🚀 Just Launched — Our New Undergraduate Program in Digital Business & Entrepreneurship is Here: Explore Now!

Resources

Career & Placements

Digital Business Program

- Bachelors/UG in Digital Business & Entrepreneurship

Newly Launched

Digital Marketing Courses

Free Masterclass

In the previous blog, we have explained in detail the SWOT analysis of TD Bank – one of the largest multinational financial services in Canada. Today we are here to elaborate on the SWOT analysis of BlackRock.

BlackRock is an American Multinational Investment Management Company based in New York, United States Of America. BlackRock is the world’s largest and major asset management organisation founded in 1988. In the early years of the company, it was primarily focused on asset management, over time, the organisation came as an investment manager.

Now, BlackRock has stepped up into the digital environment. To accelerate their digital services, they have been acquiring new marketing strategies to adapt to changing environmental aspects. They have included digital marketing in their marketing techniques. If you are interested in learning digital marketing for a fresh kick start to your career – check out our free masterclass on digital marketing by the CEO and Founder of IIDE, Karan Shah.

Before we go into the SWOT Analysis of BlackRock, let us know about BlackRock as a company.

Aditya Shastri

Lead Trainer & Business Development Head at IIDE

Updated on: Jun 30, 2025

About BlackRock

With 70+ offices in more than 30 countries – BlackRock has established itself as one of the largest asset management and investment corporations in the United States and the world also. The multinational group initially started in the year 1998 with the purpose to help more and more people experience financial well-being. Today, the company has contributed to a more equitable and resilient world.

The company was founded by Larry Fink, Robert S. Kapito, Susan Wagner, Barbara Novick, Ben Golub, Hugh Frater, Ralph Schlosstein, and Keith Anderson. BlackRock, with more than $3.5 trillion under management, is the world’s largest money manager. The firm specialises in equity and fixed-income products, as well as alternative and multi-class instruments, which it invests in on behalf of institutional and retail investors worldwide.

| Founder | Robert S. Kapito, Larry Fink & Susan Wagner |

|---|---|

| Year Founded | 1988 |

| Origin | New York, US |

| No. of Employees | 16,500+ |

| Company Type | Public |

| Market Cap | US$105.60 Billion (2022) |

| Annual Revenue | US$22 Billion (2021) |

| Net Income/ Profit | US$5 Billion (2020) |

Products & Services by BlackRock

- Portfolio Construction & Balance Sheet Solutions

- Sustainability and Climate Risk Advisory

- Capital Markets & Transaction Support

- Data, Analytics & Financial Modelling

- Enterprise Risk & Regulatory Advisory

- Asset Management

- Risk Management

Competitors of BlackRock

- Charles Schwab

- TD Ameritrade

- T. Rowe Price

- Legg Mason

- Edward Jones

That’s it, now that we have brief information about BlackRock. Let’s know more about the SWOT Analysis of BlackRock.

SWOT Analysis of BlackRock

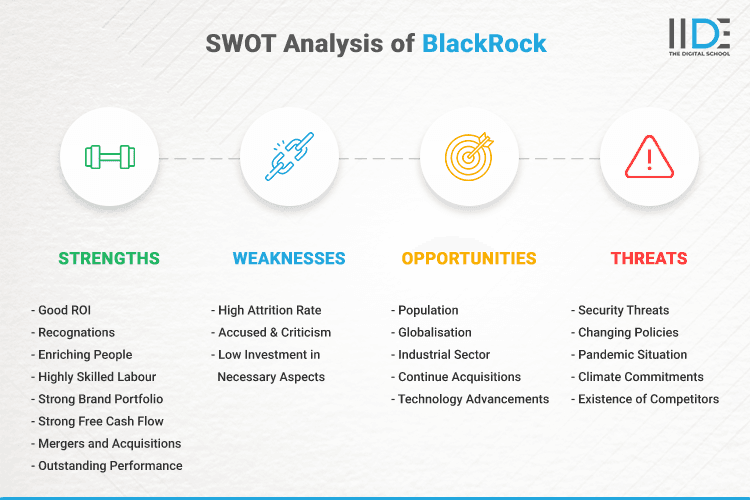

SWOT analysis is the study of the Strengths, Weaknesses, Opportunities, and Threats of a company. This helps the company to know its position in the market and what needs to be improved and what areas it can excel in. It also helps the company to strategize its framework related to business and factors affecting its growth.

To better understand the SWOT analysis of BlackRock, refer to the infographic below:

So let us first start by looking at the strengths of BlackRock from the SWOT analysis of BlackRock.

Strengths of BlackRock

Strengths are the activities that a company possesses. This helps in contributing to the company’s success. The strengths of BlackRock can be analysed as follows:

- Enriching People: One of the strengths of BlackRock is that the company is on the mission to provide the best financial advisory services. They are helping their clients navigate financial transformation with the net zero transition. Their purpose is their people and their financial well-being.

- Mergers and Acquisitions: A track record of successfully integrating additional companies through mergers and acquisitions including SSRM Holdings, the fund-of-funds business of Quellos Capital Management etc. and many more.

- Strong Free Cash Flow: There is a strong free cash flow that puts resources into the hands of the company to expand into new projects.

- Good ROI: It is relatively successful in new projects and provides a high return on capital expenditures through the creation of new revenue streams.

- Strong Brand Portfolio: Over the years BlackRock has invested in building a strong brand portfolio. This brand portfolio can be very useful if an organisation wants to expand into new product categories.

- Outstanding Performance in New Markets: BlackRock has accumulated experience to enter new markets and achieve success. The expansion has helped organisations create new revenue streams and diversify business cycle risks in the markets in which they operate.

- Highly Skilled Labour: Highly skilled workforce through successful education and training programs. By investing enormous resources in the training and development of BlackRock employees, they not only create highly qualified employees but also motivate them to achieve more.

- Recognitions: BlackRock is one of the admired companies in the Fortune list of the world’s 50 Most Admired Companies 2013. Also, the company is the world’s biggest asset manager larger than the world’s largest bank.

Weaknesses of BlackRock

Strategy is all about choices and weaknesses are areas where companies can improve through SWOT analysis and leverage their competitive advantage and strategic positioning.

(Source: EcoWatch)

- Accused & Criticism: BlackRock has faced criticism for worsening climate change, its close ties with the Federal Reserve System during the COVID-19 pandemic, anti competitive behaviour, and its unprecedented investments in China.

- Low Investment in Necessary Aspects: With its large presence in the globe, BlackRock is found to have a lesser investment in necessary infrastructure. It has rather invested in the fossil fuel industry.

- High Attrition Rate: BlackRock has a high attrition rate compared to other organisations. The bank has to spend more compared to its competitors on the training and development of its employees.

Opportunities for BlackRock

Opportunities are external factors that are in favour of the company and the firm can use it to its advantage to grow.

- Technology Advancements: Bloom in technology has been the greatest boon to mankind and the organisation as a whole. With technology advancement and adaptation to it, BlackRock can provide a wide range of services to every nook and corner of the world.

- Globalisation: Globalisation has proved to be the best opportunity for BlackRock as they can serve their worldwide customers easily with their products and services.

- Industrial Sector: Every country is transitioning into an industrialised sector. Hence, there is great potential for future customers that it can serve.

- Population: In recent years, the number of people has been expanding around the world. As the number of people increases demand also increases. This allows BlackRock to gain potential future customers.

- Continue Acquisitions: The bank is known for its number of mergers and acquisitions including acquisitions of SSRM Holdings, the fund-of-funds business of Quellos Capital Management. etc. BlackRock is strong in this area and it should continue to do so.

Threats to BlackRock

External factors that might affect the bank are known as threats. These issues should be taken into consideration as soon as possible to prevent causing damage to the firm. The threats to BlackRock are as follows:

- Existence of Competitors: The existence of big competitors such as J.P. Morgan, Chase, Bank of America etc have been threats to BlackRock. Clients may get attracted to the investment management services by other competitors.

- Pandemic Situation: Pandemic situations as Covid-19, financial losses suffered by organisations and individuals are threats to investment management corporations like BlackRock. It slows down the saving, investing and repayment of loans.

- Security Threats: If the financial institution faces any security difficulties at any moment, it can be a great threat to the company. After such situations, regaining client confidence and ensuring them would be challenging for the company.

- Climate Commitments: Financial institutions like BlackRock are not taking their financial commitments seriously. If they have not been honest with investors about their climate policies, it may attract investigation from the US SEC.

- Changing Policies: The government can change its policies anytime which can affect the working process of the company. Thus it needs to be aware of such changes which can happen in the future.

This ends our extensive SWOT analysis of BlackRock. Let us conclude our learning below.

Learn Digital Marketing for FREE

- 45 Mins Masterclass

- Watch Anytime, Anywhere

- 1,00,000+ Students Enrolled

To Conclude

BlackRock is a well known multinational investment company based in New York, US. In the SWOT analysis of BlackRock, we have observed that the organisation’s brand value and its variety of services have increased its stability in the market whereas in technological advancement competitors are ahead and far better than BlackRock.

With increasing growth in the investment management market and to stay intact in the market, one needs to focus on its marketing and technological advancements, in a changing environment where everyone is on their gadgets like phones and laptops, digital marketing plays an important role in spreading brand awareness all over the globe.

If you want to start or upgrade digital marketing skills, explore our 4 months online digital marketing course with certification which will help you upskill yourself in all the aspects of digital marketing.

We hope this blog on the SWOT analysis of BlackRock has given you a good insight into the company’s strengths, weaknesses, opportunities and threats.

If you enjoy in-depth company research just like the SWOT analysis of BlackRock, check out our IIDE Knowledge portal for more fascinating case studies.

Thank you for taking the time to read this, and do share your thoughts on this case study of the SWOT analysis of BlackRock in the comments section below.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

Courses Recommended for you

Author's Note:

I’m Aditya Shastri, and this case study has been created with the support of my students from IIDE's digital marketing courses.

The practical assignments, case studies, and simulations completed by the students in these courses have been crucial in shaping the insights presented here.

If you found this case study helpful, feel free to leave a comment below.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.