Orginally Written by Aditya Shastri

Updated on Dec 12, 2025

Share on:

Nvidia, founded in 1993, has established itself as the global leader in graphics processing units (GPUs) and, more recently, artificial intelligence (AI). With an unprecedented market valuation of $4 trillion in 2026, Nvidia continues to dominate AI hardware, helping power everything from gaming to data centres. Want to understand the strengths, weaknesses, opportunities, and threats that shape Nvidia's future? This detailed SWOT analysis will provide the answers.

About Nvidia

Founded in 1993, Nvidia Corporation is a leader in the gaming, AI, and semiconductor industries. Known for its cutting-edge GPU technology, Nvidia powers everything from high-performance gaming to artificial intelligence. The company’s slogan, "The Way It's Meant to Be Played", emphasises its commitment to providing gamers with exceptional experiences.

By 2026, Nvidia reached a $4 trillion market valuation, underscoring its significance in AI and gaming hardware.

| Attribute | Details |

|---|---|

| Official Company Name | Nvidia Corporation |

| Founded | 1993 (Santa Clara, California, USA) |

| Website | nvidia.com |

| Industries Served | Semiconductors, AI, Gaming, Automotive, Data Centres |

| Geographic Areas Served | Global |

| Revenue (FY25) | $44 billion (Q1 FY25) |

| Net Income (FY25) | $18.8 billion |

| Employees | ~36,000 |

| Main Competitors | AMD, Intel, Qualcomm, Broadcom, Arm Holdings |

Learn Digital Marketing for FREE

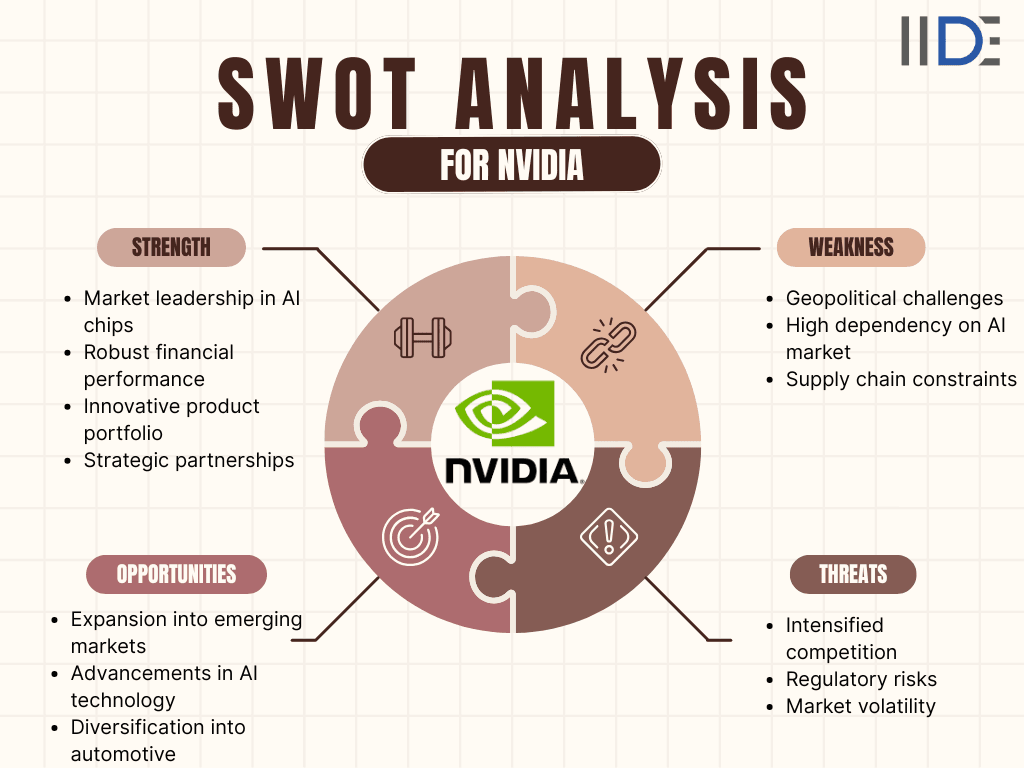

SWOT Analysis of Nvidia

Brand Strength: Nvidia’s Superpowers in 2026

Market Leadership in AI Chips:

- Nvidia dominates the AI chip market with a market share of over 80%.

- Its H100 chips are the backbone of AI infrastructure, driving advancements in AI across industries like healthcare, automotive, and cloud computing.

- Nvidia's leadership in AI is central to its growth, and its chips are in high demand as AI adoption accelerates globally.

Robust Financial Performance:

- Nvidia’s Q1 FY25 revenue soared to $44 billion, marking a 69% year-over-year growth. This financial performance demonstrates Nvidia's strong position and reflects the booming demand for AI, gaming, and cloud technologies.

Innovative Product Portfolio:

- Nvidia’s GeForce RTX 50 Series continues to set the bar for gaming performance and graphics technology.

- The company consistently innovates, expanding its product lines and solidifying its position as a leader in both gaming and AI technology.

Strategic Partnerships:

- Nvidia has built strong alliances with tech giants like Microsoft, Meta, and Google, ensuring its leadership in the AI and cloud computing markets.

- These partnerships enable Nvidia to expand its reach and integrate its technology into the backbone of AI infrastructure and data centres.

Brand Weakness: Nvidia’s Struggles in 2026

Geopolitical and Regulatory Challenges:

- Nvidia faces hurdles due to trade restrictions, especially with China, where its market access and production capabilities are at risk.

- Ongoing regulatory scrutiny regarding its acquisitions and market dominance presents a challenge for Nvidia’s growth, especially in terms of potential delays or rejections of major mergers.

Overreliance on the AI Market:

- While AI is a key revenue driver, Nvidia’s overdependence on this market exposes it to volatility.

- The AI sector's fluctuations, regulatory challenges, and shifts in consumer demand for AI-powered devices may affect Nvidia’s revenue growth in the coming years.

Supply Chain Constraints:

- Nvidia relies on third-party manufacturers, such as TSMC, leaving it vulnerable to supply chain disruptions.

- The semiconductor shortage continues to impact its ability to meet demand, particularly as Nvidia’s chips are essential to AI infrastructure and gaming devices.

SWOT analysis of Asus offers a look at how a major Nvidia partner balances innovation, affordability, and global market presence.

Brand Opportunities: Future Moves for Nvidia

Expansion into Emerging Markets:

- With increasing demand for AI technology and gaming solutions, Nvidia has significant growth potential in emerging markets like Asia, Latin America, and Africa, where gaming and AI adoption are on the rise.

- Expanding its footprint in these markets could boost revenues.

Advancements in AI Technology:

- Nvidia is at the forefront of AI innovation with developments in its Rubin and Feynman microarchitectures.

- These advancements are set to solidify Nvidia’s leadership in the AI sector, especially in fields like deep learning, computer vision, and automated driving.

Diversification into Autonomous Vehicles:

- Nvidia’s DRIVE platform offers immense opportunities in the autonomous vehicle sector, positioning Nvidia as a key player in the future of self-driving cars and connected vehicle technologies.

- This expansion into autonomous vehicles could significantly broaden Nvidia's market share.

Sustainability Trends:

- With growing global demand for sustainable technology, Nvidia has an opportunity to lead the way in creating energy-efficient AI-driven solutions.

- As green technology becomes more prominent, Nvidia can align its products with environmental sustainability initiatives in industries like agriculture and healthcare.

Brand Threats: Nvidia’s Competitive & External Risks

Intensified Competition:

- Nvidia faces significant competition from AMD, which has been gaining ground in the GPU market.

- Additionally, emerging AI startups are starting to challenge Nvidia’s market share, especially in the AI chip and cloud computing sectors.

Geopolitical Tensions:

- Nvidia’s global operations expose it to geopolitical risks, particularly trade wars and export restrictions in key markets like China.

- Trade conflicts could disrupt its supply chains and lead to increased tariffs, potentially affecting its bottom line.

Economic Downturn:

- Global economic uncertainty and potential recessions could impact demand for high-end GPUs and AI solutions.

- As spending on tech and gaming may decrease during economic slowdowns, Nvidia could face slower sales growth.

Regulatory Pressures:

- Nvidia is also vulnerable to antitrust investigations in the event of acquisitions or market dominance concerns.

- Increased regulatory scrutiny on AI technology and data privacy could result in legal challenges or delays in product rollouts.

SWOT analysis of Acer highlights how PC brands integrate Nvidia’s technology while competing on scale, design, and pricing.

Summary Table – SWOT of Nvidia

IIDE Student Takeaway, Conclusion & Recommendations

Nvidia’s market dominance in the AI chip industry is unmatched, holding over 80% of the AI chip market share.

Its financial performance remains stellar, with Q1 FY25 revenue surging by 69% year-over-year, solidifying its position as a leader in both gaming and AI technology.

Innovations in GPUs and strategic partnerships with industry giants like Microsoft and Google strengthen Nvidia’s ability to lead in the AI and gaming sectors.

However, Nvidia's reliance on AI, coupled with geopolitical challenges such as trade restrictions and regulatory risks, presents significant vulnerabilities.

Core Tension:

The core tension for Nvidia lies in its overdependence on AI technologies, which, while profitable, exposes the company to market volatility.

With increasing regulatory scrutiny and trade restrictions, particularly in key markets like China, Nvidia faces uncertainty that could disrupt its supply chain and affect its long-term growth.

Additionally, the geopolitical instability introduces challenges for its international operations and expansion strategies.

Future Outlook:

Nvidia is positioned for sustained growth, particularly in the AI and gaming industries, with its ongoing investments in autonomous vehicles and the development of next-gen AI architectures.

The company’s diversification into emerging sectors strengthens its competitive edge, yet external factors like global economic conditions and regulatory pressures will play a significant role in determining its trajectory.

Actionable Recommendations:

Expand into Emerging Markets: Nvidia should focus on strengthening its presence in developing economies where AI and gaming adoption are growing rapidly. This will help the company tap into new revenue streams and reduce reliance on saturated markets.

Diversify Product Portfolio: To mitigate risks associated with its overdependence on AI, Nvidia should explore opportunities in autonomous vehicles and sustainable technology, aligning itself with global shifts toward eco-friendly innovations.

Strengthen Supply Chain Resilience: Nvidia should diversify its supplier base and establish contingency plans to protect against geopolitical disruptions, ensuring smoother production and delivery processes.

Conclusion:

Nvidia’s future looks promising, driven by strong financials, market leadership, and continuous innovation in AI and gaming technologies.

However, the company must address its vulnerabilities, such as geopolitical risks and supply chain challenges, to secure long-term growth.

By diversifying its portfolio, expanding into emerging markets, and enhancing resilience against external threats, Nvidia can maintain its leadership in the evolving tech landscape.

Want to Know Why 5,00,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

GeForce graphics cards are primarily designed for gaming and consumer use, offering high performance for video games and multimedia applications.

Quadro graphics cards are designed for professionals and are optimised for tasks such as computer-aided design (CAD), 3D rendering, video editing, and other content creation applications. They offer enhanced stability and performance for professional use.

The NVIDIA RTX series refers to a family of graphics cards powered by NVIDIA's Turing architecture, featuring real-time ray tracing and AI-driven features. The RTX cards, such as the RTX 3080, RTX 3070, and RTX 3090, provide enhanced graphical performance for gaming, professional visualisation, and content creation.

No, in addition to graphics cards, NVIDIA is involved in the development of products for:

- Artificial Intelligence (AI)

- Data centres and cloud computing

- Autonomous vehicles (through their NVIDIA Drive platform)

- Mobile gaming (with the NVIDIA Shield)

- Supercomputing (with products like NVIDIA DGX systems)

NVIDIA is a leader in AI and deep learning, providing hardware and software solutions for training and deploying machine learning models. Their NVIDIA A100 Tensor Core GPUs are used extensively in AI data centres, providing powerful performance for tasks such as data processing, neural network training, and inference.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.