Updated on Jan 5, 2026

Share on:

As we move into 2026, Phoenix Mills continues shaping India’s premium retail and real-estate landscape. But what differentiates it this year? Are there emerging opportunities or rising risks that investors and businesses should watch?

This introduction sets the groundwork for a clear understanding of the company’s strategy, market positioning, and future prospects, leading into a detailed SWOT analysis that highlights what truly drives Phoenix Mills in 2026.

Before diving into the article, I would like to inform you that the research and initial analysis for this piece were conducted by Muskan Tawri. She is a current student in IIDE’s Online Digital Marketing Course, July Batch 2025.

If you found this helpful, feel free to reach out to Muskan Tawri to send a quick note of appreciation for her fantastic research, she will appreciate the kiddos!

About Phoenix Mills

Phoenix Mills has come a long way from its beginnings in 1905, when it started as a textile mill in Mumbai. Over the decades, it transformed itself into one of India’s most influential retail-led mixed-use developers, shaping some of the country’s most iconic malls Phoenix Marketcity and Palladium being its crown jewels.

The brand’s guiding philosophy, often reflected in its slogan Creating Retail Destinations, speaks to its mission of building spaces that blend shopping, entertainment, dining, and culture into one immersive ecosystem.

But here’s a story that truly captures Phoenix Mills’ journey: What began as a single textile mill in a crowded corner of Mumbai has grown into a network of landmark properties across major Indian cities, places that attract millions of visitors each year and influence urban lifestyles.

This shift wasn’t accidental; it was a bold reinvention driven by consumer trends, strategic foresight, and a deep understanding of how people connect with spaces.

Key Highlights

| CATEGORY | DETAILS |

|---|---|

| Founded | 1905 |

| Headquarters | Mumbai, India |

| Industry |

Retail-led real estate, mixed-use developments |

| Flagship properties |

Phoenix Marketcity (Mumbai, Pune, Chennai, Bangalore), Palladium |

| Core Strength |

Large-scale lifestyle destinations combining retail, entertainment, and dining |

| Brand Slogan | Creating Retail Destinations |

| Relevance in 2024-2026 |

Expanding premium mall portfolio, rising footfall, strategic mixed-use townships |

What Does SWOT Mean for Phoenix Mills?

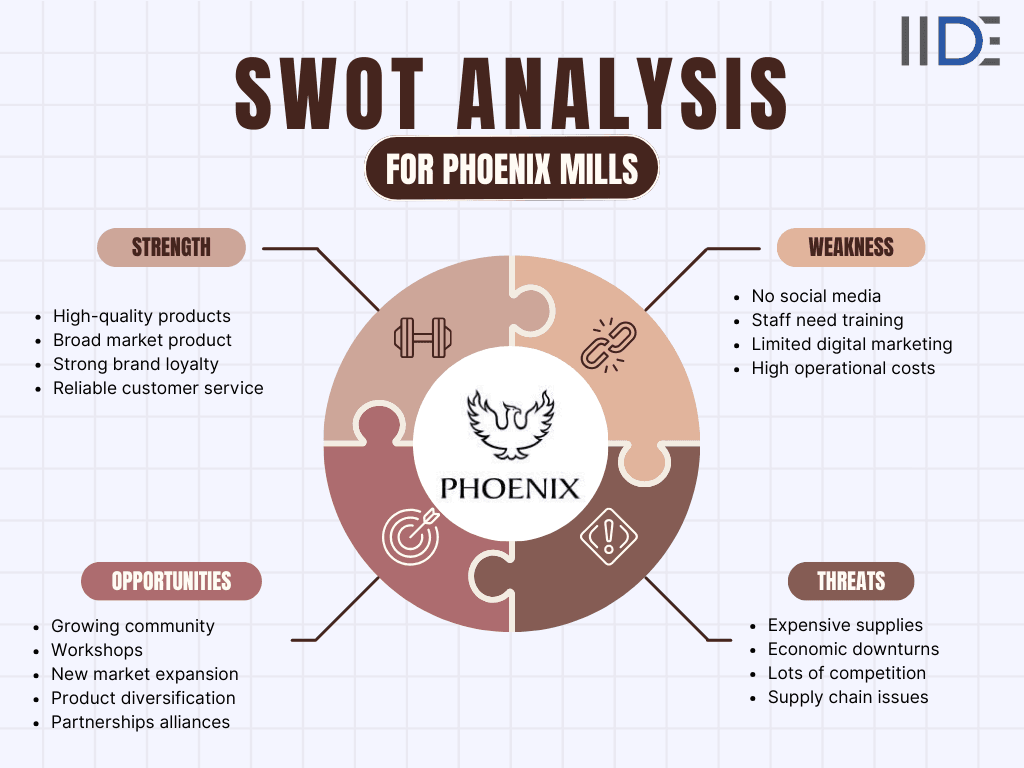

In this analysis, we’ll break down Phoenix Mills through the SWOT framework:

- Strengths: What the brand does exceptionally well

- Weaknesses: Internal limitations that may slow progress

- Opportunities: External trends the brand can leverage

- Threats: Challenges that could impact its future

This will help us understand how Phoenix Mills is navigating 2026 and what lies ahead for the company.

Why SWOT Analysis Matters for Phoenix Mills in 2026?

1. Growing Competitive Landscape: Phoenix Mills faces pressure from traditional mall developers and new competitors like mixed-use township builders, global investors, and experiential retail brands. A SWOT analysis helps the company understand where it stands and how it can protect its advantage.

2. Shifts in Consumer Preferences: Shoppers in 2026 expect more than retail they want entertainment, luxury experiences, events, digital convenience, and sustainable spaces. Analyzing strengths and weaknesses helps Phoenix Mills stay aligned with what today’s customers truly value.

3. Rapid Impact of Technology & Innovation: Automation, smart mall systems, data-driven tenant planning, and digital customer experiences are reshaping the industry. A SWOT analysis helps Phoenix Mills evaluate how well it is adapting to these changes and where more innovation is needed.

4. Economic Conditions & Market Uncertainty: Rising costs, inflation, interest-rate fluctuations, and changes in consumer spending habits can influence footfall and tenant performance. SWOT helps the company plan for economic risks and identify opportunities for resilience.

5. Expectations Around Social Responsibility: Consumers and investors increasingly prefer brands that support communities, reduce environmental impact, and create inclusive spaces. SWOT helps Phoenix Mills identify areas where it can strengthen its social responsibility initiatives.

6. Need for Strong Ethical & Sustainable Practices: Ethical sourcing, transparent operations, fair tenant policies, and sustainable building practices are becoming essential. A SWOT analysis highlights where Phoenix Mills is doing well and where it must improve to protect brand trust.

Learn Digital Marketing for FREE

SWOT Analysis of Phoenix Mills

The SWOT Analysis of Phoenix Mills highlights the brand’s strong position in India’s retail real estate sector, supported by its premium malls and consistent customer appeal. While its strengths include high brand visibility and experiential destinations, challenges such as rising costs and regulatory pressure remain areas to watch.

The company has promising opportunities in expanding into new cities and tapping the growing demand for lifestyle-focused retail, but it must also navigate threats from emerging competitors, changing consumer habits, and digital disruption.

1. Strengths of Phoenix Mills: Why It Remains a Powerhouse in India’s Retail & Real Estate Industry

Phoenix Mills Limited (PML) has steadily built a reputation as India’s most influential retail-led mixed-use developer, known for iconic destinations like Phoenix Marketcity and Palladium. Backed by strong financial growth, premium brand partnerships, and landmark developments, the company continues to dominate India’s retail and commercial real-estate space in 2026 and beyond.

Strong Leadership in India’s Retail Mall Industry:

- Operates some of the most popular malls in India, with high daily footfall.

- Builds malls that are more than shopping spaces, entertainment, food, and events all in one place.

- Strong brand mix helps Phoenix malls achieve higher sales per square foot compared to competitors.

Powerful Global Brand Partnerships:

- First choice for international brands entering India.

- Hosts well-known categories: fashion, beauty, electronics, lifestyle.

- Strong retail performance attracts more premium brands every year.

- Special campaigns and events increase brand visibility.

Strong Expansion and Future Growth Plan (2026 & Beyond):

- Building new Marketcity and Palladium malls in major Indian cities.

- Focus on future-ready designs: mixed-use spaces with offices + retail + hotels.

- Sustainability-focused construction for long-term efficiency.

- Constant upgrades ensure the malls stay relevant for the next decade.

Strong Backing and Industry Trust:

- Supported by global investor CPPIB, giving long-term financial security.

- Over 100 years of legacy evolving from textile mills to premium real estate.

- Known for high-quality construction, governance, and reliability.

- Strong industry reputation attracts new retailers and investors easily.

2. Phoenix Mills Weaknesses: Key Challenges for India’s Mall Leader in 2026

Phoenix Mills is a strong retail real-estate brand, but it still faces challenges that limit its growth. Here are the major weaknesses that may affect the company in the coming years.

Heavy Dependence on Metro Cities:

- Most Phoenix malls are in big metros; competitors like Nexus Malls dominate Tier-2 cities.

- Economic slowdowns in metros can quickly affect Phoenix’s rentals and footfall.

- Limited presence in emerging cities means missing early growth opportunities.

Slow Expansion Compared to Competitors:

- Phoenix opens fewer malls per year than DLF or Lulu Group.

- Long development timelines reduce first-mover advantage in new markets.

- Competitors expand quickly into North and South India while Phoenix moves cautiously.

Slower Digital Adoption Than Competitors:

- Phoenix is improving digitally but still behind DLF’s advanced digital loyalty systems.

- Limited integration between online customer behavior and in-mall shopping.

- Younger shoppers expect stronger digital engagement and rewards.

- Lower digital reach may weaken long-term customer engagement.

Discover innovative marketing strategy of Phoenix Mills that blends experiential retail events, digital campaigns, and luxury brand partnerships to dominate India's premium mall landscape and drive footfall growth.

3. Phoenix Mills Opportunities: New Growth Paths for India’s Retail Leader

Phoenix Mills has strong potential to grow as shopping habits change and new consumer groups, especially Gen Z, shape how malls look in the future. Here are the key opportunities ahead.

Tapping Global Trend: “Experience-Focused Malls”:

- Gen Z prefers malls with events, ambience, and social hangouts, not just stores.

- Phoenix has already tested experience-led zones like seasonal décor installations that go viral on Instagram.

- Entertainment pilots such as gaming pop-ups and live music events at Marketcity malls show high engagement.

- This helps Phoenix attract repeat visitors, not just shoppers.

Growth in Tier-2 Cities with Rising Middle-Class Demand:

- Global shift: emerging cities are becoming new consumption hubs.

- Gen Z in these cities demands modern cafes, fashion stores, and entertainment spaces.

- Phoenix’s “Marketcity” format can expand to cities like Indore, Jaipur, Lucknow, Coimbatore.

- Lower real estate costs make long-term returns stronger.

Digital Integration & Gen Z Loyalty Programs:

- Global trend: malls use apps, rewards, and data analytics to personalize offers.

- Gen Z expects quick digital rewards, QR deals, and mobile-led experiences.

- Phoenix can enhance its loyalty program with real-time points and app-exclusive offers.

- Pilot campaigns like brand pop-up notifications and app-based event booking show good response.

- Strong digital adoption will boost footfall and repeat visits.

Surge in International Brands Entering India:

- Gen Z drives strong demand for beauty, fashion, and tech labels.

- Phoenix already hosts many flagship stores (Zara, H&M, Sephora, Apple).

- New brands entering India prefer malls with high-quality infrastructure, Phoenix is a top choice.

- Phoenix can secure more exclusive/first-in-city store launches.

- Pilot expansions by brands in Palladium Mumbai show strong sales traction.

4. Phoenix Mills Threats: Rising Challenges for India’s Retail Real Estate Giant

Phoenix Mills is a strong player in India’s mall industry, but changing consumer habits and global market shifts bring new risks. Understanding these threats helps reveal where the brand must stay alert.

Shift Toward Online Shopping & Global E-Commerce Trends:

- Global trend: online retail is growing faster than physical retail in many regions.

- Gen Z shops heavily via apps, quick commerce, and influencer-led brands, reducing store visits.

- International e-commerce giants like Amazon and Shein attract price-sensitive youth.

- Lower mall footfall can impact tenant sales and rental growth.

Rising Competition from New Mall Developers:

- Competitors like Nexus, DLF, Lulu, and Prestige are expanding aggressively across India.

- New malls offer modern designs and digital-first experiences that attract Gen Z.

- Competitor loyalty programs and tech integrations may shift shoppers away.

- Brands may choose malls with lower rentals or stronger traffic.

Economic Slowdowns Impact Premium Spending:

- Global inflation trends reduce discretionary spending worldwide.

- Gen Z cuts luxury shopping first during economic stress, focusing on affordable online alternatives.

- Premium brands may downsize or renegotiate rents during low-demand periods.

- Mall revenues become unpredictable during downturns.

Changing Lifestyle Trends Among Gen Z:

- Younger consumers spend more on cafes, concerts, creators, and entertainment than on clothing.

- If malls don’t evolve fast enough, Gen Z may prefer standalone experience hubs.

- Pop-up culture and street-style retail reduce dependency on big mall spaces.

- Social media-led discovery means brands don’t always need mall visibility.

Uncover the SWOT analysis of Balrampur Chini Mills to reveal its dominant sugar production strengths and ethanol expansion opportunities amid raw material price volatility and regulatory hurdles in India's competitive agri-processing sector.

IIDE Student Takeaway, Conclusion & Recommendations

From the SWOT analysis, Phoenix Mills shows strong fundamentals, premium malls, high-performing global brands, and proven experience-led formats. However, it also faces threats like rising digital shopping trends, competition from new-age mall developers, and its heavy dependence on metro cities.

The core tension sits between Phoenix Mills traditional, high-end physical mall model and India’s rapidly shifting digital, convenience-first, and youth-driven retail behavior.

Recommendations:

- Expand faster into Tier-2 cities to capture new demand.

- Strengthen digital loyalty programs to engage Gen Z.

- Invest in more pilot experiences like pop-ups, creator events, and tech-led zones.

- Build sustainable, energy-efficient mall formats to manage long-term costs.

Future Outlook:

Phoenix Mills can continue to dominate India’s retail landscape if it blends strong physical experiences with digital innovation and youth-first strategies.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Feb 20, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

Phoenix Mills develops and manages retail malls, hospitality, offices, and residential projects spanning over 11 million sq ft in cities like Mumbai, Pune, and Bangalore.

In the 1980s-2000s, amid textile decline, it redeveloped mill land into High Street Phoenix, launching retail and commercial spaces by 1987.

Owned by the Ruia family, chaired by Atul Ruia, with public shares traded on BSE/NSE under PHOENIXLTD.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.