Orginally Written by Aditya Shastri

Updated on Dec 12, 2025

Share on:

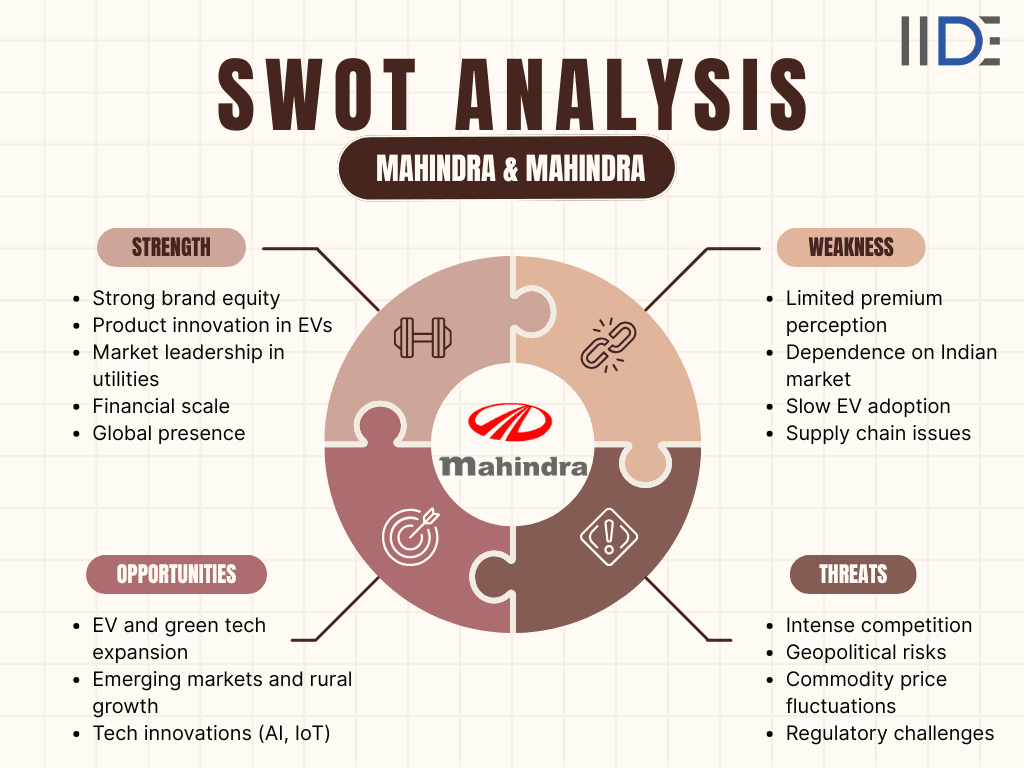

Mahindra & Mahindra is a prominent multinational company known for its innovations in automotive, agriculture, and IT. The brand continues to lead in sectors like tractors and utility vehicles, but how does it fare in the competitive landscape of 2026? This SWOT analysis provides a clear view of Mahindra’s strategic position, valuable for entrepreneurs and business students alike, as they navigate the company’s strengths, weaknesses, opportunities, and threats.

About Mahindra and Mahindra

Founded in 1945, Mahindra & Mahindra is an Indian multinational conglomerate with major operations in the automotive, agriculture, and IT sectors.

Known for its “Rise for Good” slogan, the company embodies a commitment to growth through sustainability and innovation. As of 2026, Mahindra continues to make significant strides in the electric vehicle market, transforming the way the world views mobility. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats, and this analysis will explore these elements in-depth.

Overview Table

| Company Name | Mahindra & Mahindra |

|---|---|

| Founded Year | 1945 |

| Website URL | www.mahindra.com |

| Industries Served | Automotive, Agriculture, IT, Aerospace, Financial Services, Real Estate, Hospitality |

| Geographic Areas Served | Global (Presence in over 100 countries) |

| Revenue |

₹1,59,211 crore |

| Net Income | ₹12,929 crore (approximately $1.5 billion USD) (FY25) |

| Employees | 324,000 (as of March 31, 2025) |

| Main Competitors | Tata Motors, Suzuki Motor Corporation, Ashok Leyland, Bajaj Auto, Hyundai Motor India |

Learn Digital Marketing for FREE

SWOT Analysis of Mahindra & Mahindra

Brand Strength: Mahindra & Mahindra’s Powerhouse in 2026

Brand Equity & Recognition:

- Mahindra & Mahindra boasts a strong brand image, particularly in the automotive and agriculture sectors, both in India and internationally.

- It is recognised for its rugged, reliable vehicles and commitment to innovation.

Product Innovation:

- With its electric vehicle initiatives like the e2o and eVerito, Mahindra is tapping into the growing green mobility trend, helping it position itself as a sustainable automaker in the future.

Market Leadership:

- Mahindra is a market leader in the tractor and utility vehicle markets, particularly in India.

- It continues to be a trusted name for urban and rural customers alike, driving market dominance in these categories.

Global Presence:

- Mahindra operates in over 100 countries, providing a strong international presence.

- Its global footprint allows it to capture a diverse customer base across different markets.

Financial Performance:

- Mahindra’s impressive revenue of ₹1,32,000 crore (approximately $17.2 billion USD) in FY 2025 reflects its strong financial position and scalability.

- The company’s growing profitability further solidifies its market leadership.

Customer Loyalty & Operational Scale:

- Mahindra’s loyal customer base, paired with over 150,000 employees globally, allows it to scale its operations efficiently, ensuring consistent growth across its business segments.

SWOT analysis of Tata Steel provides insight into how industrial giants manage scale and legacy—similar to Mahindra’s manufacturing depth.

Brand Weakness: Mahindra & Mahindra’s Struggles in 2026

Brand Perception:

- Despite its strength in utility vehicles, Mahindra’s brand perception is often seen as utilitarian, which can limit its appeal in the premium vehicle market compared to international automotive brands like Toyota and Ford.

Dependence on the Indian Market:

- Despite its global presence, Mahindra still relies heavily on the Indian market, which makes up a substantial portion of its revenue.

- This reliance limits its ability to adapt quickly to international trends and demands.

Slow EV Adoption:

- While Mahindra has made strides with the e2o and eVerito, its electric vehicle market share remains small compared to global EV leaders like Tesla.

- This slow adoption could result in missed opportunities in the rapidly expanding EV market.

Supply Chain Issues:

- Like many automotive companies, Mahindra has faced supply chain challenges, particularly with the global semiconductor shortage.

- This has affected production schedules and delayed the delivery of key models.

SWOT analysis of Tata Motors explores how innovation and strategic acquisitions drive competitiveness in the Indian automotive sector.

Brand Opportunities: Future Moves for Mahindra & Mahindra

Sustainability and Green Technologies:

- With the growing focus on sustainability, Mahindra’s investments in electric mobility and eco-friendly tractors position it well to align with global ESG trends.

- The company’s push for greener technologies in agriculture and vehicles gives it a competitive advantage.

Expansion into Emerging Markets:

- Mahindra has significant opportunities to expand further into emerging markets like Africa and Southeast Asia, where rugged vehicles and tractors are in high demand due to the growing agriculture and infrastructure sectors.

Tech Innovations (AI, IoT):

- Leveraging AI and IoT for connected cars and smart farming solutions provides Mahindra with an opportunity to diversify its offerings, attracting tech-savvy and eco-conscious consumers, especially Gen Z.

Strategic Partnerships & M&A:

- Mahindra could look into strategic partnerships with fintech, insurtech, or automotive technology firms.

- This could help it scale faster, particularly in the EV space and connected mobility solutions.

Brand Threats: Mahindra & Mahindra’s Challenges in 2026

Intensified Competition:

- Mahindra faces increasing competition from domestic giants like Tata Motors and Ashok Leyland, and global players such as Toyota and Ford, particularly in the SUV and electric vehicle markets.

- This competition puts pressure on Mahindra to innovate rapidly and improve its product offerings.

Geopolitical Risks:

- With Mahindra operating in over 100 countries, it is exposed to geopolitical risks, including trade wars, tariff changes, and regional instability.

- These factors could disrupt operations, particularly in global manufacturing and exports.

Fluctuating Raw Material Prices:

- As an automotive and agricultural player, Mahindra is highly sensitive to the rising costs of raw materials like steel, aluminium, and rubber.

- Fluctuations in material costs can significantly affect margins and profitability.

Regulatory Hurdles:

- Mahindra’s operations in multiple countries expose it to changing environmental regulations, particularly in Europe and North America, where stricter emission norms could increase compliance costs.

- Additionally, regulatory shifts could slow down the expansion of its electric vehicle and green technology initiatives.

SWOT analysis of Honda highlights how global automakers leverage R&D and brand trust to stay competitive, relevant for Mahindra’s global ambitions.

Buyers Persona:

Rohan

Mumbai

Occupation: Accountant

Age: 30 years

Motivation

Interest & Hobbies

Pain Points

Social Media Presence

Summary Table – SWOT of Mahindra & Mahindra

IIDE Student Takeaway, Conclusion & Recommendations

Mahindra & Mahindra, a global leader in the automotive and agriculture sectors, has a strong foundation in India and operates in over 100 countries.

The company is known for its rugged utility vehicles and market leadership in tractors.

However, its brand perception remains heavily utilitarian, limiting its appeal in premium markets.

While Mahindra has made strides with electric vehicles (EVs), including the e2o and eVerito, its EV adoption is still lagging compared to global leaders like Tesla.

The company faces supply chain challenges, including semiconductor shortages, and a heavy reliance on the Indian market, which exposes it to regional risks.

Core Tension:

The core tension for Mahindra & Mahindra lies in balancing its traditional market leadership in affordable vehicles and tractors with the growing demand for premium vehicles and sustainable mobility.

Mahindra has a strong position in utility vehicles and agriculture, but its slow progress in the EV market and premium segments puts its future growth at risk.

The company must evolve from its utilitarian roots to address the demands of the premium segment and global consumers while maintaining its mass-market dominance.

Future Outlook:

Mahindra’s future outlook is positive if it can execute on its sustainability initiatives and EV rollouts.

The shift to electric mobility and the push for green technology in agriculture present significant growth opportunities.

However, Mahindra must address its slow EV adoption, enhance its premium offerings, and resolve its supply chain vulnerabilities to remain competitive in 2026 and beyond.

Actionable Recommendations:

Accelerate EV Adoption: Focus on expanding the EV portfolio with more models, targeting global markets and premium segments.

Improve Brand Perception: Launch premium variants and enhance branding to cater to higher-income consumers.

Strengthen Supply Chain: Invest in global supply chain diversification and technological solutions to mitigate risks.

Expand into Emerging Markets: Focus on Africa and Southeast Asia, where demand for utility vehicles and tractors is high.

Conclusion:

Mahindra & Mahindra is well-positioned to maintain its leadership in India and expand globally, provided it successfully navigates the challenges of evolving consumer preferences and market dynamics.

By focusing on EV innovation, premium products, and supply chain resilience, Mahindra can secure long-term growth and sustain its competitive edge in the automotive and agricultural industries.

Want to Know Why 5,00,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Mahindra & Mahindra is a multinational conglomerate based in India. It is part of the larger Mahindra Group, which operates in sectors such as automotive, aerospace, agribusiness, construction, defence, energy, hospitality, and information technology.

Yes, Mahindra & Mahindra is actively involved in the electric vehicle market. They manufacture electric vehicles like the Mahindra eVerito, e2o Plus, and the Mahindra Treo (an electric three-wheeler).

Apart from tractors, Mahindra & Mahindra offers a variety of agricultural equipment such as:

- Harvesters

- Tillers

- Plows

- Balers

- Seeders

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.