Updated on Dec 11, 2025

Share on:

Learn Digital Marketing for FREE

Current news about the brand

- The specialty-focused company reported a growth of 15% in its Indian operations from ₹1,245 crore in Q1 FY23 to ₹1,426 crore in Q1 FY24

- Torrent Pharma’s share price surges 8% to hit a 52-week high; should you buy the stock? Here’s what top brokerages say

- Torrent Pharmaceuticals has received buy ratings from the brokerage company Prabhudas Lilladher, which is optimistic about the pharmaceutical sector. Here analysts see strong gain in 2023

- Why is the market unimpressed by Torrent’s Curatio deals?

Buyers Persona:

Dr. Sarah Anderson

New York City

Occupation: Cardiologist

Age: 38 years

Motivation

- Patient Well-Being

- Continuous Learning

- Professional Excellence

- Staying Competitive

- Contribution to Research

Interest & Hobbies

- Reading

- Fitness

- Travel

- Volunteer Work

- Health and Nutrition

Pain Points

- Managing a busy schedule with a large number of patients

- Keeping up with the rapid advancements in the field of cardiology

- Ensuring her patients have access to reliable and effective medications

Social Media Presence

As we are clear about the foundations of Torrent Pharmaceuticals, let’s move on to the SWOT analysis of Torrent Pharmaceuticals.

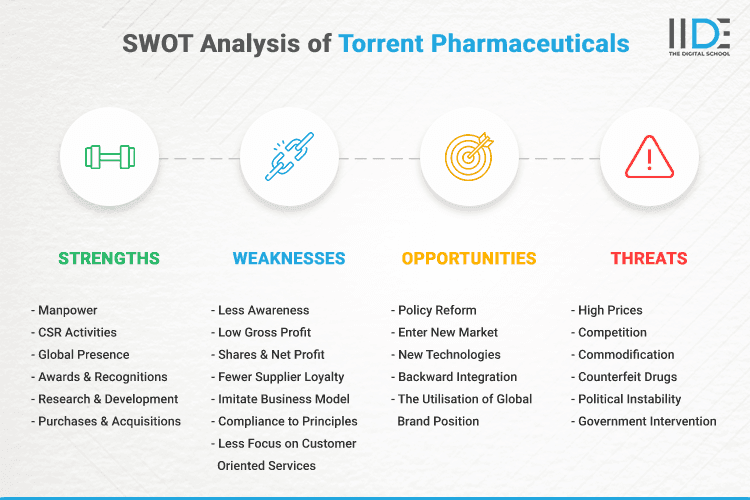

SWOT Analysis of Torrent Pharmaceuticals

SWOT stands for strengths, weaknesses, opportunities, and threats which is an analytical technique used for assessing your business in the four aspects. SWOT analysis is simple to analyze and determine what is best for the company at present as well as to formulate a successful strategy for the future. Accordingly, the SWOT analysis of Torrent Pharmaceuticals is carried out.

To better understand the SWOT analysis of Torrent Pharmaceuticals, refer to the infographic image below.

Let’s first start by analyzing the strength of Torrent Pharmaceuticals from the SWOT analysis of Torrent Pharmaceuticals.

Strengths of Torrent Pharmaceuticals

Strengths are defined as what each business does or has best in itself. The following are the strengths of Torrent Pharmaceuticals Ltd.

- Manpower: Torrent Pharma makes sure to hire the best talent across the country and incentivize them accordingly. Hiring the right people definitely gives cutting-edge competition to other firms.

- Global Presence: It’s been more than 63 years since the company’s establishment and during this period, the company has been distributing its products in more than 40 countries,

- Research & Development: Torrent Pharma invests heavily in R&D as compared to its competitors. The company is involved in promoting both basic and applied research.

- Awards & Recognitions: In 2001, Torrent Pharma bagged the Gold Trophy for the IDMA Quality Excellence Award for its Formulations facility and the Silver Trophy for its API manufacturing facility. It also got the ‘Best Suppliers’ award from the Sri Lankan State Pharmaceutical Corporation. At the 10th CNBC TV18 India Business Leader Awards 2014, Torrent Pharma was awarded the Most Promising Company of the Year.

- CSR Activities: Through its CSR activities, Torrent makes continuous efforts to give back all the care, healing, support, and nurturance to society. Torrent strongly believes that the sustainability of any business is directly related to the well-being and development of the society in which it is embedded.

- Purchases & Acquisitions: Torrent Pharmaceuticals is always ahead in terms of international acquisitions in 2005 it acquired Pfizer to enter the German market and later on to capture the US market in 2015 it purchased ANDA of Minocycline from Ranbaxy.

Weaknesses of Torrent Pharmaceuticals

Torrent Pharma should focus on improving its flaws in order to retain its brand name in the market. The following listed are the weaknesses of Torrent Pharma.

- Fewer Supplier Loyalty: Torrent Pharma is leading the Biotechnology and Drugs Industry and is continuously trying to lower the prices in the supply chain.

- Imitate Business Model: The revenue model of Torrent Pharma is quite easy to copy and many firms have been imitating their model.

- Less Awareness: The general public uses medicines of Torrent Pharma as prescribed by the doctor, but they are not aware of which brand of medicine they are consuming. For Instance, Cipla spends heavily on advertising, so the brand’s name has reached the ears of all Indian households.

- Compliance to Principles: The firm functions in such a sector in which it has to function beneath specific regulations and limitations which can be a difficult and expensive matter for Torrent Pharmaceuticals. There is also an added hazard of dealing with illegal compositions.

- Low Gross Profit: The company has been operating with a very thin profit margin because of tough competition.

- Less Focus on Customer-Oriented Services: Though Torrent Pharma has many manufacturing plants and doing good in R&D, it needs to buckle up to provide good customer-oriented services.

- Shares & Net Profit: Torrent Pharmaceuticals shares tanked over 16%. The company reported a year-on-year decline of 16% in its consolidated net profit at Rs 249 crore for the October-December quarter as its US business registered a decline in revenue of 20%.

Opportunities for Torrent Pharmaceuticals

Torrent Pharma should have an eye on exploiting external opportunities in order to gain an advantage from them. A few of these are listed below:

- Enter New Market: The government has created barriers for new entrants in the field of BioTechnology and Drugs Industry, Torrent Pharma should seize the opportunity and try to increase its customer base.

- Policy Reform: According to some experts and reviews, The Patient Protection and Affordable Care Act (ACA Act) passed by the US government will open a new set of reforms that will favor the pharma companies dealing with generic drugs. If this news is true, it will benefit Torrent Pharmaceuticals Ltd. to a large extent.

- New Technologies: Torrent Pharmaceuticals may use the new technologies to implement a differentiated pricing approach in the new market. It will allow the company to keep its current consumers by providing excellent service while also attracting new customers through various value-oriented offers.

- The Utilisation of Global Brand Position: Over the years, Torrent Pharmaceuticals Ltd. has gained a global market stand or goodwill worldwide. This can help the company by utilizing the global brand positioning and expanding it towards other potential markets.

- Backward Integration: Torrent Pharma should focus on creating raw materials for the medicines themselves in order to increase its profit margin.

Threats to Torrent Pharmaceuticals

Torrent Pharma should try to remove the external threats as they have a vital role in creating hindrances to the growth of a firm. The threats of Torrent Pharmaceuticals are:

- Political Instability: Hefty taxation and an unstable political environment limit an organization to achieve heights of prosperity.

- Government Intervention: Medical care administrations are heavily controlled by the government in various nations including the U.S.

- Commodification: For those working in the Healthcare Industry, commoditization has a negative effect because it doesn’t let the manufacturer charge a profitable fee for what they produce.

- Competition: Torrent Pharmaceuticals has been under excessive competition from Emcure Pharmaceuticals and Abbott Laboratories.

- High Prices: Pharmaceutical companies require various chemical compositions which can result in high-priced drugs. This can limit the expansion in various Asian and African countries with low per capita income.

- Counterfeit Drugs: Torrent Pharmaceuticals product is also vulnerable to counterfeit and low-quality product imitation, particularly in emerging and low-income regions.

Example of a Failed Campaign Or Backlash from Viewers

A very limited amount of information is available regarding a social media campaign that targeted Ahmedabad-based Torrent Pharmaceuticals Ltd. in 2018. The campaign accused the company of defrauding clearing and forwarding (C&F) agents of approximately Rs. 45 crore. The allegations suggested that Torrent Pharma was involved in actions that deprived C&F agents of their rightful earnings. This campaign gained traction on social media under the hashtag #TorrentPharmascam.

However, it’s worth noting that detailed information about this specific case is not readily available in online search results, which shows that the incident may not have received extensive coverage in publicly accessible sources, making it challenging to provide a comprehensive account of the situation.

Top 5 Competitors of Torrent Pharmaceuticals

- Pfizer: It is one of the Providers of pharmaceutical products for multiple disease treatments. It has developed a novel cancer medicine that works by inhibiting blood supply in tumor cells and destroys cellular reproduction. The other product includes Chantix which helps smokers to quit smoking. In 2022, the company recorded annual revenues of $92.95B and a net profit of $29.04B.

- Sanofi: It is a developer of pharmaceutical & nutraceutical products. The company covers seven major therapeutic areas such as cardiovascular, central nervous system, diabetes, internal medicine, oncology, thrombosis, and vaccines. It also develops dietary supplement products to increase body immunity power. In 2022, the company recorded annual revenues of $45.19B and a net profit of $8.8B.

- AbbVie: It is a global, research-based biopharmaceutical company. It has developed adalimumab, which is marketed under the trade name Humira, a biopharmaceutical treatment for autoimmune diseases. It also develops medicines including AndroGel, Creon, Duodopa and Duopa, Kaletra, Lupron, Niaspan, Norvir, and Sevoflurane. In 2022, the company recorded annual revenues of $56.74B and a net profit of $7.54B.

- Roche: It is the developer of pharmaceuticals and diagnostics kits for multiple diseases. It manufactures diagnostic equipment and reagents for research and medical diagnostic applications. In 2022, the company recorded annual revenues of $66.26B and a net profit of $13.01B.

- Novo Nordisk: It is a global healthcare company with five product areas, diabetes, obesity, haemophilia, growth hormone therapy & hormone replacement therapy. The company makes several drugs under various brand names, including Levemir, NovoLog, Novolin R, NovoSeven, NovoEight, and Victoza. It has a global presence including North & South America, Europe, Asian & African countries. In 2022, the company recorded annual revenues of $26.32B and a net profit of $8.54B.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

-

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.