Students Centric

Placements Report

Trackable results, real numbers

Reviews

Proven success, real voices

Trainers

Expert-led, Industry-Driven Training

Life at IIDE

Vibrant Spirit student life

Alumni

Successful Journeys, Inspiring Stories

Learning Centre

Webinars

Blogs

Case studies

Live, Interactive Masterclasses

Fresh Insights, quick reads

Real-life, Industry relevant

More

Hire from us

Hire Top Digital Marketing Talent

Work with us

Join Our Team, Make an Impact

Customised Training

Personalised digital marketing training for your company

Refer & earn

Simple, easy rewards

Contact us

Get the answers you need

About us

Know more about IIDE

Explore all course options

Trending

Professional Certification in AI Strategy

- Ideal for AI Enthusiast

Updated on Aug 9, 2025

Last time we did a detailed SWOT Analysis of India’s largest tyre manufacturer – MRF Tyres. This time we will dive into the SWOT Analysis of Kesoram Industries in depth.

Kesoram industries began in 1919 and it has experienced a lot of ups and downs in the company but after all the situations the company has come to the top list. They offer products including tyres, cement and rayon that are in demand and user-friendly for the customers. So now it’s just the never-stopping production of the products by them.

The greatest of all that helped Kesoram Industries to create a place in the market is its marketing aspects. As the world is going online due to the pandemic situation, digitalisation has completely changed the world of marketing and if you are interested to know about it – check out our Free Masterclass on Digital Marketing by the CEO and Founder of IIDE, Karan Shah.

So now it’s time for us to know more about the Kesoram Industries and how they became so successful in the manufacturing industry. Going ahead this blog will give you an in-depth study of the SWOT Analysis of Kesoram Industries. Before we go ahead let us know in brief about the Kesoram company, its products, financial status, competitors, and much more.

About Kesoram Industries

In 1919, Kesoram Industries limited launched its business with the name Kesoram cotton mills ltd. in 1986 the company had taken the important decision of renaming its company Kesoram Industries Limited.

Kesoram Industries Limited is under the flagship of ‘B K Birla Group of Companies. The production of the company ranges from tires to cement to rayons. Kesoram Industries Limited had an all India ranking of 121 for the year 2010. With its net income of Rs 5020.63 crore and a net profit of Rs 648.29 crore.

In 1959, the first rayon plant was built under the name Kesoram Rayon. After the building of the plant, the company began the production of tyres and cement by the name Birla Tyres and Birla Shakti Cement. And by going further the company launched another cement plant in 1986 by the name Vasavadatta Cement at Sedam, dist. Gulbarga (Karnataka).

A small stationery packing unit was installed by the company in 2011. The company has taken great growth and has grown a lot stronger. It entered into a joint venture with Maharashtra Seamless Limited and Dhariwal Infrastructure Private Limited in 2012. It is listed on four global stock exchanges: The national stock exchange of India, Bombay stock exchange, Calcutta stock exchange association, Société de la bourse de Luxembourg. The company reported a net profit of Rs 339.67 crore during the quarter of 2014- 2015 by selling a tyre plant to Kesoram Industries.

| Founder | Manjushree Khaitan |

|---|---|

| Year Founded | 1919 |

| Origin | Kolkata, India |

| No. of Employees | 1,600+ |

| Company Type | Public |

| Market Cap | Rs 1,494 Crore 2022 |

| Annual Revenue | Rs 4554.23 Crore 2021 |

| Net Income/ Profit | Rs 166.94 Crore 2021 |

Products of Kesoram Industries

Kesoram industries have been in the manufacturing fields for ages and deals in the great products:

- Birla tyres

- Birla shakti cement

- Kesoram rayon

Competitors of Kesoram Industries

As the company is a well-known company. It has a great and competitive competitor:

- Apollo tyres ltd

- Continental corporation ltd

- Bridgestone

- CEAT ltd

- The Goodyear tire and rubber company

Now that we have got an understanding of the company’s core business let’s go through the SWOT Analysis of Kesoram Industries.

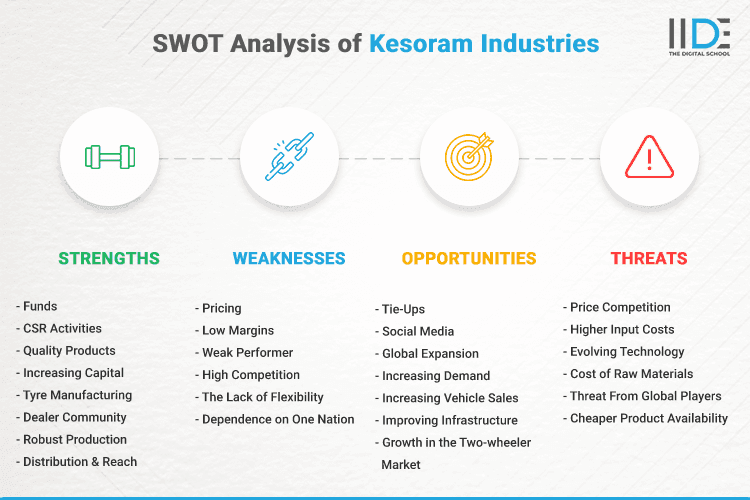

SWOT Analysis of Kesoram Industries

Talking about Kesoram Industries, let’s understand how this corporation can cater to different individuals using SWOT analysis. The SWOT analysis of Kesoram Industries helps us to understand companies through the lens of internal and external factors. Strength and weakness are based on internal factors whereas opportunities and threats rely on external factors of the bank.

Below is a step-by-step detailed guide to help you with the SWOT analysis of Kesoram Industries.

Strengths of Kesoram Industries

Let us look at the strengths of Kesoram Industries –

- Distribution & Reach: Kesoram Industries have a great distribution network which makes it easier for the customers to get access to their products. The company carries out the distribution of tyres, cement, rayon, transparent paper, and filament yarn.

- Dealer Community: Kesoram has a lot of dealers to whom they sell their products and then the products are further sold by the retailers. Kesoram shares a great and strong relationship with its dealers.

- Robust Production: The company has a large production of all their products that the supply is never diminished according to the demand. Kesoram Industries produces the capacity of 4,635 metric tons of rayon yarn per year.

- Increasing Capital: The company is effectively using its capital to generate profits and has improved in the last 2 years. And is also able to generate net cash. The annual net profit of the company is also increasing.

- Funds: the company effectively uses the shareholder’s fund – Return on equity (ROE). Promoter holding increased by more than 2% and FPI/FII increased their shareholding.

- Quality Products: Kesoram Industries believes in serving society with superior quality. There’s no doubt regarding the quality of Kesoram Industries and even customers never fail to admit it. Kesoram Industries never compensates with the high priority features like grip, fuel efficiency, durability, endurance, and noise control.

- CSR Activities: Kesoram Industries maintains its brand image through involvement in various CSR activities including initiatives in education, health, livelihoods and water conservation. Through these initiatives, Kesoram Industries is trying to bring empowerment to local communities and get them into the mainstream of development.

- Tyre Manufacturing: Kesoram Industries have grown in the market since its started the production of tires and cement under the brand name Birla Tyres and Birla Shakti Cement respectively. Since then, Kesoram Industries Limited has grown stronger.

Weaknesses of Kesoram Industries

Let’s have a look at the weaknesses of Kesoram Industries –

- Weak Performer: The company is seen as a weak performer as it lost its stock by more than 20% in 1 month.

- Pricing: Kesoram Industries has a good number of competitors in the Indian market, so it will need to keep its prices intact since that will be its main differentiator.

- High Competition: The presence of other major brands like MRF, Apollo Tyres, CEAT Tyres etc in the tyre manufacturing segment has led to limited market share. And in the cement industry brands like Ultratech cement, Ambuja, and Wonder cement are leading the market and the presence of Birla Shakti cement in front of these players is equal to zero.

- Dependence on One Nation: Kesoram Industries is heavily reliant on the Indian market. The company has never tried to expand overseas. If somehow the market gets unprofitable, it may affect its revenue stream and long term growth.

- The Lack of Flexibility: Kesoram Industries has built good recognition in the past but in recent years Kesoram Industries has been struggling to market its products at the same wavelength as before. Their quality of tyres and cement are still maintaining their standards but they’re not able to keep up with the recent trends which have led to their competitors seizing the market share.

- Low Margins: Kesoram Industries focuses mostly on rayon and the competition is very high in this domain, because of which sales volume is low.

Opportunities for Kesoram Industries

The following are the possible opportunities for Kesoram Industries –

- Tie-Ups: As the company is mainly in the B2B Market it can focus on more tie-ups with automobile companies.

- Growth in the Two-wheeler Market: The demand for the two-wheeler market is expected to rise in the next decade, and the two-wheeler tyres market will potentially hold the highest market share in the Indian market. Thus it will be a good opportunity for Kesoram Industries to look into this market.

- Social Media: The number of internet users has substantially increased post covid, and thus Kesoram Industries can promote its products, interact with customers, and respond quickly to complaints through various social media sites like Facebook, Instagram, Twitter etc.

If you have a business that you think can go online then you can also do the same. But hold on! Are you aware of the latest and quickest methods of promoting a business on social media sites? If your answer is yes, no-no, yes then you should check out our short term course in social media marketing that will help you to clear your yes, no-no, yes confusion. The course looks short but it will make you aware of every nook and corner used to promote your business on social media.

- Global Expansion: Kesoram Industries can make use of India’s market supremacy to expand to other regions of the world.

- Improving Infrastructure: One of the most huge advantages of Kesoram Industries is that its brand Birla Shakti cement is a prominent brand in the cement industry, which is expanding in India owing to an increase in infrastructure demand. This need will not diminish any time soon, given the growing population and improving economic conditions.

- Increasing Demand: People are opting for more stable structures and intensive use of cement is taking place, even the government is spending heavily on infrastructure projects. Thus, this is the right time to fully tap these markets.

- Increasing Vehicle Sales: Emerging economies like India, China and Brazil are showing an increase in sales of vehicles. The growing disposable income of people in these nations is the reason for the surge in demand. This demand will create a proportional increase in demand for tyres by car manufacturers and automakers.

Threats to Kesoram Industries

Following are the threats of Kesoram Industries –

- Cheaper Product Availability: Many individuals look for a cheaper option for any product or service. Although the quality of the product is great the consumer is ready to compromise it if a cheaper option is available. If Kesoram Industries doesn’t go with value-based advertising they could lose the market share to cheap rip-offs.

- Cost of Raw Materials: Rubber is the key raw material in manufacturing tyres; if the cost of the raw material increases it could lead to great loss for the company. Mainly the production of tyres could come to a standstill leading to lack of sales.

- Evolving Technology: Technology is ever-changing, and if Kesoram Industries doesn’t manage to adapt to the new upcoming trends, then very soon it will be kicked out of the market by its competitors.

- Higher Input Costs: Cement makers like Orient, Birla, Ramco and Dalmia are facing difficulties to mitigate higher input costs due to labour shortages caused by the Holi holiday and elections in some regions. This has led to an increase in average cement price by a marginal 2% in March over February 2022 passing on some portion of the increase to consumers.

- Threat From Global Players: It faces stiff competition in Indian markets from global players. Due to India’s rapid expansion, many new multinational cement and tyre businesses are projected to emerge in the future years, ushering in a wave of change and potentially igniting a price war.

- Price Competition: When a business engages in price competition, its bottom line suffers. The threat to Kesoram Industries is just the same. Kesoram Industries is obliged to compete on price due to the enormous number of brands offered, which has a detrimental impact on its bottom line.

Well, we have come to an end with the SWOT analysis of Kesoram Industries. Let us conclude what we have seen.

Learn Digital Marketing for FREE

- 45 Mins Masterclass

- Watch Anytime, Anywhere

- 1,00,000+ Students Enrolled

To Conclude

Kesoram Industries have very good assets and a very strong brand name in the field of tyre segment and cement. The company has a very good business network all over the country and capable promoters. The promoters have also taken every step to bring the company back on track. The reduction in debt and interest costs has given clear visibility that the company will make a turnaround in the coming quarters.

Kesoram Industries has seen a lot of ups and downs in the past years but the company has tried to create a balance after all the ups and downs because of the support of its loyal customers, the promoters, the workers and a great team. In the upcoming years, the company will be in profit and the leading company.

Kesoram industries needed to undertake the method of digital marketing. So that it can reach all the necessary markets and make their company a well-known company. In a changing world, digital marketing is of utmost importance.

Due to the pandemic, the world has adopted the mode of online marketing. So if you’re interested in learning about digital marketing and want more upskilling, then what are you waiting for, go and check out the IIDE’s 3 Month Advanced Online Digital Marketing Course to know more.

We hope this blog on the SWOT Analysis of Kesoram Industries has given you a good insight into the company’s strengths, weaknesses, opportunities and threats.

If you enjoy in-depth company research just like the SWOT analysis of Kesoram Industries, check out our IIDE Knowledge portal for more fascinating case studies.

Thank you for taking the time to read this, and do share your thoughts on this case study of the SWOT analysis of Kesoram Industries in the comments section below.

Want to Know Why 2,50,000+ Students Trust Us?

Dive into the numbers that make us the #1 choice for career success

Courses Recommended for you

MBA - Level

Post Graduate in Digital Marketing & Strategy

Best For

Fresh Graduates

Mode of Learning

On Campus (Mumbai & Delhi)

Starts from

Mar 2, 2026

Duration

11 Months

Live & Online

Advanced Online Digital Marketing Course

Best For

Working Professionals

Mode of Learning

Online

Starts from

Feb 20, 2026

Duration

4-6 Months

Online

Professional Certification in AI Strategy

Best For

AI Enthusiasts

Mode of Learning

Online

Duration

5 Months

Offline

Undergraduate Program in Digital Business & Entrepreneurship

Best For

12th Passouts

Mode of Learning

On Campus (Mumbai)

Duration

3 Years

Recent Post

- Bosch 2025: Strategic Insights into Market Position, Challenges, and Growth Opportunities

- Nasher Miles Marketing Strategy 2025: A Journey from Trolleys to Trendsetters

- Beco Marketing Strategy 2025: Leading India’s Eco-Friendly Revolution

- P-TAL Marketing Case Study: Reviving India’s Timeless Craftsmanship

- Marketing Case Study: Rocca - Rising Above the Chocolate Crowd in India

- Unveiling What's Up Wellness Marketing Strategy: Key Tactics and Insights

- Lenskart Marketing Strategy 2025: AI, Content & Omni-Channel Success

- Ruban's Jewelry Marketing Strategy for Crafting Timeless Success in the Luxury Market

- Decoding iMumz’s Marketing Playbook: A Wellness Brand Built on Empathy

- Nish Hair Marketing Strategy: The Complete AIDA Playbook for D2C Success

Author's Note:

I’m Aditya Shastri, and this case study has been created with the support of my students from IIDE's digital marketing courses.

The practical assignments, case studies, and simulations completed by the students in these courses have been crucial in shaping the insights presented here.

If you found this case study helpful, feel free to leave a comment below.

Aditya Shastri leads the Business Development segment at IIDE and is a seasoned Content Marketing expert. With over a decade of experience, Aditya has trained more than 20,000 students and professionals in digital marketing, collaborating with prestigious institutions and corporations such as Jet Airways, Godrej Professionals, Pfizer, Mahindra Group, Publicis Worldwide, and many others. His ability to simplify complex marketing concepts, combined with his engaging teaching style, has earned him widespread admiration from students and professionals alike.

Aditya has spearheaded IIDE’s B2B growth, forging partnerships with over 40 higher education institutions across India to upskill students in digital marketing and business skills. As a visiting faculty member at top institutions like IIT Bhilai, Mithibai College, Amity University, and SRCC, he continues to influence the next generation of marketers.

Apart from his marketing expertise, Aditya is also a spiritual speaker, often traveling internationally to share insights on spirituality. His unique blend of digital marketing proficiency and spiritual wisdom makes him a highly respected figure in both fields.