Updated on Dec 12, 2025

Share on:

Suzuki, one of the leading automotive and motorcycle producers, is robust in 2025. Why so? What challenges lie ahead? This analysis examines the position of Suzuki in the market and what makes it compete. Business owners and students will understand brand strategies and market trends. Learn how Suzuki keeps its edge and what the future holds for the company. These insights can be applied to your own business or career.

Before we get to the article, I'd like you to know that Aditi Srivastava, who is a student of IIDE's PG in Digital Marketing, March Batch 2025, carried out the research and initial analysis for this article. If you liked this, please don't hesitate to contact her to send a quick word of thanks for hier excellent research work; she will thank you!

About Suzuki Motor Corporation

Suzuki Motor Corporation was established in 1909 by Michio Suzuki, starting as Suzuki Loom Works in Hamamatsu, Japan. Its humble beginnings in textile machinery evolved into one of the world's top automotive and motorcycle manufacturers. Its iconic transition from weaving looms to cars signifies more than a century of innovation and change.

Its entry into the automobile industry was made in 1955 when it produced its first car, the Suzulight. Suzuki's "Way of Life" slogan today symbolises how it helps to offer dependable mobility solutions that make people's everyday lives better on a global scale.

As we enter 2025, Suzuki persists in having a strong brand recall with total global automobile sales of 80 million units by August 2023. Yet, the increasing trend towards electric vehicles and shifting consumer demands bring new challenges.

Nevertheless, Suzuki's reputation and adamant pursuit of innovation in manufacturing and technology keep it on track in the dynamic motor vehicle environment.

| Key Feature | Details |

|---|---|

| Founded | 1909 |

| Founder | Michio Suzuki |

| First Car | Suzulight (1955) |

| Global Sales | 80 million units (as of 2023) |

| Primary Markets | India (32.6%), Japan (36%), Europe (10%) |

| Market Position | 8th most valuable automaker in the world (Maruti Suzuki) |

Learn Digital Marketing for FREE

Why SWOT Analysis Is Important to Suzuki in 2026?

Market Competition: Suzuki competes with both legacy competitors, such as Ford and General Motors and emerging market players such as Tesla and BYD in the electric vehicle space. The company's Indian subsidiary, Maruti Suzuki, has been a huge success story, becoming the 8th most valuable car manufacturer in the world with a market cap of $57.6 billion.

Changes in Customer Preferences: With changing customer preferences towards electric vehicles and premium features, Suzuki evolves with new product offerings and technology plans. The company announced its Technology Strategy 2025 with emphasis on reducing weight, carbon-neutral fuels, and the development of electric vehicles.

Technology and Innovation: Technology is also a critical component of Suzuki's innovation process, from computerised production lines to working on new sustainable mobility solutions. It is investing heavily in electric vehicle technology with future plans to introduce the e-Vitara and other EV models.

Economic Impact: Economic conditions and increasing prices affect consumers' spending behaviour. Suzuki's emphasis on low-cost, fuel-efficient cars will be in good standing during economic uncertain times while retaining a sound market share in major regions such as India and Japan.

Regulations and Sustainability: Suzuki's operations are influenced by new sustainability regulations and climate laws, driving the brand towards greener solutions. It wants to become carbon neutral by 2050 in Japan and Europe and by 2070 in India. Suzuki is also leveraging renewable energy solutions, such as solar and wind energy generation, in its plants.

Ethical Practices & Social Responsibility: Suzuki is further enhancing its ethical practices based on community involvement, sustainable sourcing, and sustainability initiatives such as biogas plants and renewable energy systems.

SWOT Analysis of Suzuki

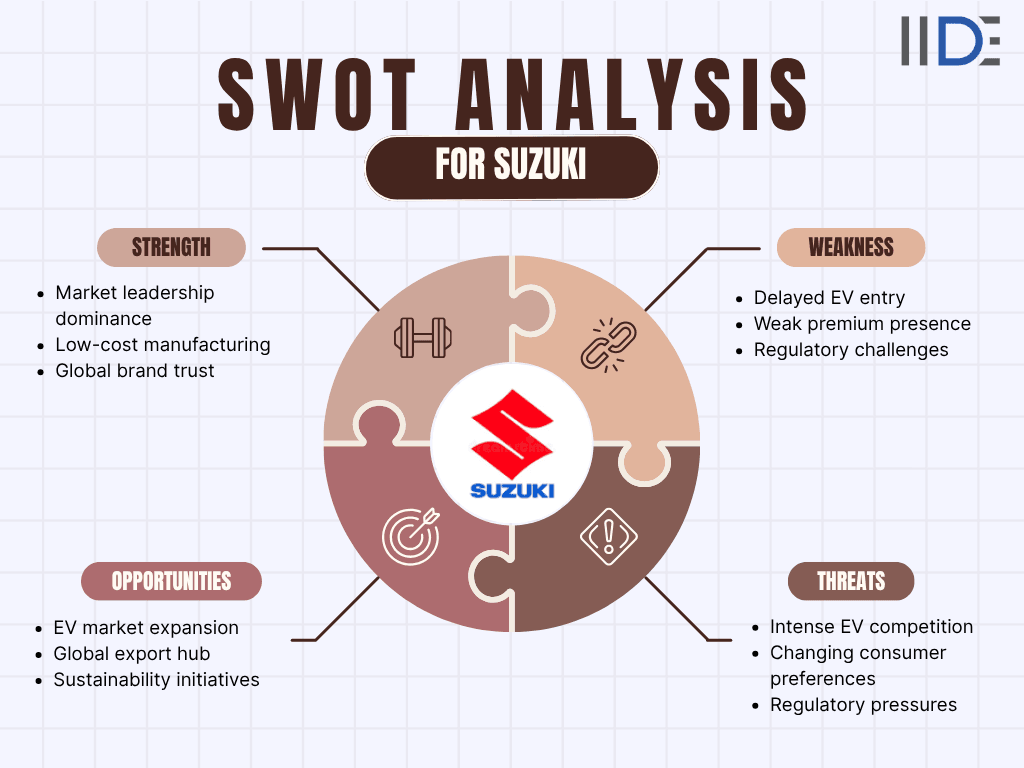

Suzuki, a globally recognized automaker, leads the Indian market with strong brand trust, efficient manufacturing, and a vast distribution network. Facing challenges like late EV entry and weak premium presence, it can still leverage sustainability trends and strategic alliances to grow globally.

Suzuki Strengths: How the Auto Pioneer Succeeds in 2025

Suzuki has been able to position itself as a dominant player in both motor vehicle and two-wheeler markets worldwide due to its leadership in the market, affordable production, and ongoing innovation. Let's take a look at how Suzuki's strengths make it well set to succeed in 2025.

1. Market Leadership & Dominance

- Maruti Suzuki maintains an overbearing 42% of the Indian passenger vehicle market share and is the undisputed market leader.

- Suzuki has recorded 80 million global automobile sales with an increased presence in 184 countries.

- In India alone, the company has sold more than 20 million domestic units, showcasing consistent market dominance.

- Maruti Suzuki emerged as the 8th most valuable automaker in the world with a market capitalisation of $57.6 billion, overtaking Ford, GM, and Volkswagen.

2. Low-Cost Manufacturing & Operations

- Suzuki's low-cost basis supports competitive pricing with quality maintenance.

- Efficient manufacturing in India with skilled labour and reduced production costs benefits the company.

- A high level of automation across factories guarantees uniform quality as well as scalability.

- Localisation strategies minimise costs, with localised components being the majority in key markets.

3. Global Distribution Network

- Large dealer network of more than 4,000 showrooms and 3,700 service centres across India alone.

- Broad distribution penetration guarantees product availability in both urban and rural markets.

- Sound supply chain associations facilitate smooth running and bypass bottlenecks.

- Export possibilities from India to more than 100 countries, becoming a global manufacturing base.

4. Trusted Brand Recognition

- Deeply entrenched brand loyalty spanning decades, particularly in India, where Suzuki and first car ownership are synonymous.

- Reliable and superior mileage engines compared to rivals, with the lowest maintenance expenses in the industry.

- Unwavering performance in the automobile as well as motorbike segments, with successful model rollouts.

- Financial stability, international resources, and technology access by the parent company.

Weaknesses of Suzuki: Issues in a Fast-Changing Market

While Suzuki has strong market leadership, there are a number of weaknesses that the company has to overcome to remain competitive in 2025. These weaknesses are key to understanding the weakness of the brand and strategising for future growth.

1. Delayed Entry into Electric Vehicle Segment

- Suzuki will launch its first electric vehicle (e-Vitara) in 2025, much later than major competitors like Tata Motors, which already dominates the EV segment.

- Tata Motors held a 72.79% market share in India’s EV market as of January 2023, highlighting Suzuki’s late entry disadvantage.

- The EV market in India is projected to grow at a CAGR of 49% between 2022 and 2030, intensifying competition and making Suzuki’s delayed entry critical.

- Suzuki’s narrow EV portfolio contrasts sharply with competitors that already offer multiple electric models across segments.

2. Limited Premium Market Presence

- Maruti Suzuki has struggled in the luxury and premium car segments despite introducing models such as the Kizashi.

- Its premium retail brand, Nexa, while successful, still lags behind competitors like Hyundai and Tata in premium SUV sales.

- The company’s focus on small and mid-size cars limits access to high-margin opportunities in the premium vehicle category.

3. Regulatory and Compliance Challenges

- Maruti Suzuki faces challenges meeting India’s CAFE 3 emission regulations, which currently favor hybrid technology and larger vehicles.

- Weight-based emission rules disadvantage Suzuki’s lighter and more fuel-efficient car portfolio.

- The discontinuation of diesel engine offerings post-BS6 emission norms in 2020 has led to a decline in market share in SUV categories.

4. Safety and Quality Issues

- Product recalls continue to affect consumer trust, with 28,539 cars recalled in 2022 due to airbag controller defects.

- Safety ratings in key international markets have been lower for some models, hurting brand image among safety-conscious buyers.

- A 32.37% drop in R&D expenditure to INR 4,233 million weakens Suzuki’s innovation pipeline and long-term competitiveness.

If you're curious about how other leading beverage brands are performing in the market, check out our detailed SWOT Analysis of Tata Motors to uncover insights on their strengths, weaknesses, opportunities, and threats.

Suzuki Opportunities: Riding the Mobility of the Future

Suzuki has many opportunities to leverage in 2025, particularly with global automotive trends shifting toward electrification and sustainability. The brand can leverage these trends to widen its portfolio and adjust to changing market trends.

1. Expansion of the Electric Vehicle Market

- India's EV market is expected to reach 17 million units by 2030, with huge growth potential.

- Maruti Suzuki aims to have 15% of overall sales from electric vehicles and 50% total market share in India.

- Company plans to invest Rs 7,000 crore in EV manufacturing facilities, including a greenfield plant in Haryana.

- Direct benefits under the government's [translate:FAME] scheme encourage customer adoption of EVs.

2. Global Export Hub Development

- Exports projected at 7.5-8 lakh vehicles annually by 2030, utilizing India as a global production base.

- India-produced vehicles like the [translate:Jimny] have become top imports in Japan.

- Plans to create compact cars for African and Southeast Asian markets from Indian R&D centers.

- Collaborations with shipping lines such as MOL enhance India-Africa automobile trade.

3. Sustainability and Green Technology Initiatives

- Renewable energy use through solar installations producing over 82,000 MWh annually.

- Biogas programs and carbon-free fuel technologies align with international sustainability trends.

- Environment Vision 2050 drives green production and sustainable operations.

- Weight reduction tactics targeting 100kg improvements to enhance EV range and fuel efficiency.

4. Emerging Markets and Strategic Partnerships

- Rs 70,000 crore investment planned over 5-6 years, signaling strong growth commitment.

- Focus on Southeast Asia and Africa markets with rising demand for affordable, fuel-efficient vehicles.

- Technology partnerships to accelerate electric mobility and sustainability innovations.

- Government support for the [translate:'Make in India'] initiative creates a favourable policy environment for expansion.

Threats to Suzuki: Navigating Industry Challenges in 2025

Suzuki has a number of external threats that can affect its future development and market share. These threats are such that identifying them enables the brand to determine areas of strategic realignment and threat mitigation.

1. Pierce Electric Vehicle Competition

- Tesla's introduction in India with the [translate:Model Y] at Rs 59.89-67.89 lakh introduces premium EV competition.

- Chinese electric vehicle giant [translate:BYD] is expanding in India with several models and competitive pricing, including 5-minute charging technology.

- Local players such as Tata Motors, Mahindra, and Hyundai already have a presence in the EV segment with various products.

- New entrants like [translate:VinFast] and other international players are making the EV segment even more competitive.

2. Shifting Consumer Preferences

- From small cars to mid-size SUVs, Suzuki has lagged behind in meeting evolving consumer needs.

- Increasing demands for sophisticated features, upscale interiors, and the latest technology.

- Health and safety awareness prompt calls for greater safety ratings and more airbags.

- Affluent consumers are shifting from traditional value-oriented offerings to premium brands in expanding markets.

3. Regulatory and Environmental Pressures

- Tighter emission standards, such as [translate:CAFE,3], potentially disadvantage Suzuki's mild-hybrid technology.

- Weight-based emission rules penalize lighter vehicles, counter to Suzuki's compact car advantage.

- Mandatory safety regulations, like possible 6-airbag mandates, add compliance costs.

- Increasing environmental laws are accelerating the shift toward electric vehicles quicker than Suzuki’s current projections.

4. Economic and Market Risks

- Global supply chain disruptions impact automobile manufacturing and component availability.

- Rising raw material prices increase production costs and squeeze profit margins.

- Economic slowdowns could reduce consumer demand, especially in price-sensitive markets.

- Exchange rate fluctuations affect export competitiveness and profitability of foreign operations.

IIDE Student Takeaway, Recommendations & Conclusion for Suzuki in 2026 and Beyond

Suzuki's SWOT analysis of Suzuki presents a company with deep roots but struggling with heavy transformation issues. The brand leadership of Suzuki in India, low-cost manufacturing, and global reach network offer heavy leverage in the tough automotive market.

Yet the late initiation of electric vehicles and excessive competition from Tesla, BYD, and homegrown players pose heavy risks to Suzuki's growth in the future.

Core Tension: Although Suzuki's cost leadership and market dominance guarantee present-day success, the increasing move towards electric cars and premium offerings threatens its conventional value-based strategy.

Future Outlook: To continue its competitive edge, Suzuki needs to speed up its electric vehicle launches, enter premium segments, and utilise its India manufacturing expertise as a worldwide export base while overcoming challenges in regulatory compliance.

Recommendations:

- Electric Vehicle Acceleration: Launch e-Vitara early and accelerate EV portfolio expansion to grab the expected 17 million unit Indian EV market by 2030. Invest significantly in battery technology and charging infrastructure alliances.

- Premium Market Entry: Create higher-margin premium cars in the Nexa brand to take on Hyundai and Tata in high-margin SUV segments while keeping mass-market leadership.

- International Export Strategy: Use India's cost leadership to emerge as the leading export centre for emerging African and Southeast Asian markets, taking advantage of collaborations with MOL and TradeWaltz.

- Leadership in Sustainability: Promote renewable power plans and carbon-free manufacturing to keep pace with global sustainability trends and regulatory needs.

Suzuki's good market standing, brand franchise trusted by its customers, and support from the parent company give the firm grounds to negotiate the automobile transformation. Its investment pledge of Rs 70,000 crore in India shows its resolve to be a leader in the changing mobility economy.

In the future, Suzuki's success will hinge upon how well it manages to balance its historical competitiveness in low-cost, dependable vehicles with the imperative of electric innovation and upscale positioning. If the company is able to effectively pursue its electric vehicle strategy and still lead with cost, Suzuki will continue to be a leading player in the worldwide automotive market for decades to come.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Feb 20, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.