Updated on Jan 6, 2026

Share on:

Victoria Plc, a well established UK based fashion and lifestyle brand, continues to hold a strong position in the retail market in 2026. But what keeps the brand relevant in an increasingly competitive and digital first environment?

This analysis explores Victoria Plc’s market position, competitive landscape, and strategic approach to sustaining its brand presence.

Let’s discover how Victoria Plc maintains its competitive edge and what lies ahead for the brand.Understanding these insights can help you apply similar strategic thinking to real world business scenarios and professional decision making.

Before diving into the article, I would like to inform you that the research and initial analysis for this piece were conducted by Nandini Gupta. She is a current student in IIDE’s PGPDM, June’ 25 batch.

If you found this helpful, feel free to reach out to Nandini Gupta to send a quick note of appreciation for her research. She will appreciate the kudos!

About Victoria Plc 2026

Founded way back in 1895, Victoria Plc is one of the UK’s oldest and most respected flooring companies.

Headquartered in Worcester, England, the company designs, manufactures and distributes a wide range of flooring products, from carpets and underlay to ceramic tiles, luxury vinyl tiles (LVT), artificial grass and accessories.

Today, Victoria operates across Europe, the USA and Australia and employs over 5,300 people, and proudly stands as Europe’s largest carpet manufacturer.

Overview Table

| Attribute | Details |

|---|---|

| Official Name | Victoria PLC |

| Founded Year | 1895 |

| Headquarters | Worcester, United Kingdom |

| Website URL | www.victoriaplc.com |

| Industries Served | Floor coverings: carpets, underlay, rugs, ceramic tiles, LVT, artificial grass, accessories |

| Geographic Areas | UK, Spain, Italy, Belgium, Netherlands, Germany, Turkey, USA, Australia |

| Revenue (FY25) | ≈ £1.1 billion (flat year-on-year) |

| Adjusted EBITDA (FY25) | ≈ £114 million |

| Employees | ≈ 5,350 across 30+ sites |

| Stock Listing | AIM (London), ticker VCP.L |

| Main Competitors | Tarkett, Mohawk Industries, Interface, James Halstead, Forbo, Beaulieu, Balta |

Learn Digital Marketing for FREE

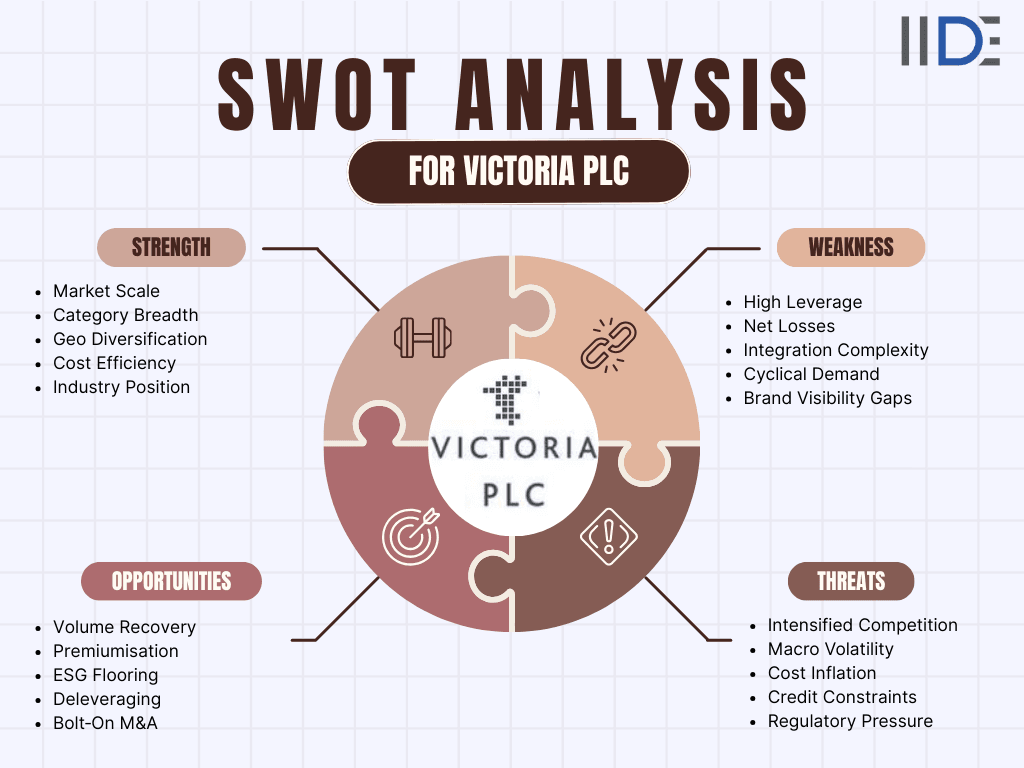

SWOT Analysis of Victoria PLC 2026

Strengths of Victoria PLC

Victoria Plc demonstrates several core advantages that underpin its long term business resilience.

- Established Brand & Market Heritage - Operating since 1895, Victoria Plc has built strong brand credibility and trust, particularly across the UK and European markets.

- Diverse Product Portfolio - The company offers a wide range of flooring solutions beyond carpets, including ceramic tiles, luxury vinyl tiles (LVT), artificial grass, underlay, and accessories, catering to multiple customer segments.

- Geographic Reach & Distribution - With manufacturing and distribution sites across the UK, Europe, Australia, and North America, Victoria enjoys a broad customer base and a well established global supply network.

- Strategic Acquisitions - Victoria’s acquisition led growth strategy has helped expand its product range and strengthen its presence in key international markets.

- Focused Business Model - A balanced approach to organic growth and disciplined investments supports steady profitability and long term shareholder value.

Weaknesses of Victoria PLC

Despite its strengths, Victoria Plc faces a few internal challenges that could impact performance.

- Technology Investment Gap - The company’s current technological capabilities may fall short of future growth requirements, especially in areas like data analytics and digital platforms.

- Integration Challenges - Managing and integrating different organisational cultures following acquisitions can create operational inefficiencies.

- Operational & Financial Pressures - There is room to improve liquidity management and financial planning to ensure more efficient resource allocation.

- High Labour Turnover - Higher than average employee turnover can increase recruitment, training, and operational costs.

- Product Positioning Weakness - While sales remain strong, Victoria’s products do not always have clearly differentiated value propositions in competitive markets.

Opportunities of Victoria PLC

Several external trends present meaningful growth opportunities for Victoria Plc.

- Sustainability & Eco-Friendly Products - Rising demand for sustainable, recyclable, and environmentally friendly flooring solutions offers a chance to attract new customer segments.

- Government Trade Agreements - Evolving trade agreements and construction standards could help Victoria expand into new markets more efficiently.

- Digital Channels & eCommerce Growth - Strengthening online distribution, digital marketing, and customer insights can improve engagement and revenue generation.

- Post Recession Recovery - Improving economic conditions and increased spending on home renovations and construction projects may drive higher demand for flooring products.

Threats of Victoria PLC

Victoria Plc must also navigate several external risks that could affect its business performance.

- Competitive Pressures - Global competitors are continuously investing in new technologies, materials, and cost efficient production methods.

- Supplier Bargaining Power - Dependence on a limited pool of suppliers may expose the company to rising raw material and input costs.

- Currency Fluctuations - Operating across multiple international markets makes Victoria vulnerable to foreign exchange volatility.

- Emerging Market Entrants - New players with leaner cost structures could intensify competition and erode market share.

- Macroeconomic Uncertainties - Inflation, interest rate changes, and recessionary risks may reduce construction activity and consumer spending on renovations.

SWOT of Victoria PLC

IIDE Student Takeaway, Recommendations & Conclusion

Victoria Plc remains a robust player in the global flooring industry, supported by a legacy brand, diversified offerings, and strategic growth initiatives. Its biggest advantages lie in its wide geographic footprint and long heritage, assets that build trust with customers and partners.

However, to stay competitive in 2026 and beyond, the company needs to:

- Invest more deeply in technology - especially data analytics and digital selling platforms.

- Clarify product positioning - to stand out in crowded markets.

- Strengthen integration practices - to maximize acquisition value.

Victoria’s future outlook hinges on its ability to adapt swiftly to global market changes while leveraging its deep operational strengths.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

More Case Study

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.