Orginally Written by Aditya Shastri

Updated on Nov 18, 2025

Share on:

Marriott International is one of the world’s largest hospitality companies, operating, franchising, and licensing hotels, resorts, and residences globally. As of 2025, Marriott is navigating post-pandemic recovery, shifting consumer preferences, and macroeconomic headwinds.

Why examine Marriott’s SWOT now? Because in 2025, the hospitality sector is volatile - rising operational costs, digital disruption, and geopolitical shifts are redefining what success looks like.

For entrepreneurs, students, and industry watchers, understanding Marriott’s internal advantages and vulnerabilities, and its external opportunities and threats offers a blueprint for strategy in this sector.

Before diving in this blog, I would like to inform that the research and analysis has been done by Berhanu Abebe, who is a student of IIDE's Online Digital Marketing Course, May Batch 2025. If you find this read helpful, reach out to Berhanu and compliment him for his hardwork - he will appreciate it.

About Marriott

Marriott International, headquartered in Bethesda, Maryland, was founded in 1927 by J. Willard Marriott and his wife Alice. Today, it spans 30+ brands and 7,642 properties in 131 countries and territories (with 1.42 million rooms). Some properties are directly managed; and many are franchised.

Marriott’s slogan and positioning revolve around “experience, loyalty, consistency,” binding luxury, premium, and mid-tier stays under trusted brand umbrellas.

| Item | Detail |

|---|---|

| Official Name | Marriott International, Inc. |

| Founded | 1927 |

| Headquarters | Bethesda, Maryland, USA |

| Industries |

Hospitality, lodging, resorts, residential, timeshare |

| Global Reach | ~131 countries / territories |

| Properties / Rooms |

~7,600+ properties; ~1.42 million rooms |

| Business Model |

Franchising, management, direct ownership |

| Competitors |

Hilton, Hyatt, InterContinental Hotels Group (IHG), Accor, Airbnb (threat) |

| Recent Financial Notes |

Marriott forecasts moderated growth in China; room growth around 4–5 % in 2025 |

Why SWOT Analysis of Marriott Matters in 2025?

- Competitive Shakeups: Alternative lodging (Airbnb, boutique/local rentals) is disrupting the traditional hotel model.

- Consumer Shifts: Guests expect seamless digital experiences, sustainability, and hyper-personalization.

- Operational Pressures: Rising wages, energy costs, and maintenance costs put pressure on margins.

- Regulatory & Data Risk: Data privacy, cybersecurity, and global regulation of travel affect operations.

- Macroeconomic Sensitivity: Travel demand is cyclical. Recession, inflation, or geopolitical tensions can drastically impact occupancy and rates.

This SWOT helps stakeholders grasp where Marriott is strong, where it must guard itself, and where strategic moves could pay off.

Learn Digital Marketing for FREE

SWOT Analysis of Marriott

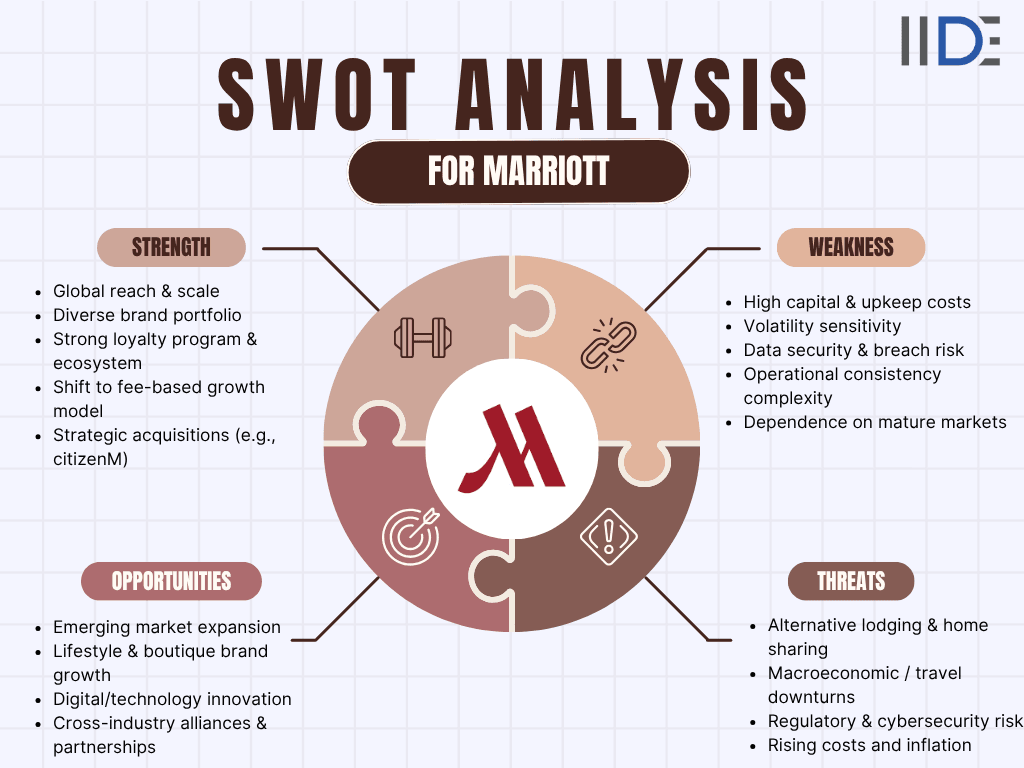

1. Strengths

Extensive global footprint & scale

- Marriott is present in 131 countries and territories, with thousands of properties.

- Scale gives Marriott negotiating power, global brand recognition, and risk diversification across regions.

Diverse brand portfolio

- Across luxury (Ritz-Carlton, St. Regis), premium (Marriott, Sheraton), midscale (Courtyard), extended stay, and select service, Marriott covers many market segments.

- This allows flexibility depending on regional demand, economic cycles, and guest preferences.

Loyalty program & ecosystem

- Marriott Bonvoy is a strong asset - it drives repeat business, facilitates upselling, and helps reduce dependence on third-party booking channels.

- Also, co-branded credit card partnerships are a growing revenue lever.

Shift toward fee-based growth & NUG strategy

- Marriott has been repositioning from volatile room revenue (RevPAR) to more stable growth in net unit growth (NUG) and fee-based income streams.

- This gives more predictable earnings and insulates against short-term demand swings.

Effective cost management & robust margins

- Marriott’s margins benefit from economies of scale, franchising/management model (lower capital burden), and operational efficiencies.

- According to Investing, Marriott’s gross profit margins are very strong (e.g. 81.89 %) in recent analysis.

Strategic acquisitions & portfolio strengthening

- Acquisition moves like Starwood, Resorts, and more recently citizenM enhance Marriott’s offerings, brand mix, and global reach.

- The citizenM deal aims to boost Marriott’s position in the “lifestyle / select service” lodging segment.

2. Weaknesses

High capital expenditure and maintenance costs

- Hotels require continuous investment - refurbishments, facility upgrades, compliance, infrastructure. These costs are large and often unpredictable.

- Especially for owned/managed properties, this burden is heavier.

Vulnerability to economic cycles & demand fluctuations

- Because hotels depend on travel (corporate, leisure), recessions or global shocks disproportionately affect occupancy and room rates.

- Even Marriott has had to moderate forecasts due to weakening demand in China. 3. Operational complexity & consistency risk.

- With thousands of properties under different ownership structures, maintaining consistent service, brand standards, and quality control is challenging.

- Franchise model means variable control over local operations.

Data security and reputational risk

- Marriott has been penalized for past data breaches. For example, it agreed to pay $52 million to resolve probes into major breaches affecting over 300 million customers.

- The FTC has mandated the company strengthen its cybersecurity practices.

Overdependence on mature markets and flagship brands

- Some regions or brand segments may saturate. If flagship luxury brands falter or markets slump, exposure risk is high.

Read the SWOT analysis of Airbnb, which highlights its strong global brand and innovative platform as key strengths, acknowledges regulatory challenges as a weakness, points to growth opportunities in emerging markets and service diversification, and warns of threats from increasing competition and regulatory pressures.

3. Opportunities

Expansion in emerging markets and under-penetrated regions

- Africa, Southeast Asia, Latin America present growth potential. Marriott’s global brand gives leverage to tap rising middle-class travel.

- Growth in luxury, lifestyle & boutique segments

- Travelers increasingly seek unique, design-oriented stays. Marriott’s acquisition of citizenM is a move in that direction.

- Strengthening brands like Autograph, Edition, Moxy can capture millennial and Gen Z preferences.

Digital innovation & personalization

- Enhancing mobile apps, AI-driven recommendations, contactless operations, and IoT-enabled rooms can improve guest experience and operational efficiency.

Alliances, cross-industry partnerships

- Travel ecosystems (airlines, credit cards, experiences) can yield synergies. Marriott already leverages co-branded credit cards.

- Also, loyalty partnerships with non-hotel services (transport, tours) can broaden value.

Sustainability & ESG leadership

- Green buildings, renewable energy, waste reduction, sustainable sourcing can differentiate Marriott, attract eco-conscious travelers, and align with regulatory shifts.

4. Threats

Competition from alternative lodging & home-sharing platforms

- Airbnb, Vrbo, and boutique/local stays offer flexibility and local flavor. This is a persistent threat for traditional hotels.

Macroeconomic headwinds & travel restrictions

- Economic downturns, inflation, currency volatility, or travel bans (due to pandemics, geopolitical tensions) can massively reduce travel demand.

- Indeed, Marriott recently warned of weak performance in China, causing revisions in profit forecasts.

Regulatory, safety, and security risks

- Cyberattacks, data breaches, privacy regulation, and safety incidents can hurt reputation and incur fines.

Rising costs & inflation pressures

- Labor costs, energy, utilities, food & beverage, and maintenance costs all rise. Margins may compress if pricing can’t keep pace.

Brand dilution and cannibalization

- With a broad brand portfolio covering overlapping segments, internal competition or dilution can confuse consumers or erode uniqueness.

IIDE Student Takeaway, Recommendations & Conclusion

Takeaway

Marriott’s greatest advantage lies in its scale, brand diversity, and loyalty ecosystem, which provide resilience and flexibility. However, it faces ongoing challenges in cost control, data security, and economic sensitivity.

Biggest Edge vs. Biggest Risk

- Edge: The loyalty-driven, fee-based growth model and global brand network

- Risk: External shocks (economic downturns, geopolitical turbulence) and digital security failures

Actionable Recommendations

- Double down on tech & data security: Invest in robust cybersecurity, data analytics, AI personalization, and contactless services to protect brand and enhance guest experience.

- Push deeper into emerging & high-growth markets: Expand selectively where brand prestige is less saturated and where middle class / tourism growth is accelerating (e.g., Africa, India, Southeast Asia).

- Differentiate via sustainable, experiential offerings: Lead in ESG, green building certifications, local-curated experiences to tap eco-conscious travelers.

- Optimize cost structure & hedgin: Lock in energy contracts, seek supply chain efficiencies, outsource non-core functions, and use dynamic pricing for better margin control.

- Brand portfolio clarity & modular expansion: Avoid internal cannibalization by clearly differentiating brand tiers, use sub-brands to test new concepts (as with citizenM acquisition).

Future Outlook Question

In an era when travel preferences and technology are evolving faster than ever, how will Marriott maintain its edge without overextending, especially in volatile macroeconomic conditions?

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.