Orginally Written by Aditya Shastri

Updated on Jan 5, 2026

Share on:

Royal Bank of Canada (RBC) stands as Canada’s largest bank in 2026, carrying a legacy of more than 150 years in operation. Known for its broad service portfolio across banking, insurance, and capital markets, RBC continues shaping both the Canadian and international banking landscape.

But what makes RBC strong in 2026? What can risk its growth? And what are future opportunities?

This SWOT analysis answers the above questions. Whether you’re an entrepreneur, student,or industry professional, reading this blog will help you to learn about current finance market trends and RBC’s brand angles in a rapidly evolving financial environment.

Before diving into the article, I would like to inform you that the research and initial analysis for this piece were conducted by Monisha Roy. She is a current student in IIDE’s Online Digital Marketing Course, July batch 2025.

If you find this helpful, feel free to reach out to Monisha Roy to send a quick note of appreciation for this fantastic research, she will appreciate the Kudos! But to proceed with SWOT analysis, we’ll start with a brief introduction on the Royal Bank of Canada.

About Royal Bank of Canada

Founded in 1864 in Halifax, Nova Scotia, Royal Bank of Canada (RBC) is headquartered in Toronto, Ontario and is one of the largest Canadian banks by market capitalization. It serves over 17 million clients in Canada, U.S and other 27 countries with a workforce of over 97,000 employees with assets exceeding CA$2.3 trillion.

Its wider service range covers personal banking, commercial banking, wealth management, insurance, and capital markets.

RBC’s value-driven culture prioritises customers first, embraces diversity, integrates collaboration, accountability, and trust building. With this strong foundation, it has successfully secured its recognition as ‘North American Retail Bank of the Year’ for three consecutive years.

Adding to its achievements, the organisation has received International Loyalty Awards (2025) and Celent Model Bank Award for Digital Onboarding.

Quick Highlights of RBC

| Year Founded | 1864 |

|---|---|

| Corporate Headquarters | Toronto, Ontario, Canada |

| Employee strength | 97,000+ worldwide (2025) |

| Vision statement |

To be among the world’s most trusted and successful financial institutions. |

| No. of Clients | 17 million+ |

| Total Assets | CA$2.325T |

| Revenue (2024) | C$57.3 Billion |

| Net Income (2024) | C$16.2 Billion |

| Market Cap | ~CA$238 Billion |

| Top Competitors |

TD Bank, Scotiabank, BMO, CIBC, Bank of America |

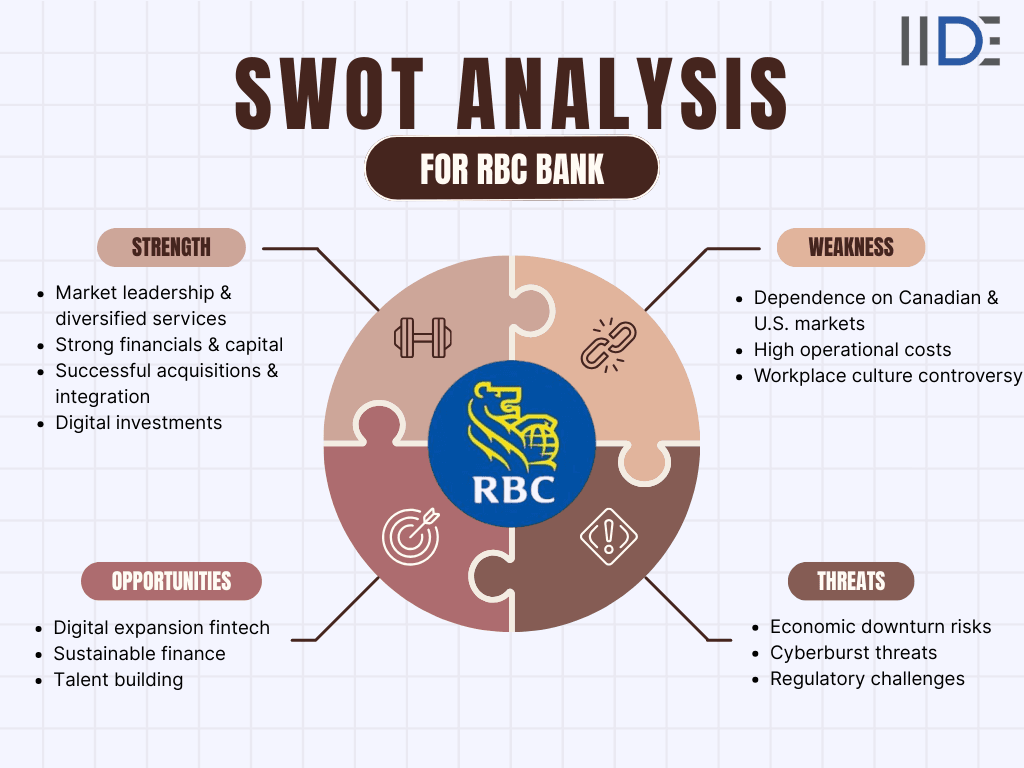

What SWOT stands for in the context of RBC?

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. In this article we will study each of these aspects to understand how RBC Bank Bank maintains its position in the competitive banking sector and what growth opportunities lie ahead in 2026.

Why SWOT Analysis Matters for RBC in 2026?

1. Competitive Disruption: To develop relevant strategy by identifying competitive pressure created over traditional banks by fintechs and digital challengers expanding lending, payments, and wealth solutions.

2. Changing Customer Expectations: To comprehend and adapt to shifting consumer demands, especially of younger demographics, who expect seamless digital experiences and personalized offerings.

3. Economic Uncertainty: To deal with unpredictable global economies that affect net interest margins due to concerns about recessions, credit quality, and fluctuating interest rates.

4. Sustainability & governance: To identify and stay relevant to Environmental, social, and governance (ESG) trends influencing growth and investor choices.

Learn Digital Marketing for FREE

SWOT Analysis of Royal Bank of Canada

A SWOT Analysis of the Royal Bank of Canada (RBC) gives a quick look at its strengths, weaknesses, opportunities, and threats in today’s banking industry. It shows how RBC uses its strong business model, works on strategic merger and acquisition, and explores new growth areas while keeping up with changing rules and technology. By looking at RBC’s position in 2026, we get a clear, easy understanding of where the bank stands and how it plans to stay ahead.

1. Strengths of RBC

Royal Bank of Canada holds multiple structural and strategic advantages. Let’s discover what makes RBS stand strong in 2026!

- Market leadership and financial power: RBC remains Canada’s largest bank by assets, market capitalization and client base. In 2025, it recorded around ~15% annual growth and continued to show high profits. This reflects its performance stability and is a dominant player in the international finance sector.

- Strong Financial Performance: In 2024, RBC generated C$57.3 billion in revenue and C$16.2 billion in profit, showing that the bank is performing very strongly. Its strong capital base also allows it to increase dividends and buy back shares. As a result, the organisation gets advantages of building trust and confidence among investors.

- Strategic Acquisitions: RBC has completed a number of major mergers and acquisitions (M&A) in the last few years. The merger of RBC with HSBC Canada, remains the most significant deal for the C$13.5 billion acquisition finalized in March 2024. This has helped strengthen the bank’s presence in Canada and gives it access to new clients, services, and growth opportunities.

- Diversified Business Model: With operations across personal banking, commercial banking, wealth management, insurance, and capital markets, RBC ensures its multichannel business portfolio. This wide service spectrum helps the bank stay stable even if one business area slows down. It also allows the firm to serve a wider customer range and capture growth opportunities across diverse financial sectors.

- Digital investments & innovation focus: RBC is investing more in digital upgrades and is using AI and cloud technology to make its services faster, smoother, and more efficient for customers. For instance, RBC spends over C$5 billion ($3.64 billion) annually on technology, including AI. A recent study reveals that, after JPMorgan Chase and Capital One, the bank was ranked third globally and first in Canada on large banks' AI maturity.

- High Return on Equity (ROE) and capital ratio: RBC regularly performs better than its competitors in efficiency and profits, with a strong ROE supporting long-term shareholder returns. Also its high CET1 ratio of about ~13.2%-13.5% highlights the bank's financial stability, strategic risk management capabilities. These strong capital levels allow the organisation to have flexibility to invest in growth and meet regulatory requirements effectively.

2. Weaknesses of RBC

Even though RBC is enjoying its strong market position, it has some internal limitations, this section aims to explore those hindrances. Understanding these factors can help to redevelop its strategic plan and reduce the chance of market loss in the near future.

- Heavy Reliance on Canadian and U.S. Markets: A significant portion of revenue still comes from Canada and the U.S., which makes the firm vulnerable to unpredicted economic fluctuations. Economic slowdown, rising unemployment, or tighter credit conditions, can directly impact RBC’s lending, deposits, and investment activities. This concentration further hinders risk management abilities through broader global diversification.

- Exposure to Mortgage Market: RBC’s large mortgage portfolio makes a close tie to Canada’s housing market. Statistically, it held around 21.7% of the Canadian residential mortgage market in mid-2024. However, any drop in home prices or changes in interest rates can directly affect its earnings due to this huge dependence on a particular sector.

- High operational Costs & Integration Challenges: Post-acquisition activities such as team integration, processes process alignment, have significantly increased RBC’s overall operating expenses. Also expansion in physical branches adds substantial costs of staffing, real estate, technology upkeep, and utilities. Consequently, these rising expenses can put pressure on its profitability, if cost-effectives plans are not implemented.

- Need for Digital Acceleration: The COVID-19 pandemic outbreak has drastically shifted the transaction pattern from traditional to digital mode. In order to cope with that and rising fintech challengers, RBC must continue investing in digital platforms and customer experience enhancements to stay competitive. Moreover, strengthening online banking, and simplifying digital processes will help RBC meet evolving customer needs and maintain its edge in a technology-driven market.

- Gender discrimination controversy: RBC is facing a federal lawsuit accusing it of gender-based pay discrimination by encouraging “boys club” culture, including a 30% bonus cut after maternity leave. Two female Managing Directors reportedly left in 2023, complaining over this issue. Whereas, RBC denies the claims and highlights updated parental-leave policies to ensure fair treatment. This controversy could down the work-culture reputation of the bank.

- Customer experience issues: Public feedback highlights challenges with service transitions such as long wait times, inconsistent brunch serve. In digital service areas, poor app performance, navigation, and response times have been reported. Improper or delayed action to these issues may reduce RBC’s customer satisfaction and retention rate.

Discover how US Bank's SWOT analysis reveals its market leadership, strong financials, and digital investments as key strengths, while navigating challenges like high operational costs and cyber threats for strategic growth.

3. Opportunities for RBC

RBC has many opportunities for growth in 2026 particularly by aligning with market trends and changing customer needs and market trends. Now, this section will further look into the areas of opportunities in detail.

- Strategic global Expansion & Acquisitions: Focus on strategic expansion and acquisitions in Asia, Latin America, and emerging markets could boost its global presence. Additionally, such moves would reduce its heavy reliance on the Canadian market and create new revenue streams. As a result, RBC will gain new customers and stay competitive at global level.

- Customer relationship: Nowadays, many people are relying more on personal savings for retirement for safeguarding their wealth. This has led to more clients being willing to pay for advice from financial experts. With this increasing demand for wealth management, RBC has opportunities to grow its lifetime values by fostering deeper client relationships building.

- Digital & FinTech Integration: Global consumer behavior is increasingly shaped by the rapid integration of digital technology into everyday life. Therefore, enhancing digital banking services and partnerships with fintechs can drive customer engagement and operational efficiency. These intergenerational steps will help RBC to address GenZ-driven service demand trends and influence their financial decisions closely.

- Sustainable Finance: Growing demand for sustainable financial products presents an opportunity for RBC to develop green loans and Environmental, Social, and Governance (ESG)-linked investment solutions. RBC can attract clients and investors interested in sustainability by offering products that support low-carbon projects, renewable energy, and ethical initiatives. This not only reinforces its brand position but also meets global climate goals and emerging regulatory expectations.

4. Threats to RBC

Although RBC is strong, it still faces external risks such as economic condition, fierce competition that could impact its business and finances. Understanding these threats is beneficial to recognize its improvement areas and develop relevant strategies. Here’s a closer look at what might hinder RBC’s business in 2026 and beyond.

- Economic Uncertainty & Potential Recession: According to a survey by the Bank of Canada, there is a 35% chance that Canada is already in a technical recession or may enter one within the next six months. This uncertainty can reduce customer spending, slow borrowing, and weaken business investment. For RBC, this may put pressure on its financial performance in terms of credit quality and poor loan growth.

- Competitive Pressure: RBC faces intense competition from other Big Five banks in Canada, due to similar client-base, products, and market share. Beside that, rapidly growing fintech companies are attracting customers with innovative, faster, and often more personalized financial solutions. This dual pressure can squeeze profit margins of RBC and challenge its customer retention rate as well.

- Cybersecurity Risks: With the rapid rise in digital adoption, the threats of cyberattacks and data breaches increases in the finance industry Any successful attack might risk sensitive client data, disrupt banking operations, and lead to financial losses. RBC, as an active digital finance service provider can face such massive breakdown if robust security measures and monitoring are not incorporated.

- Regulatory Changes: Continuously evolving financial rules and regulations can increase RBC's compliance costs and limit its lending capacities. Stricter regulations can also limit the bank’s capability to introduce new products, enter new markets or to lend freely, and hamper profitability. HSBC, a leading market player, faces similar regulatory pressures, which signify that RBC must navigate carefully to withstand these difficulties.

Royal Bank of Canada- SWOT Snapshot 2026

Explore Bank of Maharashtra's SWOT analysis to understand its regional diversified services and successful integrations as advantages, alongside opportunities in sustainable finance amid regulatory and economic pressures.

IIDE Student Takeaway, Conclusion & Recommendations for RBC

Highlights of Biggest Advantage vs. Biggest Risk

- Advantage: RBC’s diversified revenue streams and strategic acquisitions give it an edge in market reach.

- Risk: Economic volatility, high competition and cyber-security concerns, pose real threats to profitability.

Conclusion

The SWOT analysis of HBS reflects that the organisation is strong in 2026 with robust financial eco-system, market leadership, and digital innovation. However, there are challenges like market dependence, expenses, and reputational risks.

At the same time, opportunities in global expansion, fintech, improving client relationships and offering sustainable finance solutions are encouraging. To conclude, RBC will need to balance its growth with innovation, and client focus to stay forward and maintain its competitive position.

Recommendations

- Mortgage control: RBC may take strategic temporary plans to combat economic fluctuation by diversifying its loan types and offer non-mortgage loans to reduce overdependence on housing mortgages portfolio.

- Education programme: RBC may launch new educational programs or financial literacy campaigns and enhance its 2023 Indigenous Peoples Course. This step will engage younger clients and build long-term relationships relevant to current market requirements.

- Extensive monitoring: RBC needs to strengthen its monitoring system within its internal operation system to identify hassles faced by customers and improve this immediately to stay competitive.

- Training and talent acquisition: RBC may focus on enhancing employee training to improve communication and digital skills for stronger client relationships. Furthermore, it may hire regional talents within the host country to provide seamless service to global clients.

- Enhance cybersecurity investments: RBC may increase investments in cybersecurity to strengthen its digital security infrastructure and overall digital security resilience against potential online threats.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 23, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

Non-residents can apply online using RBC's non-resident application by selecting "NO" when asked about Canadian residency during the process.

Access balance inquiries, transfers, payroll, e-Transfers, bill pay, foreign exchange rates, and 24/7 transactions via RBC Mobile app or web portal.

RBC provides options like the Avion Visa Infinite Business for rewards on travel and cash back, with no annual fee on select plans and flexible payment terms.

RBC offers integrated payroll processing via RBC One platform, handling direct deposits, tax filings, and employee self-service for small to mid-sized businesses.

Through export financing, letters of credit, and multi-currency accounts, RBC helps businesses manage forex risks and global payments efficiently.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.