Explore the World of Startups After 12th – Register Free

Students Centric

Placements Report

Trackable results, real numbers

Reviews

Proven success, real voices

Trainers

Expert-led, Industry-Driven Training

Life at IIDE

Vibrant Spirit student life

Alumni

Successful Journeys, Inspiring Stories

Learning Centre

Webinars

Blogs

Case studies

Live, Interactive Masterclasses

Fresh Insights, quick reads

Real-life, Industry relevant

More

Hire from us

Hire Top Digital Marketing Talent

Work with us

Join Our Team, Make an Impact

Customised Training

Personalised digital marketing training for your company

Refer & earn

Simple, easy rewards

Contact us

Get the answers you need

About us

Know more about IIDE

Explore all course options

Trending

Professional Certification in AI Strategy

- Ideal for AI Enthusiast

Orginally Written by Aditya Shastri

Updated on Aug 9, 2025

Previously we looked at the elaborated marketing strategy of Microsoft, the world’s leading software application provider. Now, let us hop over and look at the elaborated SWOT Analysis of Eduvanz.

Eduvanz is a Non-Banking Financial Institution (NBFC) providing low-interest education loan services. Founded in the year 2016, eduvanz has become a leading student loan provider across India. Eduvanz’s goal is to help learners by providing fast, convenient, and low-cost education loans.

The way to attract clients is to be on top. Digital Marketing has become an important aspect and in such a competitive industry, digital marketing is a must. You can check out the free digital marketing Masterclass on different concepts of digital marketing.

The education loan industry has seen a sharp increase in demand due to the pandemic. As the average income per working population decreases, demand for education loans will see a boom in the coming future. Any person, whether earning in lakhs or crores always dreams of sending his children to top schools and colleges across the globe. When it comes to payment, paying the fee amount at once has been difficult in a new era.

As of 2022, technology has made its way into every industry in some or the other way. In the loan industry, technology such as AI algorithms, software, and data analysis has been introduced by various companies. Eduvanz has also developed its own proprietary AI algorithms and software to assess the risks involved and determine the interest rate and assist their customer.

Eduvanz has also partnered with the best corporates and certificate providers to increase their scope and to make skill-seekers much more skilful as required in today’s time. There are lots of options to choose from and finance becomes a blockade in a country like India whose per capita income is Rs 4,80,000 and for a family of 3 the average cost of living is around Rs 25,000 per person per month. If a low-interest education loan will be taken then the average person can save or invest to earn a high income to repay the loan.

As education institutes fees are paid late it is difficult to offer first-class education starting from day 1. Their money is stuck in the cash flow cycle and the quality of education diminishes.

Continuing with our topic, we will cover the strengths, weaknesses, opportunities, and threats surrounding Eduvanz. Before we begin, let us begin by learning about the company, its history, products, services, and financial success.

About Eduvanz

Founded in 2016 by Varun Chopra & Raheel Shah – Eduvanz, an NBFC is a leading education loan provider in India. They have financed over 20,000 + students and have partnered up with 350+ institutions. Eduvanz was started in 2016 and already has received 100 crores worth of investment from incorporations like Sequoia and Unitus. The license has been provided by the RBI. Eduvanz has come up with algorithms to determine the rate which is to be offered to every individual client.

As of 2022, they also have no-cost EMI apple products. This is a wonderful initiative because classes have been shifted to online mode and technology has become a need to increase skills.

Eduvanz annual revenue has increased by 200% in FY 21- 22. It shows that Eduvanz has been capturing the market. Eduvanz has also partnered with institutions that are offering part-time skill learning options. This means eduvanz is not only made for youngsters but people who wish to learn something new.

| Founder | Varun Chopra & Raheel Shah |

|---|---|

| Year Founded | 2016 |

| Origin | Mumbai, India |

| No. of Employees | 156+ |

| Company Type | Private |

| Market Cap | Rs 185 Crore (2021) |

| Annual Revenue | Rs 13.5 Crore (2021) |

| Net Income/ Profit | Rs 7.42 Crore (2021) |

Products & Services Offered by Eduvanz

Various services offered by the Eduvanz are: Eduvanz annual has seen a 200% increase:

- Low-Interest loans

- Apple Products

- Services to Educational Institutions

Eduvanz has received Rs 75 crores funding from Sequoia:

- Student Finance

- Pay it off

- Defynance

- Study Loans

Competitors of Eduvanz

- Lendi

- Drip Capital

- OnDeck

- Lendio

As now we have a better understanding of Eduvanz, let’s look into the SWOT Analysis of Eduvanz.

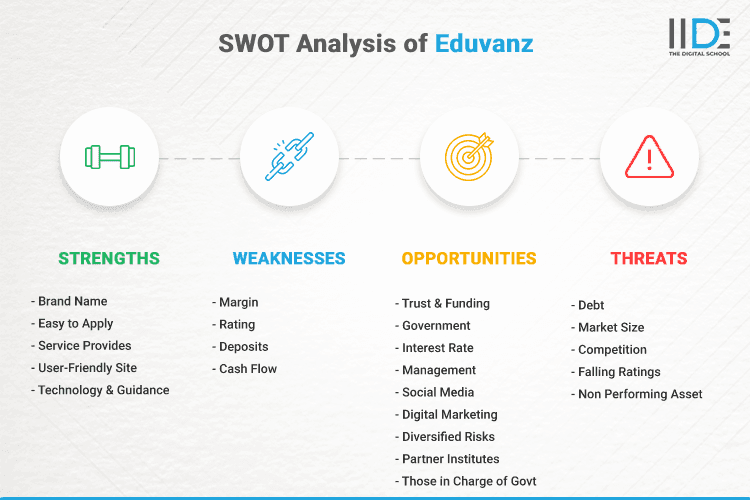

SWOT Analysis of Eduvanz

A SWOT analysis identifies a company’s strengths, weaknesses, opportunities, and threats. A proven and true management paradigm that allows Eduvanz to compare its business and performance with competitors and the industry as a whole.

So let us go ahead and first have a glance at the strengths of Eduvanz from the SWOT analysis of Eduvanz.

Strengths of Eduvanz

As one of the leading companies in the industry, Eduvanz. It has numerous strengths that make it stand out in the market. These strengths not only help protect your market share in existing markets but also help you penetrate new markets.

- Brand Name: The name ‘Eduvanz’ does not tie the company to just providing loan services as their core business. With the right amount of funding, they are growing their business deep into the education sector.

- Easy to Apply: The procedure to apply is simple which will increase customer satisfaction. If the procedure would be complicated, customers would prefer to take loans from competitors. For any firm, with more complicated procedures, customers are less likely to approach the business.

- User-Friendly Site: The site is simple and user-friendly. Navigating through the site is not all complicated. White, chosen as the background colour and the light colours used makes the site less stressful.

- Service Provides: It provides loans with low cost and low interest in many cities. Due to low cost, low-interest loans people are joining this company. It provides online and offline learning platforms. It has lots of courses for students.

- Technology & Guidance: They use their application to provide loans so people don’t need to go outside for the loans and it also guides how to use the app. Also, Eduvanz guides its customers on how to use apps and how to process loans and how pay the amount of a loan in instalments.

Weaknesses of Eduvanz

Strategy is all about choices and weaknesses are areas where companies can improve through SWOT analysis and leverage their competitive advantage and strategic positioning.

- Margin: As eduvanz moto low-interest rate loans, their gross margin on sales will not be huge and thus they can easily go in loss.

- Deposits: Currently, Eduvanz is not allowed to accept deposits, so equity debt will be at stake. Eduvanz not being an investment company can’t rely on investing in shares, stocks, etc.

- Rating: Eduvanz’s rating is 3.9 which may cause customers to prefer to take loans from their competitors instead of them. Eduvanz should try to increase its rating by providing good and fast services.

- Cash Flow: The cash flow can be a problem for Eduvanz, paying off debt is a slow process that takes up to years. Surviving on low-interest rates can be hard for eduvanz in the long run.

Opportunities for Eduvanz

Opportunities are potential areas for companies to focus on to improve results, increase sales, and ultimately profit.

- Partner Institutes: If signing deals with institutes with students coming from lower-income group families, eduvanz will have higher engagements with diversified risks. They should partner up with private institutions where students are looking to enrol but fail to pay the fees.

- Diversified Risks: On an average amount charged to learn any particular skill is RS 50,000 from a reputed institution. To earn higher revenue, lots of engagements are required and money would be divided more than banks taking a risk by giving crores worth rupees of loan to one organisation/ person.

- Management: Eduvanz has experienced Those charged with governance. They can train their workforce to accept the application of low-risk. Having trusted and well-trained staff makes the business efficient and there’s less chance of failure. As the decisions are taken by management, experience management is a necessity in this type of industry.

- Interest Rate: Interest rates are offered as RBI notification and based on performance. So, higher rates can be applied to certain students. As interest rates shall apply as per performance, highly deserving students will get fair rates and the risk would be lower.

- Funding: Funding has given Eduvanz a chance to grow. They can improve promotion or invest in a different industry. They can partner with many more institutions than before. Eduvanz recently raised a fund of Rs 100 Crores from Juvo to expand and build a robust IT infrastructure, AI/ML capabilities for risk assessment along with the hiring of key team members across distribution, institute partnerships, technology and operations.

- Government: The government is supporting education and also gives benefits to companies such as eduvanz. The cost will decrease which will increase profit, which indeed can be invested to grow the eduvanz business.

- Trust: Every loan applied and accepted application will increase their goodwill and they will be recommended by their customer.

- Digital Marketing: Eduvanz needs to spend time increasing its ranking on google. Without proper SEO, companies like HDFC bank will be preferred and are shown at the top.

- Social Media: Social media like Instagram is youth-focused, adding content of partnered institutes and promoting their site on social media will attract youngsters to apply for loans. Facebook will be useful for promotion sites among parents.

- Those in Charge of Governance: The board of directors knows to whom Eduvanz should provide loans. They should train their employees in such a way loans of less risk are given to people with higher interest.

Threats to Eduvanz

Threats are environmental factors that can harm a company’s development. Here are some of Eduvanz’s threats:

- Competition: There are lots of competitors who can offer better interest rates than Eduvanz. It is the biggest threat, marketing is needed to compete. As the competition keeps coming in Eduvanz’s Cost of acquisition of customers will get higher and prices too.

- Non Performing Asset: If the loan is given to everyone there will be a great risk that the loan won’t be repaid. The outstanding loan will eventually be called a non-performing asset performing asset. The more we do not perform, the cash flow cycle will decrease.

- Debt: Usually any debt taken is paid 5 to 15% which can be more than interest. So Earning After-Tax could be negative.

- Market Size: As the pandemic comes to an end people are getting job opportunities with their regular pay. The demand for loan-taking customers has decreased.

- Ratings: If not improved, disastrous consequences can happen. If trust goes, getting it back is not easy. Many customers make their decision by looking at the reviews and if not satisfied will not be interested in taking a loan from Eduvanz.

This ends our extensive SWOT analysis of Eduvanz. Let us conclude our learning below.

Learn Digital Marketing for FREE

- 45 Mins Masterclass

- Watch Anytime, Anywhere

- 1,00,000+ Students Enrolled

To Conclude

From the above, it can be concluded that Eduvanz’s capital is enough to grow but they need to be careful and research the new areas as the market has diminished. They need to work on digital marketing to stay with the competition and have a higher market share.

For Eduvanz, digital marketing has to improve to gain more market share. Currently, their site isn’t on top, and with help of SEOs, Social Media, etc they can get additional engagements. A team should be appointed to prime their official pages. Eduvanz has received a lot of funding and should use it carefully.

Digital marketing is the most important aspect of marketing in the digital era. To improve brand image and brand recognition digital marketing is needed. Digital marketer earns a lot on average in India.

If you are looking forward to making your career in digital marketing and are interested in learning more and upskilling, check out IIDE’s Online Digital Marketing Course to know more.

We hope this blog on the SWOT analysis of Eduvanz has given you a good insight into the company’s strengths, weaknesses, opportunities and threats.

If you enjoy in-depth company research just like the SWOT analysis of Eduvanz, check out our IIDE Knowledge portal for more fascinating case studies.

Thank you for taking the time to read this, and do share your thoughts on this case study of the SWOT analysis of Eduvanz in the comments section below.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

Courses Recommended for you

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

- Bosch 2025: Strategic Insights into Market Position, Challenges, and Growth Opportunities

- Nasher Miles Marketing Strategy 2025: A Journey from Trolleys to Trendsetters

- Beco Marketing Strategy 2025: Leading India’s Eco-Friendly Revolution

- P-TAL Marketing Case Study: Reviving India’s Timeless Craftsmanship

- Marketing Case Study: Rocca - Rising Above the Chocolate Crowd in India

- Unveiling What's Up Wellness Marketing Strategy: Key Tactics and Insights

- Lenskart Marketing Strategy 2025: AI, Content & Omni-Channel Success

- Ruban's Jewelry Marketing Strategy for Crafting Timeless Success in the Luxury Market

- Decoding iMumz’s Marketing Playbook: A Wellness Brand Built on Empathy

- Nish Hair Marketing Strategy: The Complete AIDA Playbook for D2C Success

Author's Note:

I’m Aditya Shastri, and this case study has been created with the support of my students from IIDE's digital marketing courses.

The practical assignments, case studies, and simulations completed by the students in these courses have been crucial in shaping the insights presented here.

If you found this case study helpful, feel free to leave a comment below.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.