Orginally Written by Aditya Shastri

Updated on Dec 12, 2025

Share on:

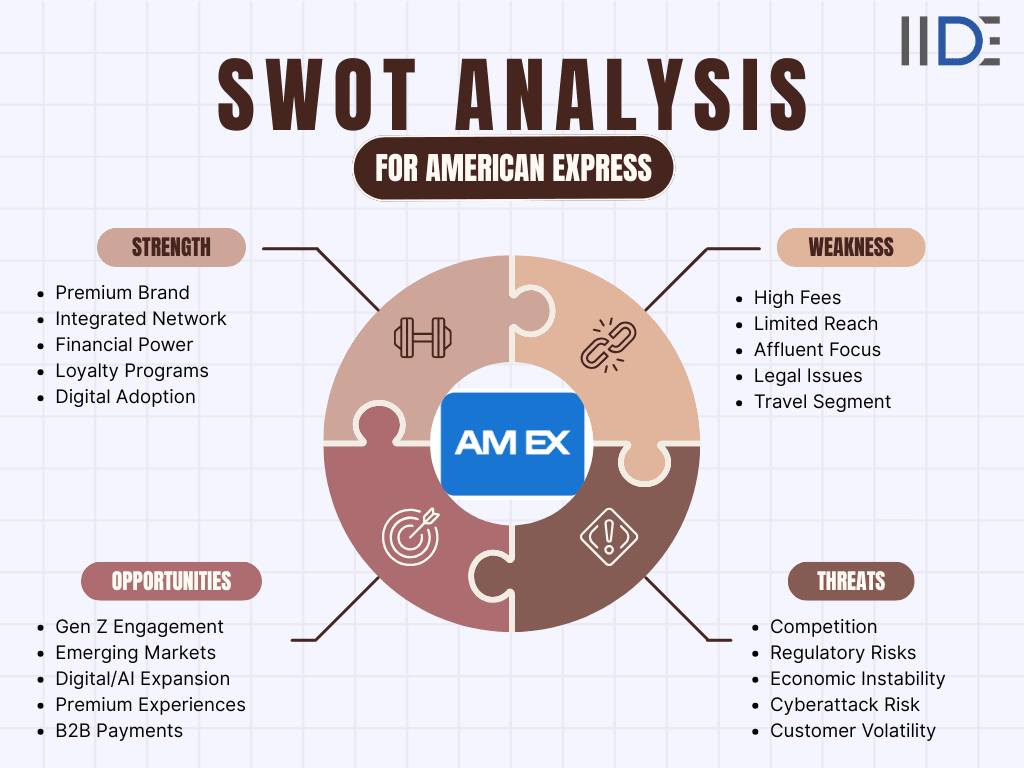

American Express (Amex) remains a global leader in premium payment solutions, combining a prestigious legacy with technology-driven innovation in 2025. Despite fierce competition and shifting consumer needs, Amex's brand strength and customer loyalty continue to set it apart.

How is American Express navigating evolving market dynamics to maintain its leadership? This deep dive SWOT analysis offers entrepreneurs and business students vital insights into Amex’s strategic position.

Before jumping into the article's content, I would like to inform you that the research and foundation for this piece were conducted by Shivani Goyal, a student in IIDE’s PG in Digital Marketing, March Batch 2025.

If you found the piece valuable to you and your business, please reach out to Shivani Goyal with a simple note of thanks for her research. She would really appreciate the kudos.

About American Express

Founded in 1850, American Express is a premium financial services brand known for its trusted, exclusive credit cards and loyalty programs. Operating worldwide, with over 170 million cardholders and presence in 140+ countries, Amex reported $56.4 billion in revenue in 2023.

Its slogan “Don’t Live Life Without It” exemplifies its commitment to unique customer experiences. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats - a tool critical to understanding Amex’s 2025 market relevance.

| Attribute | Details |

|---|---|

| Official Name | American Express Company |

| Founded Year | 1850 |

| Website | www.americanexpress.com |

| Industries Served | Financial Services, Payments |

| Geographic Areas | 140+ Countries |

| Revenue (2023) | $56.4 Billion |

| Net Income (2023) | $8.9 Billion |

| Employees | Approx. 64,000 |

| Main Competitors | Visa, Mastercard, Discover, PayPal, Stripe |

Learn Digital Marketing for FREE

SWOT Analysis of American Express

Brand Strengths of American Express

Global Prestige and Market Leadership

- American Express continues to dominate the premium payments sector with universally recognized branding, elevated by the Platinum and Centurion cards, which represent 37% of the luxury credit card space.

- This enduring prestige positions Amex at the forefront of financial exclusivity and trust.

Seamless, Integrated Global Payment Network

- Operating in 140+ countries with a vertically integrated model, Amex uniquely manages both card issuance and its own payment network, processing more than $1.24 trillion annually a differentiation few competitors can match.

Outstanding Financial Performance

- In 2025, Amex boasts a 35% return on equity with continuous revenue growth, anchored in robust demand for its premium products and services.

Strategic Loyalty and Rewards Programs

- The Membership Rewards program remains central, engaging about 68% of cardholders and enhancing loyalty through valuable partnerships and campaigns like “Shop Small,” which win over both consumers and merchants.

Strong Digital Investment & Innovation

- American Express has invested over $1.2 billion in digital infrastructure, powering a 15% rise in transaction volumes and delivering increasingly personalized offers and user experiences.

Brand Weaknesses of American Express

Limited Penetration in Emerging Markets and Debit Segment

- Amex’s primary focus on premium credit products leaves it less visible in emerging economies and among consumers who prefer debit or alternative payment options.

High Fee Structures Impact Acceptance

- Both annual cardholder fees and merchant transaction costs are higher than many competitors, reducing American Express’s acceptance among price-sensitive audiences and businesses.

Reliance on Affluent Customers

- With a customer base concentrated in high-income households, Amex is more vulnerable to economic downturns that impact discretionary and luxury spending.

Legal and Compliance Risks

- A recent $230M settlement over small business marketing practices underscores ongoing challenges with compliance, impacting reputation and increasing operational risk.

Fintech Competition in Key Segments

- Fintechs and new digital banks are closing in fast, particularly in corporate spend management and all-in-one digital solutions, pressuring Amex’s historical strengths.

Travel Segment Volatility

- Post-pandemic changes in travel habits have resulted in patchy recovery with segments like economy airfare and domestic travel still lagging, affecting the value of premium travel-focused card perks.

Brand Opportunities for American Express

Tapping Gen Z and Millennial Growth

- The fastest-growing spending segments are younger consumers, whose preferences for digital-first, lifestyle-oriented products can be catered to with targeted marketing, rewards, and new financial tech.

Expansion in High-Growth Markets

- Asia-Pacific and Latin America are seeing rapid increases in affluence and card adoption, and strategic local partnerships can accelerate American Express’s footprint.

Fintech Partnerships & Digital Ecosystem Expansion

- By collaborating with innovative fintech firms, Amex can enrich its digital offerings ranging from card management to seamless e-commerce experiences and app-based payment solutions.

Premium Travel & Lifestyle Market Leverage

- Demand for exclusive hospitality, curated experiences, and personalized rewards allows Amex to solidify its value proposition for affluent clients globally.

B2B Payment Solutions Growth

- Businesses are seeking streamlined, tech-savvy payments; Amex’s capacity to offer advanced B2B services with strong analytics creates fertile ground for diversification.

Brand Threats Facing American Express

Escalating Competition from Fintechs & Global Players

- Traditional giants (Visa, Mastercard, PayPal, Stripe) and nimble fintech disruptors are undercutting fees and innovating rapidly, steadily eroding Amex’s traditional market moat.

Macroeconomic Uncertainty & Spending Shifts

- Instabilities including inflation, recession risks, and fluctuating consumer confidence could reduce both cardholder and business client spending.

Regulatory & Compliance Pressures

- Increasing global regulations around data privacy, compliance, and consumer rights demand constant adaptation and increase costs.

Heightened Cybersecurity Risks

- Digital expansion brings more opportunities for cyber threats and data breaches, each with high potential to damage trust and trigger costly remediation.

High Income Segment Dependence

- Economic cycles that impact affluent consumer behavior especially discretionary and travel spend pose persistent revenue risks for Amex’s premium-heavy client base.

Summary Table – SWOT of American Express

IIDE Student Takeaway, Conclusion & Recommendations

Recap Key SWOT Highlights

American Express stands strong in 2025 with unmatched global brand prestige, innovative loyalty programs, and a solid financial track record. Its premium card lineup ensures deep loyalty and high profit margins by attracting the world’s most affluent consumers.

Identify the Core Tension

The main challenge for Amex is maintaining its exclusive, premium identity while also needing to broaden its appeal for wider market adoption especially as more cost-conscious customers and competitive fintech players reshape the payments landscape.

Future Outlook

Moving forward, Amex’s future success depends on how well it can blend its rich heritage with digital innovation and adaptive business models. The ability to balance exclusivity with greater accessibility will be crucial.

Actionable Recommendations

- Launch more flexible and lifestyle-oriented products for Gen Z and Millennials, using AI and digital personalisation to stand out.

- Strengthen partnerships and localise offerings to accelerate expansion in emerging markets with high growth potential.

- Adjust merchant fee structures and consider incentives to increase Amex’s acceptance among more businesses, while maintaining the brand’s premium value.

- Invest heavily in cybersecurity and fraud prevention to protect its expanding digital operations and sustain consumer trust.

- Expand B2B payments offerings and refine travel/lifestyle perks, diversifying revenue streams and reinforcing the premium brand promise.

Want to Know Why 5,00,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.