Orginally Written by Aditya Shastri

Updated on Feb 17, 2026

Share on:

Sephora is one of the world's leading prestige beauty retailers, with 2,500+ stores across 30+ markets and an omnichannel model that sets the global benchmark. Can it hold its ground against Ulta, rising D2C brands, and fast-shifting Gen Z loyalties in 2026?

This Sephora SWOT Analysis unpacks what is powering the brand forward and where the real vulnerabilities lie, making it essential reading for entrepreneurs and business students.

About Sephora

Founded in 1969 in Limoges, France by Dominique Mandonnaud and acquired by LVMH in 1997, Sephora is the world's leading prestige beauty retailer. Operating 2,500+ stores in 30+ countries and generating EUR 16.4bn in sales, it is LVMH's star performer.

Its slogan, "We Belong to Something Beautiful," reflects its inclusive identity. This swot analysis of sephora is an essential strategy case study for business learners. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats.

Sephora Company Overview 2026

| Parameter | Details |

|---|---|

| Official company name | Sephora SAS |

| Parent group | LVMH Moët Hennessy Louis Vuitton SE |

| Founded year | 1969 |

| Founder | Dominique Mandonnaud |

| Headquarters | Neuilly-sur-Seine, France |

| Website | www.sephora.com |

| Industries | Beauty and personal care retail (prestige cosmetics) |

| Key geographies served | Europe, North America, Middle East, Asia Pacific (online global) |

| Stores (approx., 2025) | 3,000+ stores in 35 markets globally |

| Ownership | Wholly owned subsidiary of LVMH since 1997–1998 |

| Revenue (Selective Retailing 2025) | €18.35bn (+4% organic growth) |

| Sephora contribution | ~€16-17bn est. (90%+ of segment; "remarkable" growth) |

| Net income | Not disclosed separately from LVMH Selective Retailing operations |

| Employees (approx., 2025) | 52,000 globally |

| Main competitors | Ulta Beauty, Nordstrom, Macy’s, Amazon Beauty, D2C brands, mass retailers |

Learn Digital Marketing for FREE

SWOT Analysis of Sephora 2026

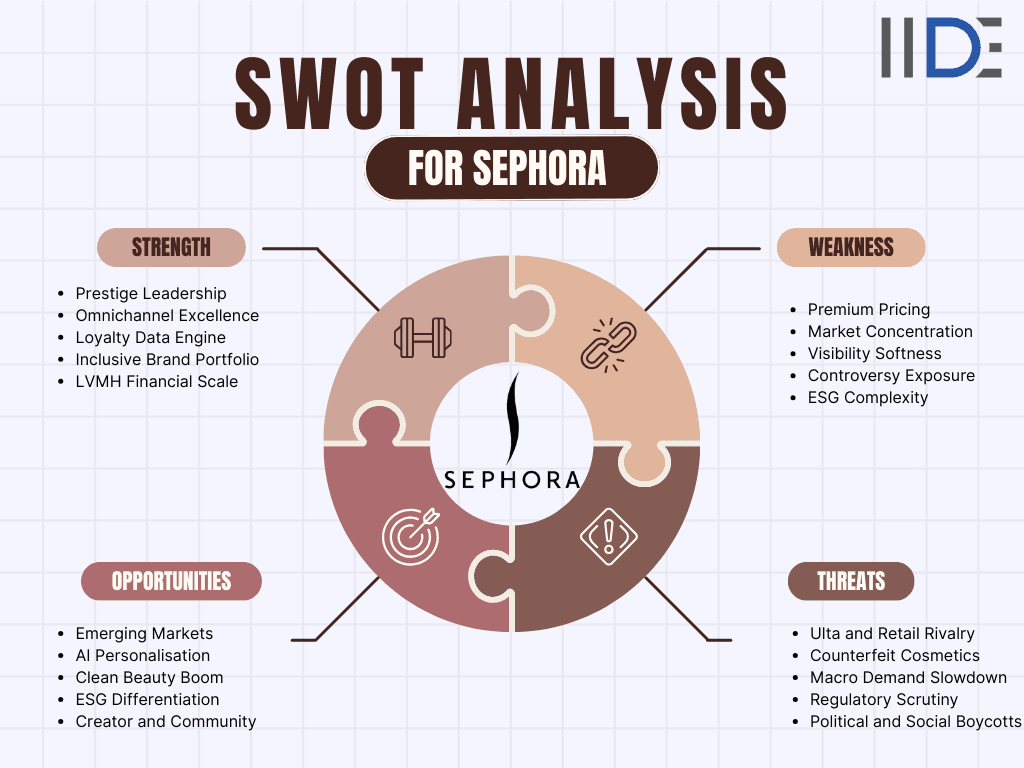

In 2026, Sephora stands as LVMH's star performer in selective retailing, combining global prestige positioning with category-leading digital capabilities and a loyalty data engine that most competitors would struggle to build from scratch.

Yet this sephora swot analysis also surfaces real structural vulnerabilities: premium pricing exposure during a period of sustained consumer caution, intensifying promotional rivalry with Ulta Beauty, periodic reputational controversy from partner brands, and a macro environment that continues to test discretionary spending in the developed markets where Sephora generates most of its revenue.

Sephora's Strengths 2026: The Brand's Superpowers

No swot sephora review can begin without acknowledging the formidable brand equity Sephora has built over five decades. Its strengths are not merely cosmetic; they are structural advantages embedded in its business model, technology infrastructure, and cultural positioning that give it a durable edge in the global beauty market.

1. Global Prestige Beauty Leadership and Brand Equity

Sephora occupies a singular position in global beauty retail, aspirational enough to command premium pricing, yet accessible enough to attract a wide demographic range. With 2,500+ stores in more than 30 countries, its iconic black-and-white brand codes and open-sell layout are immediately recognisable from Sao Paulo to Seoul. Even as LVMH's wider portfolio faced headwinds in 2024, Sephora delivered outperformance in selective retailing, with estimated sales of approximately EUR 16.4bn, representing roughly 90% of LVMH's selective retail segment. This scale of market leadership is a foundational pillar of its competitive moat.

2. Digital-First Omnichannel Experience

Sephora is widely cited as the global benchmark for seamless omnichannel retail execution. Its integrated ecosystem, spanning a feature-rich mobile app, responsive e-commerce platform, and a connected in-store experience, removes friction at every touchpoint. Services including buy-online-pick-up-in-store, in-app booking for beauty consultations, AI-powered skin diagnostics, virtual try-on tools, and unified loyalty tracking create a shopping journey that is both personalised and frictionless. For students examining the sephora swot analysis 2025, this is the definitive case study in tech-enabled retail: Sephora does not simply sell beauty products; it sells a digitally enhanced discovery experience that competitors find extremely difficult to replicate at this scale.

3. Beauty Insider Loyalty Programme and First-Party Data Engine

The tiered Beauty Insider programme, spanning Insider, VIB, and Rouge tiers, has evolved into one of the most sophisticated first-party data engines in global retail. With tens of millions of active members worldwide, it enables hyper-personalisation through transaction history, browsing behaviour, in-store consultation outcomes, and digital engagement signals. This data flywheel powers targeted communications, curated product recommendations, exclusive member events, and high-margin cross-selling across categories, deepening customer lifetime value in ways that anonymous transactional retail cannot match.

4. Curated, Inclusive Brand Portfolio and Private Label

Sephora's curation capability is a genuine competitive differentiator. Its assortment blends legacy prestige houses with fast-emerging indie labels, celebrity-founder lines such as Fenty Beauty, and its own Sephora Collection private label, giving shoppers meaningful choice across price points, aesthetics, and innovation cycles. Strong category management keeps shelves fresh, while exclusive partnerships and owned brands enable Sephora to capture incremental margin and shape beauty trends rather than simply follow them.

5. Sustainability and DE and I as Strategic Differentiators

Through its Green Heart roadmap and annual impact reporting, Sephora invests meaningfully in sustainable packaging, clean ingredient transparency, and circularity-inspired retail initiatives. Its diversity, equity, and inclusion commitments are equally substantive: tripling the number of Black-owned brands on its shelves, co-creating the Mitigate Racial Bias in Retail Charter with industry peers, and running the Accelerate incubator programme for women of colour. For purpose-driven consumers, particularly Gen Z cohorts who explicitly align brand values with purchasing decisions, these credentials represent a tangible competitive strength that deepens both customer trust and employer brand.

6. Financial and Operational Scale Under LVMH

Operating within LVMH's global luxury ecosystem grants Sephora privileged access to group-wide capital allocation, best-practice sharing across 75+ luxury brands, superior bargaining power with landlords and suppliers, and a global distribution infrastructure that independent beauty retailers simply cannot access. These structural advantages allow Sephora to invest consistently in experiential flagships, technology innovation, and geographic expansion, even when the broader macro environment turns cautious.

Sephora's Weaknesses 2026: Struggles in a Shifting Market

Every rigorous sephora swot analysis 2025 must hold the brand accountable to its real limitations. Sephora's weaknesses are not existential, but they are strategically meaningful, particularly as competitive dynamics in US beauty retail intensify and consumer expectations around value and brand values continue to evolve at an accelerating pace.

1. Premium Pricing and Accessibility Gaps

Sephora's commitment to prestige positioning carries a structural accessibility trade-off. Its higher price points and focus on premium brands limit penetration in value-sensitive consumer segments, especially during prolonged inflationary periods when shoppers audit discretionary spend with heightened scrutiny. In US mass and masstige categories, Ulta Beauty and big-box retailers offer a more affordable entry point and are actively capturing share in baskets where price perception drives the decision. This pricing dynamic is a recurring vulnerability in the current consumer environment.

2. Channel and Market Concentration Risk

Despite its global retail footprint, Sephora remains heavily dependent on mature markets, particularly North America and Western Europe, for the bulk of its revenue and profitability. Early 2025 commentary from LVMH flagged a cautious consumer environment and softer underlying trends in key developed markets, suggesting that overreliance on discretionary beauty spend in high-cost geographies creates meaningful structural exposure when macroeconomic cycles deteriorate.

3. Promotional Visibility and Retail Media Performance Gaps

Spring 2025 analysis comparing the promotional performance of Ulta and Sephora revealed that Ulta was driving stronger brand-partner growth and superior visibility across makeup, skincare, and fragrance categories. Sephora's organic search rankings and sponsored ad performance lagged in several key categories during peak promotional windows. For strategists working through swot analysis sephora, this implies real gaps in promotional timing discipline, paid search execution, and retail media investment, areas where its closest US rival has become measurably more aggressive and effective.

4. Reputational and Political Controversy Exposure

Sephora has faced boycott campaigns driven by social-media narratives, some linked to corporate political donation histories and others tied to partner brands embroiled in geopolitical controversy, most visibly the backlash associated with Huda Beauty. These episodes generate significant noise, invite scrutiny of Sephora's stated values around inclusivity, and can measurably impact customer sentiment, particularly among Gen Z shoppers who hold brands to exceptionally high standards of values consistency.

5. ESG Execution Complexity at Scale

While Sephora publishes robust impact and DE and I reports, the sheer breadth of its assortment, spanning thousands of SKUs across dozens of countries and hundreds of brand partners, makes consistent enforcement of clean-ingredient standards, sustainable packaging requirements, and labour practice benchmarks genuinely difficult. Any visible misalignment between a partner brand's behaviour and Sephora's stated values can surface rapidly online, creating a perceived weakness that undermines its purpose-driven positioning with the precise audience it most needs to retain.

Sephora's Opportunities 2026: Future Moves for the Beauty Giant

The global beauty industry is entering one of its most dynamic growth phases, driven by emerging market demand, AI-enabled personalisation, and shifting consumer values around sustainability and authenticity. The sephora swot framework surfaces several high-conviction growth vectors that Sephora is uniquely positioned to exploit, given its data infrastructure, global brand relationships, and LVMH's financial backing.

1. Growth of the Global Cosmetics Market

The global cosmetics and personal care market is on a sustained upward trajectory, with projections pointing toward a market exceeding USD 700bn by the early 2030s, driven disproportionately by skincare, haircare, and science-backed wellness beauty. Sephora is well placed to capitalise on this tailwind by deepening its category leadership in high-growth sub-segments including clinical skincare, scalp health, and gender-inclusive grooming, and by curating assortments that reflect evolving consumer definitions of beauty in 2026 and beyond.

2. Emerging Markets and Regional Expansion

LVMH's own strategic commentary highlights Sephora's continued market-share gains and active plans to reinforce its footprint in Europe, the Middle East, North America, and newer high-potential markets including the United Kingdom and Gulf Cooperation Council countries. Economies across Southeast Asia, India, and Latin America, where rising middle classes are accelerating beauty spend, represent a significant long-term growth opportunity for modular Sephora formats, localised e-commerce platforms, and marketplace channel partnerships.

3. AI, AR, and Data-Driven Personalisation at Scale

Sephora already deploys virtual try-on and AI-powered skin diagnostic features within its app. Advances in large-language-model recommendation engines, dynamic pricing algorithms, predictive replenishment systems, and generative AI content creation offer the next frontier of competitive differentiation. Integrating Beauty Insider data with richer behavioural signals, purchase intent data, and content engagement metrics can effectively turn every member's app into a personalised beauty operating system, one that learns, adapts, and converts with measurably superior efficiency over time.

4. Clean, Sustainable, and Ethical Beauty Leadership

Consumer research consistently shows that Gen Z and Millennial shoppers are increasingly willing to pay a premium for products aligned with their environmental and ethical values. Sephora's Green Heart roadmap, sustainable packaging standards, and ingredient transparency tools already provide a credible foundation for differentiated private-label offerings that set a new category standard. Formalising a verified-clean curation framework and communicating it clearly across channels could be a significant market differentiator relative to both prestige and mass-market beauty competitors.

5. Creator, Community, and Marketplace Ecosystems

Sephora's existing digital community features and social content initiatives already drive peer-to-peer beauty discovery at scale. The strategic opportunity now lies in formalising and monetising creator programmes, deepening social commerce integrations across TikTok Shop, Instagram, and Pinterest, and building curated brand-incubator marketplaces in select regions, adding long-tail assortment and rich consumer engagement data without carrying the full inventory and supply chain risk of traditional multi-brand retail.

Sephora's Threats 2026: Challenges in a Competitive Arena

Even the most admired brands operate in environments where external forces can erode well-established advantages with surprising speed. The sephora swot analysis identifies five material threat clusters that strategists, students, and brand managers should monitor closely as Sephora navigates 2026 and beyond.

1. Intensifying Competition from Ulta Beauty and Digital-Native Rivals

Ulta Beauty's strong loyalty programme mechanics, its expanding Target shop-in-shop footprint, and its superior promotional visibility across beauty categories in 2025 highlight the seriousness of the competitive challenge in US beauty retail. Beyond Ulta, department stores, brand D2C sites, Amazon's aggressively expanding beauty category, and discount platforms all compete on price, convenience, or exclusivity, collectively compressing Sephora's share in categories where its differentiated experience advantage is least pronounced.

2. Counterfeit and Grey-Market Beauty Products

The proliferation of counterfeit cosmetics on unregulated online marketplaces, representing billions in estimated lost sales annually across the prestige beauty industry, poses a serious ongoing threat to brand trust for all premium retailers. As a high-equity retailer whose core value proposition is rooted in product authenticity and consumer safety, Sephora must continually invest in supply chain authentication technology, traceability systems, and consumer education programmes to prevent any association with unsafe or fraudulent products entering its ecosystem.

3. Macroeconomic Slowdown and Discretionary Spend Pressure

LVMH's 2025 financial disclosures reflect group revenue pressure and an increasingly cautious consumer behavioural shift, even as Sephora continued to outperform its direct peers within the selective retailing segment. A prolonged inflationary environment, sustained currency volatility, or a recessionary period across key Western markets could push more shoppers toward lower-priced channels, reduce basket sizes in prestige beauty categories, and test Sephora's ability to maintain its margin profile without compromising its premium positioning.

4. Regulatory, ESG, and Data Privacy Risks

Rapidly evolving regulations on cosmetic ingredients, green marketing claims, data privacy practices, and international labour standards are increasing compliance costs and legal exposure for global beauty chains operating across multiple jurisdictions simultaneously. Any perceived misstep on diversity, racial bias in retail operations, or the handling of politically controversial partner brands can escalate with extraordinary speed in the era of always-on social media scrutiny, threatening Sephora's inclusive beauty reputation at the precise moment when values-alignment is a primary consumer selection criterion.

5. Fast-Changing Consumer Preferences and Trend Velocity

Beauty trends are accelerating in ways that were not foreseeable a decade ago, amplified by TikTok's algorithm-driven viral cycles and platform-native creators who can make or break a product category within 48 hours. If Sephora misjudges local market tastes, overcommits inventory to a fading trend, or fails to identify the next generation of indie winners before they achieve breakout scale on social platforms, it risks ceding cultural relevance to more agile competitors, a concern that informed swot analysis sephora observers now track closely as beauty trend cycles continue to compress.

SWOT of Sephora (Infographic-Ready)

This compact summary grid serves as the core visual anchor for the Sephora SWOT Analysis. Use it as an at-a-glance reference for presentations, academic submissions, or strategic planning documents.

IIDE Student Takeaway, Conclusion and Recommendations

For business students and aspiring marketers, this Sephora SWOT Analysis reveals a brand with formidable omnichannel capabilities, rich first-party data, and a prestige positioning that is difficult to replicate. Its core strength lies in turning Beauty Insider insights into loyalty and margin. Its core challenges are premium price perception in an inflationary cycle, a widening promotional gap with Ulta Beauty, and reputational risks from partner-brand controversies that escalate fast.

The strategic tension in 2026 is clear: Sephora must act as an authentic values-driven curator and a hard-nosed growth engine inside LVMH, without letting controversy, counterfeits, or macro softness erode trust or profitability.

Five actionable priorities:

- Deepen personalisation within Beauty Insider using AI-curated replenishment prompts and skin-profile-linked offers to protect mid-ticket shoppers from trading down.

- Build region-specific value ladders, including curated bundles and private-label lines, that protect prestige equity while improving perceived affordability.

- Formalise a brand-partner governance framework with clear thresholds for handling political and ethical controversies, activated proactively rather than improvised under public pressure.

- Invest in irreplicable in-store services such as clinical skin diagnostics and artistry masterclasses, tying all outcomes back to Beauty Insider data to compound customer insight.

- Accelerate entry into underpenetrated markets including Southeast Asia, India, and the Gulf using modular, locally curated formats rather than transplanting the Western flagship model.

The Sephora SWOT Analysis 2026 playbook makes one thing clear: brands that orchestrate data, purpose, and experience at scale will lead the next decade of beauty retail. Sephora has the infrastructure and credibility to do exactly that, provided it executes with the discipline its position demands.

Want to Know Why 5,00,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

MBA - Level

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 23, 2026

Duration

11 Months

Live & Online

Best For

Working Professionals

Mode of Learning

Online

Starts from

Mar 6, 2026

Duration

4-6 Months

Online

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

More SWOT Analysis

Sephora has revolutionised the beauty retail industry by creating a one-stop destination for all beauty needs, offering a wide range of products from high-end to drugstore brands, and providing personalised services like beauty consultations, makeup applications, and virtual try-ons.

Sephora’s competitive advantage lies in its diverse product range, exclusive partnerships, loyalty programs, strong brand equity, and cutting-edge technology integration for personalised shopping experiences both in-store and online.

Sephora caters to various customer segments by offering a wide range of products, from affordable drugstore brands to luxury beauty lines. Their beauty loyalty program, Beauty Insider, also provides tailored perks for customers based on their shopping habits, ensuring that all types of customers feel valued.

The Sephora Beauty Insider program is a loyalty program that rewards customers with points for every purchase, which can be redeemed for exclusive products, discounts, and experiences. The program helps build customer loyalty and keeps shoppers coming back for personalised rewards.

Sephora stays relevant to Gen Z consumers by offering trendy and inclusive beauty products, collaborating with popular influencers, and embracing social media platforms like TikTok and Instagram. They also emphasise inclusivity and diversity in their advertising and product offerings.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.