Orginally Written by Aditya Shastri

Updated on Jan 5, 2026

Share on:

TVS Motor Company is India’s third-largest two-wheeler manufacturer and one of the fastest-growing players in the EV scooter segment for 2024-25. Known for its performance bikes, scooters, and award-winning customer service, the brand has become a global leader in mobility.

But what is driving TVS’s rise in such a competitive market? And where does it still struggle? This detailed SWOT Analysis of TVS Motors will help entrepreneurs, MBA students, and marketers understand the company’s current strategic position and how it can grow in the future.

A quick note before you dive into this article: the research and initial analysis were carried out by Teresa Nemthianmawi, from IIDE’s Online Digital Marketing Course, July Batch 2025. If you enjoy the insights here, don't hesitate to drop Teresa Nemthianmawi a message; she'd love to hear your feedback.

About TVS Motors

Founded in 1911 by T. V. Sundram Iyengar, TVS Motor Company is headquartered in Chennai, India. It has grown into a global two and three-wheeler powerhouse serving over 80+ countries with a diverse range of motorcycles, scooters, and EVs.

Known for model lines such as the Apache series and iQube electric scooters, the company combines innovation with a robust dealer network. In 2025, TVS is the third-largest two-wheeler company in India and a growing EV contender.

TVS Motors Overview Table

| Category | Details |

|---|---|

| Official Name | TVS Motor Company Ltd. |

| Founded | 1978 |

| Headquarters | Chennai, India |

| Website | https://www.tvsmotor.com |

| Industries | Two-wheelers, Three-wheelers, EVs |

| Geographies | India, ASEAN, Africa, Latin America |

| Revenue (2024) | Approx. ₹31,000 crore |

| Net Income (2024) | Approx. ₹2,000+ crore |

| Employees | 5,000+ |

| Major Competitors |

Hero MotoCorp, Honda, Bajaj Auto, Ola Electric, Ather Energy |

Why SWOT Analysis Matters Now?

The two-wheeler market is undergoing rapid transformation. Traditional ICE leaders are competing with EV-first disruptors such as Ola and Ather. Consumer preferences are shifting toward connected vehicles, sustainable mobility, and affordable EVs.

Technological shifts like AI-driven dashboards, battery swapping, telematics, and digital-first service models are reshaping competition.

At the same time, economic pressures, global supply chain changes, and emission regulations are forcing automotive giants to rethink cost, manufacturing agility, and product strategy. This makes it the perfect time to study a SWOT Analysis of TVS Motors to understand its strategic strengths and vulnerabilities.

Learn Digital Marketing for FREE

SWOT Analysis of TVS Motors

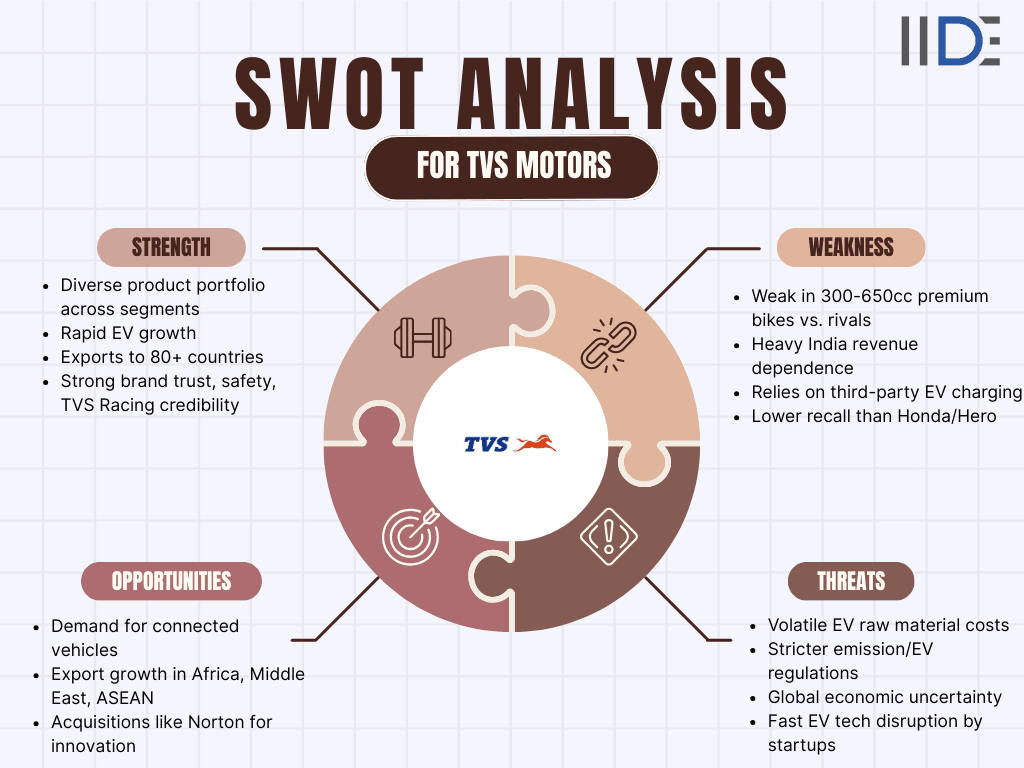

TVS Motors is growing strong thanks to its wide range of two-wheelers, fast-rising EV sales (especially the iQube), and a global presence in 80+ countries. The brand is trusted for reliability, racing heritage, and steady financial performance.

However, it still struggles in premium high-CC bikes, depends heavily on the Indian market, and is slowed down by limited EV charging infrastructure. Some entry-level models also face quality concerns compared to rivals.

On the positive side, the booming EV market, connected vehicle demand, export growth, and smart partnerships (like acquisitions or charging alliances) give TVS big chances to expand. But strong competition, rising EV component costs, new regulations, and fast-paced tech changes remain key threats.

In short, TVS is well-positioned for the future, especially in EVs, but must strengthen its premium lineup and EV ecosystem to stay ahead.

1. Strengths of TVS Motors

Strong Product Portfolio Across Segments: TVS Motors offers one of the most diverse product ranges in the Indian two-wheeler market. From family scooters like Jupiter and Ntorq to commuter bikes and performance models like the Apache RTR series, the company caters to every consumer category. This wide offering helps TVS serve both mass and premium customers and reduces dependency on a single product line.

Rapid Growth in the Electric Vehicle Category: The TVS iQube has emerged as one of the highest selling electric scooters in India. The brand has seen triple digit growth in its EV segment since 2023. This early success allows TVS to gain strong footing in a market where many legacy brands are still catching up.

Growing Global Footprint: TVS exports two wheelers to more than 80 countries. This global presence helps the company diversify risk and capture revenue from markets beyond India. Regions like Africa, Latin America, and Southeast Asia contribute steadily to its international volumes.

Strong Brand Equity and Customer Trust: TVS is widely known for dependable performance, solid build quality, and safety. Its long history in motorsports through TVS Racing enhances its credibility among performance enthusiasts. The company often ranks high in customer satisfaction awards and product reliability studies.

Strategic Partnerships for Innovation: Collaborations such as the TVS and BMW Motorrad partnership have helped TVS enter the premium motorcycle segment with shared technology. TVS Racing also strengthens brand visibility among younger customers and supports innovation in two wheeler design and engineering.

Solid Financial Stability: Over the past few years, TVS has reported strong revenue growth and improving profit margins. Its financial discipline and continuous investment in R&D make it a stable player in a competitive market. This stability allows TVS to aggressively invest in EVs and exports.

2. Weaknesses of TVS Motors

Limited Presence in High Capacity Motorcycles: TVS has a weaker position in the premium 300 CC to 650 CC segment compared to brands like Royal Enfield or Bajaj KTM. This limits its ability to capture premium customers and reduces its participation in the fast growing mid segment market.

Heavy Dependence on the Indian Market: Although TVS operates internationally, India continues to generate the majority of its revenue. This exposes the company to economic slowdowns, fluctuating consumer demand, and local policy changes that can affect sales.

Slow Development of EV Charging Infrastructure: TVS relies mostly on third party networks for EV charging. The absence of a dedicated fast charging ecosystem delays the widespread adoption of its electric scooters. Customers in smaller towns also experience limited access to public chargers.

Lower Brand Recall Compared to Honda and Hero: While TVS has a loyal user base, brands like Honda and Hero still enjoy stronger top of mind recall among Indian buyers. This affects first choice preference in highly competitive segments.

Quality Concerns in Entry Level Models: Some budget two wheelers from TVS have received mixed reviews regarding long term durability. These issues, even if limited, can negatively impact consumer confidence in crowded price sensitive categories.

Discover the strategic insights from our comprehensive SWOT analysis of Maruti Suzuki, revealing its market dominance, EV challenges, and growth opportunities in India's auto sector.

3. Opportunities for TVS Motors

Strong Growth Potential in the EV Market: India aims for EV penetration of 40 to 45 percent by 2030. With rising fuel prices and government incentives, TVS has a major opportunity to expand its EV lineup. Upcoming electric motorcycles can help the brand stay ahead of competitors that are still developing their EV strategies.

Rising Demand for Smart and Connected Vehicles: The success of the Ntorq, which offers Bluetooth connectivity and smart features, shows that customers value technology. Scaling connected tech across more models can help TVS build a strong digital advantage and appeal to younger audiences.

Expanding Export Markets: Affordable two wheelers have growing demand in Africa, the Middle East, and ASEAN countries. TVS can use its competitive pricing and dependable product quality to gain market share and reduce dependency on India.

Strategic Acquisitions to Boost Innovation: The acquisition of Norton Motorcycles has already added premium expertise to TVS. Additional acquisitions in EV tech or digital mobility can strengthen international positioning and accelerate product development.

Collaborations for Charging and Battery Swapping: Partnerships with energy companies can help TVS unlock faster charging access for customers. Battery swapping networks can further reduce charging time and increase convenience for commuters.

Sustainable Manufacturing and Green Mobility Leadership: Consumers worldwide are shifting toward environmentally responsible brands. TVS can use eco-friendly operations, emissions reduction plans, and sustainable practices to strengthen its brand value.

4. Threats to TVS Motors

High Competition from Traditional and EV Players: TVS faces strong competition from Hero, Honda, and Bajaj across petrol segments. In the EV market, brands like Ola Electric and Ather Energy innovate quickly and continuously launch new products. This competitive pressure forces TVS to invest heavily in R&D and marketing.

Increasing Costs of EV Raw Materials: The prices of lithium, battery cells, and semiconductors are unpredictable. These fluctuations increase manufacturing costs and can reduce profit margins for EVs, which already operate on tight pricing.

Regulatory and Compliance Challenges: India has introduced stricter emission norms and new EV safety regulations. These rules require continuous technology upgrades, which increase TVS’s development and testing costs.

Global Economic Uncertainty: Many export markets face inflation, currency fluctuation, and recession fears. These economic issues can reduce demand for two wheelers and affect TVS’s international revenue.

Rapid Technological Disruption in EVs: New age EV startups innovate at a faster pace than traditional automakers. If TVS does not keep up with technology such as fast charging, connectivity, and advanced batteries, it risks losing relevance in future mobility.

Explore the insightful SWOT analysis of BMW blog to uncover strategic strengths like premium branding and EV innovation alongside key challenges in a competitive luxury auto landscape.

IIDE Student Takeaway, Conclusion & Recommendations

- TVS Motors’ SWOT reveals a company with strong fundamentals, wide product range, rising EV sales, and expanding global reach, matched with clear challenges such as limited premium bike presence, reliance on India, and growing EV competition.

- The core tension lies between its fast EV momentum and the aggressive rise of EV-first rivals who innovate faster and scale quicker.

- Overall, TVS has a promising future, but sustaining leadership will depend on how quickly it strengthens its EV ecosystem, brand positioning, and premium offerings.

- To stay ahead, TVS should accelerate the launch of EV motorcycles and position them against emerging performance EV players.

- Strengthening charging and battery-swapping partnerships will boost user convenience and reduce barriers to adoption.

- The brand must also invest in the mid-segment premium category, leveraging its BMW partnership and racing heritage to challenge Bajaj and Royal Enfield.

- Enhancing digital-first service experiences, loyalty programs, and connected tech will help deepen customer engagement and retention.

- From a marketing standpoint, TVS should highlight sustainability, reliability, and smart features to differentiate itself in a crowded market.

Final Outlook

If TVS uses its strengths strategically to fix current gaps and capture fast-growing EV opportunities, it is well-positioned to remain a major force in India’s mobility future, possibly even leading the two-wheeler EV segment by 2030.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

You May Also Like

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.