Explore the World of Startups After 12th – Register Free

Students Centric

Placements Report

Trackable results, real numbers

Reviews

Proven success, real voices

Trainers

Expert-led, Industry-Driven Training

Life at IIDE

Vibrant Spirit student life

Alumni

Successful Journeys, Inspiring Stories

Learning Centre

Webinars

Blogs

Case studies

Live, Interactive Masterclasses

Fresh Insights, quick reads

Real-life, Industry relevant

More

Hire from us

Hire Top Digital Marketing Talent

Work with us

Join Our Team, Make an Impact

Customised Training

Personalised digital marketing training for your company

Refer & earn

Simple, easy rewards

Contact us

Get the answers you need

About us

Know more about IIDE

Explore all course options

Trending

Professional Certification in AI Strategy

- Ideal for AI Enthusiast

Orginally Written by Aditya Shastri

Updated on Aug 9, 2025

In the previous article, we did an in-depth SWOT analysis on the U.S Bank. Today we are here with another detailed SWOT Analysis of PNC, one of the most dominant banks in the United States.

PNC – Pittsburgh National Corporation is the fifth-largest bank by assets in the United States. It provides its consumers, corporations, government, and other institutions with an array of financial products and services. PNC is dominating the financial services and asset management market of America.

The bank has maintained its position in the American market with all its efforts in working on its marketing strategies. In this developing digital period, they have been adopting advanced marketing strategies which are essential for reaching out and making a great Digital presence. So if you want to know how to utilize digital marketing for your benefit – take a look at our free masterclass on digital marketing by the CEO and Founder of IIDE, Karan shah.

Thus, this makes us keen to know everything about how PNC works. Here in this blog, we have a comprehensive SWOT analysis of PNC. But first, let’s take a look and know more about how PNC works as a firm.

About PNC

With the mergers between predecessor companies Pittsburgh National Corporation and Provident National Corporation the name came PNC is an American Multinational bank holding company and financial services headquartered in Pittsburgh, Pennsylvania, U.S. It has a proud heritage of more than 176 years old and 40 years old as PNC, it is among the top 10 big banks in the United States, and the largest banking group in Pittsburgh, Pennsylvania region.

Over 50 million private clients are served with wealth and asset management services by the financial institute, which employs over 62,000 people globally. PNC serves consumer and business banking services via 2,945 branches throughout its operations in 27 states of the United States. PNC Asset Management Group, in addition to financial services, provides loan services.

| CEO | William S. Demchak |

|---|---|

| Year Founded | 1845 |

| Origin | The United States |

| No. of Employees | 62,418 |

| Company Type | Public |

| Market Cap | US$ 94.60 Billion (2021) |

| Annual Revenue | US$ 16.901 Billion (2020) |

| Net Income/ Profit | US$ 7.558 Billion (2020) |

Products & Services by PNC

PNC provides different services to keep its consumers satisfied. PNC is one of the topmost banking groups in the world. Below mentioned are some of the PNC products and services.

- Personal and commercial banking

- Wealth management

- Investment services

- Financial planning

- Credit cards

- Insurance

- Mortgages

Competitors of PNC

PNC brings huge competition for itself, as it provides services in the whole world. Below mentioned are some of the competitors for PNC:

- U.S. Bank

- M&T Bank

- Wells Fargo

- Bank of America

- BB&T Corporation

Now that we have some idea of how PNC works, let’s focus on a detailed SWOT analysis of PNC.

SWOT Analysis of PNC

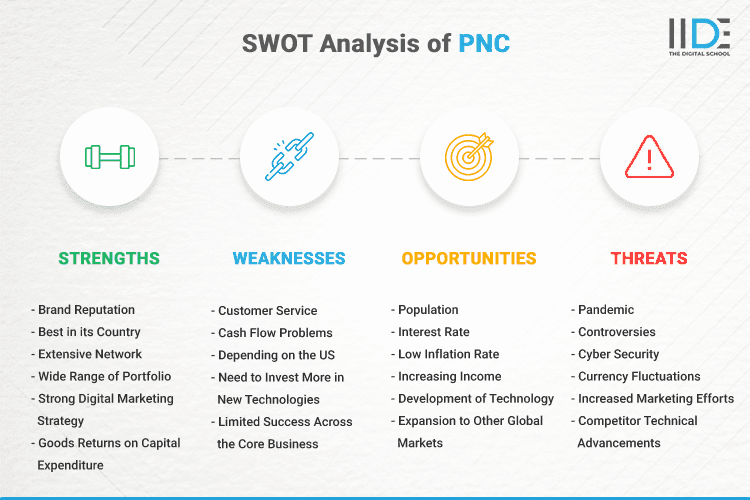

SWOT analysis of PNC is the study of strengths, weaknesses, opportunities, and threats of the company. This will help the company understand strong factors for their growth, weakness, and threats to rectify them for further growth.

To better understand the SWOT analysis of PNC, refer to the infographics below:

Below is a step-by-step detailed guide to help you with the SWOT analysis of PNC.

Strengths of PNC

Certain abilities of an organization that are advantageous in capturing market share, attracting more customers, and maximizing profits can be called the strengths of that organization.

- Extensive Network: The bank has more than 62,000 employees at 2900+ branches in the United States, making PNC the 5th largest bank by several branches.

- Wide Range of Portfolio: The variety of wealth management and financial services the bank offers acts as one of their strengths wherein they can be benefited from various offerings.

- Brand Reputation: PNC has been in the business of banking for a large number of years. Also, with the variety of secure services, it provides such as the virtual wallet of PNC which is backed with secured digital channels to provide its users to securely transact with PNC. These big steps made PNC established as a leader in the industry. This helps the corporation to gain a reputation and get recognized easily.

Useful Tip: The time is digital and you can build your business reputation online by learning the ways from an online reputation management course which is taught by digital industry experts in a simple yet effective way.

- Strong Digital Marketing Strategy: With a very strong online presence on every social media site has built a strong customer relationship. Want to know how social media works as a strength for PNC? Then you must check out the benefits of social media marketing to get the answer to your query.

- Best in its Country: The Bank is the best in the United States in terms of institutional asset management and wealth management services.

- Goods Returns on Capital Expenditure: PNC is relatively successful at executing net income of US$ 7.558 Billion from annual revenue of US$ 16.901 Billion.

Weakness of PNC

Weakness is the area where PNC can improve upon by building strategies. Below mentioned are the weakness of PNC:

- Limited Success Across the Core Business: Although PNC is one of the leading organizations in its industry it faces challenges in moving to other product segments with its present culture.

- Cash Flow Problems: There is a lack of proper financial planning at PNC regarding cash flows, leading to certain circumstances where there isn’t enough cash flow as required leading to unnecessary unplanned borrowing.

- Need to Invest More in New Technologies: According to the country’s scale of expansion and the geographical areas PNC needs to invest more money in technology to integrate the processes across the board. Currently, the investment in technology is not on par as per the vision of the company.

- Customer Service: Improper customer service, as well as lack of solving customer queries, can cause a negative image of the brand. This can either be through mouth publicity or by any other means.

- Depending on the US: PNC’s global presence is not up to the mark. The bank is dependent more on the US. Also, the PNC lags behind the top US banks in terms of financial and banking services.

Opportunities for PNC

Opportunities are external factors that allow an organisation to grow and be more profitable. Following are some opportunities for PNC:

- Expansion to Other Global Markets: The company is planning to expand to more developing countries. This serves them as an opportunity to acquire a new customer base.

- Development of Technology: Since the FinTech industry is growing at a very rapid pace, there are advancements in technologies too. Using these kinds of technologies can increase efficiency and decrease cost.

- Increasing Income: There has been an increase in average household income along with an increase in consumer spending following the recession. This will result in growth in the PNC’s target market with new customers that can be attracted towards the business.

- Population: The population has been growing and is expected to grow at a positive rate for the upcoming years. This is beneficial for the PNC as there will be an increase in the number of potential customers that it can target.

- Interest Rate: Lower interest rates than compared to previous years provides an opportunity for the PNC to undergo expansion projects that are financed with loans at a cheaper interest rate.

- Low Inflation Rate: The low inflation rate can bring more stability in the market and enable credit at a lower interest rate to the customers of the PNC.

Threats to PNC

The threats faced by the PNC are listed below:

- Currency Fluctuations: As the company is operating in numerous countries it is exposed to currency fluctuations especially given the volatile political climate in several markets across the world.

- Competitor Technical Advancements: New technological advancements by a few competitors within the sector constitutes a threat to PNC since customers who are drawn to this new technology may switch to competitors, reducing PNC’s overall market share.

- Pandemic: Financial losses incurred by companies as well as individuals can cause a threat to the bank in repayment of loans.

- Increased Marketing Efforts: Due to the rise of digital marketing, there is an increasing number of promotional messages which are being sent by competitors. It clutters up the space, which leads to losing out on customers. PNC is well versed and trying to adopt a variety of the latest digital marketing skills to get ahead of the competition. You must also check out these skills to achieve the same.

- Controversies: PNC has been in more than 5+ legal controversies including security fraud settlement, not giving overtime wages, lawsuits from a military channel and many more.

- Cyber Security: It’s been one of the major risk factors in the financial sector. Such as recently, a woman from Washington country’s bank account was wiped out by a hacker pretending to be a bank representative.

This ends our detailed SWOT analysis of PNC. Let us conclude our learning below.

Learn Digital Marketing for FREE

- 45 Mins Masterclass

- Watch Anytime, Anywhere

- 1,00,000+ Students Enrolled

To Conclude

PNC is growing in the sector of banking in the United States, as well as the global market too. As we had a look at the SWOT Analysis of PNC, there is a lot more to grow in many aspects.

With the emergence of the digital world, where almost every individual spends at least an hour of his/her time on phones, proper digital marketing, and online presence can be a great way to improve customer relations.

If you want to learn digital marketing or want to upskill yourself. Take a look at our 3 Months Advanced Digital Marketing course where you can learn everything about digital marketing in-depth just like this case study.

We hope this blog on the SWOT Analysis of PNC has given you a good insight into the company’s strengths, weaknesses, opportunities, and threats. You can also read our comprehensive study on the SWOT Analysis of JP Morgan Chase.

If you enjoy in-depth company research just like the SWOT analysis of PNC, check out our IIDE Knowledge portal for more fascinating case studies.

Thank you for taking the time to read this, and do share your thoughts on this case study of the SWOT analysis of PNC in the comments section below.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

Courses Recommended for you

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

- Bosch 2025: Strategic Insights into Market Position, Challenges, and Growth Opportunities

- Nasher Miles Marketing Strategy 2025: A Journey from Trolleys to Trendsetters

- Beco Marketing Strategy 2025: Leading India’s Eco-Friendly Revolution

- P-TAL Marketing Case Study: Reviving India’s Timeless Craftsmanship

- Marketing Case Study: Rocca - Rising Above the Chocolate Crowd in India

- Unveiling What's Up Wellness Marketing Strategy: Key Tactics and Insights

- Lenskart Marketing Strategy 2025: AI, Content & Omni-Channel Success

- Ruban's Jewelry Marketing Strategy for Crafting Timeless Success in the Luxury Market

- Decoding iMumz’s Marketing Playbook: A Wellness Brand Built on Empathy

- Nish Hair Marketing Strategy: The Complete AIDA Playbook for D2C Success

Author's Note:

I’m Aditya Shastri, and this case study has been created with the support of my students from IIDE's digital marketing courses.

The practical assignments, case studies, and simulations completed by the students in these courses have been crucial in shaping the insights presented here.

If you found this case study helpful, feel free to leave a comment below.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.