Updated on Oct 17, 2025

Share on:

Mastercard stands tall as a leading global payment network in 2025, consistently innovating across digital transactions, cross-border payments, and financial inclusion. Despite seeing fierce competition from giants like Visa and nimble fintech disruptors, its powerful brand and partner network keep Mastercard crucial to the world economy.

Want to know how Mastercard remains resilient amid rapid change? This SWOT analysis reveals must-know insights for financial students, business strategists, and investors.

Before diving into the article, I would like to inform you that Bharti Kaur conducted the research and initial analysis for this piece. She is a student in IIDE’s PG in Digital Marketing, March Batch 2025.

If you found this helpful, feel free to reach out to Bharti Kaur to send a quick note of appreciation for his fantastic research; he will appreciate the kudos!

About MasterCard

Founded in 1966, Mastercard is a global pioneer in payment solutions, connecting over 210 countries across physical and digital commerce. Its tagline, "Priceless", speaks to the value delivered to consumers and merchants alike.

With a 2024 revenue of $25 billion and a relentless focus on secure innovation, Mastercard’s reach shapes the future of payments. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats, a crucial lens for Mastercard’s 2025 outlook.

| Attribute | Details |

|---|---|

| Company Name | Mastercard Incorporated |

| Founded Year | 1966 |

| Website URL | www.mastercard.com |

| Industries | Financial Services, Payments |

| Geographic Areas | 210+ countries |

| Revenue (2024) | $25 billion |

| Net Income (2024) | $11 billion |

| Employees | ~34,000 |

| Main Competitors | Visa, American Express, PayPal, Discover, Stripe, Adyen |

Learn Digital Marketing for FREE

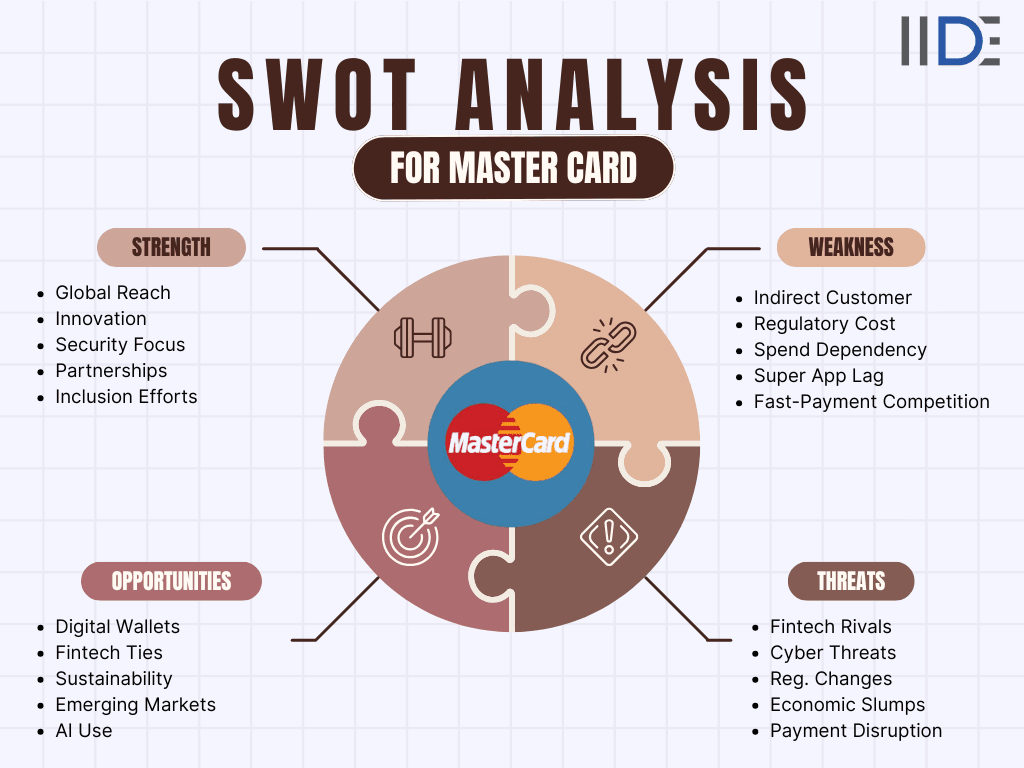

SWOT Analysis of Master Card

Brand Strengths

Global Acceptance & Trusted Brand:

- Accepted in over 210 markets, Mastercard is one of the most recognised and widely used payment platforms worldwide.

Strong Partnerships & Innovation:

- Partner ecosystem spans banks, fintechs, and digital wallets, fueling innovation and rapid rollout of new services.

Financial Performance & Scale:

- 2024 revenue of $25 billion and net income of $11 billion, ranking among the most profitable in fintech.

Secure Digital Solutions:

- Investment in AI and biometrics provides state-of-the-art security, while new launches like Mastercard Identity Check drive user trust.

Focus on Inclusion:

- Programs like Mastercard Foundation help 50M+ people gain access to the digital economy, embedding the brand in emerging markets.

Brand Weaknesses

Limited Direct Customer Relationship:

- As primarily a network provider, Mastercard relies heavily on issuing banks, lacking a direct consumer connection.

Regulatory Pressures:

- Laws like the EU’s PSD2, data localisation, and cross-border transaction rules add cost and operational complexity.

Dependence on Payment Volumes:

- Lower consumer spending during downturns or market shocks impacts revenue more severely than diversified financial competitors.

Lag in Super App/Fintech Integration:

- Compared to new fintech super apps, Mastercard sometimes moves slowly in launching holistic financial services.

Competition in Real-time Payments:

- New, fast payment networks (including central bank digital currencies and RTP systems) could disrupt core business unless Mastercard adapts quickly.

Brand Opportunities

Digital Wallet & Crypto Integration:

- Collaborations with giants like Apple Pay, Google Pay, and expanding crypto card programs drive new transaction streams.

Fintech & Open Banking Partnerships:

- Partnering with innovative fintechs allows Mastercard to tap new audiences and develop leading-edge payment solutions.

Sustainability & ESG Initiatives:

- Focus on eco-friendly cards, carbon tracking, and green finance can strengthen loyalty with values-driven consumers.

Expanding in Emerging Markets:

- Furthering local partnerships in Africa, Southeast Asia, and Latin America capitalises on massive digital financial inclusion trends.

AI & Data Analytics:

- Deeper use of AI enables personalised services and real-time fraud protection, enhancing consumer and merchant value.

Brand Threats

Intense Competition:

- Visa, PayPal, and digital-first entrants (like Stripe, Adyen, Revolut) constantly innovate and compete on fees and features.

Cybersecurity Risks:

- Data breaches, fraud, and cyberattacks can impact trust, usage, and regulatory standing.

Regulatory Overhauls:

- GDPR, PSD2, and possible government push toward alternative payment rails threaten long-term business models.

Slow Adoption in Some Markets:

- Cash dominance or regulatory barriers can stall penetration, especially in underbanked geographies.

Economic Downturns:

- Global recessions or market shocks decrease discretionary spending and cross-border transaction volume.

Summary Table – SWOT of MasterCard

IIDE Student Takeaway, Conclusion & Recommendations

Recap of Key Insights:

Mastercard’s 2025 SWOT analysis shows a brand thriving on a global scale, technological innovation, and strong strategic alliances. Its digital solutions and partnerships keep the company at the centre of the payments industry, while its commitment to financial inclusion sets it apart in emerging markets.

Core Strategic Tension:

The biggest challenge ahead for Mastercard is its ability to respond quickly enough to the rise of direct-to-consumer fintechs and the ongoing open-banking revolution. The company’s dependence on bank partners and payment volume creates pressure as markets move toward instant, integrated digital payment solutions.

Outlook for the Brand:

Looking forward, Mastercard’s continued growth will depend on how successfully it can diversify, innovate, and build more direct relationships with end-users. Staying agile in the face of competition and global regulation will be vital.

Actionable Recommendations:

- Invest further in real-time payments and instant transaction solutions to compete with new fintech infrastructures.

- Broaden crypto and digital wallet integrations to meet evolving consumer preferences and stay relevant in digital finance.

- Forge more localised partnerships in high-growth markets, adapting services to local regulatory and customer needs.

- Leverage artificial intelligence to lead in fraud prevention, personalised experiences, and data-driven insights.

- Expand B2B ecosystems and sustainability initiatives to enhance revenue diversity and brand reputation.

Want to Know Why 5,00,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

Feb 20, 2026

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.