Students Centric

Placements Report

Trackable results, real numbers

Reviews

Proven success, real voices

Trainers

Expert-led, Industry-Driven Training

Life at IIDE

Vibrant Spirit student life

Alumni

Successful Journeys, Inspiring Stories

Learning Centre

Webinars

Blogs

Case studies

Live, Interactive Masterclasses

Fresh Insights, quick reads

Real-life, Industry relevant

More

Hire from us

Hire Top Digital Marketing Talent

Work with us

Join Our Team, Make an Impact

Customised Training

Personalised digital marketing training for your company

Refer & earn

Simple, easy rewards

Contact us

Get the answers you need

About us

Know more about IIDE

Explore all course options

Trending

Professional Certification in AI Strategy

- Ideal for AI Enthusiast

Orginally Written by Aditya Shastri

Updated on Aug 9, 2025

The last time we saw the complete SWOT analysis of HDFC Bank. This time we will explain the SWOT Analysis of IndusInd Bank.

Established In April 1994, IndusInd Bank is one of the finest new-generation banks. The headquarter of IndusInd bank is located in Mumbai, Maharashtra. IndusInd Bank provides its customers with commercial, transactional, and electronic banking services.

Another facet lying behind IndusInd success is its marketing. Let it be festive seasons or just regular marketing, IndusInd always comes up with a unique way of gaining the attention of the people. IndusInd Bank ties up with many e-commerce websites. They allow their users to avail exciting offers in making payments from IndusInd’s Debit or Credit cards or any other means of payment.

They also associate many celebrities to advertise their bank. This marketing means is also a part of digital marketing. If you want to know what digital marketing is, then you can watch the Free MasterClass on Digital Marketing 101 by the Founder and CEO of IIDE, Karan Shah.

Before we dive into the SWOT Analysis of IndusInd Bank, let’s take a look at the company, its history, finances, products, and opponents.

About IndusInd Bank

(S.P. Hinduja – The Founder of IndusInd Bank, Source: IIDE Creator’s Room)

S.P. Hinduja is the founder of IndusInd Bank. IndusInd Bank was inaugurated by the Union Finance Minister Manmohan Singh in the year 1994. IndusInd Bank is the first among the new-generation private banks in India.

The primary objective of IndusInd bank was to serve the NRI community. During the ’90s, only a few banks were operating in India, and the people belonging to the NRI community used to face many problems. IndusInd Bank started its operation with 100 crore rupees, of which 60 crores were of Indian Residents and the rest 40 crores were of Non-Indian Residents.

IndusInd Bank was rated as one of the top-performing banks by various reports. They increased their network from 36% to 77% in the year 2001-02. They became the first bank to implement the Electronic Funds Transfer scheme of RBI with the help of MoneyGram International Ltd and Zoha Inc.

As of September 30, 2021, IndusInd Bank has 2,015 branches and 2,886 automated teller machines (ATMs) distributed across 760 geographical locations of the country. IndusInd Bank also has multi-lateral tie-ups with other banks which provides them with access to more than 18,000+ ATMs for their customers. IndusInd Bank also has its representative offices in London, Dubai, and Abu Dhabi.

| Founder | S.P. Hinduja |

|---|---|

| Year Founded | 1994 |

| Origin | Mumbai, India |

| No. of Employees | 30,674+ |

| Company Type | Public |

| Market Cap | Rs 10,772 Crore (2020) |

| Annual Revenue | Rs 36,000 Crore (2020) |

| Net Income/ Profit | Rs 4,417 Crore (2020) |

Services By IndusInd Bank

Being one of the largest banks in the country and operating for the last two decades, IndusInd provides its customers with many services. Some of the IndusInd services are :

- Credit cards

- Consumer banking

- Corporate banking

- Finance and insurance

- Mortgage loans

- Private banking

- Wealth management

- Investment banking

Competitors of IndusInd Bank

Anyhow, IndusInd Bank is one of the leading private sector banks of the country, but the larger the company the more competition it has in the market. Likewise, there are other banks too in the field of banking who are giving tough competition to IndusInd in some of the other fields. The top 5 competitors of IndusInd bank are:

- HDFC Bank

- ICICI Bank

- Kotak Mahindra Bank

- Axis Bank

- IDBI Bank

Now as we are filled with the knowledge of IndusInd Bank, let us just dive into the SWOT analysis of IndusInd Bank to know more about the bank from the business perspective.

SWOT Analysis of IndusInd Bank

SWOT universally stands for Strengths, Weaknesses, Opportunities, and Threats. It is a tried-and-true management prototype that allows IndusInd Bank to compare itself with other giants’ performance and their marketing strategies. It is a great tool to examine where a company falls short, where it is leading in the market and obviously to get to know about the tactics to outstrip others.

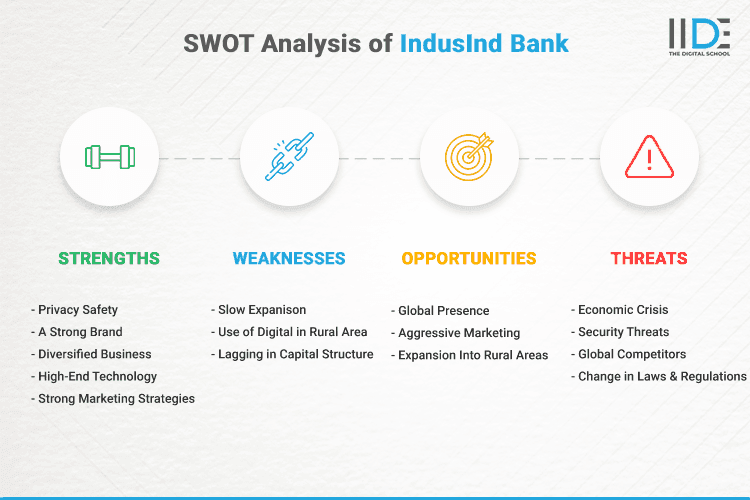

To better understand the SWOT analysis of IndusInd Bank, refer to the infographic below:

Let’s proceed further with expanding on the strengths of the IndusInd Bank from the SWOT analysis of IndusInd Bank.

Strengths of IndusInd Bank

Strengths describe that in which place an organization is unbeatable and what detaches it from the competition. The following are the strengths of IndusInd Bank :

- A Strong Brand: The biggest factor which determines a brand’s recognition is its brand presence. Operating since 1994, IndusInd’s customer recognition and brand value is their biggest strength to be a leader in the particular field.

- Diversified Business: IndusInd works in many sectors such as Commercial Banking, Financial Marketing, Retail Banking, Corporate Finance, etc.

(IndusInd Bank Launches Digital Lending Platform, Source: ANI News)

- Strong Marketing Strategies: IndusInd comes up with many ad campaigns to spread awareness about the threats in print media and many news channels. Its digital presence among many social media handles such as Facebook, Instagram, Twitter & YouTube with the involvement of digital marketing also helps a particular brand to grow.

Bonus Tip: IndusInd Bank offers online services like UPI app for easing the transaction process, net banking services and digital online processes for easy credit. Digitalisation has benefited customers with a cashless and hassle-free experience while banking. So, isn’t investing in learning digital marketing skills worth the investment? If you think yes, then there are several short-term courses in IIDE that will help you learn about digital marketing and how to leverage its power to grow.

- Privacy Safety: One of the biggest factors depending upon the customer to choose a particular bank is their data safety. IndusInd always takes care of their customers’ safety.

- High-End Technology: To ensure the seamless working of its banking services, IndusInd always relies on advanced technology.

Weaknesses of IndusInd Bank

Weaknesses stop an organization from performing at its prime level. These are the areas where a business needs to enhance to remain competitive. The few deficiencies which must be addressed by IndusInd Bank are :

- Use of Digital in Rural Area: The use of the digital mode of banking and other finance-related works is not known by many rural peoples.

- Lagging Behind Many Banks In Capital Structure: Though IndusInd is one of the largest banks in the country, its competitors are moving forward than IndusInd in terms of capital structure.

- Few No. of Branches as Compared with the Leading Banks: Many of the leading competitors of IndusInd are expanding rapidly to capture more of the market cap but in terms of expansion, IndusInd is working slowly.

Opportunities for IndusInd Bank

Opportunities are complimentary external factors that could give an organization a keen advantage. The opportunities for IndusInd Bank are :

- Expansion Into Rural Areas: IndusInd Bank can expand to rural areas to capture more markets. Expanding in the rural areas will also help them to bank the unbanked and underbanked.

- Aggressive Marketing: One of the biggest opportunities for each brand nowadays is their marketing techniques.

- Global Presence: Many of IndusInd’s competitors are expanding globally. To increase their customers globally, it’s the best chance for IndusInd to expand their market.

Threats to IndusInd Bank

Threats are the factors that have the potential to harm the company’s growth. Some of the Threats to IndusInd Bank are :

- Change in Laws and Regulations: When the government changes laws and regulations, it might have an impact on the bank’s business operations.

- Global Competitors: There are many global giants in the banking and finance sectors and it poses a threat to IndusInd bank to be competitive in the banking industry.

- Security Threats: If a bank encounters any security difficulties such as cyber-attacks which can cause substantial financial losses for the customers as well as banks. In such circumstances, regaining customers’ confidence becomes challenging.

- Economic Crisis: As a result of the economic crisis, clients are not saving money in banks, reducing bank liquidity and making it difficult to operate efficiently.

This ends our descriptive SWOT analysis of IndusInd Bank. Let us conclude our learning below.

Learn Digital Marketing for FREE

- 45 Mins Masterclass

- Watch Anytime, Anywhere

- 1,00,000+ Students Enrolled

To Conclude

IndusInd is one of the greatest private sector banks in this country. Throughout the SWOT Analysis of IndusInd bank, we can conclude that it has a strong customer base and also comes with unique ways of marketing to attract its customers.

They always come up with great offers to their customers whether it’s on saving accounts or current accounts. In today’s world offers are a great means to attract more customers and IndusInd uses this technique very well in their marketing. Being a bank, their market presence through advertisement is way greater than other banks whether it’s by coming up with celebrities or by some unique advertising techniques.

However, the growth of many other banks creates a ruckus among each other to come up with better marketing techniques to attract more of the customers base. Digital Marketing plays a significant role in this digital era to reach out to more people and to attract a large amount of audience. If you’re also interested in learning more and want to upskill your career in the field of digital marketing, then do checkout IIDE’s 3 Month Advanced Online Digital Marketing Course to know more.

We hope this blog on the SWOT analysis of IndusInd Bank has given you a good insight into the company’s strengths, weaknesses, opportunities and threats.

If you enjoy in-depth company research just like the SWOT analysis of IndusInd Bank, check out our IIDE Knowledge portal for more fascinating case studies.

Thank you for investing your valuable time to read this, and do share your thoughts on this case study of the SWOT analysis of IndusInd Bank in the comments section below.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

Courses Recommended for you

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 23, 2026

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

- Bosch 2025: Strategic Insights into Market Position, Challenges, and Growth Opportunities

- Nasher Miles Marketing Strategy 2025: A Journey from Trolleys to Trendsetters

- Beco Marketing Strategy 2025: Leading India’s Eco-Friendly Revolution

- P-TAL Marketing Case Study: Reviving India’s Timeless Craftsmanship

- Marketing Case Study: Rocca - Rising Above the Chocolate Crowd in India

- Unveiling What's Up Wellness Marketing Strategy: Key Tactics and Insights

- Lenskart Marketing Strategy 2025: AI, Content & Omni-Channel Success

- Ruban's Jewelry Marketing Strategy for Crafting Timeless Success in the Luxury Market

- Decoding iMumz’s Marketing Playbook: A Wellness Brand Built on Empathy

- Nish Hair Marketing Strategy: The Complete AIDA Playbook for D2C Success

Author's Note:

I’m Aditya Shastri, and this case study has been created with the support of my students from IIDE's digital marketing courses.

The practical assignments, case studies, and simulations completed by the students in these courses have been crucial in shaping the insights presented here.

If you found this case study helpful, feel free to leave a comment below.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.