Orginally Written by Aditya Shastri

Updated on Dec 12, 2025

Share on:

Alibaba is one of the world’s largest e-commerce and cloud computing conglomerates, dominating China’s digital economy while expanding its global footprint.

In 2025, Alibaba leverages AI innovation and diverse business operations to boost growth. But how will it navigate regulatory challenges and fierce competition internationally?

This SWOT analysis offers entrepreneurs and business students vital insights into Alibaba’s competitive positioning and future prospects.

If you found this helpful, feel free to reach out to Lunguamliu Kamei, to send a quick note of appreciation for his fantastic research, he will appreciate the kudos!

Lunguamliu Kamei, is a current student of IIDE’s PG In Digital Marketing & Strategy, May 2025 batch.

About Alibaba

Founded in 1999 in Hangzhou, China, Alibaba Group revolutionised e-commerce and cloud services, becoming a global technology leader. With a mission to make it easy to do business anywhere, Alibaba serves millions of consumers and merchants worldwide.

In 2025, Alibaba’s AI-powered B2B platform and cloud innovations continue to shape global trade. SWOT stands for strengths, weaknesses, opportunities, and threats, essential for understanding its strategic position.

| Attribute | Data (2025) |

|---|---|

| Official Company Name | Alibaba Group Holding Limited |

| Founded Year | 1999 |

| Website URL | www.alibaba.com |

| Industries Served | E-commerce, Cloud Computing, Digital Media, Fintech |

| Geographic Areas | Global, with strong dominance in China and growing overseas |

| Revenue | Approx. $135 billion (annual 2024–25 forecast) |

| Net Income | Estimated $9–11 billion (latest estimates) |

| Employees | Over 204,000 (2025) |

| Main Competitors | Amazon, JD.com, Pinduoduo, Tencent |

Learn Digital Marketing for FREE

Why SWOT Analysis Matters for Alibaba in 2026

Alibaba SWOT Analysis 2025. China’s tech scene is going through a tough phase right now. Competition is intense, people are spending less, and the economy has been shaky. On top of that, there’s constant pressure from new regulations.

But interestingly, while some areas are slowing down, things like AI, cloud computing, and fast online commerce are taking off faster than ever.

For Alibaba, being strong in cloud and AI could be a total game changer. Still, it’s not all smooth sailing. The company has to deal with unpredictable policy changes, struggles to grow outside China, and the challenge of keeping its profits steady.

In a way, Alibaba’s story is like a real-life business lesson. It shows how a company can scale up, pivot when needed, let go of what’s not working, and make sure its tech investments actually support its bigger goals.

SWOT Analysis of Alibaba 2026

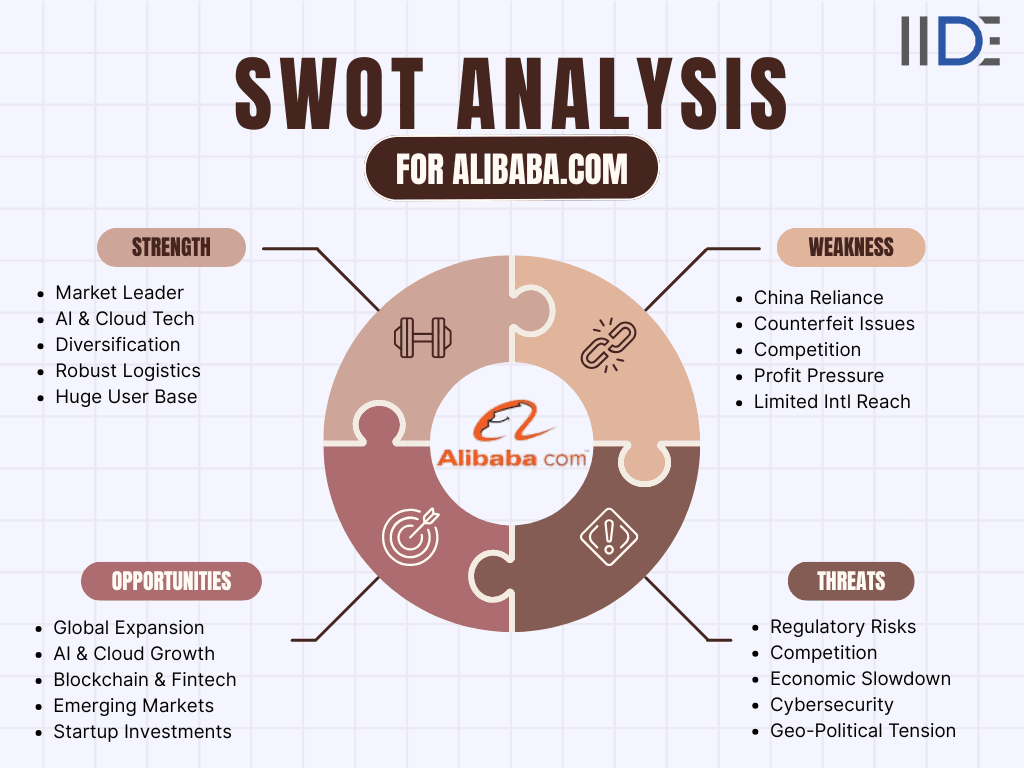

Let’s take a look at Alibaba’s main strengths, weaknesses, opportunities, and threats in 2025.

Strengths of Alibaba

Strong Financial Performance

Alibaba is in a solid financial position in 2025, with annual revenue of around 140 billion US dollars and a massive 62 percent jump in profits. This impressive growth shows the company’s ability to bounce back and adapt even in a tough economic environment.

AI-Driven Strategy Paying Off

A big reason behind Alibaba’s success is its strong focus on artificial intelligence. The company’s AI-powered products have seen triple-digit sales growth, while its cloud business continues to expand steadily. Projects like Tongyi Qianwen, Alibaba’s generative AI model, and Cloud Infrastructure 3.0 are helping businesses modernize across Asia, giving Alibaba a major edge in 2025.

Smart Business Restructuring

To stay focused, Alibaba has been cutting down on less profitable areas such as physical retail stores and delivery subsidiaries that don’t align with its long-term vision. This cleanup has allowed the company to concentrate resources on high-growth sectors like cloud computing, AI, and digital commerce.

Reinvesting for Sustainable Growth

With its stronger financial base, Alibaba is investing heavily in infrastructure, AI innovation, and international expansion. At the same time, it’s rewarding shareholders through buybacks and value-driven growth. These moves show Alibaba’s commitment to building lasting success rather than chasing short-term gains.

Weaknesses of Alibaba

High Spending on Growth

Alibaba is investing a lot of money in cloud computing and AI. While that’s great for long-term growth, it’s hurting profits right now. They’re spending so much to stay ahead that they end up keeping less profit from each dollar they make.

Too Dependent on China

Most of Alibaba’s business still depends on China. So, if the Chinese economy slows down or the government brings in new rules on data or competition, Alibaba feels the hit almost immediately.

Struggles with New Ventures

Some of Alibaba’s newer projects, like expanding into overseas markets or running food delivery services, haven’t been very successful yet. They’re either growing too slowly or losing money, which drags down overall performance.

Regulatory Pressure

Being one of the biggest tech companies in China comes with constant government oversight. From data privacy to anti-monopoly rules, Alibaba always has to stay careful about what it does. This makes the future a bit unpredictable, even for such a strong company.

Opportunities

Growth in AI and Cloud Services

The global demand for AI and cloud technology is booming, and Alibaba is in a great spot to benefit. With its strong focus on cloud computing and an AI-first strategy, the company is expected to see cloud revenue grow by around 25 to 30 percent by the end of fiscal year 2026.

Rise of Quick Commerce and Instant Services

Alibaba’s “Shanguo” quick commerce platform could tap into a massive market that’s expected to reach nearly 2 trillion RMB, or about 267 billion US dollars, by 2030. With existing platforms like Taobao and Ele.me, Alibaba already has a strong foundation to expand in this space.

Better Monetization of E-commerce and Ads

Alibaba is finding smarter ways to make money from its huge online ecosystem. Stronger ad revenues, higher tech service fees, and AI-powered tools that improve logistics and recommendations are helping the company make each transaction more valuable.

Expanding Internationally

Even though global expansion comes with challenges, emerging markets offer big opportunities. Cross-border trade and cloud services outside China could become key growth drivers for Alibaba in the coming years.

Improving Efficiency and Focus

Alibaba has been cleaning up its business by letting go of loss-making divisions and focusing on what truly drives profit. This focus on high-margin areas is helping the company boost cash flow and strengthen its overall performance

Threats

Regulatory Uncertainty

China’s tech sector is still under tight government control. The ongoing crackdowns, anti-monopoly rules, and strict data laws continue to create uncertainty for big companies like Alibaba. These regulations could lead to fines, limit how the company operates, or even force changes in its structure.

Macroeconomic Challenges and Slowing Consumer Spending

China’s economy has been slowing down. With weaker growth, rising prices, and lower consumer confidence, people are spending less. That’s a problem for Alibaba since its e-commerce business depends on how much people buy online.

Intense Competition

Alibaba faces tough rivals everywhere. In cloud and AI, it competes with Tencent, ByteDance, and Huawei in China, and with Amazon and Microsoft globally. In e-commerce, it goes up against Pinduoduo, JD.com, and several smaller up-and-coming players. And in international markets, Alibaba deals with strong local competitors in every region it enters.

Cost and Margin Pressures

Running such a large business comes with high costs. Logistics, labor, and new technology investments all add up. On top of that, Alibaba might need to spend more to stay competitive in fast-moving areas like quick commerce, which can put more pressure on its profit margins.

Global Trade and Geopolitical Risks

Tensions between major countries, trade restrictions, and currency fluctuations all affect Alibaba’s international growth. Political and economic issues, especially between the United States and China, can raise costs or limit new opportunities for expand

Buyers Persona:

John

London

Occupation: Small business owner

Age: 35 years

Motivation

Interest & Hobbies

Pain Points

Social Media Presence

Summary Table - SWOT of Alibaba

IIDE Student Takeaway, Recommendations:

Key Findings Recap

Alibaba is financially strong and performing better than many expect, especially given macro pressures. AI & cloud are central to its growth momentum.

The company is actively cleaning up its portfolio, exiting non-core/losing assets, which helps in sharpening strategic focus and improving profitability.

But it is not without risks: regulatory pressure, economic headwinds, and competitive threats are real.

Biggest Advantage vs Biggest Risk

Advantage: Alibaba’s leadership in AI & cloud, combined with its dominant position in China’s retail ecosystem, gives it scale, data, infrastructure, and the ability to monetize across multiple fronts.

Risk: Over-dependence on China in a rapidly changing regulatory & economic environment; margin erosion due to heavy investments and competitive pressure.

Actionable Recommendations

Continue portfolio rationalization - divest or spin off units that are consistently underperforming or have low margins. Use proceeds to fund high potential growth areas.

Focus on margin discipline in cloud & AI investments - ensure that investments are calibrated, perhaps more incremental, to avoid overspending that doesn’t yield ROI quickly.

Enhance monetization tools - improve customer management, ad platform offerings, tech/ service fees, personalized recommendations, better logistics.

Strengthen risk management - especially around regulatory compliance, data privacy, and cross-border operations; perhaps maintain closer dialogue with regulators, diversify geographies.

Expand international presence smartly - target emerging markets where cost structures, regulatory risk, and competition are more manageable; tailor offerings to local needs rather than trying a “one-size-fits-all” export of the China model.

Want to Know Why 5,00,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.