Updated on Jan 7, 2026

Share on:

Ferrero Rocher remains the gold standard of premium boxed chocolates, created by Italy's Ferrero Group and sold in 120+ countries worldwide. Currently positioned as the ultimate gifting chocolate for celebrations and hospitality moments, it faces intensifying competition from health-focused premium brands and cocoa inflation pressures.

How can Ferrero Rocher maintain its luxury aura while adapting to Gen Z preferences? This analysis offers key insights for entrepreneurs and business students studying premium brand strategy.

Before moving forward, I would like to inform that the research and analysis of this content is done by Aadi Chandura, who is a student of IIDE's Online Digital Marketing (ACDM) , June Batch 2025. If you find this content interesting, reach out to Arnav to appreciate his hardwork - he will be over the moon.

About Ferrero Rocher

Source:ferrerorocher.com

Founded under the Ferrero Group (est. 1946 in Alba, Italy), Ferrero Rocher chocolates soon evolved into a global symbol of luxury gifting and indulgence. As of 2024, Ferrero operates in 50+ countries, has 37+ manufacturing plants, and sells products in 170+ nations.

Its signature gold foil packaging, creamy hazelnut centre, and crunchy wafer shell make it one of the most recognizable and gift-worthy chocolates worldwide.

A strong business indicator: The Ferrero Group closed fiscal year 2023–24 with a turnover of €18.4 billion, reinforcing Rocher’s dominant position in the premium confectionery sector.

Overview Table

| Parameter | Detail |

|---|---|

| Official company name | Ferrero International S.A. (Ferrero Group) |

| Founded Year | Group: 1946; Ferrero Rocher: 1982 |

| Website URL | www.ferrero.com |

| Industries served | Premium confectionery, chocolate, spreads |

| Geographic areas served | 170+ countries worldwide |

| Revenue (FY 2023/24) | €18,400,000,000 |

| Net Income | Not publicly disclosed (private company) |

| Employees | 47,000+ |

| Main Competitors | Lindt, Godiva, Nestlé, Mondelez, Mars |

Learn Digital Marketing for FREE

Why SWOT Analysis of Ferrero Rocher Matters Now in 2026

The chocolate industry is changing rapidly due to:

- Intensifying competition (premium and artisanal brands)

- Rising demand for healthier / sustainable chocolates

- Inflation and raw-material price volatility

- Growth of emerging markets like India with rising gifting culture

These factors make it crucial to analyze Ferrero Rocher’s current and future positioning.

SWOT Analysis of Ferrero Rocher 2026

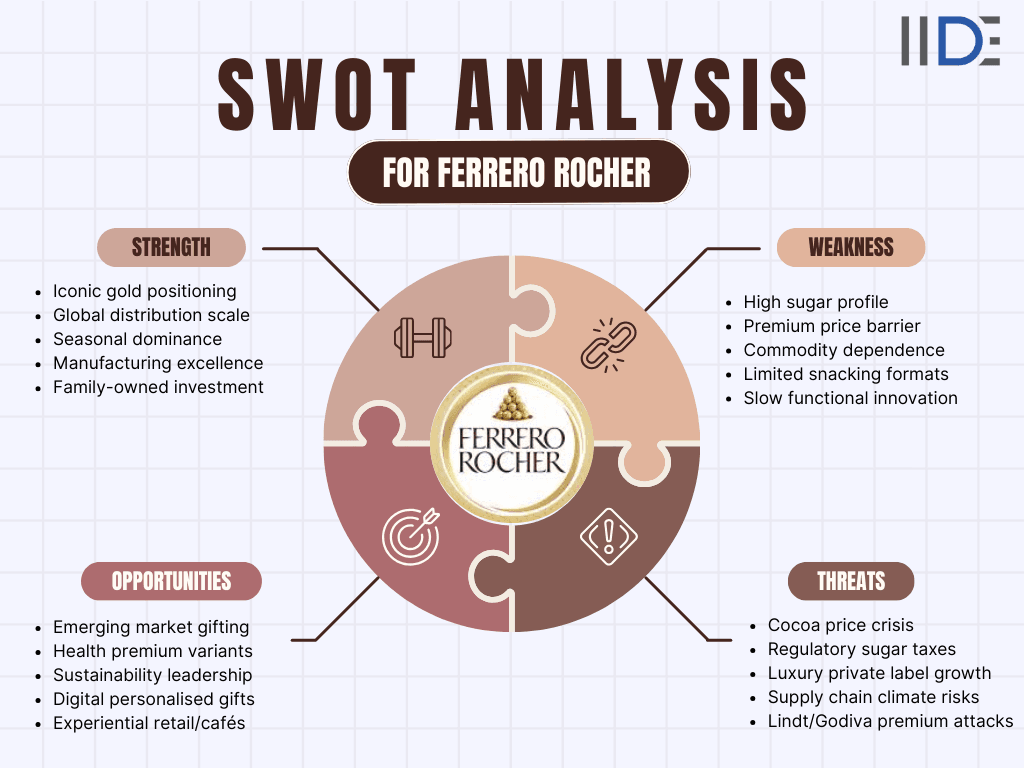

Ferrero Rocher's Strengths: The Gold Wrapper's Superpowers in 2026

- Unmatched premium brand equity: Ferrero Rocher's distinctive gold foil, hazelnut centre, and wafer-chocolate combination create instant global recognition as the gifting chocolate leader, dominating Christmas, Diwali, and Lunar New Year shelves worldwide.

- Ferrero Group scale advantage: Backed by €18.4B turnover parent with complementary brands (Nutella, Kinder), ensuring unmatched distribution reaching 4.5B consumers across 170 countries.

- Gifting category dominance: Owns 25-35% market share in premium boxed chocolates in key markets, with signature 16/24/36-piece packs driving seasonal peaks representing 60%+ of annual volume.

- Manufacturing excellence: Italian production maintains exacting quality standards across 35+ global factories, enabling consistent taste/texture that builds decade-long loyalty.

- Family-owned agility: Private ownership enables long-term brand investments without quarterly pressures, supporting continuous category innovation while preserving heritage positioning.

(Recent wins: 2025 Christmas campaigns generated 1.2B social impressions; launched Collection Moments prestige assortment boosting average transaction value 18%)

Ferrero Rocher's Weaknesses: Cracks in the Golden Shell 2026

- High-sugar indulgence positioning: 15g sugar per praline conflicts with global health trends; lacks credible low/no-sugar variants vs. Lindt Excellence 85% range gaining 22% premium dark share.

- Premium pricing limits accessibility: €1.20-1.50 per praline positions 15% above category average, vulnerable during inflation when consumers trade down to private label luxury alternatives.

- Hazelnut/cocoa dependency: 30%+ COGS tied to volatile commodities (cocoa +45% YOY, hazelnuts +22%); single sourcing strategy creates supply vulnerabilities.

- Limited everyday snacking presence: Primarily gifting/occasion-driven (75% sales); minimal single-serve formats vs. Mars/KitKat dominating impulse channels.

- Slow health/wellness innovation: No functional benefits (protein, fiber, vitamins) despite Gen Z demanding "indulgence with benefits"; competitors launching chocolate-collagen/probiotic variants.

Ferrero Rocher's Opportunities: Future Moves for the Golden Praline

- India/Middle East premiumisation: Urban middle class expansion creates $2.5B premium chocolate opportunity by 2028; Diwali/Ramadan gifting rituals perfect for localised 200g/500g packs.

- Health-conscious luxury variants: Reduced sugar (50%), high-protein (10g/pack), or collagen-boosted editions maintaining premium credentials; pilot dark chocolate 70% Collection launched Q4 2025.

- Sustainability premium storytelling: Responsible hazelnut/cocoa programs + recyclable gold foil position as ESG leader; 2025 consumer study shows 68% Gen Z pay 15% premium for sustainable luxury.

- Experiential retail expansion: Ferrero Rocher cafés/boutiques (10 opened 2025 Italy/France) + duty-free prestige displays; Collection prestige line +42% sales growth.

- Digital gifting/personalisation: AI-curated corporate gift boxes with engraving; India D2C platform Q1 2026 launch targeting 25-35 urban professionals.

Ferrero Rocher's Threats: Storm Clouds Over the Gold Mine

- Cocoa crisis escalation: Prices doubled to $12K/ton (2026); Mars/Nestlé absorbing via scale, private brands gaining 18% value share with synthetic cocoa alternatives.

- Lindt/Godiva premium attacks: Lindt Excellence +22% volume via dark chocolate health halo; Godiva Chocolixir café chain expansion stealing prestige positioning.

- Sugar regulation tightening: EU front-of-pack warnings + UK dessert levy proposals; similar to Unilever Magnum -12% volume post-tax implementation.

- Private label luxury surge: Tesco/M&S gold-foiled pralines at 40% discount erode entry-premium segment; Aldi 2025 premium range +28% share gain.

- Climate/supply disruptions: Hazelnut yields -15% (Turkey drought); West Africa cocoa virus threatens 25% production loss by 2028.

SWOT Analysis of Ferrero Rocher

IIDE Student Takeaway, Conclusion & Recommendations

Ferrero Rocher enters 2026 with formidable competitive strengths: unmatched premium brand equity, global gifting dominance, and manufacturing excellence backed by €18.4 billion Ferrero Group scale. However, these coexist with structural challenges - high sugar positioning, commodity exposure, and limited health credentials amid tightening regulations and private label pressure. The core strategic tension remains balancing indulgence heritage with health/sustainability evolution without diluting luxury aura.

Business students should note how seemingly unassailable premium brands face existential margin threats from commodity inflation and regulatory shifts. Ferrero Rocher's family-owned structure provides strategic flexibility but demands faster innovation execution versus listed peers.

Actionable recommendations:

- Launch tiered health portfolio - Core remains indulgent, flanked by 50% reduced sugar and 10g protein variants using hazelnut-forward formulations; test India/Brazil Q2 2026.

- Build sustainable sourcing moat - Vertically integrate hazelnut orchards (target 30% owned supply by 2028) + blockchain cocoa traceability for +15% price justification.

- Digital-first Gen Z acquisition - India D2C platform with AI gifting curator; corporate gifting CRM capturing 1M premium customers by 2028.

- Experiential prestige tier - Expand 50 Ferrero Rocher cafés globally by 2028 generating 20% margins vs. 12% grocery; Collection prestige line to 30% portfolio mix.

- Defensive price architecture - Launch 8-praline "impulse luxury" packs at 20% below current pricing defending against Aldi/Tesco encroachment.

Beyond 2026, Ferrero Rocher must evolve from gifting icon to everyday permissible luxury through credible health credentials and owned channels. Prioritising functional innovation while maintaining gold wrapper mystique determines whether it remains chocolate royalty or becomes a nostalgic relic.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Jan 23, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.