ABOUT DCB Bank

An Indian private sector scheduled commercial bank is DCB Bank Limited. It is one of the new generation banks that the Reserve Bank of India, the country’s bank regulator, granted a licence to operate as a scheduled commercial bank. The licence was granted to DCB Bank on May 31, 1995.

The bank afterwards changed its name to DCB Bank Ltd. in the year 2014. In India, DCB Bank has 333 branches spread throughout 19 states and 3 union territories. Small tickets, secured loans, and typically the non-salaried section make up the majority of its books.

DCB Bank is a new generation private sector bank with 400 branches across India as of June 1st, 2022.

The Bank is administered by a qualified management group under the direction of the Board of Directors. Retail, micro-SME, SME, mid-Corporate, agriculture, commodities, government, public sector, Indian banks, cooperative banks, and non-banking finance companies are among the business segments of DCB Bank (NBFC). Approximately 1,000,000 people use it.

The Bank’s promoter, with a share of about 15%, is the Aga Khan Fund for Economic Development (AKFED). About 39.4% of the Resident Individual category’s sharing strategy of DCB Bank.

Quick Stats on DCB Bank| CEO | Murali Natrajan |

|---|

| CMO | Bharat Laxmi Das |

|---|

| Area Served | Worldwide |

|---|

| Industry | Banking, Financial Services |

|---|

| Market Share/ Revenue | ₹3,964.81 crores (US$500 million) (FY 21-22) |

|---|

| Vision | Aspire to be the leading client-centric global universal bank. |

|---|

| Tagline | We believe you |

|---|

Marketing Strategy of DCB Bank

Let’s examine DCB Bank’s marketing approach and how they execute the marketing programme etc.

Segmentation, Targeting & Positioning

The process of segmenting a targeted market into contactable segments is called segmentation. To better understand the target audience, market segmentation separates a market into subgroups based on demographics, needs, priorities, similar interests, and other psychographic or behavioural features.

To understand the tastes and preferences of various client groups in the market, a segmentation strategy is essential. It aids in classifying clients based on comparable demand and requirement patterns. It employs techniques for geographic and demographic segmentation.

To stay competitive and customer-focused, Deutsche Bank employs differentiated targeting techniques.

It employs a value-based positioning approach since it has established itself as a private bank with a focus on its clients and business to provide them with services that are cost-effective.

Marketing Campaigns

Earn up to 6.75% p.a. with DCB Bank Savings Account

On May 22, an advertisement was released on the youtube channel of DCB Bank. The theme was cricket which Indian families are crazy about. They announced about earning 6.75% p.a. On a DCB Bank savings account.

DCB Bank Remit – A warm embrace from across the seas

This advertisement depicts a daughter studying abroad and her father, who is concerned about her financial situation.

With DCB Bank make payments from India from anywhere to anywhere easily Remit up to US$ 25,000/- from any bank in India, multiple currency options available, and safe and secure remit from the comfort of your home

Social Media Marketing

DCB Bank is active on Instagram, LinkedIn, Facebook, Twitter

With 3360 followers on Twitter, and 3612 on Instagram

Twitter post:

DCB Bank Corporate Social Responsibility #The CSR project has been awarded India’s Best Bank for CSR 2022 by AsiaMoney for the Livelihood Improvement Project at Banki. We’re Delighted for this recognition from #Asiamoney.

Instagram: with 3612 followers

Linkedin: with more than 3laksh followers and more than 5k employees on Linkedin

Youtube:

With more than 1k subscribers to DCB Bank’s youtube channel it seems DCB Bank is inactive in this area (youtube) DCB Bank is active on all social media platforms but on a few, it is not active like youtube but this cannot be considered as low or has to be improved as they are active in other business platforms like Twitter and LinkedIn

It is very active on Twitter and LinkedIn as they are the most featured business professional apps to explore your business

SEO Strategies

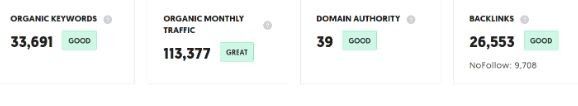

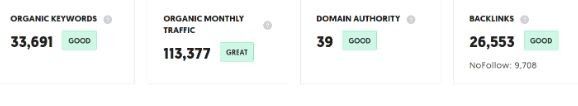

According to SEO ranking, the number of keywords – below 500 is bad, above 1000 is good, and 10,000+ is amazing.

As we can see www.DCB Bank has 33,691 organic keywords and it is considered to be good. That means DCB Bank’s digital marketing is gaining a lot of insights. The organic monthly traffic is more than 100,000. Which is considered to be great. its domain authority is 39 which is considered to be good.

Influencer Marketing

DCB Bank contracts Team Pumpkin for social media management. Team Pumpkin, which has offices in Delhi, Mumbai, and Bangalore, has lately begun offering its services to the Bank from its Mumbai office. The CBO of Team Pumpkin, Swati Nathani, commented on the victory by saying, “It’s been a pleasure working with DCB Bank and its team because of the vision and ideas they bring to the table. We are eager to add new ideas, viewpoints, and excellent execution to DCB Bank’s digital portfolio.

Ecommerce Strategies

DCB Bank has a website where customers can open a savings account anytime via the Internet or Mobile Banking App. DCB Bank’s website can fulfil users’ banking needs from anywhere, anytime. Through the website, one can access each and every detail of his/her account. Users can gain the benefits of ways of doing banking online.

Mobile Apps

Download and install the DCB Bank Mobile Banking app from either Playstore or AppStore. Register on the app with your DCB Bank Debit Card or DCB Bank Internet Banking login details. Scan the QR code to download the DCB Bank Mobile Banking app.

The official mobile banking app for DCB Bank is called DCB Bank Mobile Banking. Our brand-new app has a lot of new features and is safe and simple to use.

This app has a 4.3 rating in the google play store brand new experience with the new DCB Bank mobile banking.

Content Marketing Strategies

DCB Bank has various stories and blog posts on its website about its achievements. They usually add blogs or new feeds to their story segment to create awareness about the brand and enhance the branding span. On their website, we can see news & updates, a corporate gallery, sustainability, innovation & strategy, Credit Suisse Value and purpose etc. and many more.

This ends with an elaborative marketing strategy of DCB Bank. Let us conclude our learning below from the marketing strategy of DCB Bank.