Orginally Written by Aditya Shastri

Updated on Oct 17, 2025

Share on:

Mother Dairy stands among India’s top dairy brands, delivering quality milk and a wide variety of food products across the nation in 2025. Facing new competition, shifting consumer tastes, and digital disruption, how does Mother Dairy stay resilient and relevant?

This SWOT analysis highlights key strengths, present-day challenges, and new opportunities for business leaders and aspiring entrepreneurs in the fast-evolving FMCG sector.

Before diving into the article, I would like to inform you that Samyak Singh conducted the research and initial analysis for this piece. He is a student in IIDE’s PG in Digital Marketing, March Batch 2025.

If you found this helpful, feel free to reach out to Samyak Singh to send a quick note of appreciation for his fantastic research; he will appreciate the kudos!

About Mother Dairy

Established in 1974 as a subsidiary of the National Dairy Development Board (NDDB), Mother Dairy fuels India’s nutrition sector with fresh milk, edibles, oils, and fruits & vegetables. “Rishton ka Swaad Badhaye” (Enriching Relationships with Taste) is its guiding slogan, and the brand achieved a record-breaking turnover of ₹17,000 crore in FY25.

SWOT stands for strengths, weaknesses, opportunities, and threats—the lens for understanding Mother Dairy’s relevance and future.

| Attribute | Details |

|---|---|

| Official Name | Mother Dairy Fruit & Vegetable Pvt Ltd |

| Founded Year | 1974 |

| Website URL | www.motherdairy.com |

| Industries Served | Dairy, Edible Oils, Fruits & Vegetables |

| Geographic Areas | Pan-India |

| Revenue (2024–25) | ₹17,000 crore (projected) |

| Net Income (2025) | Not public; strong operational surplus |

| Employees | ~3,000 |

| Main Competitors | Amul, Hatsun, Britannia, Parag, Country Delight |

Learn Digital Marketing for FREE

SWOT Analysis of Mother Dairy

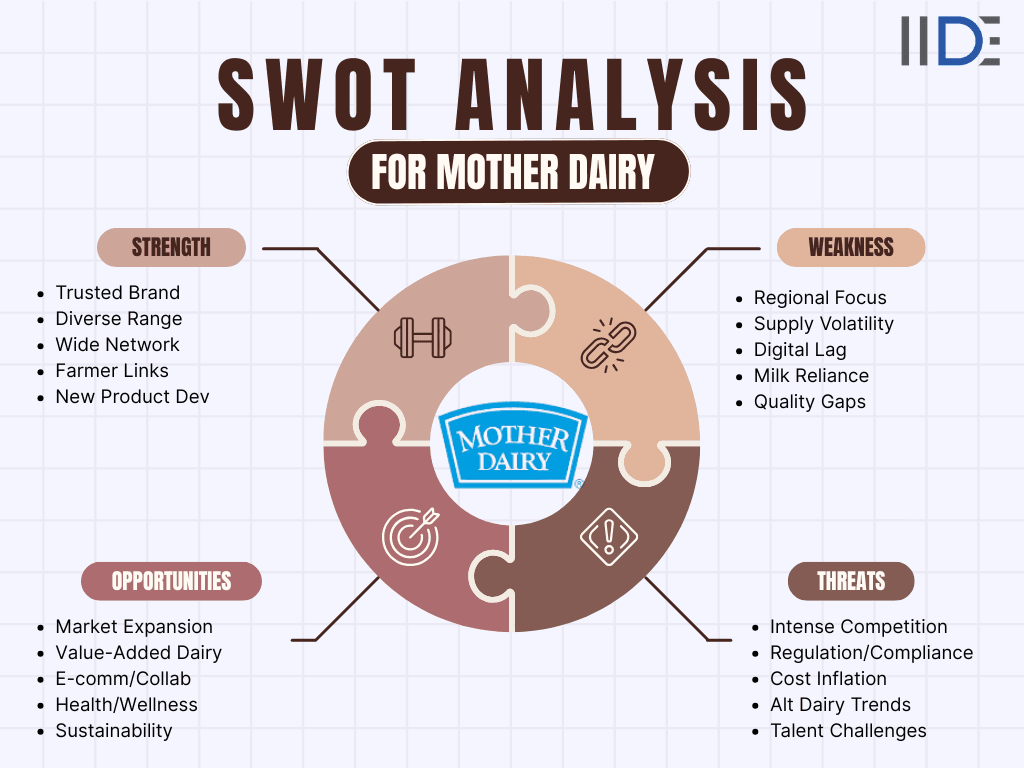

Mother Dairy’s Strengths (2025)

Pan-India Brand Trust and Quality Leadership:

- Recognition for consistent quality and value pricing in urban and semi-urban regions, especially Delhi-NCR.

Diverse Product Portfolio:

- From milk and paneer to oil (“Dhara”) and fruits/veggies (“Safal”), Mother Dairy enjoys strong recall in multiple food and beverage segments.

Robust Distribution and Retail Network:

- Over 800+ milk booths, digital payment options at Safal/Mother Dairy outlets, and wide modern trade presence.

Backwards Integration and Farmer Partnerships:

- Direct sourcing links with thousands of farmers and co-ops strengthen supply reliability and traceability.

Ongoing Product Innovation:

- 30+ new launches in 2024–25 (e.g., premium ice creams, packaged sweets, frozen vegetables) fuel market expansion and revenue diversity.

Mother Dairy’s Weaknesses (2025)

North-Centric Brand Perception:

- Primarily seen as a Delhi-NCR heavyweight, limiting its national brand appeal versus Pan-India giants like Amul.

Supply Chain & Price Volatility Risks:

- High input costs (feed, logistics), frequent price revisions, and inflation affect profit consistency.

Dependency on the Liquid Milk Segment:

- The majority of revenue still comes from milk; non-milk products face fierce competition and slower ramp-up in other regions.

Digital Transformation Gaps:

- Despite some progress, digital D2C and e-commerce are behind newer, agile dairy startups.

Quality Complaints:

- Occasional issues at Safal outlets on fruits/veggies and urban complaints may affect consumer trust if not addressed.

Mother Dairy’s Opportunities (2025)

Expanding into Southern and Western India:

- Aggressive expansion into new geographies (Kolkata, Jaipur, Nagpur), factory investment, and localised products can fuel growth.

Value-Added and Health-Focused Products:

- Fortified milk, probiotic yogurt, and packaged sweets/cooking aids match health trends and urban demands.

Leveraging E-commerce and Digital Payments:

- Improving last-mile delivery and digital-only products to win the new-age consumer.

Strategic Collaboration:

- Partnering with food tech, delivery apps, and online grocery to expand reach and tap Gen Z/Millennial markets.

Sustainability and Supply Resilience:

- Investing in traceable supply chains, cold storage, and environmentally friendly packaging to meet regulatory and consumer scrutiny.

Mother Dairy’s Threats (2025)

Rising Competition:

- New-age dairies (e.g., Country Delight), food startups, and legacy players (Amul, Britannia) compete on price, technology, and service.

Regulatory Pressure:

- Changes in GST, food safety, and FSSAI regulations increase compliance costs and risk of penalties.

Input Cost Inflation & Weather Impact:

- Climate volatility can disrupt raw milk supply, raise costs, and reduce volumes, affecting margins.

Changing Urban Consumption Patterns:

- Vegan/plant-based alternatives and premium organic milks are gaining a share in metro cities.

Attrition and Talent Retention:

- High top management turnover could affect stability and strategic continuity.

Summary Table – SWOT of Mother Dairy

IIDE Student Takeaway, Conclusion & Recommendations

Mother Dairy’s position as a trusted dairy and FMCG brand is secured by decades of product quality, backward integration, and value-driven innovation. The brand’s core strength remains its broad consumer base and tightly linked farm-to-table supply chain. Yet, the pivotal challenge is expanding beyond its historical North-centric stronghold, managing volatility in input costs, and accelerating digital transformation to compete with nimble, tech-savvy entrants.

To build for the future, Mother Dairy should:

- Invest in digital transformation, creating robust D2C and e-commerce platforms with localised user experience.

- Diversify further into health, wellness, and premium dairy, leveraging R&D to innovate fortified, functional products.

- Strategically grow operations in untapped regions, implementing hyper-local marketing and distribution.

- Form alliances with food-tech/apps for a broader reach and to capture younger consumers shifting to online shopping.

- Address quality and supply chain complaints transparently, turning feedback into service improvements.

With focused investment in technology, product differentiation, and sustainable supply chains, Mother Dairy can cement its leadership and capture the next wave of urban and rural growth in India’s fast-changing consumption landscape.

Want to Know Why 5,00,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.