Updated on Dec 12, 2025

Share on:

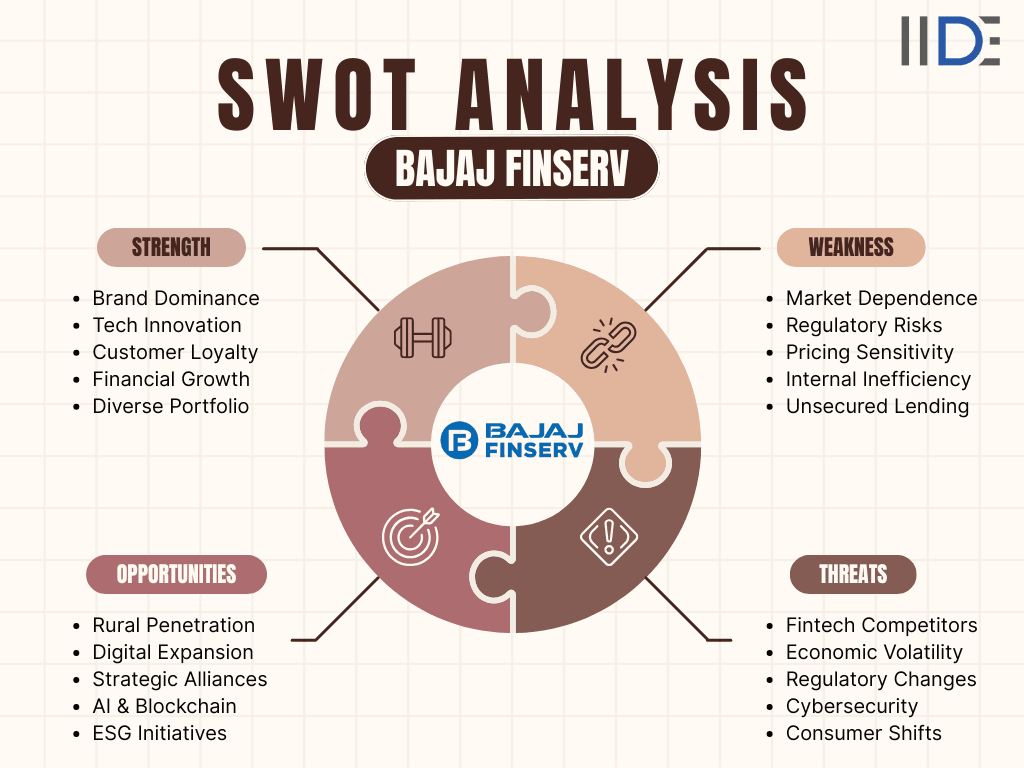

Bajaj Finserv, a leading financial conglomerate, dominates India’s financial services sector with its robust offerings in lending, wealth management, and insurance. As the company thrives in a competitive market, can Bajaj Finserv maintain its growth in the face of increasing regulatory challenges? This SWOT analysis provides key insights into the company's strategy for 2025. Essential reading for entrepreneurs and business students looking to understand the dynamics of the financial sector.

About Bajaj Finserv

Founded in 2007, Bajaj Finserv is India’s prominent financial services provider, operating in lending, insurance, wealth management, and digital finance sectors. With the compelling slogan, "Think it. Done.", the company emphasises swift financial solutions.

In 2025, Bajaj Finserv reported exceptional growth, becoming India’s largest NBFC by revenue. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats.

Overview Table

| Particulars | Details |

|---|---|

| Official Name | Bajaj Finserv Ltd. |

| Founded Year | 2007 |

| Website | www.bajajfinserv.in |

| Industries Served | Financial Services |

| Geographic Areas Served | India, Select International Markets |

| Revenue (2025) | ₹85,000 crore |

| Net Income (2025) | ₹6,500 crore |

| Employees | 40000 |

| Main Competitors | Main Competitors |

Learn Digital Marketing for FREE

SWOT Analysis of Bajaj FinServ

Brand Strength: Bajaj Finserv’s Financial Powerhouse in 2025

Brand Recognition & Market Presence:

- Bajaj Finserv is a dominant player in India’s financial services sector, with a strong market presence and brand equity.

- Its reputation is built on delivering reliable lending and insurance services to millions of customers nationwide.

Diverse Product Portfolio:

- Bajaj Finserv’s diverse offerings, including personal loans, insurance, mutual funds, and wealth management services, position it as a one-stop financial solutions provider.

- This broad product base helps it maintain a competitive edge in multiple verticals.

Technological Innovation:

- The company has embraced digital finance, utilising cutting-edge technologies such as AI, blockchain, and big data analytics to provide personalised financial services and enhance customer experience.

Impressive Financial Performance:

- Bajaj Finserv’s revenue stands at ₹85,000 crore in 2025, showcasing its substantial financial growth and operational scale.

- This performance underscores its position as a leader in India’s financial services industry.

Customer Loyalty & Nationwide Distribution:

- Bajaj Finserv’s wide distribution network, supported by its parent company Bajaj Group, ensures its dominance across India.

- It enjoys strong customer loyalty, driven by trust and consistent service.

SWOT analysis of BDO Global gives insight into how financial service firms navigate regulatory pressures and global expansion.

Brand Weakness: Bajaj Finserv’s Struggles in 2025

Market Overdependence:

- Bajaj Finserv is highly dependent on the Indian market, which limits its ability to scale in global markets.

- The company faces challenges in expanding its footprint internationally due to fierce competition and regulatory barriers.

Increasing Regulatory Scrutiny:

- Bajaj Finserv’s growth is impacted by the rising regulatory scrutiny on financial institutions in India.

- New regulatory changes, particularly in lending practices and insurance regulations, could strain operations and profitability.

High Exposure to Unsecured Lending:

- A significant portion of Bajaj Finserv's lending portfolio is exposed to unsecured loans, increasing its vulnerability to loan defaults and economic downturns.

Price-Sensitive Consumer Base:

- Bajaj Finserv’s reliance on a price-sensitive consumer base may impact its ability to introduce premium financial products, such as high-end insurance plans or wealth management services, which require higher margins.

Internal Inefficiencies:

- The company has been expanding rapidly, which has led to internal inefficiencies in certain processes, such as customer service management and logistics.

- These inefficiencies could hinder future growth if not addressed.

SWOT analysis of eBay shows how digital platforms leverage trust and scale—ideas that intersect with digital finance offerings.

Brand Opportunities: Bajaj Finserv’s Future Growth Avenues

Expansion into Rural Markets:

- Bajaj Finserv has significant opportunities to expand into under-penetrated rural markets, where access to financial services is still limited.

- The growing middle class in rural India presents a lucrative customer base for its lending and insurance products.

Growing Demand for Digital Services:

- As the digital finance market continues to grow, Bajaj Finserv is well-positioned to capitalise on the demand for online personal loans, insurance policies, and investment products, particularly targeting Gen Z and millennials.

Strategic Partnerships:

- Partnering with fintech and insurtech firms could enhance Bajaj Finserv’s digital capabilities, allowing it to offer innovative products and reach tech-savvy consumers who prefer online financial services.

Leveraging AI & Big Data:

- Bajaj Finserv can continue to leverage artificial intelligence, blockchain, and big data analytics to personalise offerings, improve risk assessments, and enhance customer engagement.

ESG Alignment:

- As sustainable investing gains traction, Bajaj Finserv can align its services with ESG (Environmental, Social, Governance) initiatives, tapping into the growing demand for socially responsible financial products, especially among Gen Z consumers.

Summary Table – SWOT of Bajaj FinServ

IIDE Student Takeaway, Conclusion & Recommendations

Bajaj Finserv, a leader in India's financial services sector, boasts a strong market presence with its diverse portfolio in lending, wealth management, and insurance. The company’s technological advancements, including AI-driven finance solutions and digital platforms, have positioned it for continued growth. However, its heavy reliance on the domestic market and increasing regulatory challenges could limit its ability to scale in an increasingly competitive landscape.

Core Tension:

The core tension for Bajaj Finserv lies in its over-dependence on the Indian market, coupled with the rising regulatory pressures within the financial sector.

While its digital innovations offer an edge, the company faces challenges in addressing the cybersecurity vulnerabilities that come with increasing digital adoption.

Additionally, regulatory changes, particularly in lending and insurance, can impose operational constraints, making it harder to sustain growth.

Bajaj Finserv’s future remains promising, but its success will depend on how effectively it balances its strong market position with the challenges of expanding globally and managing regulatory and cybersecurity risks.

Its focus on digital services, along with its leadership in financial inclusion, provides a solid foundation for continued relevance in 2025 and beyond.

Actionable Recommendations:

Expand into Rural & Semi-Urban Markets: Leverage the increasing financial inclusion trends by developing tailored products for rural and aspirational segments.

Strategic Partnerships: Collaborate with fintech and insurtech firms to drive rapid innovation and enhance service offerings.

Address Cybersecurity: Invest in cybersecurity infrastructure to ensure consumer trust as digital adoption continues to grow.

Enhance Compliance Strategies: Adapt proactively to regulatory changes, focusing on compliance management and risk mitigation.

Conclusion:

By expanding its market footprint, enhancing its technological capabilities, and addressing the evolving regulatory landscape, Bajaj Finserv can continue to lead in the financial services sector. The company’s future will depend on strategic agility, technology investments, and its ability to maintain trust amid an evolving digital ecosystem.

Want to Know Why 5,00,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

-

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Bajaj Finserv offers the following services:

- Personal Loans

- Home Loans

- Business Loans

- Insurance (Life, Health, and General)

- Fixed Deposits

- Investment Solutions

- Bajaj Finserv EMI Cards (for easy instalments)

- Bajaj Finance App for managing loans and investments

The eligibility criteria vary depending on the type of loan, but generally include:

- Age: Between 21 and 60 years (for personal loans)

- Income: A stable monthly income (criteria vary by loan type)

- Credit Score: A good credit score is often required, though Bajaj Finserv provides options for those with varying credit scores

The Bajaj Finserv EMI Network allows you to purchase products and services and convert the cost into easy monthly instalments (EMIs). This includes electronics, appliances, and more, available across thousands of partner stores.

You can check the status of your loan by logging into the Bajaj Finserv customer portal or using the Bajaj Finserv mobile app. Additionally, you can track your loan status by contacting customer support.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.