Orginally Written by Aditya Shastri

Updated on Aug 9, 2025

Share on:

HDFC Bank thrives on its comprehensive banking model, combining retail banking, corporate banking, wealth management, and digital services. Its growth is driven by digital transformation, innovation in services, and a customer-first approach. With a robust branch network, it ensures customer accessibility while leveraging technology to provide seamless banking experiences. Keep reading to uncover HDFC Bank's secrets to sustained success.

About HDFC Bank

HDFC Bank was founded in 1994 by Hasmukhbhai Parekh and is headquartered in Mumbai, India. It quickly became one of India’s leading private-sector banks, offering a broad range of services from retail banking to corporate banking and wealth management. The bank’s vision is to provide customers with an efficient, reliable, and accessible banking experience.

In the fiscal year 2024-2025, HDFC Bank achieved a net profit of approximately ₹38,000 crores and ₹2.2 trillion in total assets. With over 5,500 branches and 15,000+ ATMs across India, HDFC serves a broad customer base, offering services to individuals, SMEs, and large corporations. It also has a strong digital banking presence, reaching millions of users online through mobile apps, internet banking, and other services.

The bank’s ethos focuses on innovation, customer satisfaction, and responsible banking. With its commitment to digital transformation and a customer-centric business model, HDFC Bank continues to remain one of India’s most trusted financial institutions.

| Feature | Details |

|---|---|

| Founded | 1994 |

| Founder | Hasmukhbhai Parekh |

| Headquarters | Mumbai, India |

| Industry | Banking & Financial Services |

| Revenue (2024) | ₹1,80,000 crores |

| Presence | 5,500+ branches, 15,000+ ATMs |

| Employees | ~150,000 |

| Popular for | Retail banking, digital services, SME solutions |

Learn Digital Marketing for FREE

How does HDFC Bank make money?

1. Revenue Stream Breakdown

- Retail Banking: Offers a wide range of personal banking services, including savings accounts, loans, credit cards, and insurance. Retail banking contributes around 50–55% of total revenue

- Corporate Banking: Services to businesses, including working capital finance, trade services, and corporate loans. Corporate banking represents about 30–35% of revenue

- Treasury Income: The bank generates income from investments, foreign exchange operations, and other financial instruments, contributing about 5–10% of revenue

- Other Services: Wealth management, mutual funds, and insurance products contribute the remaining 10–15%

2. Revenue Contribution

- Retail Banking is the largest revenue generator, with its various loan products, savings accounts, and retail investments driving the highest share

- Corporate Banking brings in consistent, high-volume revenue through business lending and trade finance

- Treasury and wealth management services offer additional income diversification, with the latter becoming increasingly profitable as India’s wealth grows

3. Pricing Strategy

HDFC Bank employs a premium pricing strategy for its retail services, offering competitive rates for savings accounts, credit cards, and loans while charging higher interest rates on loans and credit card services. For corporate clients, pricing is based on the scale of lending and customised business solutions. Wealth management services use a value-based pricing model, depending on assets managed and services provided.

The SWOT analysis of Tata Steel offers valuable insights into how large, diversified companies, like HDFC Bank, manage both operational and financial growth across industries.

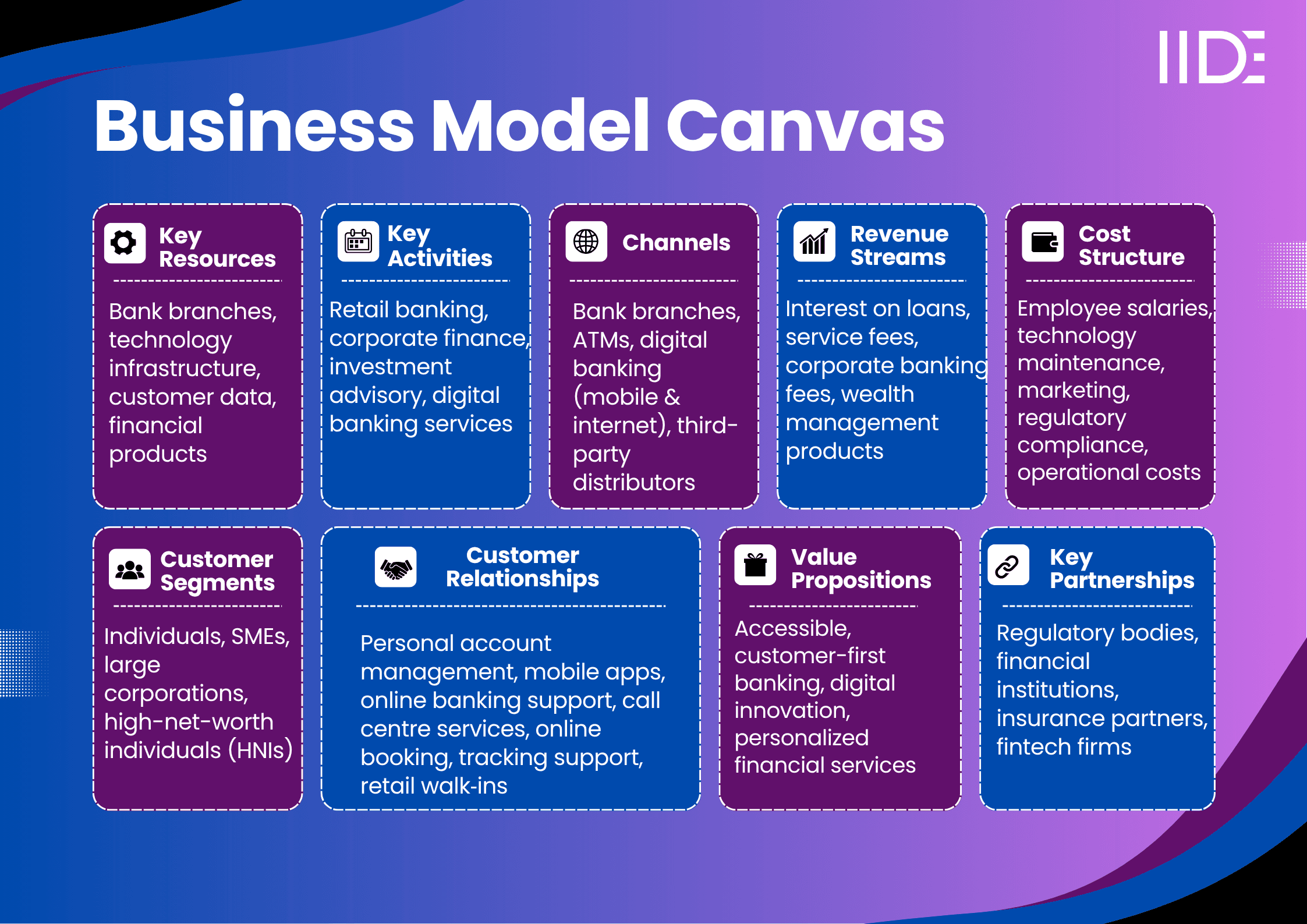

HDFC Bank Business Model Canvas

HDFC Bank Value Proposition

HDFC Bank stands out in the market by offering accessible, reliable banking solutions with a strong focus on customer satisfaction and digital innovation. For retail customers, it offers competitive savings accounts, loan products, and credit cards with convenient online banking, ensuring ease of access. For businesses, it provides tailored corporate banking services and financial solutions, enabling seamless management of working capital and trade finance.

Emotionally, HDFC Bank builds trust by offering transparency and security, especially in its mobile and online platforms. Customers feel confident knowing their financial services are accessible anytime, anywhere.

Functionally, it offers highly efficient services, such as 24/7 mobile banking, AI-powered loan approvals, and instant payments, which set it apart from traditional banking services. With a growing focus on wealth management, it provides value-added services for HNIs, while corporate clients benefit from a full range of business finance products. Digital transformation ensures its future growth, solidifying its position as a market leader.

HDFC Bank Cost Structure

HDFC Bank’s major costs include employee salaries, especially in customer service, branch operations, and technology infrastructure (for digital banking and mobile apps). The bank invests heavily in regulatory compliance and marketing campaigns, as well as in enhancing its digital platforms. Operational expenses are controlled through automation and centralised services, reducing the costs of physical branches and improving customer interactions.

HDFC Bank Customer Segment

HDFC Bank primarily serves individual consumers, from middle-income groups to high-net-worth individuals (HNIs), providing tailored banking services to suit a wide range of financial needs. Additionally, it serves small- and medium-sized enterprises (SMEs) and large corporations, offering business finance products, loans, and investment solutions. Customers are attracted by its competitive interest rates, convenience, digital services, and personalised wealth management options, which cater to their evolving financial needs.

Distribution Channels

HDFC Bank delivers its services through a combination of traditional banking branches, ATMs, and digital channels such as mobile banking apps, internet banking, and third-party distributors. The bank’s omnichannel approach ensures seamless integration across physical and online platforms, allowing customers to manage their accounts, process transactions, and invest in financial products with ease. The bank is increasingly investing in AI-powered interfaces for faster service delivery.

Key Partnerships

HDFC Bank partners with financial institutions, regulatory bodies, insurance companies, and fintech firms to provide a comprehensive range of products and services. It also collaborates with tech companies for digital banking innovations and third-party distributors for wider outreach. These partnerships help HDFC Bank remain competitive, enhance its service offerings, and provide customers with a broader range of solutions, from loans to investments and insurance.

The SWOT analysis of Bajaj Finserv highlights the competitive financial landscape in India, shedding light on strategies that are similar to those employed by HDFC Bank.

SWOT Analysis of HDFC Bank

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Market leader | Reliance on retail loans | Growing wealth management | Regulatory changes |

| Strong digital adoption | High operating costs | Expanding e‑commerce | Rising competition from fintech |

| Diverse revenue streams | Competitive credit card market | Fintech partnerships | Cybersecurity threats |

Competitor Comparison

| Brand | Pricing | Customer Experience | Channel Strategy | Market Focus | Innovation |

|---|---|---|---|---|---|

| HDFC Bank | Premium value | Reliable, accessible | Branches, digital services | B2C, SMEs, HNIs | Digital banking |

| ICICI Bank | Competitive | Omnichannel convenience | Integrated digital & physical | B2B, B2C | AI & data-driven solutions |

| Axis Bank | Flexible | Digital-first, fast | Digital-first with branches | Retail, Corporate | Digital finance tools |

| SBI | Competitive | Nationwide accessibility | Pan-India branches | Mass-market retail | Digital innovations |

What’s New With HDFC Bank?

HDFC Bank is accelerating its digital transformation with enhanced AI-powered loan products and mobile app integrations to better serve both retail and corporate clients. The bank is also expanding its wealth management services, offering personalised advisory and investment solutions to high-net-worth individuals. It is exploring blockchain-based solutions for payments and transactions, and investing in sustainability-driven finance to align with global environmental goals.

Key Takeaways for Students & Marketers

- HDFC Bank’s model is built on customer-centric innovation, especially through digital channels

- Strong retail banking services provide stable revenue, while corporate and wealth management diversify income

- Focus on digital transformation and AI-driven solutions keeps HDFC competitive

- Partnerships with fintech and regulatory bodies provide opportunities for growth and market expansion

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.