Orginally Written by Aditya Shastri

Updated on Dec 11, 2025

Share on:

Founded in 1907, Tata Steel is among the world’s most geographically diversified steel producers. With operations in 26+ countries and a legacy tied to the Tata Group, it remains an industrial cornerstone. But how is Tata Steel positioned in the current volatile steel market? Explore this deep-dive SWOT analysis to discover what future business strategists and entrepreneurs can learn from this century-old conglomerate.

About Tata Steel

Tata Steel, established in 1907, is a flagship company of the Tata Group. Known for its slogan "Values Stronger than Steel" the company embodies both legacy and innovation.

In 2025, it's recognised not only for its vast scale in India but also for its transitions in Europe. A SWOT analysis of Strengths, Weaknesses, Opportunities, and Threats provides a comprehensive 360-degree view of its current positioning.

Overview Table

| Attribute | Detail |

|---|---|

| Company Name | Tata Steel Limited |

| Founded | 1907 |

| Website | www.tatasteel.com |

| Industry | Steel, Mining, Manufacturing |

| Geographic Presence | India, Europe, South-East Asia, 26+ countries |

| Revenue (FY2025) | ₹2,18,543 crore (US$26 billion) |

| Net Income (FY2025) | ₹3,174 crore |

| Employees | 77,000+ globally |

| Main Competitors | JSW Steel, ArcelorMittal, SAIL |

Learn Digital Marketing for FREE

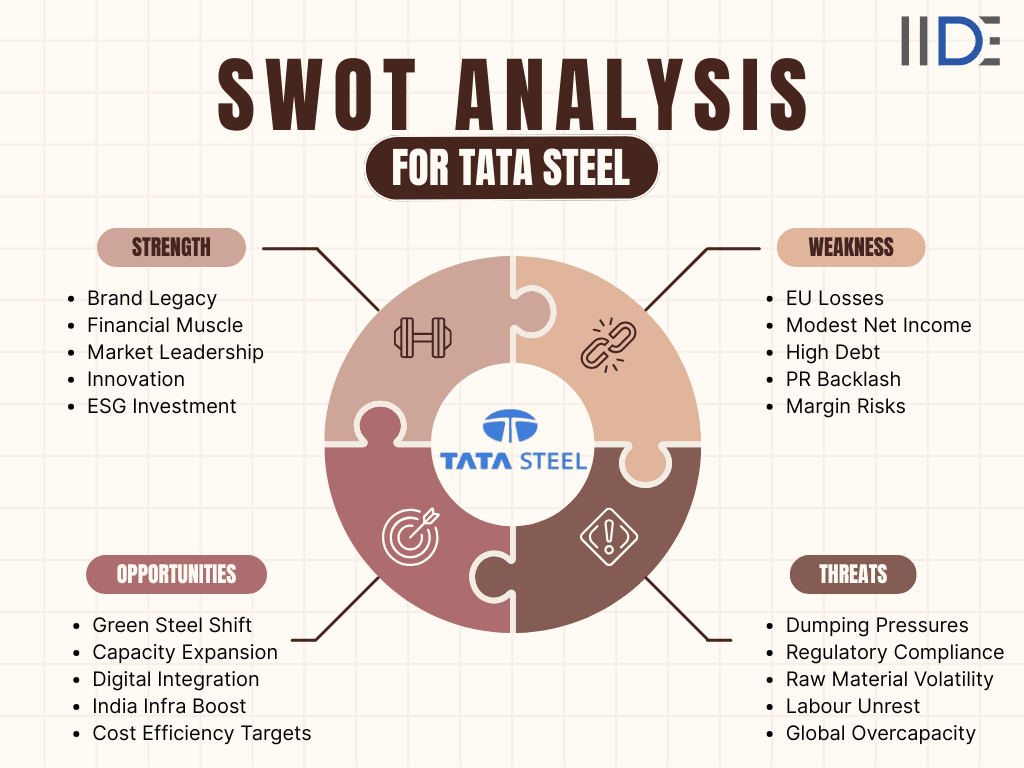

SWOT Analysis of Tata Steel

Brand Strengths

Brand Recognition & Reputation:

- Tata Steel’s century-long heritage under the Tata Group umbrella has cemented its reputation for integrity, quality, and innovation.

- The slogan “Values Stronger than Steel” reflects this legacy, as it is consistently reflected in its global presence and recognition.

Market Leadership:

- With a crude steel production of 21.7 MT and delivery of 20.9 MT in FY2025, Tata Steel remains one of India’s top steel manufacturers and a key global player.

- The Kalinganagar expansion to 8 MTpa underscores its industry dominance.

Financial Strength:

- Strong performance with ₹2.18 lakh crore in consolidated revenue and ₹25,802 crore EBITDA in FY2025.

- Standalone India operations delivered a 22% EBITDA margin, showcasing profitability.

Innovation & R&D:

- In FY2024, Tata Steel filed 142 patents and introduced 86 new products.

- Their R&D efforts also emphasise digitisation and sustainability, positioning them as tech-forward in an age-old industry.

Sustainability & ESG Focus:

- With ₹1,568 crore invested in ESG and HIsarna technology for CO2 reduction, Tata Steel is building a sustainability narrative that aligns with global climate priorities.

SWOT analysis of Saudi Aramco provides insight into how global resource companies navigate scale, regulation, and pricing volatility.

Brand Weaknesses

European Operational Losses:

- UK and Netherlands operations continue to underperform, with the UK recording a £385M EBITDA loss.

- Restructuring and decarbonization heavily weigh on the European business.

Modest Net Returns:

- Despite robust revenues, the net profit in FY2025 was ₹3,174 crore, with a modest ROE of ~6%, indicating room for financial efficiency improvements.

Debt Burden:

- Tata Steel carries a sizable total debt of ₹38,024 crore, resulting from capital-intensive expansions and restructuring initiatives.

Public Relations Challenges:

- Layoffs at Port Talbot, combined with prior environmental concerns, have drawn criticism, negatively impacting the brand's ethical image, particularly in Western markets.

Margin Vulnerability:

- High energy, raw material, and freight costs continue to challenge operating margins in non-Indian geographies.

SWOT analysis of Dabur presents a view on how legacy, trust, and supply chain strength support resilience in traditional industries.

Brand Opportunities

Green Steel Transformation:

- A £500M UK government-backed transition to electric arc furnaces (3.2 MT capacity) positions Tata Steel to meet future environmental regulations and tap into premium green steel markets.

Capacity Expansion in India:

- The ₹27,000 crore Kalinganagar project, which scales from 3 MT to 8 MT, enhances Tata Steel’s ability to meet the rising domestic infrastructure demand.

Digital Advancements:

- Adopting Industry 4.0 solutions, including AI-based predictive maintenance, can offer operational efficiency and reduced downtime.

Government Infrastructure Push:

- India’s massive investment in public infrastructure and the steel-heavy PM Gati Shakti initiative opens volume and margin growth avenues.

Cost Optimisation Strategy:

- Targeted ₹11,500 crore cost-saving across India, UK, and Netherlands will improve financial flexibility and reduce debt overhang.

Brand Threats

Dumping & Import Pressure:

- Chinese and Korean steel imports pose a threat to India's domestic pricing power, squeezing margins and impacting volume growth.

Environmental Regulation Costs:

- EU and UK green mandates require significant capital investment for compliance, particularly with the shift away from blast furnaces.

Commodity Price Fluctuations:

- Volatile coal and iron ore prices, as well as foreign exchange (forex) instability, pose a threat to financial predictability and margins.

Labour Discontent:

- Job cuts in the UK have triggered union resistance and may affect Tata Steel’s employer reputation and productivity.

Industry Overcapacity:

- Global excess steel capacity puts pressure on prices and intensifies competition from Asian and European producers.

SWOT analysis of Mahindra and Mahindra highlights how industrial diversity and rural strength can buffer external risks.

Summary Table – SWOT of TATA Steel

IIDE Student Takeaway, Conclusion & Recommendations

Tata Steel’s SWOT analysis reveals a powerful legacy brand navigating dual markets.

While its Indian operations are thriving with a 22% EBITDA margin, European losses underline systemic vulnerabilities.

The brand’s strength in innovation, scale, and ESG focus gives it a competitive edge.

However, heavy debt and reputational challenges in the UK must be carefully managed.

The core tension for Tata Steel lies in executing a profitable green transition while preserving market share in a globally saturated industry.

Tata Steel’s £500M UK arc furnace project and ₹27,000 Cr Indian expansion reflect proactive foresight, positioning it well for future growth, yet the company must balance this with financial discipline to avoid over-leveraging.

For students and entrepreneurs, Tata Steel exemplifies how even century-old giants must adapt or risk stagnation.

Its journey suggests several key takeaways:

- Prioritize Operational Digitization: Invest in AI-based personalization and mobile-first tools to gain real-time efficiency and scale operations.

- Balance Sustainability Goals with Stakeholder Sensitivity: While pursuing green initiatives, maintain transparent communication to manage public perception and mitigate PR risks.

- Leverage Cost-Cutting for Reinvestment: Utilize cost-cutting measures not just for margin protection but also as a means for reinvestment in innovation and sustainability initiatives.

In conclusion, Tata Steel's future depends on harmonizing financial discipline, environmental responsibility, and strategic expansion. Its playbook offers valuable lessons on resilience, reinvention, and global adaptability, emphasizing that even the strongest players must remain agile in an ever-changing world.

Want to Know Why 5,00,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Tata Steel is one of the world’s largest steel manufacturing companies, part of the Tata Group. It operates in multiple sectors, producing steel for a variety of applications, including automotive, construction, infrastructure, and industrial use.

Tata Steel was founded in 1907 by Jamsetji Tata and is one of the oldest steel manufacturers in India.

Tata Steel manufactures a wide range of products, including:

- Flat products (like hot-rolled and cold-rolled steel)

- Long products (such as bars, rods, and wire rods)

- Steel for the automotive and construction sectors

- Tubes, pipes, and other specialised products

- Steel solutions for packaging, infrastructure, and more

Tata Steel operates in over 26 countries, with a strong presence in Europe, India, and South-East Asia. It also has manufacturing facilities in countries such as the UK, the Netherlands, and Canada.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.