Orginally Written by Aditya Shastri

Updated on Nov 18, 2025

Share on:

CVS Health (previously CVS Corporation) is a leading U.S. integrated health care firm, with retail pharmacy, pharmacy benefit management (PBM), and insurance (via Aetna). CVS is refocusing strongly in 2024–25 in the face of rising medical expenses, regulatory stress, and changing consumer trends.

Here in this blog, we are going to discuss where CVS is positioned currently, its internal strengths and weaknesses, and the external factors that it has to deal with. Whether you're an entrepreneur, student, or strategist, this SWOT analysis can inform decisions and uncover where the biggest risks and benefits are.

Before delving into the blog, I would like to inform that the research and analysis of this content was done by Savio Devasia, who is a student of IIDE's Online Digital Marketing Course, May Batch 2025. If you find this read interesting, connect with Savio on LinkedIn and give him kudos for this hardwork - he will appreciate it.

About CVS Health

CVS Health Corporation was established in 1963 by Stanley and Sidney Goldstein and Ralph Hoagland. It has its headquarters in Woonsocket, Rhode Island. Over the decades, it grew from being a retail pharmacy chain to a leading healthcare conglomerate with pharmacy services, health benefits, and care delivery. The brand’s slogan is “Bringing our heart to every moment of your health”.

Its goal is to assist individuals on their journey towards improved health. At 2024–25, CVS is positioning itself towards value-based care, buying care-delivery assets (e.g. Oak Street Health), and consolidating digital health services.

A surprising statistic: in Q1 2025, CVS generated total revenues of $94.6 billion, a 7.0 % increase from the same period last year.

| Metric | Value / Description |

|---|---|

| Official Name | CVS Health Corporation |

| Year Founded | 1963 |

| Headquarters | Woonsocket, Rhode Island, USA |

| Core Industries |

Retail pharmacy, PBM, Health insurance, Care delivery |

| 2024 Revenue | $372.8 billion (full year) |

| Q1 2025 Revenue | $94.6 billion (up 7 %) |

| 2025 EPS Guidance | Adjusted EPS range $6.30 – $6.40 |

| Employees | ~295,000 |

| Key Competitors |

UnitedHealth Group, Walgreens, Cigna, Humana, Express Scripts |

Why SWOT Analysis of CVS Health Matters in 2025?

- The U.S. healthcare environment is under intense pressure and regulatory changes on drug prices, increasing medical spending, and demand for consumer-driven care models are driving change.

- Multi-business model (insurer + care provider + pharmacy) is increasingly valuable, yet implementation is complicated. CVS's multi‑business model exposes it to stress across segments.

- Increasing inflation, labor expenses, and cost control pressures compress margins across healthcare.

- •For business students, health-tech entrepreneurs, or business students, CVS's strategic position illustrates how big incumbents evolve or fail.(meaning that large, established companies must adapt to changes in their market or risk being displaced by more agile competitors).

Learn Digital Marketing for FREE

SWOT Analysis of CVS Health

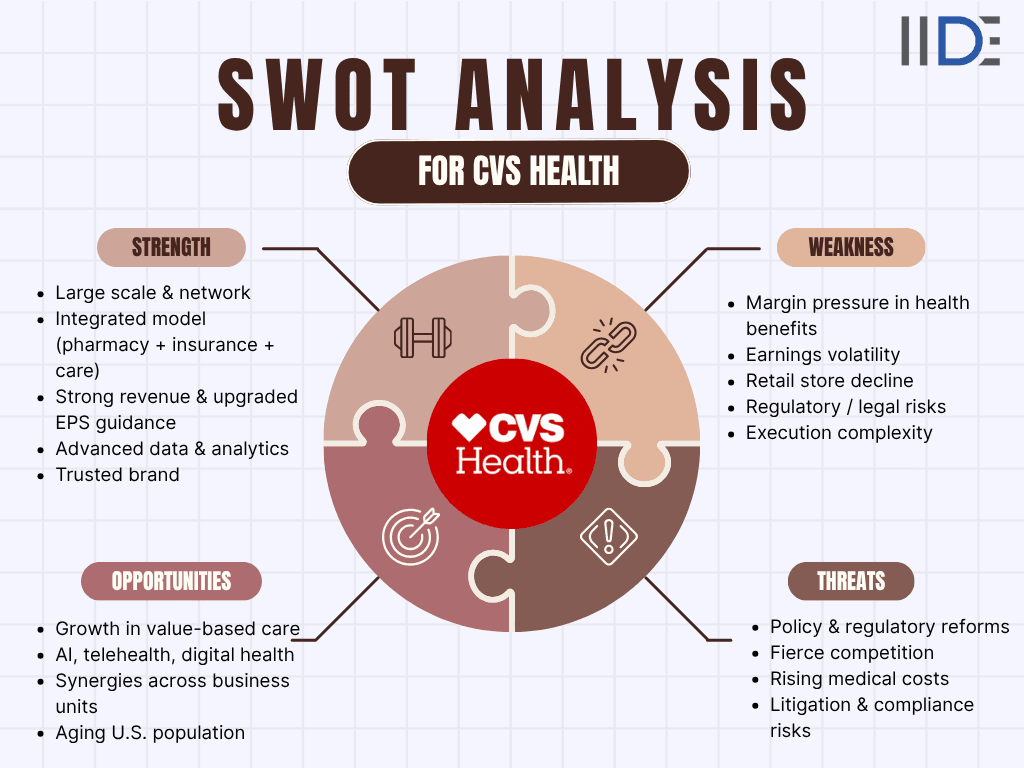

1. Strengths: “How CVS’s Integrated Model Will Drive Long-Term Healthcare Leadership”

Scale + market reach:

- CVS operates thousands of retail pharmacies across the U.S., offering massive customer touchpoints.

- Leading PBM (CVS Caremark) gives influence over drug dispensing flows.

Diversified, integrated business model:

- CVS spans pharmacy, insurance (Aetna), and care delivery. This integration enables cost control, patient management, and synergies.

Strong financial momentum:

- Q1 2025 revenue rose 7 % year-on-year.

- Raised EPS guidance to $6.30–$6.40

- Upgraded cash flow expectations to ≥ $7.5 billion

Data & digital health capabilities:

- Analytics + AI from Aetna and Caremark enhance predictive care and patient engagement.

- Transforming digitally have created a major presence in the market.

Resilient brand:

- Recognized healthcare name with strong consumer trust and loyalty

2. Weaknesses: Can CVS Stay Agile Amid Scale and Structural Complexity?

Margin pressures in health benefits:

- High medical loss ratios (MLRs) erode profitability in insurance.

Earnings uncertainty:

- Guidance withdrawals highlight volatility in segments.

Retail store decline:

- Front-store margins face e-commerce competition.

- CVS is closing underperforming stores.

Regulatory and legal risks:

- Exposure to pricing reforms and litigation (e.g., Omnicare compliance issues).

Complex execution:

- Managing pharmacy, PBM (Pharmacy Benefit Manager, third-party companies act as middlemen between insurance companies, pharmacies, and drug manufacturers to manage prescription drug benefits for various health plans.), insurance, and care simultaneously poses integration challenges.

Read SWOT analysis of Fortis Healthcare to gain a concise understanding of its strengths, challenges, growth opportunities, and industry threats.

3. Opportunities: CVS’s Path Toward Preventive and Home-Based Healthcare by 2030

Expand value-based care:

- Acquisitions like Oak Street Health and Signify Health enable home-based and preventive care.

Leverage AI & telehealth:

- Invest in predictive analytics, remote monitoring, and digital health tools.

Segment synergies:

- Cross-sharing of data between PBM (Pharmacy Benefit Manager, third-party companies act as middlemen between insurance companies, pharmacies, and drug manufacturers to manage prescription drug benefits for various health plans.) , insurance, and care delivery improves outcomes.

Demographic tailwinds:

- Aging U.S. population drives demand for integrated care.

4. Threats : Regulatory Shifts and Tech Disruption Threatening CVS’s Future

Policy and reimbursement risks:

- Medicare/Medicaid reforms and pricing caps affect profitability.

Intense competition:

- UnitedHealth, Amazon, Humana, Walgreens, and disruptors threaten share.

Medical cost inflation:

- Rising hospital, drug, and utilization costs may outpace reimbursement.

Litigation & compliance issues:

- Omnicare fines and legal scrutiny damage reputation and finances.

IIDE Student Takeaway, Recommendations & Conclusion

Key Takeaways

- Biggest strength: CVS’s scale and integrated model across pharmacy, PBM, and insurance.

- Biggest risk: Margin volatility and regulatory uncertainty.

Recommendations

1. Expand value-based care and home health services

Broaden offerings in value-based care models, which focus on delivering better patient health outcomes at lower costs, by increasing partnerships with healthcare providers and investing in home health services that allow patients to receive quality care in the comfort of their homes.

2. Invest in predictive analytics and AI tools

Allocate resources to advanced analytics and artificial intelligence technologies to enhance data-driven decision-making, accurately forecast patient needs and service demands, and proactively manage population health and operational performance.

3. Rationalize retail store presence and focus on pharmacy services

Review and optimize the physical retail footprint by closing underperforming stores, reallocating resources to stronger locations, and strengthening core pharmacy services to provide streamlined prescription management and improve customer experiences.

4. Strengthen compliance and government engagement

Enhance internal policies to ensure adherence to changing healthcare regulations, actively monitor compliance risks, and deepen collaboration with government agencies and regulators to anticipate legal changes and maintain high standards of patient safety, privacy, and quality care.

5. Improve benefits segment cost control

Implement rigorous cost-containment strategies within health benefits programs - such as negotiating better rates with providers, managing utilization of high-cost services, and leveraging data analytics to reduce unnecessary spending - ensuring financial sustainability and better outcomes for members.

This core tension between scale and agility sets the stage for CVS Health’s next chapter and understanding it helps students and entrepreneurs see how strategic adaptability can determine success in complex, regulated industries like healthcare.

Future Outlook Question

As healthcare evolves toward personalized, decentralized care, will CVS’s integration be its strongest moat, or its biggest complexity?

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

CVS Health offers a wide range of healthcare services, including retail pharmacy, pharmacy benefits management, health insurance through Aetna, and walk-in clinics at MinuteClinics.

Yes, CVS accepts most major insurance plans and also offers pharmacy benefits management to help manage prescription coverage.

CVS Specialty Pharmacy provides medications for complex or chronic conditions, with dedicated CareTeams to support patients from prescription to delivery.

MinuteClinics offer basic healthcare services for common illnesses, vaccinations, screenings, and health advice without needing an appointment.

CVS offers care management programs that include personalized medication plans, adherence support, and chronic condition education.

Yes, through its acquisition of Aetna, CVS provides health insurance options, including Medicare and Medicaid plans.

CVS ensures patient safety through medication reviews, pharmacist consultations, secure data handling, and compliance with healthcare regulations.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.