Students Centric

Placements Report

Trackable results, real numbers

Reviews

Proven success, real voices

Trainers

Expert-led, Industry-Driven Training

Life at IIDE

Vibrant Spirit student life

Alumni

Successful Journeys, Inspiring Stories

Learning Centre

Webinars

Blogs

Case studies

Live, Interactive Masterclasses

Fresh Insights, quick reads

Real-life, Industry relevant

More

Hire from us

Hire Top Digital Marketing Talent

Work with us

Join Our Team, Make an Impact

Customised Training

Personalised digital marketing training for your company

Refer & earn

Simple, easy rewards

Contact us

Get the answers you need

About us

Know more about IIDE

Explore all course options

Trending

Professional Certification in AI Strategy

- Ideal for AI Enthusiast

Updated on Dec 12, 2025

We previously discussed the SWOT Analysis of BNP Paribas, one of the world’s largest banks committed to a sustainable economy. This time, we’ll go through the SWOT analysis of DBS Bank in extensive detail.

DBS Bank Limited is a Singaporean worldwide banking and monetary administrations company settled at the Marina Bay Financial Center in the Marina Bay region of Singapore. The organization was recently known in its complete name of The Development Bank of Singapore Limited, which “DBS” was derived from, before the present famous name was taken on 21 July 2003 to mirror its job as a worldwide bank. It is one of the three renowned Singaporean megabanks, alongside OCBC Bank and United Overseas Bank (UOB).

Another factor that has helped DBS Bank become the juggernaut it is today is its marketing tactics. Marketing is evolving as the world moves online, and if you want to stay up to date, check out our Free MasterClass on Digital Marketing 101 taught by Karan Shah, the CEO and Founder of IIDE.

Do you want to know how DBS Bank was able to achieve such success in the banking industry? We shall study the SWOT analysis of DBS Bank and discover the solution in this blog. But first, let’s study more about DBS Bank as a firm, its foundation, products, financial situation, and competitors.

About DBS Bank

Founded on 16 July 1968 by the public authority to assume control over the modern financing exercises from the Economic Development Board, the bank’s primary design was to give advances and monetary guidance to the assembling and handling of businesses and to help layout and redesign existing enterprises in Singapore.

Recorded on the Singapore Exchange, the bank was set up by the Government of Singapore on 16 July 1968 to assume control over the modern financing exercises from the Economic Development Board. Today, it’s beyond what 150 branches can be found all through the country. DBS is the biggest bank in Southeast Asia by resources and among the biggest banks in Asia, with resources adding up to US$501 billion (S$650 billion) starting on 31 December 2019.

It likewise stands firm on market-prevailing footings in purchaser banking, depository, and markets, resource the board, protections business, value, and obligation gathering pledges in different locales besides Singapore, remembering for China, Hong Kong, Taiwan, Indonesia, and South Korea.

| Founder | Government of Singapore |

|---|---|

| Year Founded | 1968 |

| Origin | Singapore |

| No. of Employees | 24,100+ |

| Company Type | Public |

| Market Cap | $86.158 Billion (2022) |

| Annual Revenue | Rs 2,673 Crore (2021) |

| Net Income/ Profit | SGD 6.39 Billion (2021) |

Products & Services by DBS Bank

Being one of the biggest banks in the world and operating for the past four decades, DBS provides its customers with many services and benefits. Some of the services offered by DBS are

- Retail banking

- Corporate banking

- Investment banking

- Mortgage loans

- Private banking

- Wealth management

- Credit cards

- Finance

- Insurance

Competitors of DBS Bank

There are different banks in the field of banking who are giving intense contests to DBS in a portion of different fields. The main 4 competitors of DBS bank are:

- OCBC Bank

- HSBC Bank

- SCB Bank

- UOB Bank

Now since we learned about the bank, let us have a look at the SWOT Analysis of DBS Bank.

SWOT Analysis of DBS Bank

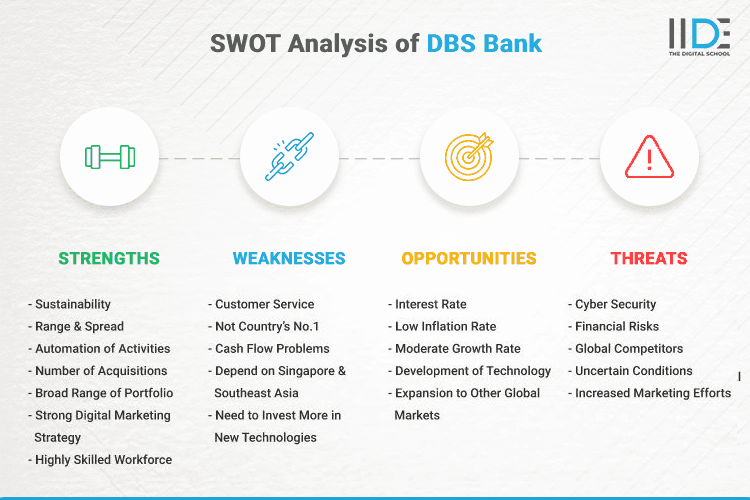

SWOT analysis of DBS Bank is an examination of the company’s strengths, weaknesses, opportunities, and threats. This allows the organisation to understand its market position, as well as what areas need to be addressed and where it can shine. It also aids the corporation in strategizing its business framework and elements affecting its growth.

To better understand the SWOT analysis of DBS Bank, refer to the infographics below:

Below is a step-by-step detailed guide to help you with the SWOT analysis of DBS Bank.

Strengths of DBS Bank

DBS Bank, being one of the industry’s leading corporations has several advantages that enable it to prosper in the marketplace. These advantages not only assist it in retaining market share in existing areas but also in expanding into new ones.

- Range & Spread: DBS Bank has a wide distribution network of 150 branches throughout the nation including Singapore, Indonesia, Hong Kong etc. that ensures its services are easily accessible to a large number of consumers in a timely way across the whole country.

- Number of Acquisitions: The bank has acquired several big companies in the course of its journey including the POSB Bank acquisition in the year 1998 etc.

- Sustainability: The group is working towards South East Asia’s sustainable development by bringing emerging sustainable programmes. Such sustainable developments show the devotion of the group towards the country.

- Broad Range of Portfolio: One biggest strength that DBS Bank has is that it offers a wide range of financial and consulting services to its customers ranging from investment banking, asset management, private banking and insurance.

- Automation of Activities: Successful automation of banking activities with a well-developed IT structure and Infrastructure has made the overall efficiency better.

- Strong Digital Marketing Strategy: With a very strong online presence on every social media site has built a strong customer relationship. Want to know how social media works as a strength for DBS Bank? Then you must check out the benefits of social media marketing to get the answer to your query.

- Diversified and Highly Skilled Workforce: Diverse people, perspectives and ideas have helped DBS Bank build a strong, dedicated and connected workforce. Additionally, the organisation has been investing huge resources in the development and mentoring of its employees.

Weaknesses of DBS Bank

A company’s weaknesses keep it from realizing its greatest potential. To assist the company to excel in all areas, one should assess the weaknesses and seek to improve them.

- Cash Flow Problems: There is a lack of proper monetary planning at DBS Bank in regards to cash flows, leading to certain situations where there isn’t suitable cash flow as needed leading to unnecessary unplanned borrowing.

- Need to Invest More in New Technologies: According to the country’s scale of expansion and the geographical areas DBS Bank needs to invest more funds in technology to coordinate the processes across the board. Currently, the investment in technology is not on par with the vision of the company.

- Depend on Singapore & Southeast Asia: DBS Bank’s global presence is not up to the mark. The bank is dependent more on Singapore & South Asian regions. Also, DBS Bank lags behind the top Southeast Asian banks in terms of several branches.

- Customer Service: Improper customer service, as well as a lack of solving customer queries, can cause a negative image of the brand. This can either be through mouth publicity or by any other means.

Opportunities for DBS Bank

Opportunities are external variables that work in the company’s favour, and the company can take advantage of them to grow.

- Moderate Growth Rate: Following a moderate growth rate in the business, a financial uptick and increase in client spending provide an opportunity for DBS Bank to attract new clients and increase its share of the total industry.

- Expansion to Other Global Markets: The company is planning to expand to more developing countries as well as the Middle East nations too such as Abu Dhabi. This serves them as an opportunity to acquire a new customer base.

- Development of Technology: Since the FinTech industry is growing at a very rapid pace, there are advancements in technologies too. Using these kinds of technologies can increase efficiency and decrease cost.

- Interest Rate: Lower interest rates than compared to previous years provides an opportunity for DBS Bank to undergo expansion projects that are financed with loans at a cheaper interest rate.

- Low Inflation Rate: The low inflation rate can bring more stability to the market and enable credit at a lower interest rate to the customers of DBS Bank.

Threats to DBS Bank

Threats are external elements that may have an impact on the bank. To avoid inflicting damage to the company, these concerns should be addressed as quickly as feasible. The threats to DBS Bank are as follows:

- Global Competitors: If DBS Bank wants to expand its business around the world, they have to be careful of what policies they make or how they provide its services in the foreign market or how they market itself, where already existing local banks are what the people trust in.

- Increased Marketing Efforts: Due to the rise of digital marketing, there is an increasing number of promotional messages are being sent by competitors. It clutters up the space, which leads to losing out on customers. DBS Bank is well versed and trying to adopt a variety of the latest digital marketing skills to get ahead of the competition. You must also check out these skills to achieve the same.

- Uncertain Conditions: The dynamic market environment makes it difficult not for a bank but for every company to be vigilant and to take precautions before any crisis occurs. One other example of an uncertain condition is the Covid pandemic which made most businesses go on a complete shutdown and only visioners were and can take advantage of such situations.

- Financial Risks: Because the company operates in several countries, it is subjected to currency fluctuations, which are exacerbated by the world’s increasingly volatile political climate in a variety of industries.

- Cyber Security: It’s been one of the major risk factors in the financial sector. It is a must for financial systems to have the ability to withstand this cyber-attack by increasing IT monitoring and control.

Now that we have come to the end of this thorough SWOT Analysis of DBS Bank. Let’s see the summation of this article in the conclusion.

Learn Digital Marketing for FREE

- 45 Mins Masterclass

- Watch Anytime, Anywhere

- 1,00,000+ Students Enrolled

To Conclude

DBS Bank is a well-known financial services firm with a global reach. The SWOT analysis of DBS Bank revealed that the firm is strongly reliant on its consumers and has great brand recognition and trust. It has a strong sustainable foundation and has a presence in all of the areas it services, but profits and losses have been variable in recent years.

With rising competition in a saturated industry like finance, corporations are left to fight it out by improving their marketing efforts to win over their customers. Being well-versed in digital marketing is a requirement for all marketing enthusiasts in today’s shifting scene, where it is of vital significance. If you want to learn more and improve your skills, take a look at our Online Digital Marketing Course in India where you can learn everything about digital marketing in-depth just like this case study.

We hope this blog on the SWOT Analysis of DBS Bank has given you a good insight into the company’s strengths, weaknesses, opportunities, and threats. You can also read our comprehensive study on the SWOT Analysis of JP Morgan Chase.

If you enjoy in-depth company research just like the SWOT analysis of DBS Bank, check out our IIDE Knowledge portal for more fascinating case studies.

Thank you for taking the time to read this, and do share your thoughts on this case study of the SWOT analysis of DBS Bank in the comments section below.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

Courses Recommended for you

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

Feb 20, 2026

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

- Bosch 2025: Strategic Insights into Market Position, Challenges, and Growth Opportunities

- Nasher Miles Marketing Strategy 2025: A Journey from Trolleys to Trendsetters

- Beco Marketing Strategy 2025: Leading India’s Eco-Friendly Revolution

- P-TAL Marketing Case Study: Reviving India’s Timeless Craftsmanship

- Marketing Case Study: Rocca - Rising Above the Chocolate Crowd in India

- Unveiling What's Up Wellness Marketing Strategy: Key Tactics and Insights

- Lenskart Marketing Strategy 2025: AI, Content & Omni-Channel Success

- Ruban's Jewelry Marketing Strategy for Crafting Timeless Success in the Luxury Market

- Decoding iMumz’s Marketing Playbook: A Wellness Brand Built on Empathy

- Nish Hair Marketing Strategy: The Complete AIDA Playbook for D2C Success

Author's Note:

I’m Aditya Shastri, and this case study has been created with the support of my students from IIDE's digital marketing courses.

The practical assignments, case studies, and simulations completed by the students in these courses have been crucial in shaping the insights presented here.

If you found this case study helpful, feel free to leave a comment below.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.