About Manappuram Finance Limited – Company Overview

Source: Google

Manappuram Finance isn’t your average lender. They hold the distinction of being India’s first online gold loan provider, and they’ve built their reputation on being a people-oriented company.

For over two decades, Manappuram has seen gold as more than just a precious metal; they’ve seen it as a potential key to unlocking opportunity. They recognised that many Indians lacked access to traditional financial channels. Manappuram’s solution? Gold loans. By empowering people to leverage their gold assets, they turned dreams into reality.

This approach wasn’t just good for individuals; it benefitted the Indian economy as a whole. Manappuram’s innovative approach unlocked billions of rupees worth of gold that was previously sitting idle. This influx of gold into the financial system helped reduce economic vulnerabilities and even created new employment opportunities.

Manappuram’s focus goes beyond just profits; they prioritise delivering value to their customers, regardless of social status. This customer-centric approach has earned them the trust of millions of Indians, solidifying their position as the country’s most trusted gold loan provider. When customers feel empowered and valued, trust is built, and that trust fuels Manappuram’s continued success.

For those looking to understand the marketing strategies of prominent companies like Manppuram, it’s beneficial to learn digital marketing to grasp the techniques and approaches that drive such achievements.

What’s New With Manappuram Finance Limited?

- Revenue: Manappuram Finance Limited reported revenue of ₹4,354 crore for the fiscal year 2023 [Source: Manappuram Annual Report 2023].

- Loan Portfolio: The company has a gold loan portfolio worth ₹17,300 crore as of March 2023 [Source: Manappuram Annual Report 2023].

- Market Share: Manappuram holds a significant share of the gold loan market in India, commanding approximately 20% [Source: CRISIL Report 2023].

For those interested in understanding these latest trends in detail, one must study digital marketing online and gain insights into how digital techniques can be applied to enhance financial services marketing.

Business News

Manappuram announced plans to expand its microfinance and housing finance operations to diversify its portfolio [Source: Economic Times, June 2024].

Product Launch

Manappuram launched an AI-driven digital platform for gold loans, offering quicker approvals and enhanced customer experience [Source: Manappuram Press Release, April 2024]. Interested in knowing how they marketed this product? To learn more about this marketing strategy, along with tips and tricks on how to replicate the same, consider enrolling in one of the best online marketing courses out there.

Marketing News

Manappuram rolled out a new marketing campaign focused on the theme ‘Trust and Prosperity’

to reinforce its brand values and customer commitment [Source: Marketing Week, May 2024].

Celebrity News

Bollywood actor Amitabh Bachchan renewed his endorsement deal with Manappuram, continuing as the brand ambassador for their gold loan services [Source: Times of India, March 2024].

Buyer Persona of Manappuram Finance Limited

The buyer persona of Manappuram shares the description of its customers. The table below illustrates customer’s lifestyles, pain points, and reasons for purchasing this company’s services.

Based on the description mentioned above, it’s no surprise that Manappuram’s digital marketing strategy involves the use of platforms like Instagram and Facebook. Here, it features a blend of financial planning and investment opportunities that match its target audience.

Social media as noted in the buyer persona plays a very important role in forming a company’s marketing strategy. One should consider attending a free Instagram marketing course to understand this importance and gain an understanding of the functioning of various social media platforms.

Marketing Strategy of Manappuram Finance

Let us have a look at Manpurram’s Finance Limited marketing strategies:

Segmentation, Targeting, Positioning

Manappuram Finance is a leading gold loan NBFC (Non-Banking Financial Company) in India. They cater specifically to the credit needs of people from lower socio-economic classes, particularly in rural and semi-urban areas.

Their core product is the gold loan. Customers can access quick cash by pledging their gold jewellery as security. This is a valuable service for those who may not have access to other traditional loan options.

Manappuram Finance goes beyond just gold loans. They offer a variety of retail credit products and financial services, including online gold loans, personal loans, vehicle loans, and micro-home finance. They even have specialised loan options for teachers and healthcare professionals.

By consistently introducing new products and keeping the needs of diverse financial backgrounds in mind, Manappuram Finance has positioned itself as India’s first and most reliable online gold loan provider. They have earned the trust of millions of Indians by providing them with the financial resources they need.

Manappuram Finance Limited performs a variety of digital marketing activities to implement a successful marketing campaign. To learn more about the thought process that goes behind the formulation of a strategy, you should attend this free digital marketing certification and learn the practices that are trending in this dynamic industry.

Marketing Campaigns

1) Predict the Winner Contest 2022

Source: Google

The ‘Predict the Winner Contest’ is the latest advertisement campaign by Manappuram Finance. The campaign went on between October 1, 2022 and November 12, 2022. During this campaign, customers got a chance to win rewards by predicting the results of the 2022 T20 World Cup matches. This is an example of creative gold loan advertisement ideas that engage customers.

Check out our digital marketing blogs to keep reading information about other companies amazing marketing campaigns

2) Instant Gold Loan Campaign

Source: Google

Manappuram Finance launched its latest advertising campaign, the Instant Gold Loan, on June 10th, 2022. This campaign caters to customers who need quick access to cash while offering them flexibility and convenience.

The Instant Gold Loan allows users to apply for a loan against their gold jewellery without any processing charges. Here’s how it works: After applying online, a Manappuram service executive visits your home to assess the value of your gold. Upon determining the value, you receive the loan amount immediately. This efficient process ensures quick and trouble-free access to gold loans.

The campaign has been a resounding success, leading to a significant increase in sales for Manappuram Finance. This is a prime example of gold loan marketing strategies.

3) Diwali Dhamaka

Source: Google

In an effort to attract customers during the festive season, Manappuram Finance launched their Diwali Dhamaka campaign. This limited-time offer, which ran until November 30th, 2021, aimed to incentivise both, new and existing customers.

Here’s how it worked: Anyone who pledged a fresh loan amount of over Rs. 25,000 would receive a lucky draw coupon. These coupons offered a chance to win exciting prizes, including TVs, washing machines, microwave ovens, smartwatches, and a variety of other household items.

To spread the word about this festive promotion, Manappuram Finance utilised various social media platforms to reach a wider audience. This campaign showcases gold loan marketing activities that resonate with consumers during festive times.

Are you finding this blog interesting? Check out our digital marketing case studies to read more amazing information.

Mannapuram Digital Marketing Strategy

Social Media Marketing

Manappuram Finance utilises a multi-platform social media approach to connect with its audience. They’re active on Facebook, Instagram, Twitter, LinkedIn, and YouTube, reaching a diverse audience across various channels.

- Facebook: With 49.6k followers, Facebook boasts the highest number of fans for Manappuram Finance.

- LinkedIn: Close behind is LinkedIn, where Manappuram Finance has a strong presence with 73.3k followers.

- Instagram: They’ve also cultivated a following of 30.2k on Instagram.

- Twitter: While Twitter has a smaller following of 8.4k, it remains a valuable platform for engagement.

- YouTube: Manappuram Finance’s YouTube channel has 11.3k subscribers.

Manappuram Finance uses its social media platforms not just for promotions and announcements, but also to provide valuable content. They share helpful insights, financial suggestions, and even scammer alerts, making them a resource for their followers. An element of social media is a critical part of Manappuram’s digital marketing strategy.

Many people across India, especially in Mumbai are looking to understand and implement such effective strategies. This has led them to enrol in the best digital marketing courses in mumbai so that they can gain comprehensive knowledge and practical skills.

SEO Strategies

A proper SEO strategy is vital to a brand’s online success as it aids in achieving its long-term objectives. Manappuram realises the significance of SEO. Therefore, they keep their website remarkably optimised.

Manappuram Finance receives over 16.9k organic monthly traffic (Number of visitors from search) and has over 31.5k organic keywords (Natural search terms used online). This implies that Manappuram’s digital marketing strategies are giving them favourable results. They need to try and keep their ranking in Google organic SERP results at a greater place.

For those looking to achieve similar results, enrolling in digital marketing courses in gurgaon can provide valuable insights and practical skills.

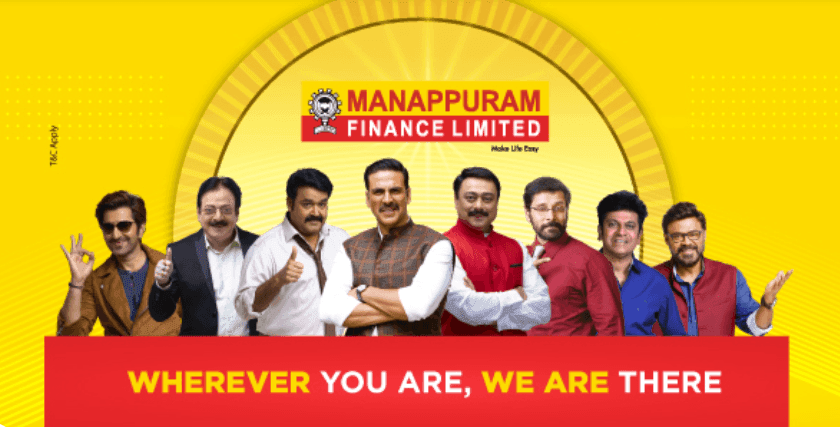

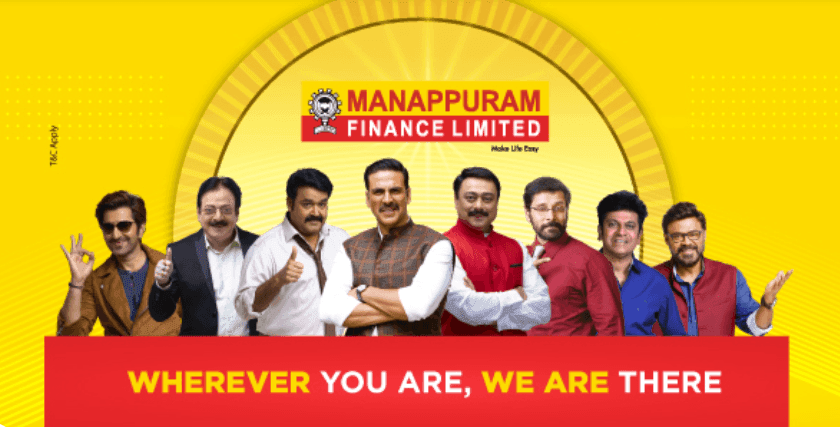

Influencer Marketing

Source: Google

Manappuram Finance has collaborated with many TV and film celebrities and social media influencers to market their business on several occasions.

They’ve enlisted eight celebrities as ambassadors to endorse their products: Akshay Kumar for Hindi-speaking regions, Jeetu Madnani for West Bengal, Vikram for Tamil Nadu, Sachin Khedekar for Marathi, Venkatesh for AP/Telangana, Puneet Rajkumar for Karnataka, Mohanlal for Kerala, and Uttam Mohanty for Odisha

These brand ambassadors actively promote and endorse Manappuran products which help the company gain visibility and become popular among the celebrities’ fan base. This is one of their key gold loan marketing strategies.

E-commerce Strategies

Manappuram Finance provides several online banking solutions. Online services include applying for a gold loan online, online payment of principal or interest in a Gold loan, Forex, and money transfers.

Manappuram provides several other services, such as the Quick Pay app, loan calculator, and the OGL App, to avail of a gold loan anytime, anywhere, even from the comfort of your home. Manappuram Finance also lets users make a gold loan payment through PAYTM.

Mobile Apps

Manappuram Finance offers several mobile applications, including Manappuram OGL, which lets you apply for a gold loan online and view your account details. Users can also check their dues and pay them online on the go.

The app provides several other features for their customer’s convenience, such as partial payments and provision for full settlement.

Besides their main mobile application Manappuram OGL, the company also offers several other apps like MAFIL PL Repay, Makash Agent, Makash Merchant, and Manappuram BA Channel.

Content Marketing Strategies

Content marketing is a strategic approach to creating and sharing valuable, relevant, and consistent content to attract and retain a clearly defined audience — and, ultimately, to drive profitable customer action.

Manappuram Finance Limited is very active on social media. It publishes content regularly on its Twitter, Instagram, and Facebook handles, including financial suggestions, promos and offers, celebrity endorsements, industry myths, facts, etc. Their LinkedIn profile also provides regular updates.

Their YouTube channel is currently standing at 11.3k subscribers. They create video content around their offers and schemes. They also do fun quizzes and contests occasionally on their YouTube channel. Their YouTube channel also contains shows and interviews with celebrities.

Their website includes press releases and blogs on the latest financial news, financial suggestions, scammer alerts, insightful facts, historical facts, and so on.

Many people especially from Patna are interested in mastering these strategies. This has led to a surge in demand for digital marketing courses in patna that offer comprehensive training and insights into effective digital marketing practices.

Top Competitors That Influence the Marketing Strategy of Manappuram Finance

Manappuram is not the only player in this industry; many other rivals engage in similar gold loan marketing activities.

- Muthoot Finance: A leading NBFC specialising in gold loans with an extensive branch network.

- HDFC Bank: Offers a wide range of financial services, including competitive gold loan products.

- ICICI Bank: Known for its innovative financial solutions and strong customer base in the gold loan segment.

- Bajaj Finserv: Provides diverse financial products, including gold loans, with a focus on customer convenience.

- IIFL Finance: Offers comprehensive financial services, including gold loans, with a robust digital platform.

Failed Campaigns About Manappuram Finance Limited

Manappuram launched a marketing campaign aimed at promoting its gold loan services, featuring visuals and messages that were intended to attract a broad audience.

Issue: Manappuram faced backlash for a campaign that was perceived as insensitive to cultural sentiments.

Backlash: The campaign led to significant negative feedback on social media, impacting the brand’s image.

Response: Manappuram issued a public apology, withdrew the campaign, and committed to more culturally sensitive marketing practices in the future.

Learn From Asia’s #1

Digital Marketing Institute

AI-Based Curriculum

Dive in to the future with the latest AI tools

Placement at top brands and agencies