Orginally Written by Aditya Shastri

Updated on Aug 9, 2025

Share on:

In our prior blog, we had done an end-to-end SWOT analysis of one of the largest private-sector banks, HDFC. In this blog, we will be focusing on the SWOT Analysis of JP Morgan Chase.

JP Morgan Chase is the largest bank in the world by market capitalization which evaluates at $453.5 Billion. It is also one of the top 3 most trusted banks in the U.S with a market experience of over 2 decades. With their immeasurable knowledge in the industry, they have been providing their customers with the best services.

They have their branches in over 100 countries and to cater to such a large audience they have been implementing some of the most successful marketing techniques using digital platforms as most of the customers are online nowadays. So if you are interested in learning the latest skills in digital marketing – check out our Free MasterClass on Digital Marketing 101 by the CEO and Founder of IIDE, Karan Shah.

Thus this makes us curious to know how JP Morgan Chase has become so successful in its field, we have elaborated on the topic SWOT Analysis of JP Morgan Chase in detail. But before we study its SWOT analysis let us first know about JP Morgan Chase as a company, its services, competitors, financials, and more.

About JP Morgan Chase

JP Morgan Chase is one of the oldest financial institutions in the world which was founded in the year 2000 by John Pierpont Morgan, John Thompson, Balthazar P. Melick, and Aaron Burr. It has its headquarters located in New York City, New York, U.S. It has over 200,000 employees working under it all over the world.

It had come into an establishment due to the combined efforts of its predecessors namely J.P. Morgan & Co., Chase National Bank Chemical Bank, and The Manhattan Company. Its history dates back to 1799 which gives it an experience of more than 2 centuries.

It has made a revenue of US$119.54 billion as of 2020 and is known as the second-largest bank in terms of revenue in the world with a market share of around 9.2%. It has total assets of about US$3.684 trillion as of June 2021 and is the 4th largest bank as of total assets.

| Founders | John Pierpont Morgan, John Thompson, Balthazar P. Melick, and Aaron Burr |

|---|---|

| Year Founded | December 1, 2000 |

| Origin | New York City, New York, U.S |

| No. of Employees | 2,55,351 (2020) |

| Company Type | Public |

| Market Cap | US $453.5 Billion (2020) |

| Annual Revenue | US $119.54 Billion (2020) |

| Net Profit | US $29.13 Billion (2020) |

Services of JP Morgan Chase

JP Morgan Chase has such an extended reach in the market it also provides its customers with some of the best services available. Following are the services provided by JP Morgan Chase:

- Asset Management

- Commercial Banking

- Institutional Asset Management

- Investment Banking

- Merchant Services

- Securities Services

- Treasury and Payments

- Wealth Management

Close Competitors of JP Morgan Chase

JP Morgan Chase is one of the biggest financial institutions in the world, therefore it has many competitors in the market. Some of JP Morgans competitors are:

- Goldman Sachs

- HSBC

- Citi

- Bank of America

- Trust Financial

- United Bank

Now that we have understood the company let us start with the extensive SWOT Analysis of JP Morgan Chase.

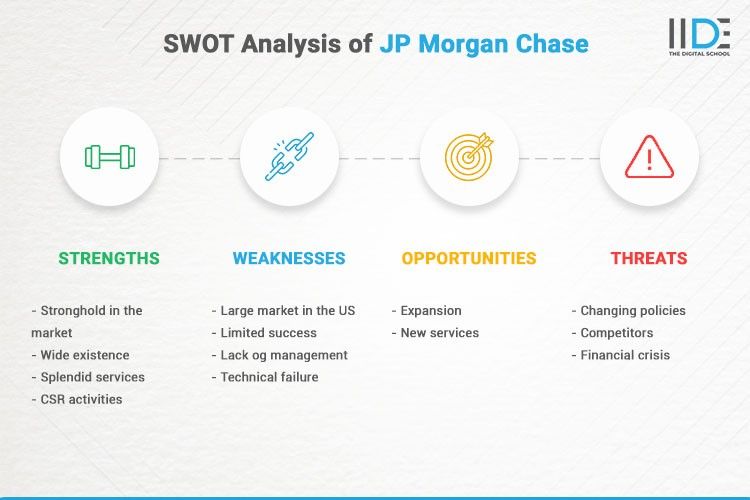

SWOT Analysis of JP Morgan Chase

SWOT Analysis is a method for identifying and analyzing internal strengths and weaknesses and external opportunities and threats that shape the current and future operations and help develop the company’s strategic goals.

We can understand the SWOT Analysis of JP Morgan Chase one by one by starting with its strengths.

Strengths of JP Morgan Chase

Strengths are the positive points of a company that helps it to get a hold of the market. JP Morgan Chase should evaluate them and see what improvements can be down by them to get a better hold of the market.

- Stronghold in the market: It has a good reputation in the market with a strong brand name and a well-executed financial base. This helps it to expand its business in different markets.

- Wide existence: It has its branches in over 100 different countries of the world and over 200,000 employees working under it which helps it to manage and evolve its business and make it strong.

- Splendid services: with an experience of over 2 decades it has been providing its customers with some of the best services in the market and this helps them strengthen their bond with their customers.

- CSR activities: JP Morgan Chase is well known for its commitment to its CSR strategies. In 2019, they invested $324.5 million in global charity and business ventures intending to contribute $1.75 billion by 2023.

Weaknesses of JP Morgan Chase

Weaknesses are the negative factors that a company possesses in its span of time. These factors can be a problem in the future if not taken care of now.

- Large market in the US: Even though JP Morgan Chase has operations in over 100 countries, they are mainly dependent on US activities. This overreliance on the US market is also seen as a weakness. If this market experiences a crisis, the effects for the bank might be enormous.

- Limited Success: It only has limited success in its current business and not in other markets.

- Lack of management: JP Morgan Chase has been engaged in several incidents in recent years, between 2002 and 2009, the UK Financial Services Authority (FSA) penalized the bank $33.32 million for failing to secure billions of pounds in client’s funds. Such incidents need to be taken care of in the future.

- Technical failure: In Feb 2018, JP Morgan Chase experienced a technical issue. Its online banking system had a security flaw that allowed certain users to gain access to other users’ account information. Customers who were affected by the problem voiced their anger on social media. Technical difficulties can occur in any organization but, when they occur in such a large company customer’s trust may be affected.

Opportunities for JP Morgan Chase

Opportunities are the new ways JP Morgan Chase can grow in the market. It needs to find the different opportunities in the market and try to capture them.

- Expansion: If JP Morgan Chase expands its business more in other countries it can catch hold of more of the market and be at the top of its industry in all aspects. This can also help it in financial stability.

- New Services: it needs to provide its customers with new services and diversify its portfolio.

Threats to JP Morgan Chase

Threats are the potential negative factors that can arrises in the future. JP Morgan Chase needs to be aware of these threats which can affect their business growth and to know how to deal with them.

- Changing Policies: the government can change its policies anytime which can affect the working process of the company. Thus it needs to be aware of such changes which can happen in the future.

- Competitors: JP Morgan Chase faces a large number of competitors in the market due to its wide market spread in different countries. With the change in time, there are new companies entering the market that want to be at the top. This can create tough competition for it.

- Financial Crisis: The company can face a financial crisis anytime in the future without its knowledge so to avoid trouble in such times it needs to have a proper financial study of its company and keep separate provisions for such times.

- We have now completed the SWOT Analysis of JP Morgan Chase. These studies help the company to analyze and prosperous in the market.

Learn Digital Marketing for FREE

Conclusion

As we have seen, JP Morgan Chase is one of the best financial service companies in the market with about 9.2% of the world’s market share. It is one of the strongest companies in the market with a good reputation and a wide reach which can still be developed by providing new services. Even though it has many positive points there are some flaws that hold it back.

It is mainly dependent on the US market which can lead to trouble if there is any change in policies in the market. It can prevent reliance on only one market by increasing its awareness in other markets. It can implement this with the use of digital media which can help it cater to a large audience in any market as almost all people are using digital platforms nowadays. If you are interested in learning more and upskilling, check out IIDE’s 3 Month Advanced Online Digital Marketing Course to know more.

If you would like to read such detailed analyses of companies, find more such insightful case studies on our IIDE Knowledge portal.

Thank you for taking the time to read this, and do share your thoughts on this case study in the comments section below.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.