About General Electric

General Electric (GE) is a prominent American firm that is one of the world’s largest and most diverse. In 1892, the corporation was formed by combining the assets of the Edison General Electric Company and two other electrical firms.

It creates one of the world’s largest lines of electrical consumer products and became a leading seller of different sorts of home appliances through its General Electric and Hotpoint appliance brands.

The corporation declared its intention to split into three public entities on November 9, 2021. Each new entity will focus respectively on energy (renewable energy, electricity, and digital), aviation and healthcare.

Quick Stats on General Electric

| Founder |

Thomas Edison, Elihu Thomson, Edwin J. Houston, Charles A. Coffin |

| Year Founded |

1892 |

| Origin |

New York, United States |

| No. of Employees |

205,000 |

| Company Type |

Public |

| Market Cap |

$118.14 Billion (2021) |

| Annual Revenue |

$ 75.619 Billion (2020) |

| Net Profit |

$ 5.230 Billion (2020) |

Products of General Electric

Following are the type of products General Electric sells in the market –

- Aircraft engines

- Electrical distribution

- Electric motors

- Energy

- Finance

- Health care

- Software

- Wind turbines

Competitors of General Electric

Among the plethora of businesses in this sector, the following are the top 5 competitors of General Electric –

- 3M

- Hitachi

- Honeywell international

- Siemens AG

- Mitsubishi Corporations

SWOT Analysis of General Electric

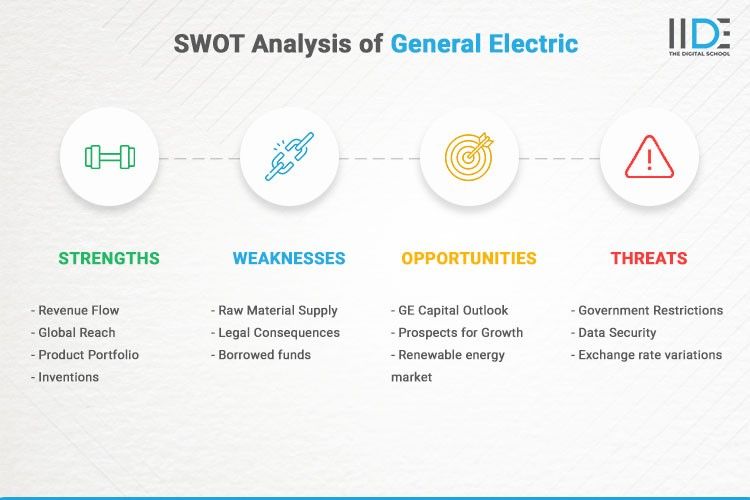

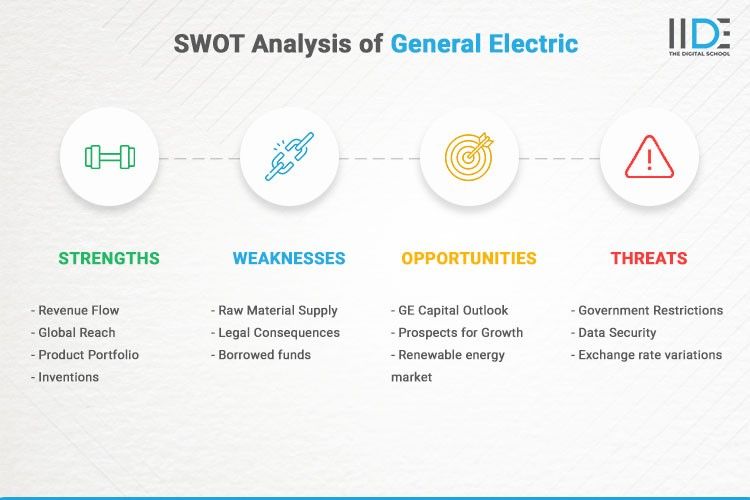

1. Strengths of General Electric

Strengths are the aspects of a company’s operations where it excels, providing it a competitive edge. General Electric has the following advantages –

- Revenue Flow – GE’s varied portfolio is maintained with balanced revenue streams from all of its companies, reducing the danger of the company becoming overly reliant on a single business division. GE Capital is the greatest revenue provider, accounting for roughly 25% of total revenue, while water, aviation, healthcare, and oil and gas each contribute 10-20% of total revenue.

- Global Reach – General Electric has a worldwide presence, which considerably boosts the brand’s dynamics. They are presently active in 160 countries throughout the world, with 205,000 employees under the GE umbrella in 2020. The company’s size has an impact on its market share, client base, popularity, and power, as well as its strategic position in the industry.

- Product Portfolio – General Electric’s product range is diverse, with GE Capital, aviation, power and water, oil and gas, healthcare, appliances and lighting, energy management, and transportation all being represented. With all of its business verticals, the company has a wide portfolio and serves a variety of markets.

- Inventions – Any firm may benefit greatly from innovation. A brand that is able to continually innovate stays current and avoids becoming obsolete. GE has earned a reputation as one of the world’s most inventive firms. Their work in several industries demonstrates this. In the past, two GE employees (Ivar Giaever and Irving Langmuir) were awarded the Nobel Peace Prize.

2. Weaknesses of General Electric

Weaknesses are elements of a business or brand that may be strengthened. The following are some of General Electric’s flaws –

- Raw Material Supply – Dependence on third parties, contract manufacturers, and commodity markets for raw material supply are one of its weaknesses. GE is extremely reliant on many third parties, contract manufacturers, and commodity markets for raw material supply. Any delays in delivery or disagreements in the agreement might put GE’s activities on hold and have a negative impact on revenues.

- Legal Consequences – The enormous brand of GE is sometimes used as a draw for litigation disputes. They’ve had a lot of litigation in the past, and while most of them were settled, a huge company’s brand may be tarnished by frequent lawsuits. Even after a matter has been dismissed or settled, dealing with the aftermath can be difficult.

- Borrowed funds – GE has a large amount of debt, which has an impact on the company’s operations. The corporation owes more than $200 billion in long-term debt. In addition, a large amount of money is spent on interest payments on borrowed funds.

3. Opportunities for General Electric

The phrase “opportunity” refers to avenues in a company’s surroundings that can be used to increase revenues. The following are some of the possibilities: The following are the possibilities for General Electric –

- GE Capital Outlook – GE Capital has a bright future in the United States, because of strengthening economic conditions and the increasing credit card industry. The demand for GE capital items may increase, boosting the company’s top line.

- Prospects for Growth – GE is a large corporation that produces in a variety of market categories, giving the organisation a lot of room for expansion. Many fields, including artificial intelligence and robots, are rising at a rapid pace, and GE has a lot of promise in them. Because they currently have such a diverse portfolio, they can swiftly expand into other areas.

- Renewable energy market – The forecast for renewable energy is bright, and it is likely to continue to rise. GE is well-positioned to increase sales and market share by developing renewable energy.

4. Threats to General Electric

Threats are environmental factors that have the potential to limit a company’s growth. General Electric’s threats are as follows –

- Government Restrictions – Because all of GE’s companies are subject to numerous federal, state, municipal, and foreign laws, the company must adhere to a variety of environmental and regulatory regulations. This raises the company’s compliance expenses and slows its expansion.

- Data Security – A person’s personal security is a valuable asset. Several GE employees complained that their personal information had been exposed on the business server. The corporation acknowledged the charges, claiming that a group of hackers had gained access to the internal system. Incidents like this might erode people’s faith in these companies. It also causes people to be hyper-aware of their data.

- Exchange rate variations – For a corporation like GE, which has global operations in different regions of the world, currency fluctuations become a significant concern when currencies strengthen or weaken versus the US dollar.

With this we come to the end of the SWOT Analysis of General Electric. In the below section, let’s conclude the case study.