Orginally Written by Aditya Shastri

Updated on Aug 9, 2025

Share on:

About Reliance Capital Limited

Reliance Capital has businesses in asset management, mutual funds, life insurance, and general insurance, commercial finance, home finance, stockbroking, wealth management services, distribution of financial products, private equity, asset reconstruction, proprietary investments, and other activities in financial services.

Reliance Capital Limited was incorporated in 1986 at Ahmedabad in Gujarat as Reliance Capital & Finance Trust Limited. The name Reliance Capital came into effect on 5 January 1995. In 2002, Reliance Capital Ltd shifted its registered office to Jamnagar in Gujarat before it finally moved to Mumbai in Maharashtra, in 2006.

| Founder | Dhirubhai Ambani |

|---|---|

| Year Founded | 1986 |

| Origin | Jamnagar, Gujrat |

| No. of Employees | 18360 (2020) |

| Company Type | Public |

| Market Cap | 495.94 Crore (2021) |

| Annual Revenue | 18359 Crore (2020) |

| Net Income/ Profit | -1079 Crore (2020) |

Services Provided by Reliance Capital Limited:

Following are the different financial services provided by Reliance Capital:

- Asset Management

- Mutual Funds

- Life Insurance

- Commercial Finance

- Stock Broking

Competitors of Reliance Capital Limited

The company has intense competition, some of its major competitors are as follows:

- Tata Capital

- Transamerica

- Midden Brabant Advies

- Aditya Birla Capital

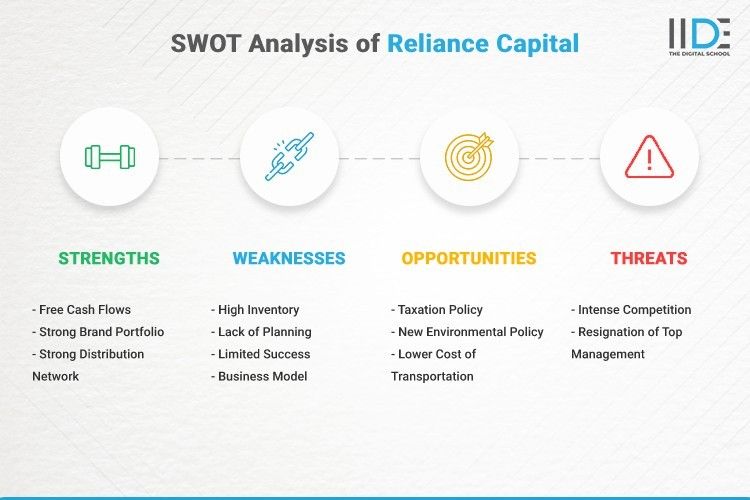

SWOT Analysis of Reliance Capital Limited

SWOT analysis is a vital strategic planning tool that can be used by Reliance Industries managers to do a situational analysis of the organization. It is a useful technique to analyze the present Strengths (S), Weaknesses (W), Opportunities (O) & Threats (T).

1. Strengths of Reliance Capital Limited

As one of the leading organizations in its industry, Reliance Industries has numerous strengths that help it to thrive in the marketplace.

- Free Cash Flows – The company has free cash flows that provide resources to expand into new projects and help in expansion.

- Strong Brand Portfolio – Over the years Reliance Industries has built a strong brand portfolio and the company has a great name due to its parent group.

- Strong Distribution Network – Over the years Reliance Industries has built a reliable distribution network that can reach the majority of its potential market.

2. Weaknesses of Reliance Capital Limited

Weaknesses are internal factors of the company which is the cause of loss to the company. Let’s look at some of the weaknesses of Reliance Capital.

- High Inventory – Reliance Capital has a high inventory which can hammer the long-term growth of the company.

- Lack of Planning – Financial planning is not done properly and efficiently. The current asset ratio of the company shows that it can plan the finance decision more efficiently.

- Limited Success – If we look at the success of Reliance Capital without taking into account its parent group, we can say it is still limited.

- Business Model – The structure of the company is compatible with only the present business model of the company.

3. Opportunities of Reliance Capital Limited

- Taxation Policy – The new taxation policy can significantly impact the way of doing business and can open new opportunities for established players such as Reliance Industries to increase its profitability.

- New Environmental Policies – The new environmental policies will bring new opportunities for the company, it can take advantage of them.

- Lower Cost of Transportation – Decreasing the cost of transportation because of lower shipping prices can also bring down the cost of Reliance Industries Its products thus providing an opportunity to the company.

4. Threats of Reliance Capital Limited

- Intense competition – Stable profitability has increased the number of players in the industry over the last two years which has put downward pressure on not only profitability but also on overall sales.

- Resignation of Top Management – The resignations of core people of the company is a red flag, leading to fluctuations in decision making.

Learn Digital Marketing for FREE

Conclusion

Reliance Capital Limited is a traditional company doing alright at its level, the company has a strong parent group giving it a base for its brand image. It also has a strong network in the country and is providing efficient services but frequent resignations in the top management can lead to slow decisions, which will affect the growth of the company.

Overall the Reliance group has done a great job in its marketing strategies and digital marketing on social media and various platforms but Reliance Capital can improvise itself in this area. Digital marketing is a necessary factor in today’s world. If you also want to learn about digital marketing do check out top-quality courses provided by IIDE which can be completed in some months, helping you upskill your knowledge.

If you liked the blog and would like to read more such case studies, do check out IIDE Knowledge Portal.

Thank you for taking the time to read the case study, do write your opinions in the comments section below.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.