Orginally Written by Aditya Shastri

Updated on Aug 28, 2025

Share on:

Saudi Aramco, the world's largest oil and gas company, remains a dominant force in the global energy sector in 2025. But as the world pivots toward renewable energy, how sustainable is Aramco’s market dominance? Entrepreneurs and business students must explore the challenges and opportunities that such industry giants face. Could Saudi Aramco’s future strategies reshape the global energy landscape? Dive into this SWOT analysis for key insights.

About Saudi Aramco

Founded in 1933, Saudi Aramco stands as the world's largest integrated energy and chemical company in 2025. Known for its iconic slogan, "Energy is Opportunity," it symbolises Saudi Arabia's global economic power. Recently, Aramco recorded a historic revenue of $605 billion in 2024, solidifying its market dominance. SWOT analysis, identifying strengths, weaknesses, opportunities, and threats, reveals Aramco's potential to adapt to emerging global trends.

Overview Table

| Attribute | Details |

|---|---|

| Company Name | Saudi Arabian Oil Company (Saudi Aramco) |

| Founded Year | 1933 |

| Website URL | www.saudiaramco.com |

| Industries Served | Oil, Gas, Petrochemicals, Energy |

| Geographic Area | Global |

| Revenue (2024) | $605 Billion |

| Net Income (2024) | $161 Billion |

| Employees | 70,000+ |

| Main Competitors | ExxonMobil, Chevron, Shell, BP |

Learn Digital Marketing for FREE

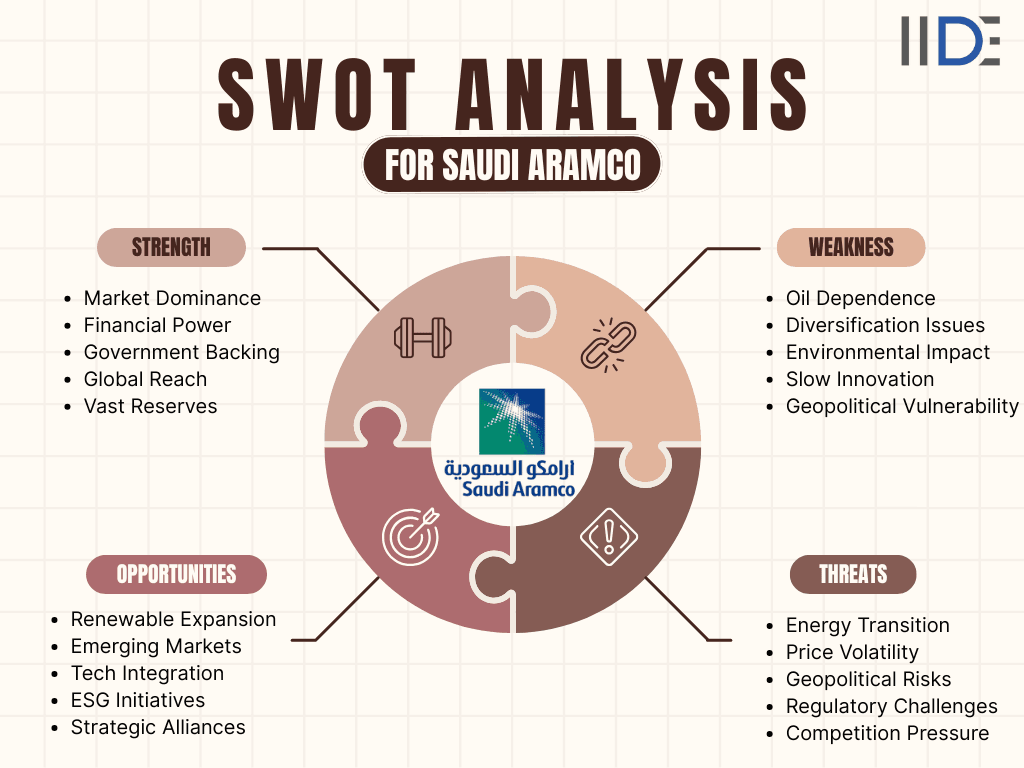

SWOT Analysis of Saudi Aramco

Brand Strength: Saudi Aramco’s Superpowers in 2025

Dominant Market Leader:

- Saudi Aramco is the world's largest oil company, leading the global energy market with a dominant share in oil production and reserves.

- The company’s scale and influence in the energy sector remain unmatched, securing its position as a market leader in 2025.

Exceptional Financial Performance:

- With revenue of $605 billion in 2024, Saudi Aramco continues to demonstrate outstanding financial strength.

- The company’s profitability, backed by its vast reserves, allows it to fund expansion into other energy sectors, such as renewables and technology.

Vast Oil Reserves:

- Aramco’s vast oil reserves are among the largest in the world, ensuring a stable source of revenue for decades to come.

- This unique advantage allows the company to maintain its leadership despite fluctuating oil prices.

Global Presence:

- Operating in over 100 countries, Saudi Aramco has a global reach, providing it with the ability to influence energy markets and secure international partnerships.

- Its vast network of subsidiaries and operations in major energy hubs solidifies its competitive edge.

Strong Government Backing:

- As a state-owned enterprise, Aramco benefits from significant government support in terms of resources, geopolitical influence, and long-term strategic planning.

- This backing provides Aramco with unique operational advantages and stability.

SWOT analysis of Tata Steel offers a strong industrial comparison, exploring how legacy and global operations influence competitiveness.

Brand Weakness: Saudi Aramco’s Struggles in 2025

Overdependence on Oil Revenue:

- Saudi Aramco’s financial model remains heavily reliant on oil revenue, making it vulnerable to market volatility, especially as global energy transitions toward renewable sources.

- This over-reliance could hinder future diversification.

Limited Diversification:

- While Aramco has started exploring renewables, its diversification into non-oil sectors remains slow compared to its competitors in the energy space.

- Expanding into alternative energy sources is critical to long-term sustainability.

Environmental Criticism:

- Saudi Aramco continues to face public and environmental scrutiny over its role in climate change due to its vast carbon footprint.

- Pressure from environmental groups and regulatory bodies is increasing, particularly in Western markets.

Vulnerability to Geopolitical Issues:

- As the world’s largest oil exporter, Aramco is exposed to significant geopolitical risks, including oil price fluctuations, regional instability, and trade restrictions that can disrupt operations and revenue.

Slow Innovation in Renewables:

- Although Aramco has begun investing in renewable energy, its progress in the green energy space lags behind competitors like ExxonMobil and Shell, which are moving faster toward carbon-neutral energy solutions.

Brand Opportunities: Future Moves for Saudi Aramco

Expansion into Renewable Energy:

- With global demand for clean energy growing, Aramco has a significant opportunity to expand its renewable energy portfolio.

- Investments in solar, wind, and green hydrogen could enhance its long-term market positioning and help mitigate risks associated with fossil fuels.

Increasing Demand in Emerging Markets:

- As emerging markets in Asia, Africa, and Latin America expand their energy needs, Saudi Aramco can capture new growth by increasing its energy production and distribution in these regions.

Technological Advancements (AI, Blockchain):

- Saudi Aramco has the opportunity to leverage AI, blockchain, and big data analytics to optimise oil production, reduce operational costs, and improve sustainability in its operations.

- These innovations will enhance its market competitiveness and operational efficiency.

Sustainability and ESG Initiatives:

- As the world shifts toward sustainability, Aramco can capitalise on ESG (Environmental, Social, Governance) initiatives.

- The company’s investments in carbon capture and sustainable technologies could attract environmentally conscious investors and strengthen its market image.

Strategic Global Partnerships:

- Aramco can form strategic alliances with tech firms and renewable energy companies, ensuring faster integration of green technologies and gaining access to new energy markets.

Brand Threats: Challenges for Saudi Aramco in 2025

Global Shift to Renewables:

- The global transition to renewable energy and the decreasing reliance on fossil fuels pose a long-term threat to Saudi Aramco’s traditional business model.

- Increasing pressure from governments and corporations to meet carbon neutrality targets could reduce global demand for oil.

Fluctuating Oil Prices:

- Oil price volatility continues to impact Aramco’s revenue, as seen with the fluctuations in global oil prices.

- As demand for fossil fuels decreases, price instability could become a greater threat to profitability.

Geopolitical Tensions:

- Aramco’s operations in the Middle East expose it to risks associated with regional conflicts, trade wars, and sanctions, which could disrupt production and harm its reputation in global markets.

Regulatory Pressures:

- Increasing regulatory scrutiny on oil and gas companies, particularly in Europe and the U.S., could impose additional compliance costs on Aramco.

- Stricter regulations on carbon emissions and environmental standards could also limit Aramco’s ability to expand its traditional oil-based business.

Intensifying Competition:

- Saudi Aramco faces growing competition from both traditional oil majors (such as ExxonMobil, Shell) and renewable energy companies (such as NextEra Energy).

- As more firms transition to cleaner technologies, Aramco’s market leadership could be at risk if it does not accelerate its own sustainability efforts.

SWOT analysis of BDO Global reflects how multinational firms manage operational complexity and compliance in diverse markets.

Buyers Persona:

Fahad

Dubai

Occupation: Business Analyst

Age: 40 years

Motivation

Interest & Hobbies

Pain Points

Social Media Presence

Summary Table – SWOT of Saudi Aramco

IIDE Student Takeaway, Conclusion & Recommendations

Saudi Aramco, the world’s largest oil company, has solidified its position as a market leader with unrivalled financial strength, reporting $605 billion in revenue in 2024.

The company’s global presence and vast oil reserves continue to provide stability.

However, its reliance on oil revenue, coupled with limited diversification into renewable energy sources, presents challenges.

The shift toward sustainability and renewable energy is increasingly critical as global markets and regulations evolve.

Core Tension:

The core tension for Saudi Aramco lies in balancing its dominance in traditional energy sectors with the urgent need for diversification into renewables.

While Aramco's financial strength and market position remain formidable, its ability to adapt to global shifts in energy consumption, particularly the transition to renewable sources, will determine its long-term sustainability.

The company must navigate this critical transition while maintaining its profitability and market leadership.

Future Outlook:

Saudi Aramco’s future will largely depend on how quickly it embraces sustainability and renewable energy technologies.

The company has a strong foundation to make this transition, but its success will depend on strategic investments in solar, wind, and hydrogen energy.

Additionally, digital transformation through AI and blockchain can enhance operational efficiency and reduce costs, enabling Aramco to maintain its competitive edge.

Actionable Recommendations:

- Invest in Renewables: Accelerate investments in solar, hydrogen, and wind technologies to diversify from oil dependency.

- Embrace Digital Transformation: Leverage AI, blockchain, and big data to enhance efficiency and adapt to market trends.

- Strengthen Transparency: Improve sustainability reporting to mitigate reputational risks and attract environmentally-conscious investors.

- Form Strategic Partnerships: Collaborate with tech innovators and renewable energy companies to accelerate the shift to a diversified energy portfolio.

Conclusion:

Saudi Aramco stands at a pivotal juncture, with its market leadership and financial strength as the foundation for future growth.

However, the company's ability to adapt and innovate will define its trajectory in an increasingly renewable-driven energy market.

By diversifying its portfolio, embracing digital technologies, and prioritising sustainability, Aramco can maintain its dominance.

Business students and entrepreneurs must watch how Aramco navigates these changes, as it offers valuable lessons in managing large-scale industrial transformation.

Want to Know Why 5,00,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Saudi Aramco is the world’s largest producer of crude oil, with production exceeding 10 million barrels per day (bpd) on average, though this number fluctuates based on demand and market conditions. The company manages approximately 260 billion barrels of proven oil reserves.

Yes, Saudi Aramco is also involved in natural gas exploration and production. The company is focusing on increasing its natural gas reserves and production, including developing projects for non-associated gas.

Saudi Aramco has global operations in various regions, including North America, Europe, and Asia. The company has refining, marketing, and distribution ventures in countries such as the United States, China, and Japan.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.