Updated on Jan 7, 2026

Share on:

Founded in Paris in 1837, has become one of the world’s most influential luxury brands, famous for its craftsmanship, exclusivity and iconic Birkin and Kelly bags. In 2025, Hermès crossed €15.2 billion in revenue, proving its continued strength in a luxury market that is changing faster than ever.

But why does Hermès stand out in 2026? Are there growing challenges the brand must prepare for? And what keeps Hermès competitive when new trends, digital shifts and younger consumers reshape the industry?

This SWOT Analysis uncovers the brand’s strengths, hidden vulnerabilities, upcoming opportunities and external threats giving entrepreneurs and students valuable insights they can apply to real-world strategy and decision-making.

Before diving into the full SWOT analysis, we would like to acknowledge that the research and initial groundwork for this case study were conducted by Vidhi khandelwal, a student of IIDE’s Online Digital Marketing Course, June Batch 2025.

If you find this analysis insightful, feel free to reach out to Vidhi khandelwal and share a note of appreciation for his excellent research effort. He will truly appreciate the recognition.

About Hermès

Did you know Hermès began as a small harness workshop in 1837 and now sells some of the world’s most coveted luxury items, including bags that often have years-long waiting lists? Founded by Thierry Hermès in Paris, the brand evolved from saddlery to a global luxury powerhouse offering leather goods, silk scarves, ready-to-wear, jewellery, watches, perfumes and homeware.

Headquartered in Paris, Hermès continues to stand out in 2025-26 for its unmatched craftsmanship and exclusivity. In 2026, the brand reported €15.2 billion in revenue - a nearly 15% growth at constant exchange rates with a recurring operating income of €6.2 billion, one of the highest margins in the luxury industry.

Its brand ethos remains rooted in heritage, artisanship and timeless luxury, making Hermès one of the most influential and enduring luxury maisons today.

Overview Table

| Item | Detail |

|---|---|

| Official Name | Hermès International S.A. |

| Year Founded | 1837 |

| Headquarters | Paris, France |

| Website | hermes.com |

| Industries |

Luxury Goods - Leather, Fashion, Watches, Jewellery, Home |

| Geography | Global (Europe, Americas, Asia, Middle East) |

| Revenue (2024) | €15.2 billion |

| Net Income (2024) | ~€4.6 billion |

| Employees | ~25,000+ |

| Key Competitors | Louis Vuitton, Chanel, Dior, Gucci |

What Does SWOT Stand For in Hermès’ Case?

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. In this article, we use this framework to understand how Hermès one of the world’s most iconic luxury brands preserves its exclusivity, navigates competition and prepares for future growth in 2026. This analysis helps decode how Hermès manages its internal strengths and challenges while responding to fast-evolving global market forces.

Why SWOT Analysis Matters for Hermès in 2026?

Hermès operates in a luxury landscape undergoing rapid transformation. Market competition, shifting consumer expectations, and global economic pressures shape how the brand performs today. A focused SWOT analysis reveals why Hermès stands out in 2026, what challenges it faces, and how it can maintain long-term leadership. Below are the key reasons this analysis is essential:

1. Competitive Landscape: Hermès competes with powerhouses like Louis Vuitton, Chanel, Dior and Gucci, all pushing aggressive innovation, marketing, and category expansion. Meanwhile, luxury resale platforms and emerging designers are redefining exclusivity. Understanding Hermès’ position in this competitive ecosystem highlights its strengths and areas to fortify.

2. Shifts in Consumer Preferences: Younger luxury buyers now expect sustainability, personalisation, digital access and transparent craftsmanship. Hermès must continue modernising while protecting the exclusivity that defines its heritage.

3. Technology and Innovation: From digital boutiques and virtual experiences to data-driven clienteling and supply chain tech, innovation is reshaping luxury retail. Hermès embraces these advancements while ensuring its craftsmanship-first brand experience remains intact.

4. Economic & Cost Pressures: Global inflation, currency changes and market slowdowns influence luxury spending. Although Hermès is resilient, it must navigate these pressures to protect margins and sustain demand across regions.

5. Regulations & Sustainability: With rising environmental and sourcing regulations across global markets, Hermès must evolve in areas such as ethical materials, low-impact packaging, carbon-conscious production and transparent supply chains. Its heritage of long-lasting products supports this shift, but more innovation is required.

6. Ethical Practices & Social Responsibility: Modern consumers expect luxury brands to commit to fair labour, responsible sourcing, environmental care and community impact. Hermès must continually strengthen these pillars to maintain relevance and trust.

For entrepreneurs, marketers and business students, Hermès’ approach offers powerful lessons in pricing strategy, brand positioning, value creation and long-term competitive advantage.

Learn Digital Marketing for FREE

SWOT Analysis of Hermès 2026

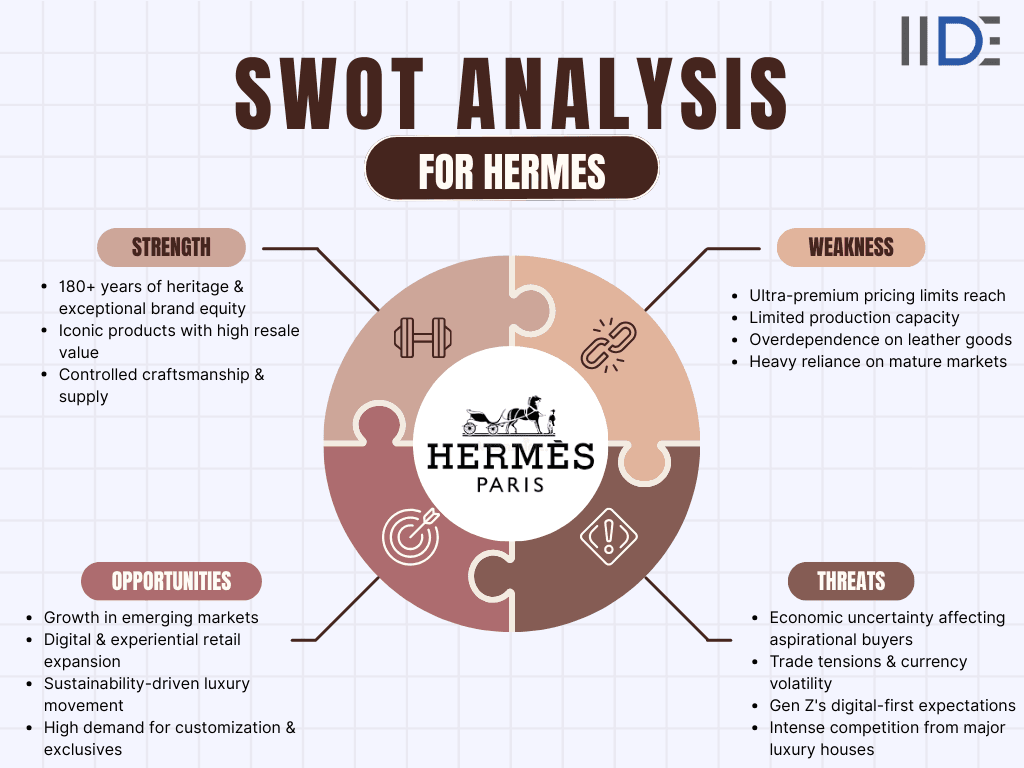

Hermès is a luxury powerhouse known for its exceptional craftsmanship, iconic bags like the Birkin and Kelly, and a fiercely loyal customer base. This SWOT analysis breaks down what Hermès needs to watch, protect, and pursue to stay desirable and keep growing in a fast-changing luxury world.

Strengths

Hermès’ strengths stem from its heritage, craftsmanship, global desirability and disciplined brand strategy. These internal capabilities give it one of the strongest competitive edges in the global luxury industry, allowing the brand to thrive even amid rising competition and shifting consumer expectations.

1. Exceptional Brand Equity & Heritage: Hermès is considered one of the world’s most prestigious luxury houses, backed by nearly two centuries of craftsmanship and exclusivity. Its brand value is built on scarcity, heritage storytelling and meticulous production qualities that reinforce Hermès as a timeless, ultra-premium maison.

Key points:

- Iconic products like the Birkin, Kelly, and silk scarves define global luxury.

- Hermès consistently ranks top for prestige, desirability, and customer loyalty.

- Its heritage storytelling and "quiet luxury" approach ensure long-term relevance.

- Demand always exceeds supply, keeping prices stable in primary and resale markets.

- The "Orange Box" is a powerful global symbol of luxury.

2. Strong 2026 Financial Performance: Hermès posted €15.2 billion in revenue in 2026, marking a strong +15% CAGR at constant exchange rates. Its €6.2 billion recurring operating income and ~40.5% margin remain among the highest in the global luxury sector.

Key points:

- Strong sales momentum across leather goods, ready-to-wear and accessories.

- High profitability driven by premium pricing and carefully managed supply.

- Revenue growth consistent across regions (Europe, Japan, Asia Pacific).

- Hermès consistently outperforms major competitors on margins and stock valuation.

- High reinvestment into artisan training and workshop expansion supports future growth.

3. Premium Pricing Power & Exclusivity: Hermès maintains one of the strongest pricing powers in the luxury sector. Known for intentionally limiting supply, the brand enforces long waitlists and prioritizes loyal clients for access to iconic products.

Key points:

- Birkin and Kelly bags often have multi-year waiting lists, boosting desire.

- Prices increase annually, yet demand grows stronger each year.

- Hermès bags hold better resale value than gold in some markets.

- Personalisation options (horseshoe stamp, custom colours) enhance exclusivity.

- Strong brand control prevents oversaturation and maintains luxury prestige.

4. Artisanal Craftsmanship & Tight Production Control: Hermès invests heavily in its artisans, many of whom undergo years of rigorous training before they're trusted to craft the brand's iconic leather goods. Each piece is handmade by a single craftsman from start to finish, ensuring unmatched quality and attention to detail.

Key points:

- All leather bags are handmade in France, preserving authenticity.

- Strict production oversight ensures consistent quality and limited defects.

- Hermès continues to open new workshops to preserve artisanal jobs.

- Craftsmanship-driven production enhances brand trust and product longevity.

- Strong alignment between craftsmanship and sustainability expectations.

5. Global Presence with Strong Geographic Balance: Hermès enjoys a stable and geographically diversified revenue stream, with strong performance across Europe, Asia-Pacific, the Americas, and emerging markets. This balanced global footprint protects the brand from regional economic downturns and allows it to capitalize on luxury growth wherever it emerges.

Key points:

- France grew +13%, Europe (ex-France) grew +19%, Japan grew +23% in 2026.

- Asia-Pacific and the Americas continue to be major growth engines.

- Strong presence in tourism-driven markets supports seasonal demand.

- Balanced global footprint reduces dependency on any single region.

- Expansion of flagship boutiques in top luxury cities strengthens visibility.

Weaknesses

While Hermès is one of the strongest luxury brands globally, it still faces internal challenges that can limit future scalability and competitiveness. Understanding these weaknesses is crucial, as they directly shape the brand’s long-term growth, profitability and ability to adapt in a rapidly evolving luxury market.

1. Ultra-Premium Pricing Restricts Audience Size: Hermès intentionally positions itself at the highest end of the luxury spectrum. While this exclusivity supports brand equity, it limits accessibility especially as emerging markets shift toward value-driven luxury.

Key points:

- Prices for Birkin and Kelly bags start in the thousands and reach six figures, excluding younger affluent consumers.

- Competitors like Gucci and Dior attract broader audiences with lower entry prices.

- High pricing makes Hermès more vulnerable during economic slowdowns.

- Limits growth in markets where aspirational luxury segments dominate.

- Creates dependency on ultra-high-net-worth customers rather than mass-affluent groups.

2. Limited Production Capacity Due to Craftsmanship Model: Hermès’ artisanal production is its signature strength but also a bottleneck. Every leather bag is handmade, which significantly slows supply.

Key points:

- Artisan training can take years, restricting rapid scaling.

- Workshop capacity cannot increase as fast as global demand grows.

- Long waitlists can frustrate younger, fast-moving luxury buyers.

- Rivals like Louis Vuitton scale production faster through hybrid craftsmanship-models.

- Low production makes seasonal launches slower and less flexible.

3. Uneven Performance Across Product Categories: While leather goods dominate Hermès' sales and drive most of its profitability, other categories like watches, perfumes, and beauty products underperform in comparison.

Key points:

- Perfumes, beauty and watches grow slower than leather and silk.

- Overreliance on leather exposes Hermès to supply constraints.

- Beauty category lags compared to Dior and Chanel, who dominate this space.

- Fashion segments remain niche due to conservative styling.

- Non-core categories contribute little to overall revenue diversification.

4. Heavy Dependence on Mature Markets: Despite global expansion efforts, Hermès still relies significantly on established regions such as Europe, Japan, and North America for the bulk of its revenue. While these markets are stable and profitable, they offer limited growth potential compared to emerging luxury markets.

Key points:

- These markets face slower GDP growth than emerging economies.

- Tourism declines or currency volatility impact store sales directly.

- Competitors have deeper penetration in China and Southeast Asia.

- Younger Asian luxury consumers lean toward trend-driven brands.

- Overreliance makes Hermès vulnerable to regional disruptions (e.g., travel bans, inflation).

5. Supply Chain & Operational Limitations: Hermès' handcrafted model, while rare and prestigious, limits operational flexibility and scalability. Each artisan can only produce a handful of bags per year, making it nearly impossible to quickly ramp up production to meet surging demand.

- Precision craftsmanship slows down production timelines.

- Scaling requires opening new workshops a long, expensive process.

- Raw material sourcing faces regulatory and ethical pressure (e.g., exotic skins controversy).

- Competitors leverage tech-enabled production for agility.

- Artisans retiring faster than new talent entering the craft also poses a long-term risk.

6. Ethical & Material Sourcing Controversies: Hermès has faced mounting criticism from animal rights groups regarding its use of exotic leathers like crocodile, alligator, and ostrich. Activists have targeted the brand's farming practices and supply chain transparency, raising ethical concerns among increasingly conscious luxury consumers.

Key points:

- Multiple campaigns target crocodile and ostrich skin sourcing.

- Competitors like Gucci and Chanel have already phased out some exotic materials.

- Negative press can affect younger, sustainability-conscious buyers.

- Regulatory pressure is increasing globally.

- Luxury consumers are questioning the ethics of exotic skins.

How does Hermès sell $10,000 handbags without advertising? Our detailed guide to Hermès' marketing strategy breaks down the brand's exclusivity playbook.

Opportunities

Hermès has several promising avenues for expansion as global luxury markets continue to evolve. Rising demand among younger affluent buyers, rapid digital transformation, and shifts toward sustainability offer the brand significant room to innovate and strengthen its leadership in 2026 and beyond.

1. Growing Demand in Emerging Luxury Markets: Asia-Pacific (excluding Japan) and the Middle East are witnessing rapid growth in affluent consumers seeking timeless European luxury. Hermès’ strong brand recognition and heritage position it well to capture this momentum.

Key points:

- Rising disposable incomes in India, South Korea, Singapore and the UAE boost luxury demand.

- Younger Asian consumers value iconic, investment-grade pieces like the Birkin and Kelly.

- Hermès' exclusivity model appeals to prestige-focused markets in the Middle East.

- Flagship expansions in cities like Dubai, Shanghai and Seoul can increase brand accessibility.

- Competitors like Louis Vuitton and Dior already dominate these regions, making timely expansion crucial.

2. Digital & Experiential Luxury Growth: Digital-first luxury buyers expect immersive, personalised brand experiences. Hermès can leverage its craftsmanship storytelling and exclusivity in new, tech-driven ways.

Key points:

- Virtual try-ons and AI-powered personal stylists appeal to Gen Z luxury shoppers.

- Exclusive online product drops create hype while maintaining scarcity.

- Virtual workshops or “behind-the-craft” experiences can highlight artisanal heritage.

- Strengthening digital clienteling builds long-term customer loyalty.

- Competitors like Gucci and Burberry already use VR/AR, giving Hermès room to catch up.

3. Rise of Sustainability-Driven Luxury: Global luxury consumers, especially younger generations, increasingly prioritize sustainability, ethical sourcing, and long-lasting quality over fast fashion and disposable trends. This shift aligns naturally with Hermès' philosophy of timeless craftsmanship, durability, and heritage.

Key points:

- Demand is rising for low-impact materials and ethically sourced leather.

- Hermès’ durable, heirloom-quality products support sustainable consumption.

- Greater transparency in sourcing can attract eco-conscious Gen Z buyers.

- Investment in biobased materials (e.g., Sylvania, the mushroom leather alternative Hermès tested) shows innovation potential.

- Sustainability-led campaigns can strengthen brand trust and global reputation.

4. Expansion Into New Categories & Haute Couture: Hermès has opportunities to expand beyond its core leather and silk categories into new, high-growth luxury segments like fine jewelry, home décor, furniture, and haute couture.

Key points:

- Growing interest in home luxury (furniture, décor, home fragrances).

- Expansion in fine jewellery appeals to millennial and Gen Z luxury buyers.

- Potential entry into haute couture elevates Hermès into a niche dominated by Dior and Chanel.

- Collaborations (e.g., Apple Watch Hermès) show success in category extension.

- Limited-edition fashion capsules can draw hype without mass production.

5. Demand for Customisation & Limited Editions: Personalised luxury is a major trend driven by Gen Z and high-net-worth individuals who seek unique, one-of-a-kind pieces that reflect their personal style and status. Today's luxury consumers don't just want exclusivity - they want ownership of something truly theirs.

Key points:

- Hermès can extend customisation beyond leather into jewellery, homeware and ready-to-wear.

- Bespoke colours, hardware, and monogramming increase client exclusivity.

- Limited-edition drops boost brand desirability and resale value.

- “Make-it-your-own” experiences strengthen client relationships.

- Rivals like Louis Vuitton amplify personalisation (e.g., hot-stamping), offering competitive pressure.

Threats

Hermès operates in one of the world’s most dynamic luxury markets, where external forces can significantly influence demand, brand equity, pricing power and long-term growth. These threats matter because they directly affect how Hermès maintains exclusivity, sustains global demand and protects profitability in 2026 and beyond.

1. Economic Uncertainty & Inflation: Even though luxury consumers are more resilient than mass-market shoppers, global economic headwinds like inflation, rising interest rates, and potential recessions can still pressure aspirational buyers - especially in newer luxury markets. .

Key points:

- Inflation reduces discretionary spending among mass-affluent customers, slowing entry-level category sales (scarves, small leather goods).

- Economic downturns historically reduce tourism, which luxury stores rely on heavily.

- Fluctuating currencies affect international pricing and profit margins.

- Competitors like Burberry and Kering have already reported slower demand during inflation spikes.

- Higher production and logistics costs may force Hermès to further raise prices, risking backlash.

2. Geopolitical Tensions & Trade Complications: With major luxury demand concentrated in Europe, the U.S., and China, Hermès is highly exposed to rising geopolitical tensions across these regions. Trade wars, tariffs, sanctions, and diplomatic conflicts could disrupt supply chains, increase costs, and limit market access.

Key points:

- Tariffs and trade restrictions can raise operational and material costs.

- Political instability can slow luxury spending (seen during US-China trade tensions).

- Currency volatility impacts cross-border pricing and revenue consistency.

- Restrictions on international travel impact in-store footfall and duty-free sales.

- Competitors like LVMH have faced delays and regulatory scrutiny in key markets.

3. Intensifying Competition in Luxury Markets: The luxury sector is becoming more competitive each year, with major houses increasing their investments in innovation, aggressive marketing, celebrity collaborations, and product diversification.

Key points:

- Louis Vuitton, Chanel, Dior and Gucci dominate digital innovation and celebrity-driven marketing.

- Competitors expand faster through hybrid production models, reducing waitlists and capturing impatient buyers.

- New luxury brands and designer collaborations steal market attention among Gen Z.

- Resale platforms make rival brands more accessible, increasing competitive pressure.

- Leather goods - Hermès’ main revenue driver is the most saturated segment in luxury.

4. Shifts in Consumer Preferences: Consumer expectations are changing rapidly, especially among Gen Z - now the fastest-growing luxury-buying demographic. This generation prioritizes digital-first experiences, sustainability, inclusivity, brand activism, and instant gratification.

Key points:

- Gen Z values sustainability, ethical sourcing and transparency more than status alone.

- Digital-first shopping expectations push brands toward immersive, interactive experiences.

- Younger buyers prefer fashion-forward, trend-driven pieces areas where Hermès is conservative.

- Competitors win younger consumers with bold designs and high-frequency collaborations.

- Consumers increasingly evaluate a brand’s climate impact before making luxury purchases.

5. Counterfeiting & Resale Market Expansion: The rise of the global resale and counterfeit markets poses serious risks to Hermès' exclusivity and brand control. High-quality fakes are becoming harder to distinguish, flooding the market and diluting brand prestige.

Key points:

- Counterfeit Birkin and Kelly bags remain among the most replicated luxury products globally.

- Resale platforms allow broader access to Hermès bags, weakening its scarcity model.

- Lower authenticity control on third-party platforms risks damaging brand trust.

- Counterfeit quality is improving, making detection harder for consumers.

- Rival brands like Chanel have tightened control, increasing their own authentication measures.

From trunks to streetwear collabs, Louis Vuitton keeps evolving. Check out our SWOT analysis of LV to see their strengths, weaknesses, and what's next for the brand.

IIDE Student Takeaway, Conclusion & Recommendations

Student Takeaway

Hermès showcases how a luxury brand can thrive by preserving heritage while strategically scaling. Students can learn how exclusivity, craftsmanship, and tightly controlled production become long-term brand assets.

Actionable Recommendations

1. Deepen digital storytelling: Introduce immersive brand experiences online AR boutiques, virtual tour of workshops, personalised digital guidance, etc.

2. Engage younger luxury consumers: Highlight sustainability credentials and modern craftsmanship through content, collaborations, and global campaigns.

3. Strengthen sustainability strategy: Communicate ethical sourcing, long-life design, and the craftsmanship story more transparently.

4. Expand carefully into new categories: Couture, home-luxury, and jewellery offer growth potential - but must maintain Hermès’ refined brand DNA.

5. Improve global resilience: Broaden supply chains, invest in artisan training, and hedge against currency and trade volatility.

Conclusion

Hermès’ 2026 position remains exceptionally strong. The brand continues to outperform competitors thanks to its unmatched craftsmanship, iconic product lines, and global loyalty. However, growing competition and changing consumer expectations mean the brand must remain agile and innovative.

Future Outlook Question: How will Hermès evolve its heritage-driven luxury model to appeal to digital-first, sustainability-conscious consumers by 2030?

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

Hermès bags are handmade by a single artisan from start to finish, using the finest materials like premium leather and exotic skins. Each bag can take 18-25 hours to craft, and artisans train for years before making iconic pieces like the Birkin or Kelly. The brand also intentionally produces limited quantities, which keeps demand high and prices even higher.

Not really. Hermès doesn't display Birkin or Kelly bags in stores, and you can't just buy one off the shelf. You typically need to build a relationship with a sales associate by purchasing other items first. Some people wait months or even years to be offered one. It's all part of Hermès' exclusivity strategy.

If you can afford one, yes. Hermès bags hold their value incredibly well and often appreciate over time. Some rare Birkins sell for more on the resale market than their original retail price. They're also built to last a lifetime with proper care, making them true investment pieces.

The main difference is the handle and closure. The Birkin has two handles and a more casual, open-top style, while the Kelly has one top handle and a structured, formal look with a front flap. The Kelly was named after Grace Kelly, and the Birkin after Jane Birkin.

No. Hermès doesn't do sales, discounts, or promotions. The brand maintains its pricing year-round to protect its luxury positioning. The only way to get a discount is through authenticated resale platforms, but even then, popular styles rarely sell below retail.

Yes. Hermès offers a spa service where they can repair, restore, and refurbish your bag. They can fix stitching, replace hardware, recondition leather, and more. This is one reason why Hermès bags last so long - they're designed to be maintained and passed down through generations.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.