About US Bank

Source: Google

US Bank, established in 1863, is one of the largest and oldest financial institutions in the United States. Founded by George Smith, the bank has a rich history of providing financial services. With a mission to help customers achieve financial stability and success, US Bank offers a wide range of products, including personal banking, business banking, and wealth management services.

Incorporated in Delaware, U.S. Bancorp is an American banking company based in Minneapolis, Minnesota. It is the fifth-largest banking institution in the United States and is the parent company of the U.S. Bank National Association.

It has over 3,106 branches spread across the world and 4,842 ATMs. The U.S. Bank’s marketing strategy has helped the company rank 113th on the Fortune 500 list and is considered an important bank by the Financial Stability Board.

It is a publicly held company traded as USB on the NYSE and is known for its best customer service through digital platforms as 80% of its transactions now happen online. They have made banking with them easy and convenient for their customers by investing in digital capabilities.

Big companies like US Bank are looking for digital marketing professionals to take their marketing campaigns a notch above. Many aspirants who want to work in such companies start looking for a digital marketing course to begin their careers in this dynamic industry.

What’s New With US Bank?

- Revenue (2023): US Bank’s marketing strategy helped the company generate revenue of $27.16 billion (Source: US Bank Annual Report)

- Number of Employees: Over 70,000 are working to achieve the marketing strategy of US Bank(Source: US Bank Corporate)

- Market Share: 5.2% of the US banking market (Source: Statista)

- Customer Satisfaction: US Bank’s marketing strategy resulted in 82% customer satisfaction (Source: J.D. Power)

Curious to learn about how companies like US Bank leverage market trends to design their campaign? Check out our advanced digital marketing course so that you can learn and implement these learnings in real-life scenarios.

Business News

As a result of US Bank’s marketing strategy, the bank recently announced a merger with a regional bank, expanding its footprint in the Midwest and enhancing its service offerings.

Product Launch

After studying US Bank’s target audience, the bank launched a new digital banking platform, providing customers with enhanced mobile banking features and personalised financial advice.

Marketing News

One part of US Bank’s marketing strategy, the ‘Power of Possible,’ focuses on inspiring customers to achieve their financial goals with the support of US Bank’s comprehensive services. Want to understand the factors that a company considers while designing the marketing strategy of US Bank? Check out our courses on digital marketing online to understand this from a marketer’s point of view.

Celebrity News

As a part of the marketing strategy of US Bank, the bank partnered with popular financial educator Dave Ramsey to promote financial literacy and responsible banking among younger audiences.

Buyer Persona

A buyer persona gives a detailed description of US Bank’s ideal customer. US Bank’s marketing strategy is based on its audience’s motivations, preferences, challenges, and online activities.

Based on the detailed breakdown, it’s no surprise that the marketing strategy of US Bank uses social media platforms like Instagram and Facebook to execute their marketing campaigns. Here, US Bank’s marketing strategy can integrate gardening and interior design to match the requirements of its target audience.

Many AI Tools like ChatGPT can help create content that is tailored to different audiences and social media platforms. You can also leverage the power of AI tools by enrolling for our free ChatGPT course now!

Marketing Strategy of U.S. Bank

Let’s have a look at the marketing strategy of US Bank and how the company conducts its marketing efforts.

Segmentation, Targeting, and Positioning

Segmentation is the process of dividing a market into distinct groups based on factors like demographics, geography, and customer needs. US Bank’s marketing strategy ensures that the bank segments its customers based on location, demographics, and lifestyle characteristics.

Targeting involves selecting specific segments to focus on. High-income individuals and business owners are common target markets for US Bank’s marketing strategy.

Positioning is about creating a clear and compelling image of your product or brand in the minds of customers. US Banks’ marketing strategy ensures that the company positions itself as convenient, secure, and catering to affluent customers.

Are you curious to learn how segmentation, targeting, and positioning can help drive success for companies like US Bank? A free digital marketing certification will help you understand this in detail.

Digital Marketing Strategy of US Bank

Social Media Marketing

On social media, the marketing strategy of US Bank faces fierce competition with other companies in its sector. US bank has an overwhelming number of followers, engagement on posts and a great social media presence on Facebook, Twitter, Instagram, LinkedIn, etc in addition to its website.

U.S. Bank is present on social media sites such as Facebook and Twitter. It has a maximum of 44.5K followers on Twitter. They provide their most recent news updates. They even have a distinct Twitter handle for resolving consumer issues and connecting with them.

They post on social media platforms, especially on Instagram the posts are related to individual stories, saving tips, pools, FAQs, product promotions information etc. and many more. On the other hand, the LinkedIn posts are more professional, including inside stories from the corporate, C-level leader’s discussions, meetups event announcements, etc.

SEO Strategies

According to SEO rankings, the number of keywords- below 500 is bad, above 1000 is good, and 10,000+ is amazing. According to Ahrefs, their website ranks for 723K organic keywords (Keywords driving unpaid search traffic), and it is considered out of the league. Hence, the digital marketing of US banks is gaining an unexpected number of insights.

Further, the organic traffic (number of unpaid visits) per month is 5.9 Million+, which is astonishing again. As a result of the US Bank’s marketing strategy, the company is putting full effort into improving its SEO game for better promotion of the brand. While the brand is working hard enough to strengthen its position in Google SERP results.

People across the country, especially the ones residing in Thane and Faridabad want to explore SEO (an important component of digital marketing). This has led them to search for information using the keywords, ‘digital marketing courses in thane’ and ‘digital marketing courses in faridabad’.

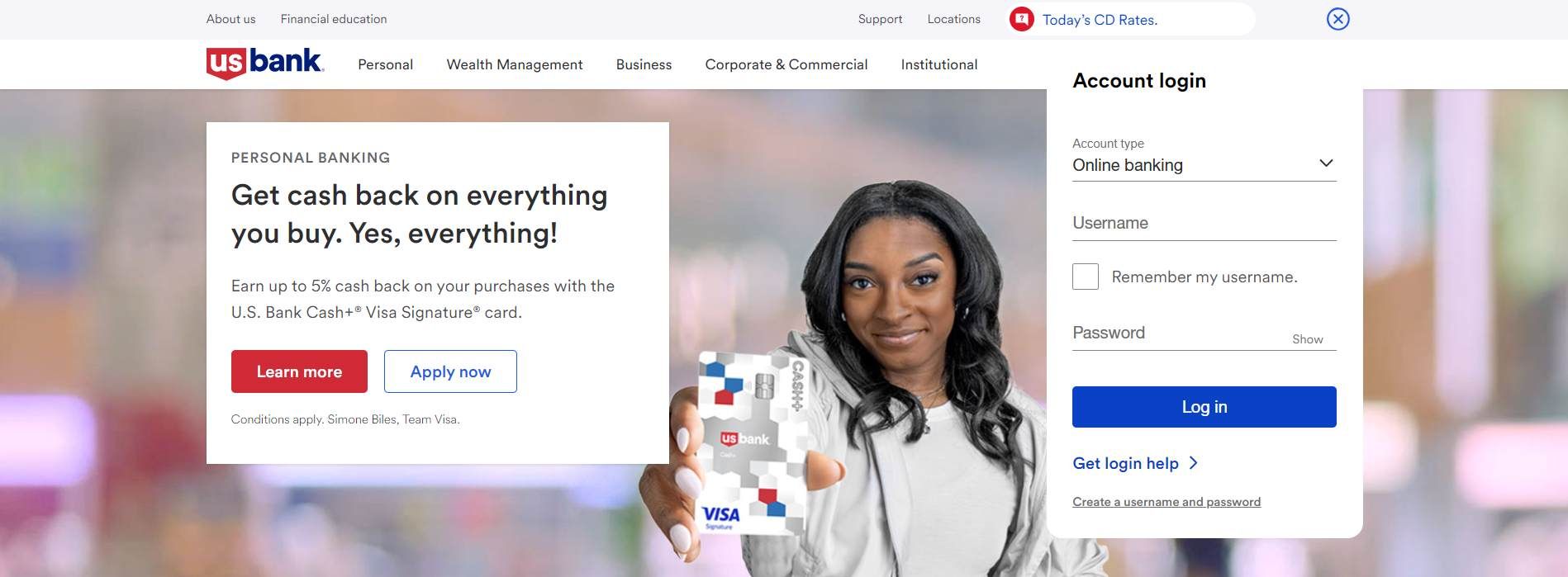

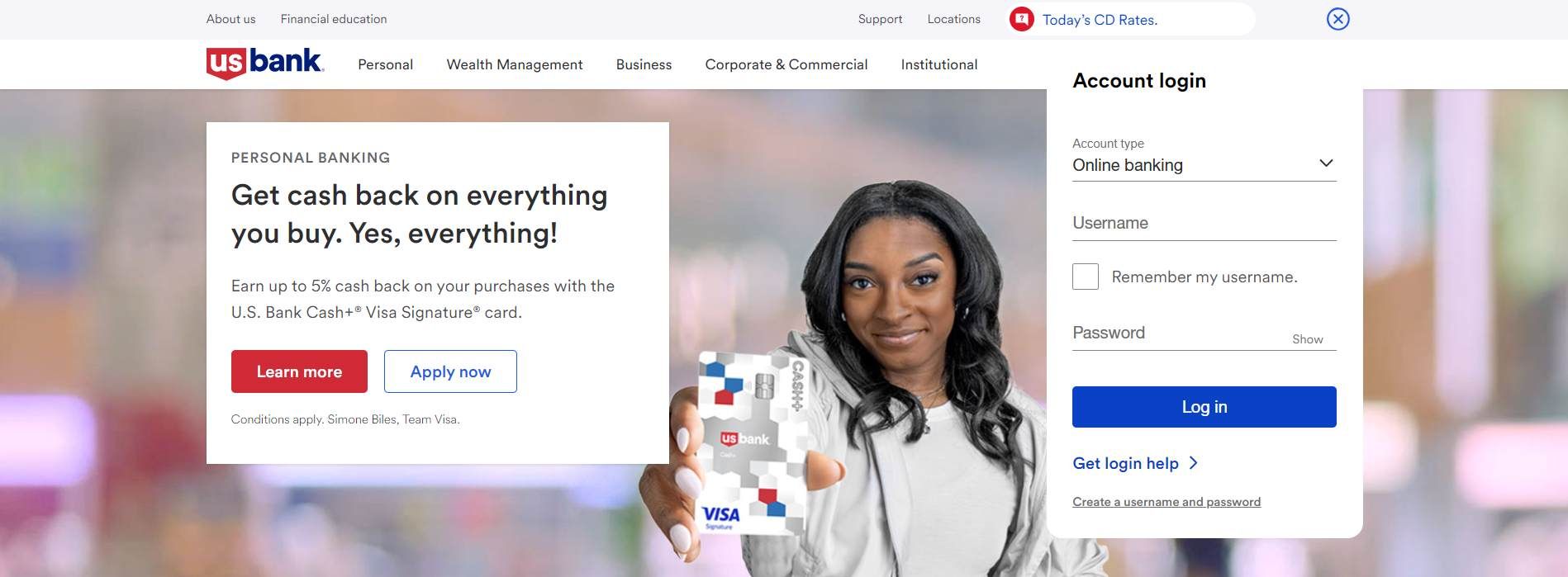

E-commerce Strategies

Source: usbank.com

The United States Bank has a website where you can access all of its banking services and learn about its new strategies. It also has Apps that give its clients a pleasant user experience. Both software versions, Android and iOS are available.

Mobile Apps

Source: play.google.com

US Bank has several mobile apps which are available on both Android & iOS smartphones. The company has a mobile app called US Bank. It helps its users and consumers in the online handling of credit cards and other activities. The app interface or UI is very simple and familiar to the user which enhances the user experience, moreover, the app is fully secured.

Content Marketing

Did you know that 61% of customers say that they’re more likely to buy from a brand that creates custom content?

U.S. Bank’s marketing strategy unveiled its ‘Achieve Your Goals’ content site.

The site (which functions similarly to a blog) only had two postings in its first two months: one in February and one in March. However, beginning in May and continuing through the summer, there were close to ten posts per month. Customers and consumers of financial services now have access to a growing resource with content organised into four main categories ‘My Money,’ ‘My Credit,’ ‘My Home,’ and ‘My Vehicles.’

Do you find this article insightful? Check out our digital marketing blogs now!

Marketing And Advertising Campaigns Designed by U.S Bank’s Marketing Strategy

As a part of U.S Bank’s advertising strategy, the bank advertises itself on news channels to ensure that clients are aware of its brand. Advertising on online channels and in print increases the bank’s visibility. U.S. Bank supports financial institutions and other events, resulting in a positive brand experience. It also sends out regular email updates.

1. ‘Power of Possible’

Source: Google

The US bank has been running a campaign ‘Power of Possible’ in selected markets since 2016. This US Bank marketing campaign highlights the stories of customers working hard towards their goals with persistence and determination and how support from the right partner – helps bring the vision to life.

As a part of US Bank’s marketing strategy, the campaign appeared on major network channels including physical and digital footprint. Stories of many customers were featured and how U.S. Bank helped customers navigate those ‘in-between’ moments toward achieving their goals.

2. ‘Redo’

As a part of the US bank’s marketing strategy, the bank launched a campaign 4 months ago aired on YouTube in which the ad ‘Redo’ highlights a couple who desperately need to renovate their basement, and Alex the Banker is there with a solution. In the ad, Alex is seen introducing ‘the U.S. Bank – Home improvement loan’ to the couples and how the U.S. Banks are always ready to help their customers plan their tomorrow. The YouTube advertisement got a successful viewership of more than 1.6 Million.

Would you like to research the marketing strategies of other well-known brands? Have a look at our digital marketing case studies now!

3. Tiny Pies

This YouTube ad, just like the ‘Redo ad before it, ditches the stuffy banker stereotype. Instead, we meet the quirky owners of Petite Pies, a bakery specialising in, well, tiny pies. Their biggest challenges? Dealing with, you guessed it, tiny payments.

Enter Alex the Banker, superhero of small businesses! She swoops in with U.S. Bank’s ‘Business Essentials’ package, a magic solution for managing their point-of-sale system. But Alex doesn’t stop there! She’s got U.S. Bank business loans ready to help Petite Pies invest in new equipment and watch their pie business boom.

What makes the US Bank’s advertising strategy absolutely brilliant is the fact that it incorporates ads such as these which serve as laugh-out-loud reminders that U.S. Bank understands small businesses and has the tools to help them conquer any hurdle, no matter how pint-sized.

Marketing Strategy of US Bank That Failed

As a part of US Bank’s marketing strategy, the company ran a campaign called ‘Your Financial Future’ which aimed to promote the brand’s range of financial services.They wanted to do this by highlighting how they could help customers achieve their long-term financial goals. The campaign featured various ads showcasing different financial products and services designed to cater to a broad audience.

Issue: US Bank faced criticism for a campaign that appeared to marginalise certain customer groups by not addressing their specific financial needs.

Backlash: The campaign was met with backlash on social media and from advocacy groups, leading to negative publicity and calls for more inclusive marketing.

Response US Bank quickly pulled the campaign, issued a public apology, and pledged to develop more inclusive and customer-centric marketing strategies in the future.

Many businesses across India especially the ones operating in Rohini face marketing challenges, but there’s a way to overcome them! Enrolling in a digital marketing course in rohini will provide you with valuable information about the right way to deal with such pitfalls.

Top Competitors That Influence the Marketing Strategy of US Bank

US Bank is not the only bank that dominates the banking industry. Many other players can have a huge impact on US Bank’s marketing strategy:

- Wells Fargo: Known for its extensive network of branches and comprehensive financial services.

- Bank of America: This bank offers a variety of banking and investment services with a strong digital presence.

- Chase Bank: This bank is renowned for offering its customer service and innovative banking solutions.

- Citibank: Provides global banking services with a focus on technology and convenience.

- PNC Bank: Offers personalised banking solutions and strong community involvement.

Learn From Asia’s #1

Digital Marketing Institute

AI-Based Curriculum

Dive in to the future with the latest AI tools

Placement at top brands and agencies