is the best in Australia and New Zealand in terms of commercial and retail banking.

- Goods Returns on Capital Expenditure: Commonwealth Bank is relatively successful at executing net income of A$ 9.63 Billion from annual revenue of A$ 30.16 Billion.

Weakness of Commonwealth Bank

Weakness is the area where Commonwealth Bank can improve upon by building strategies. Below mentioned are the weakness of Commonwealth Bank:

- Limited Success Across the Core Business: Although Commonwealth Bank is one of the leading organizations in its industry it faces challenges in moving to other product segments with its present culture.

- Cash Flow Problems: There is a lack of proper financial planning at Commonwealth Bank regarding cash flows, leading to certain circumstances where there isn’t enough cash flow as required leading to unnecessary unplanned borrowing.

- Need to Invest More in New Technologies: According to the country’s scale of expansion and the geographical areas Commonwealth Bank needs to invest more money in technology to integrate the processes across the board. Currently, the investment in technology is not on par as per the vision of the company.

- Environmental Criticism: Commonwealth Bank has been criticized several times by environmental activists for financing oil sands extractions that cause negative effects on the environment and human health.

- Dependent on Australia & NZ: Commonwealth Bank’s global presence is not up to the mark. The bank is dependent more on Australia & NZ. Also, the Commonwealth Bank is now competing with other Australian banks in terms of several branches.

Opportunities for Commonwealth Bank

Opportunities are external factors that allow an organisation to grow and be more profitable. Following are some opportunities for Commonwealth Bank:

- Expansion to Other Global Markets: The company is planning to expand to more developing countries. This serves them as an opportunity to acquire a new customer base.

- Development of Technology: Since the FinTech industry is growing at a very rapid pace, there are advancements in technologies too. Using these kinds of technologies can increase efficiency and decrease cost.

- Increasing Income: There has been an increase in average household income along with an increase in consumer spending following the recession. This will result in growth in the Commonwealth Bank’s target market with new customers that can be attracted towards the business.

- Population: The population has been growing and is expected to grow at a positive rate for the upcoming years. This is beneficial for the Commonwealth Bank as there will be an increase in the number of potential customers that it can target.

- Interest Rate: Lower interest rates than compared to previous years provides an opportunity for the Commonwealth Bank to undergo expansion projects that are financed with loans at a cheaper interest rate.

- Low Inflation Rate: The low inflation rate can bring more stability in the market and enable credit at a lower interest rate to the customers of the Commonwealth Bank.

Threats to Commonwealth Bank

The threats faced by the Commonwealth Bank are listed below:

- Currency Fluctuations: As the company is operating in numerous countries it is exposed to currency fluctuations especially given the volatile political climate in several markets across the world.

- Competitor Technical Advancements: New technological advancements by a few competitors within the sector constitutes a threat to Commonwealth Bank since customers who are drawn to this new technology may switch to competitors, reducing Commonwealth Bank’s overall market share.

- Pandemic: Financial losses incurred by companies as well as individuals can cause a threat to the bank in repayment of loans.

- Increased Marketing Efforts: Due to the rise of digital marketing, there is an increasing number of promotional messages which are being sent by competitors. It clutters up the space, which leads to losing out on customers. Commonwealth Bank is well versed and trying to adopt a variety of latest digital marketing skills to get ahead of the competition. You must also check out these skills to achieve the same.

- Controversies & Allegations: Commonwealth Bank has been in more than 10+ controversies including the 2008 financial planning scandal, money laundering scandal, Bank bill swap rate allegations and many more. Recently, Commonwealth Bank has been sued by an Indonesian family for launching fake money laundering scams.

This ends our in-depth SWOT analysis of Commonwealth Bank. Let us conclude our learning below.

To Conclude

Commonwealth Bank is growing in the sector of banking in Australia, New Zealand, as well as the global market too. As we had a look at the SWOT Analysis of Commonwealth Bank, there is a lot more to grow in many aspects.

With the emergence of the digital world, where almost every individual spends at least an hour of his/her time on phones, proper digital marketing, and online presence can be a great way to improve customer relations.

If you want to learn digital marketing or want to upskill yourself. Take a look at our 3 Months Advanced Digital Marketing course where you can learn everything about digital marketing in-depth just like this case study.

We hope this blog on the SWOT Analysis of Commonwealth Bank has given you a good insight into the company’s strengths, weaknesses, opportunities, and threats. You can also read our comprehensive study on the SWOT Analysis of JP Morgan Chase.

If you enjoy in-depth company research just like the SWOT analysis of Commonwealth Bank, check out our IIDE Knowledge portal for more fascinating case studies.

Thank you for taking the time to read this, and do share your thoughts on this case study of the SWOT analysis of Commonwealth Bank in the comments section below.

0 Comments