Orginally Written by Aditya Shastri

Updated on Aug 9, 2025

Share on:

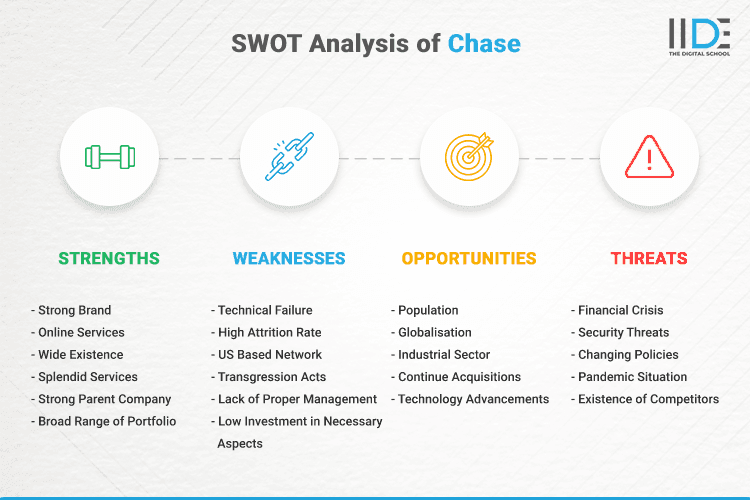

Previously, we had done the absolute SWOT Analysis of Citi – The Third-Largest Financial Service and Investment Banking Corporation. Today we are going to learn about the SWOT analysis of Chase – one of the largest subsidiary banking companies of JP Morgan Chase, located in New York City, USA.

Chase, Chase Bank or JPMC (JP Morgan Chase) Bank is one of the largest U.S. consumer and commercial banks providing banking services including saving accounts, checking accounts, mortgages, auto loans, planning, business banking and many more. It is one of the Big Four Banks of the USA.

Now, Chase has stepped up into the digital environment. To accelerate their digital banking services, they have been acquiring new marketing strategies to adapt to changing environmental aspects. They have included digital marketing in their marketing techniques. If you are interested in learning digital marketing for a fresh kick start to your career – check out our free masterclass on digital marketing by the CEO and Founder of IIDE, Karan Shah.

Before we go into the SWOT Analysis of Chase, let us know about Chase as a company.

Learn Digital Marketing for FREE

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.