Orginally Written by Aditya Shastri

Updated on Dec 11, 2025

Share on:

State Bank of India (SBI) stands tall as India’s largest bank, powering the nation’s economic growth with unmatched reach and financial strength. Facing rapid digital shifts, global ambitions, and tough competition, can SBI retain its leadership in the evolving banking landscape? This SWOT analysis unpacks what sets SBI apart in 2025, delivering valuable lessons for entrepreneurs and banking professionals in a fast-changing world.

Before diving into the article, I would like to inform you that the research and initial SWOT analysis for this piece were conducted by Neha Kudu. She is a current student in IIDE's PG In Digital Marketing & Strategy, May Batch 2025.

About State Bank of India SBI

State Bank of India (SBI) was formally created in 1955 (but traces institutional roots back to the early 19th century). Headquartered in Mumbai, it is the largest public sector bank in India, with massive reach across urban and rural markets. SBI’s slogan is “Banker to Every Indian” reflecting its mandate of financial inclusion and national presence.

By 2024–25, SBI remains central to India's banking system: it handles a significant share of deposits, credit, and government banking business.

The blue circle represents perfection and unity, while the small white keyhole symbolizes a common man at the focus of the bank’s services.

It reflects SBI’s commitment to being “The Banker to Every Indian.”

Overview Table

| Attribute | Data (2025) |

|---|---|

| Official Company Name | State Bank of India (SBI) |

| Founded Year | 1955 |

| Website URL | |

| Industries Served | Banking, Financial Services, Insurance |

| Geographic Areas | India (HQ), 30+ countries worldwide |

| Revenue | $53 billion (FY24-25) |

| Net Income | $9.2 billion (FY25) |

| Employees | ~250,000 (2025) |

| Main Competitors | HDFC Bank, ICICI Bank, Axis Bank, Punjab National Bank, BoB |

Learn Digital Marketing for FREE

Why a SWOT Analysis Matters Now

Fast-changing competitive landscape

Private banks and fintechs are aggressively eating into segments like payments, lending, and customer experience. SBI can’t rely on its size alone.

Technology disruption & customer expectations

With rising digital adoption, customers expect seamless, frictionless services. Legacy banking models are under pressure.

Macroeconomic & regulatory pressures

Interest rate cycles, stress on asset quality, regulatory changes (Basel III, provisioning norms) all pose risks.

Focus on inclusion and rural growth

Government thrust on financial inclusion, rural credit, and infrastructure financing offers opportunities for scale if SBI is agile enough to capture them.

If you're interested in understanding how other Top Banks perform, check out our detailed HDFC SWOT Analysis 2025 to compare strategies, strengths, and opportunities in the banking industry.

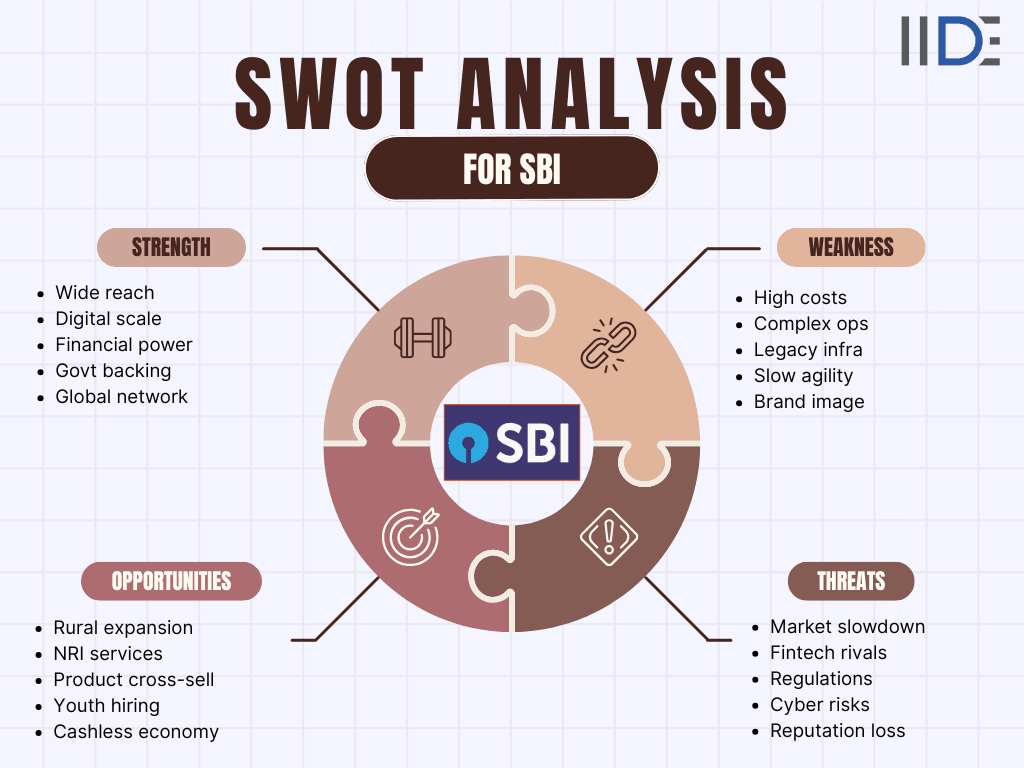

SWOT Analysis of SBI (State Bank of India)

The State Bank of India (SBI) enjoys several key strengths, including its massive scale, strong government backing, trusted brand reputation, extensive branch network, and ongoing digital transformation. However, it also faces notable weaknesses such as a relatively high operating cost base, persistent non-performing asset (NPA) pressures, reliance on legacy systems, and slower decision-making compared to private or fintech competitors.

(Source - INDIA TODAY)

Looking ahead, SBI has multiple opportunities to leverage from forging fintech partnerships and expanding into underserved markets to tapping global borrowing avenues and introducing innovative financial products. Yet, the bank must also navigate significant threats, including rising competition, macroeconomic uncertainties, evolving regulatory landscapes, and rapid technological disruptions that continue to reshape the banking sector.

Strengths

Massive scale & dominance in India

- With over 22,900 branches and a widespread ATM & service network, SBI’s reach is unmatched.

- It captures a large share of deposits and advances. As per latest data, its deposit base is ₹5,382,189.53 crore.

- Its CASA ratio remains healthy, helping in access to low-cost funds. (Though precise recent CASA ratio figures weren’t in sources, this is a known competitive advantage in many analyses)

Government backing / implicit sovereign guarantee

- The Government of India is the majority stakeholder in SBI, lending it credibility, capital support when needed, and easier access to policy avenues.

- This backing helps in investor confidence and also in large-scale roles in government-led banking initiatives.

Strong financials & capital position

- Its capital adequacy is ~14.25%, above regulatory minimums.

- In Q1 FY26, SBI’s net profit was ₹21,626 crore, an 8.45% QoQ increase and 9.89% YoY growth.

- In Q1 FY26, revenue grew ~9.77% YoY to ₹1,66,991.82 crore.

Digital infrastructure & products

- SBI’s digital flagship is YONO (You Only Need One), covering banking, shopping, investments, and more helping retain and onboard customers.

- It is investing in mobile and internet banking, APIs, fintech partnerships, and data analytics.

Diversified product portfolio & government business

- SBI handles government banking (payments, subsidies, treasury) which gives a steady stream of business and strategic importance.

- It offers retail, corporate, SME, treasury, insurance, mutual funds making it less reliant on one vertical.

Global presence

- SBI has branches, subsidiaries, and presence in ~29–30 countries (offices, representative branches), which give it international reach.

- SBI also facilitates international trade and remittances, supporting millions of Indians and businesses engaged in global transactions.

Weaknesses

High employee & operating expenses

- Running huge branch networks and manpower leads to high fixed costs. Many public sector banks (including SBI) struggle to reduce staff/overhead.

- Legacy systems and bureaucratic processes may slow digital agility.

Non-performing assets (NPAs) / asset quality risk

- While public sector banks have improved, NPAs remain a structural risk. An aggressive credit push can stress asset quality. (Industry-wide challenge)

- Provisioning requirements and write-offs negatively affect profitability.

Dependence on Indian economy / domestic market

- A large part of SBI’s revenues and exposure is domestic. Any slowdown in India (especially in sectors like infrastructure, SMEs) can impact loan repayment and demand.

- Global operations are relatively modest compared to global banks; overseas revenue is a smaller proportion.

Slower decision-making & bureaucratic inertia

- As a large public sector institution, decision-making (especially for new initiatives or partnerships) may be slower or more constrained by rules and regulation.

- This can limit its agility compared to private or fintech competitors, making it harder to quickly adapt to market changes or emerging technologies.

Technology gaps vs nimble fintechs / private banks

- Some private banks and fintechs often roll out newer features faster (UX, onboarding, personalization). SBI needs to keep closing that gap.

- Integration across legacy systems and modern APIs is a challenge.

Overexposure in certain segments

- If SBI has heavily financed sectors vulnerable to downturns (e.g., infrastructure, real estate), it may incur stress. (While source-specific sectoral exposure data was not found in my search, this is a commonly discussed risk in banking analysis.)

- High concentration in government-linked or priority sector lending could also increase risk, as these segments may face policy changes or lower profitability during economic slowdowns.

Opportunities

Fintech & platform partnerships / open banking

- SBI can partner with fintechs or act as a platform to integrate third-party services. e.g. lending APIs, digital payments, embedded banking.

- It can open up its infrastructure (APIs) to third parties under regulatory sandbox regimes.

Expansion into underserved/rural segments

- India’s financial inclusion push is far from saturation; micro credit, rural lending, microinsurance, agro-finance are growth opportunities.

- Government-led schemes (PM–JDY, Jan Dhan, rural infrastructure) can provide volume growth.

International borrowing & treasury play

- SBI plans to issue dollar bonds to tap global markets. After India’s sovereign rating upgrade, it is favorable.

- It also already plans to raise ₹50 billion via additional Tier-I (perpetual) bonds.

Sale or consolidation of non-core investments

- SBI’s recent plan to sell ~13% stake in Yes Bank (for ₹8,889 crore) signals such moves.

- Divestments free up capital to focus on core banking.

Growth in gold loans and secured lending

- Gold loans are seeing surging demand SBI recorded ~53% YoY growth in its gold loan portfolio in FY25.

- Such secured lending tends to have lower credit risk and can be scaled.

Tech-led product innovation (AI, data analytics, blockchain)

- Use of AI for credit scoring, fraud detection, personalized offers.

- Blockchain in trade finance, cross-border remittances, supply chain finance.

Cross-sell & wealth management

- Monetizing its large deposit & customer base through wealth products, insurance, mutual funds, pensions, higher yield, fee-based income.

- Expanding digital investment platforms and personalized financial advisory services can further enhance customer engagement and boost non-interest income.

Threats

Intense competition from private banks & fintechs

- Private banks like HDFC, ICICI, Kotak often lead in UI/UX, product innovation, quicker customer service.

- Fintech lenders (digital-first, nimble, often lighter cost structure) pose a threat especially in retail/SME lending, payments, credit.

Macroeconomic headwinds / interest rate volatility

- Economic slowdown leads to defaults.

- Sharp rate increases may compress net interest margin (NIM) or deter credit demand.

Regulatory / policy changes

- Basel III, provisioning norms, stress tests, changes in priority sector lending rules, etc., can squeeze margins.

- Government-mandated cost caps or social obligations (e.g., priority sector lending mandates) can reduce profitability.

Technological disruption / cyber risks

- Cyberattacks, operational risk from system failures, fraud in digital channels.

- Disruption from new technologies (e.g. crypto, decentralized finance) over time.

Global & currency risks

- For its foreign borrowings, currency depreciation or volatility may raise costs.

- Changes in global interest rates or credit conditions may affect cross-border operations.

Concentration risk in stressed sectors

- Overexposure to cyclical sectors (infrastructure, real estate) can amplify risk during downturns.

- Significant lending to a few large corporate groups can also heighten default risk if any major borrower faces financial distress.

SWOT Analysis of SBI 2025

IIDE Student Takeaway, Conclusion & Recommendations

Key Insights

- SBI’s biggest strength is its unmatched scale, credibility, and government backing.

- Its biggest weakness is its cost structure and vulnerability around NPAs and bureaucratic inertia.

- The major opportunity lies in digital transformation, fintech tie-ups, and tapping underserved segments.

- The biggest threat is competition and macro / regulatory shocks.

Strategic recommendations:

Lean into digital transformation aggressively

- Use cloud-native systems, modular architectures, partnerships with fintechs, and continuous UI/UX upgrades.

Optimize cost structure & branches

- Rationalize underperforming branches, promote self-service channels, and restructure back-office operations.

Focus on risk-ready growth

- Expand in secured lending (gold, mortgages) and carefully calibrated exposure to growth sectors. Strengthen credit evaluation using data & AI.

Strengthen cybersecurity & tech resilience

- Invest in robust security, frequent audits, fraud-detection AI, and incident management.

Market & product innovation

- Introduce micro-insurance, subscription banking, embedded financial services, neo-banking tie-ups.

Leverage overseas funding & balance sheet efficiency

- Use global capital markets judiciously, manage currency risk, and optimize capital deployment.

Cultural and organizational agility

- Encourage decentralized decision-making, faster approvals, accountability, and intrapreneurship.

Outlook & Final Thought

SBI stands at a pivotal point. Its dominance gives it weight, but inaction or slow adaptation could let nimble challengers nibble away its edges. If it embraces tech, efficiency, and customer-centric evolution, it can remain India’s banking backbone well into 2030.

Want to Know Why 5,00,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

- Its legacy systems and bureaucratic structure, which can hinder agility.

- Its vast network, which can sometimes lead to inefficiencies in operations and customer service challenges.

This is part of the broader SWOT analysis of SBI.

- Strengths

- Weaknesses

- Opportunities

- Threats

For SBI, this includes examining its market position, financial performance, and strategic management. It helps in understanding SBI's competitive analysis and marketing strategy.

- Its extensive branch network

- Strong brand reputation

- Solid financial performance

Its market position is robust, supported by its strategic management and SBI SWOT analysis. These factors contribute to its position in the SWOT analysis of the State Bank of India.

- High levels of non-performing assets (NPAs)

- Intense competition

- Regulatory pressures

Addressing these issues is crucial in order to maintain its market position and improve its financial performance analysis.

- Identifying strengths to leverage

- Addressing weaknesses

- Exploring opportunities

- Mitigating threats

This SBI market position analysis helps refine SBI's marketing strategy and ensures sustained SBI financial performance analysis.

- Expanding digital banking services

- Increasing financial inclusion

- Entering new markets

These are part of the SWOT analysis for the banking industry, aiming to enhance the SBI strategic management analysis and boost its SBI competitive analysis.

- Regulatory changes

- Economic downturns

- Emerging fintech competition

These factors can impact its SBI market position analysis and require effective strategies to mitigate risks as part of its SBI SWOT analysis.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.